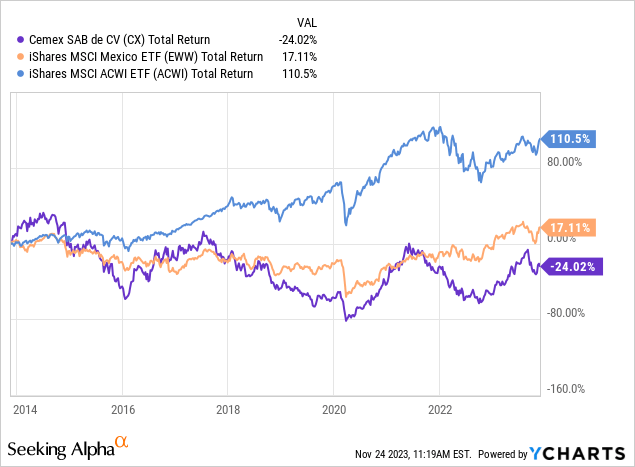

Cemex (NYSE:CX) has proved a disappointing investment for long-term shareholders. Over the past 10 years, CX has delivered a total return of -24% compared to a total return of 110% delivered by the iShares MSCI ACWI ETF (ACWI) and a total return of 17.1% total return delivered by the iShares MSCI Mexico ETF (EWW) during the same period.

I believe there are 5 reasons why CX is set to continue underperforming global equities (proxied by ACWI) going forward:

1. Highly Competitive Industry Resulting in a Thin Moat

2. Highly Levered Balance Sheet

3. Unattractive Valuation

4. Lack of a dividend or buyback

Company Overview

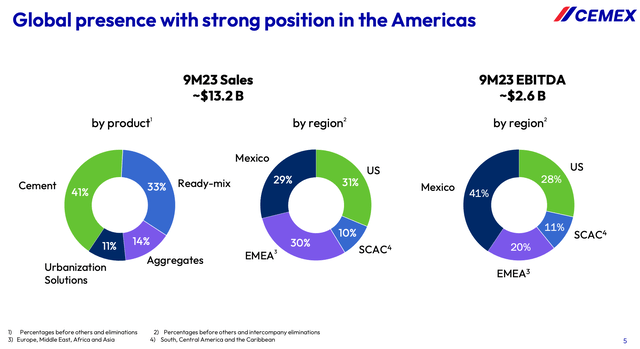

CX is one of the largest cement producers in the world. CX is a global player with operations focused on the Americas. The company generates ~29% of sales from Mexico, ~31% of sales from the U.S., ~30% from EMEA, and ~10% from South, Central America and the Caribbean.

CX’s core businesses include cement, ready-mix, urbanization solutions, and aggregates. The cement business accounts for ~41% of revenue. The aggregates business, which accounts for ~14% of revenue, produces inert granular materials such as stone, sand, and gravel which is obtained through land-based sources or by dredging marine depositions. The ready-mix concrete business accounts for ~33% of revenue. The urbanization solutions business, which accounts for ~11% of revenue, provides complementary solutions through services including industrialized construction, waste management, and other related services.

CX Investor Presentation

1. Highly Competitive Business Resulting in a Thin Moat

CX competes in a highly competitive industry. CX’s competitors include large companies such as Holcim Ltm., Heidelberg Materials, Buzzi Unicem, CRH plc, and others. CX also competes with thousands of small and medium sized companies.

Economies of scale are somewhat limited in the cement industry due to the high weight to value nature of the product. The result of this is that the cheapest source of production is often the closest producer not the largest producer. This makes it difficult for large players to enjoy benefits due to economies of scale. For this reason, the industry remains highly fragmented. The top 50 global producers of ready-mix products account for just 10% of global production and 45% of total global revenue for ready-mix concrete.

Given the commoditized nature of the building materials business, companies compete aggressively on price as product differentiation is fairly limited.

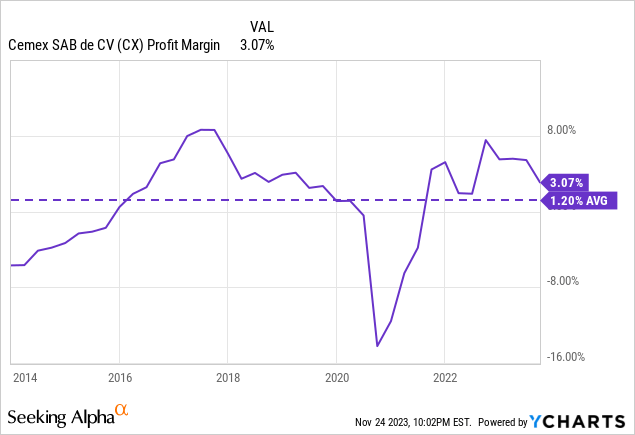

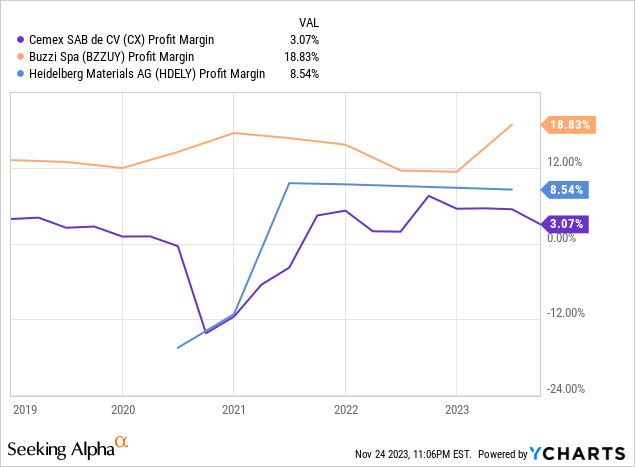

As a result of these market dynamics, CX has been able to generate only low single digit profit margins historically. Over the past 10 years, CX has generated an average profit margin of just 1.2%. In addition to a low average level of profitability, CX has experienced significant earnings volatility as the materials business is highly cyclical

2. Highly Levered Balance Sheet

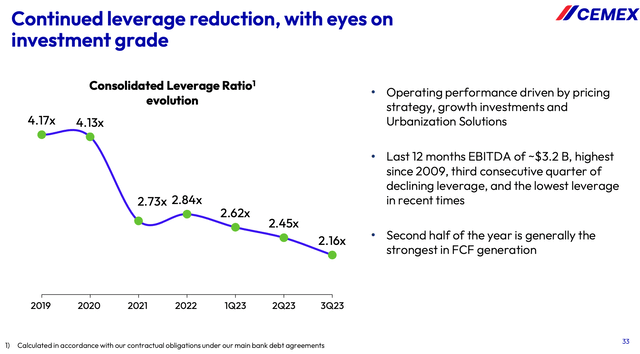

While CX has made significant progress in terms of balance sheet improvement over the past few years, the company remains highly levered.

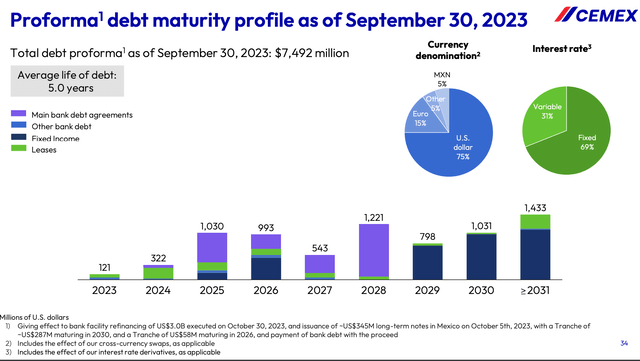

CX currently carries ~$7.5 billion of debt and has a leverage ratio of 2.16x based on calculations in accordance with the company’s bank debt agreements. Fitch estimates CX’s 2023-2024 net leverage ratio at ~2.7x.

Fitch and S&P both rate CX as BB+ which represents the highest non-investment grade rating available under both rating agency scales. Additionally, both rating agencies have a positive outlook which suggests there is some chance that CX’s rating will get upgraded to investment grade.

Despite recent balance sheet improvement, I believe CX still has a very risky balance sheet. Current leverage ratios are based on the company’s last 12 months of EBITDA of ~$3.2 billion which represents the highest level since 2009.

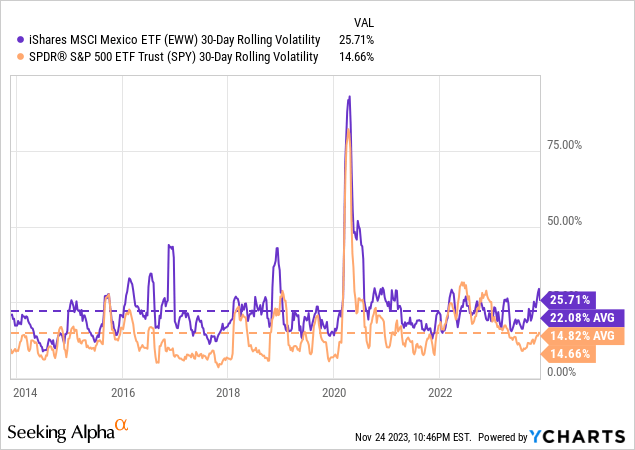

In Q3 2023, the company reported a record quarter with EBITDA growing by 32%. While CX expects FY 2023 Operating EBITDA to come in >$3.3 billion, I believe the highly cyclical nature of CX’s business means that leverage could increase rapidly in the event of any economic downturn. Moreover, the company is highly exposed Mexico which is characterized by a more volatile economy than developed markets such as the U.S.

Additionally, CX has a significant amount of fixed rate debt which will likely need to be refinanced at higher rates if interest rates remain elevated. This has the potential to significantly increase CX’s interest burden in the future.

CX’s high level of debt creates substantial risk that CX will be put in a very difficult situation in the event of a major macroeconomic slowdown.

CX Investor Presentation

CX Investor Presentation

3. Unattractive Valuation

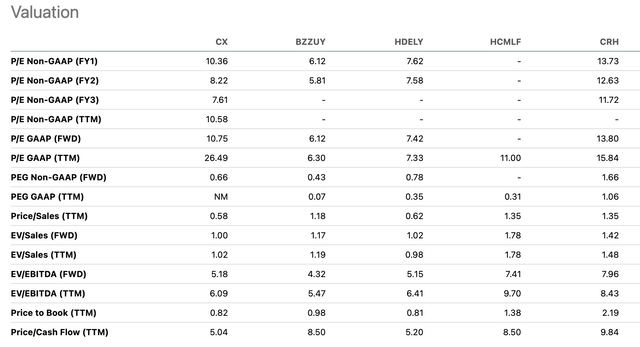

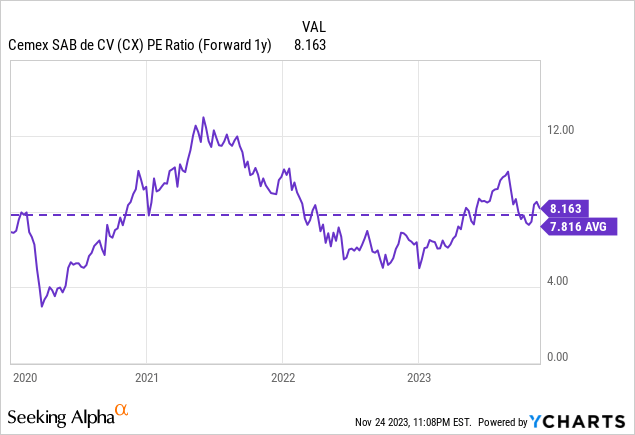

CX currently trades at 10.4x estimates FY 2023 earnings and 8.2x estimates FY 2024 earnings. Comparably, the MSCI All Country World Index trades at a forward P/E ratio of 15.9x and the MSCI Emerging Market Index trades at a forward P/E ratio of 11.4x. The MSCI Mexico Index trades at a forward P/E ratio of 11.8x.

While CX is trading at a discount in terms of forward P/E ratio compared to the MSCI All Country World Index, I believe this discount is more than justified based on the high level of earnings volatility CX has experienced historically.

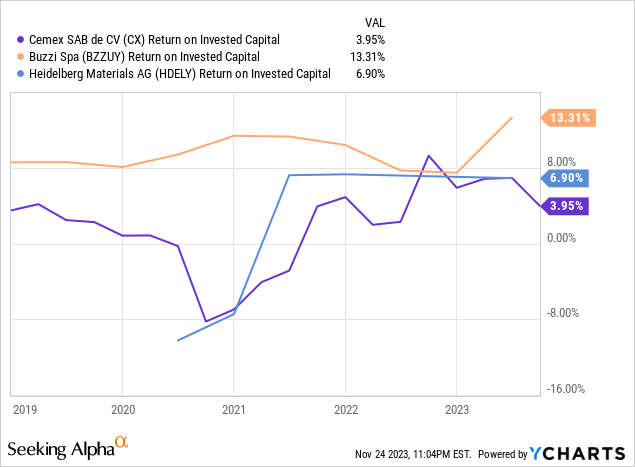

In terms of valuation relative to peers, CX is trading at a premium to peers such as Buzzi and Heidelberg Materials. I do not believe this premium is warranted given the fact that Buzzi and Heidelberg have historically performed better in regard to metric such as return on invested capital and profit margins.

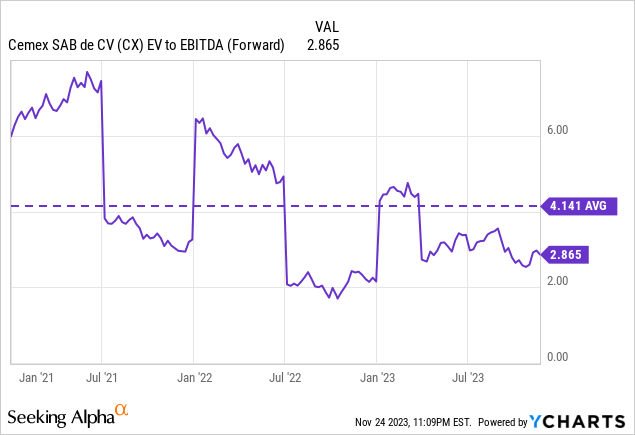

In terms of valuation relative to its own historical norm, I believe CX is not particularly attractive but the picture if mixed. On a forward P/E basis CX is trading above its recent historical average. On a forward EV / EBITDA basis CX is trading toward the lower end of its historical range. However, it is worth nothing that the company has proved a poor investment over the past few years and thus was overvalued historically. For this reason, I believe CX should trade at a discount to its historical average valuation.

Seeking Alpha

4. Lack of Dividend or Buyback

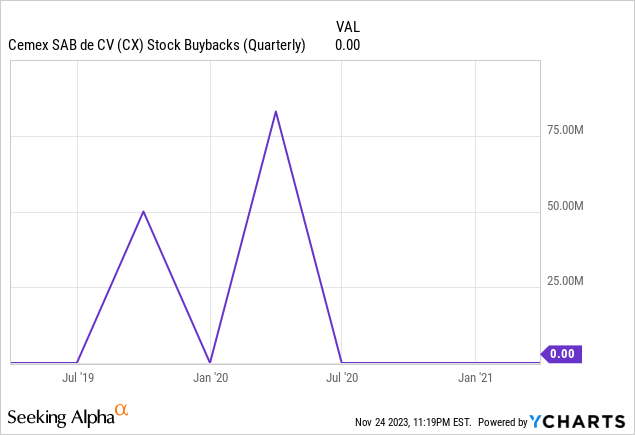

CX has not paid any dividends since 2019. Prior to the economic disruption related to the COVID-19 pandemic, CX had been repurchasing modest amounts of stocks. However, the company halted its repurchase program in 2020 and has not resumed it since.

The company has been focused on improving its balance sheet and has been using free cash flow to reduce debt. However, CX has said that it plans to start paying dividends if the company is able to improve its credit ratings to investment grade. While it is possible that CX starts paying dividends in 2024, it is not a guarantee and any initial dividend is likely to be small as the company continues to be focused on attractive investment opportunities to grow the business.

On the Q3 earnings call CX noted:

Yes, Fernando, I would just like to add, I think it’s very important, to say that we have this investment muscle now in, very well trained. We have an approved pipeline that is close to two and a $0.5 billion. We’ve already invested a fairly significant portion of that…

And the return or the IRRs of those projects, as Fernando mentioned, they’re close to about 40%. Now, of course, it’s very difficult at infinitum to continue to get 40% investments. We would like to, but that’s not what we’re guiding to. Our internal hurdle is above 20% and within an acceptable period. A lot of these investments, as they get completed within the next couple of years, we’re expecting them to contribute steady state close to $600 million to EBITDA…

Now, when we see that, we take a look at what are the other possibilities for capital deployment? I mean, one is you can buy back debt. Today, our debt is yielding 7% and on an MPB basis, doesn’t compete at all with capital allocation to these projects. We can buy back stock, which today our cost of equity is about 15%. And again, does not compare very well to invested capital at 40 plus percent for very long periods of time. These are long projects that are expected to go for many, many years. These are not short-term projects that we’re doing.

The lack of a dividend or buyback is currently a negative as shareholders are not receiving any return of capital from the company. While the investments described by management seem attractive, the company does not have a solid history of delivering strong financial performance. Thus, as an investor I am somewhat skeptical regarding the company’s capital allocation policy.

Additionally, the fact that the company appears more likely to initiate a dividend and not a buyback in the near future suggests that management does not view the stock as highly attractive at current levels. I believe this is an important signal that market participants should pay attention to.

Potential Upside Catalysts

One potential upside catalyst is stronger than expected economic growth. A stronger U.S. housing market has potential to lead to stronger than expected demand for CX products. Additionally, better than expected economic conditions in Mexico also has potential to drive near-term earnings growth for CX.

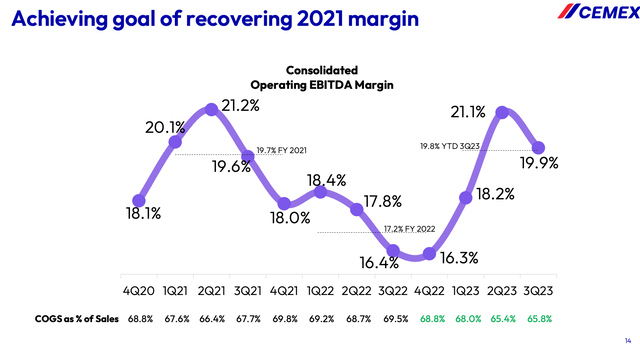

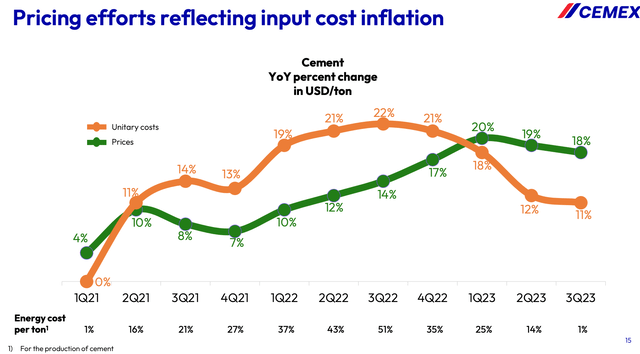

Another potential upside catalyst is if CX is able to sustain its recent improvement in margins. As shown by the chart below, CX has realized significant operating EBITDA margin improvement over the past year. A significant driver of the improvement in margins has been a reduction in COGS as a percentage of sales. A significant driver of this improvement has been a substantial increase in prices, which have risen by more than costs over the past 3 quarters.

My view as that any upside from these potential drivers is likely to be short-term in nature as the highly competitive nature of the industry will make it difficult for CX to hold onto margin gains.

CX Investor Presentation

CX Investor Presentation

Conclusion

CX has failed to deliver strong shareholder returns over the past decade. The company operates in a highly competitive business with limited benefits due to scale. Additionally, the building materials industry is highly cyclical.

The result of this is that CX has traditionally experienced a high degree of earnings volatility and has only been able to generate low single digits profit margins on average.

While CX is focused on improving its balance sheet, the company remains highly levered and still carries a non-investment grade credit rating. The highly levered balance sheet posses a risk to the company in the event of any significant economic slowdown. Moreover, the company currently has a significant portion of fixed rate debt which will likely need to be refinanced at higher rates in the future if interest rates remain elevated.

CX trades at a lower valuation than the MSCI All Country World Index and MSCI Emerging Markets Index but this discount is warranted given CX’s earnings volatility and historical inability to deliver strong results. CX’s current valuation is also unattractive relative to peers and its own historical valuation range.

Currently, CX is not returning any capital to shareholders via dividends or buybacks and is instead focused on reducing debt. While I agree with this strategy, I believe the lack of a dividend or buyback is problematic for the stock as many other cyclical investment opportunities come with high dividends and buybacks.

I am initiating CX with a sell rating and expect it to continue underperforming broad market indexes going forward. I would consider upgrading CX if the company is able to improve its balance sheet and begin returning meaningful amounts of capital to shareholders. I would view the initiation of a buyback program more favorably than the initiation of a dividend given the signaling regarding management view of the stock price.

Read the full article here