For a sector known to just sit and collect rent, triple net REITs sure have a lot going on right now. Three factors have changed, making the sector particularly opportunistic. This article will discuss these fundamental factors and then detail 3 triple net REITs we find to be particularly well positioned for double digit returns.

3 Factors Reviving Triple Net Sector

- Cap rates have risen considerably

- Escalators are back

- Valuation is cheaper

Higher cap rates

When interest rates went down to 0 following COVID, cap rates followed. In many sectors cap rates got as low as 4%.

As interest rates rose back up, it became clear that 4% cap rates would no longer be viable. Cap rates generally moved higher in 2024, but not by much. Many sellers were still trying to get cap rates in the 5%-6.5% range. It created a standstill that largely froze real estate transaction markets.

- Sellers did not want to go higher because they believed interest rates were going to go back down.

- Buyers could not reasonably buy at that cap rate as they would have no spread or even a negative spread initially.

So transactions basically just didn’t happen except in rare cases where one of the parties was particularly motivated and willing to jump the bid/ask gap.

Over time it started to become more clear that the 0 interest rate environment was the anomaly and unlikely to return. Sellers eventually capitulated and raised cap rates to a range that is more appropriate to the current interest rate environment.

Cap rates today are in the 7%-9.5% range for many high-quality triple net assets. That is enough for a healthy spread over cost of capital and has revived acquisition pipelines.

Gladstone Commercial’s President, Buzz Cooper, discussed GOOD’s acquisitions on the 2Q25 earnings call:

“This was another active quarter with $79 million in capital deployed for new industrial acquisitions [ ] We look to be in the path of growth. And so our cap rates, I think, will be 8.5% plus on an average basis.”

While not specified in the call, I believe that is referencing a GAAP cap rate.

GAAP cap rates are once again significantly higher than cash cap rates because escalators have returned in a big way.

Escalators now 2%-3.5% for many triple net transactions

Jason Fox, W. P. Carey’s CEO discussed acquisitions on their 2Q25 earnings call:

“To date, we’ve closed over $1 billion of new investments. at initial cap rates averaging in the mid-7s, primarily with fixed rent escalations approaching 3%”

He went on to point out that GAAP cap rates were in the 9s.

“Factoring in rent escalations over those long lease terms, that translates to an average yield in the mid-9% range,”

Perhaps the spread between GAAP and cash is extra large for WPC because they have 19-year lease terms, but the idea is the same across the sector.

In 2025, escalators are in full force.

There was an interesting exchange on the Broadstone Net Lease (BNL) earnings call on the revival of escalators in the triple net sector.

Yoti Yadav with Citizens Capital:

“I just wanted to hear your thoughts on why the escalators for recent build-to-suit projects are much higher? Is it more of a project based thing or just maturity of BNL strategy here?”

John D. Moragne CEO & Director

“It’s a little bit of both. We’ve been seeing higher escalators in industrial for a little while now. There was a very brief period of time where escalators in industrial really got compressed in that like 2021, early ’22 time frame, but it’s pushed out. So although the weighted average escalators across our portfolio is about 2% as you pointed out, you can see in our schedule and in terms of the deals that we’ve been doing, we’re more consistently somewhere in between 2.5% and 3% on new deals that we’re doing, both in terms of regular way acquisitions for industrial and then particularly in the build-to-suit.”

Moragne refers to industrial in the discussion above, but we have noted similar changes in other subsectors as well.

Postal Realty (PSTL) is now signing leases with the USPS with 3% escalators which is an entirely new phenomenon. Historically, post office leases had always been flat over their terms.

While escalators are unequivocally a positive for the future growth of triple net REITs, there are some interesting interactions with accounting of which to be aware.

When a lease is negotiated, the REIT is thinking about its return over the course of the lease term. Many would reject a 7% cap rate flat lease, but a 7% cash cap rate lease that has 3% escalators such that it averages a 9% return over the lease is quite accretive.

Thus, as leasing has shifted from flat or close to flat leases in the 2022-2023 timeframe to 3% escalators in new leases 2 things have happened:

- Leases are more accretive to the REIT’s long term growth

- Initial cash rent is not all that accretive

This creates a large difference between cash accounting and GAAP accounting. For instance, take a look at WPC’s growth between 2025 and 2026.

S&P Global Market Intelligence

- FFO is expected to grow from $4.38 to $4.97 or 13.4%

- AFFO is expected to grow from $4.91 to $5.04 or 2.6%

FFO accounting is heavily based on GAAP accounting and uses the average rent over the lease term. So in FFO terms the $1.1B of new leases WPC signed are at a 9.5% cap rate which makes them wildly accretive over WPC’s cost of capital around 5.5%.

AFFO accounting is a bit closer to cash accounting as it looks at current year rents. So in AFFO terms that same $1.1B of new leases is marked at a 7.5% cap rate making it only 200 basis points accretive over cost of capital.

The new leases are fully twice as accretive in FFO terms than they are in AFFO terms.

Once again, this is a larger effect in WPC because of the extremely long lease terms, but it is prevalent across the sector.

AFFO growth temporarily looks slow for the sector because of the re-introduction of large escalators into lease terms. However, these escalators are still excellent for long term fundamentals as they ensure consistent baseline organic growth for a long time.

Keep in mind the temporarily subdued AFFO growth as we discuss valuation as REITs are overwhelmingly valued based on near term AFFO growth.

Attractively valued sector

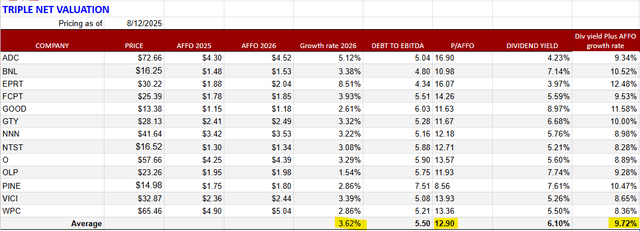

Triple net REITs trade at an average price to AFFO of 12.9X, which is substantially cheaper than the average REIT at 16.1X.

Portfolio Income Solutions

Triple net REITs are known for their high dividends with an average yield of 6.1%. In recent years, triple nets have been much more conscious of their AFFO payout ratios with the average payout now at 76%.

This means significantly more capital is retained for growth which has ticked the average AFFO/share growth rate of the sector up to 3.62%.

If we assume flat trading multiples, the total return to an investor would be the dividend plus the AFFO/share growth. At current valuation and growth projections this would imply a 9.72% annual return for the sector.

Due to the AFFO accounting phenomenon related to timing of escalators discussed earlier, I think the true growth rate of the sector is higher than 3.62%.

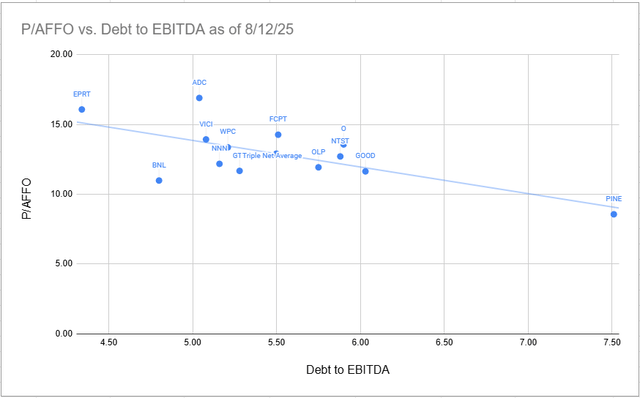

The above valuation does not account for leverage. A higher leverage REIT should trade at a lower multiple than a low leverage REIT. We adjust for leverage by plotting debt to EBITDA against P/AFFO multiple to get a better sense of which REITs are discounted in leverage neutral terms.

Portfolio Income Solutions

Valuation is one of many criteria that goes into our selection of triple net REITs.

3 Particularly interesting triple nets

With cap rates once again high enough to facilitate accretive acquisitions, I tend to favor REITs that have some sort of advantage facilitating a large and accretive pipeline. In this regard, there are 3 triple nets that stand out as having particularly strong external growth:

- W.P. Carey – cost of capital advantage

- Broadstone Net Lease – massive build-to-suit pipeline

- Gladstone Commercial – credit underwriting

As discussed earlier, WPC has $1.1B of acquisitions at a mid 9% cap rate. That is a great volume and great cap rate, but what really makes it pop in terms of growth is WPC’s low cost of capital.

The 2Q25 earnings call discussed acquisitions being funded by a combination of asset sales and cheap debt.

“Turning to our sources of capital. In parallel with our first half investments, we’ve also made good progress with our funding strategy, which we outlined at the start of the year and is centered on accretive sales of noncore assets. We recently sold an initial tranche of 15 self-storage operating properties for $175 million executed at a sub-6% cap rate.”

Not only is this a property type upgrade from self-storage to industrial, but selling below 6% and buying above 9% is an excellent spread.

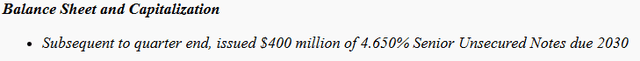

The debt portion of the acquisitions is to be funded with 4.65% senior unsecured notes.

WPC

Overall, that represents a nearly 400 basis point spread making the purchases atypically accretive.

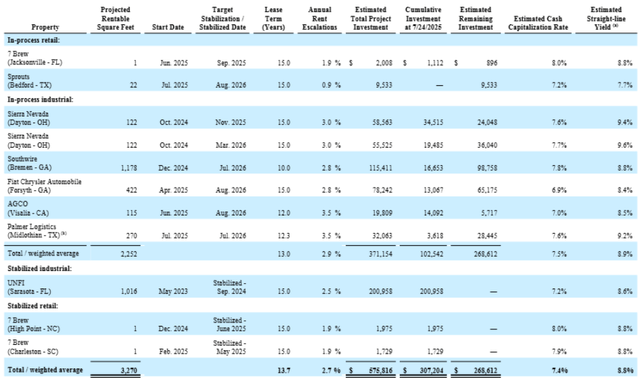

Broadstone Net Lease has a massive build-to-suit pipeline of industrial and retail properties tabulated below.

BNL

Note that BNL has a market cap of $3.15B, so these near-term developments are about 18% of market cap.

The weighted average cap rate is 7.4% cash and 8.8% GAAP. Again, the difference is the 2.7% escalators.

New properties tend to sell at lower cap rates than older properties because they are just going to be higher quality and require less maintenance. So having the opportunity to develop brand new properties at such a high cap rate is very accretive to BNL’s long-term growth. This pipeline, in combination with BNL’s substantial leverage adjusted discount to the sector, makes it a great opportunity.

Gladstone Commercial had the aforementioned $79 million acquisition pipeline in 2Q25 alone which is a tremendous pace for a roughly $600 million market cap company.

GOOD has an enhanced ability to source high cap rate acquisitions because of their in-house credit underwriting capabilities. Many other buyers of triple net properties are hamstrung into working with large tenants that have gone through the process of getting credit rated by one of the major agencies. There are relatively fewer buyers competing for assets of unrated tenants.

Some of these unrated tenants have excellent credit that simply has not been through the process of getting rated. So by being able to underwrite the credit internally, GOOD can secure sale-leaseback acquisitions with high credit tenants, but get it at the price (meaning higher cap rate) of unrated tenants.

The other benefit of GOOD right now is that the stock is trading quite cheaply which has pushed it all the way to a 9% dividend yield. In combination with the growth from acquisitions, total return potential is double digit.

The bottom line

Triple net REITs have been forsaken in the higher interest rate environment. With other fixed income investments offering reasonably high yield, demand for triple nets has plummeted. However, one thing NNN REITs offer that other fixed income doesn’t is growth. With escalators now getting signed at 3% annually, a significant amount of baseline growth is being locked in for the long term.

Current valuations account for the dividend yields, but the market is not pricing in the growth investors get on top of the yields. I think multiples will re-rate higher as these companies consistently show growth going forward.

Read the full article here