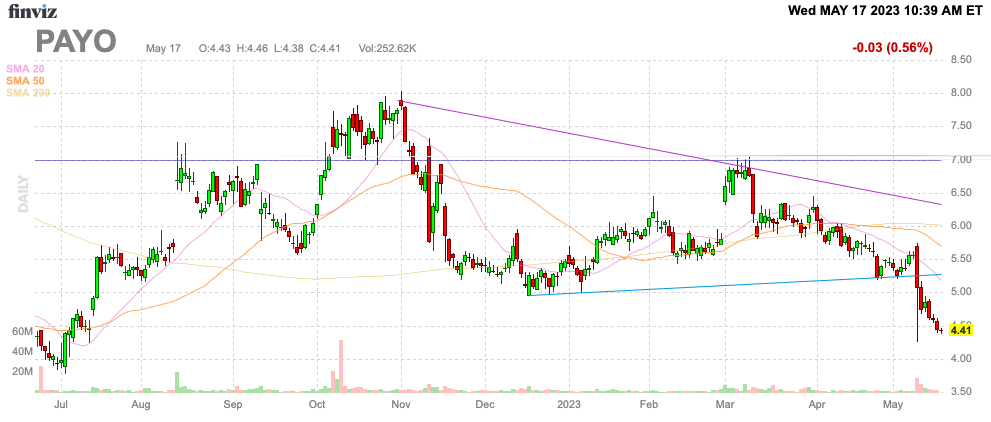

No matter the results, Payoneer Global Inc. (NASDAQ:PAYO) appears unliked by the markets. The global payments company reported another quarter with massive growth, yet the stock fell to recent lows below $5 due to cautious management commentary. My investment thesis remains ultra Bullish on Payoneer as the market extrapolates the purported current weakness too far.

Source: Finviz

Beat After Beat

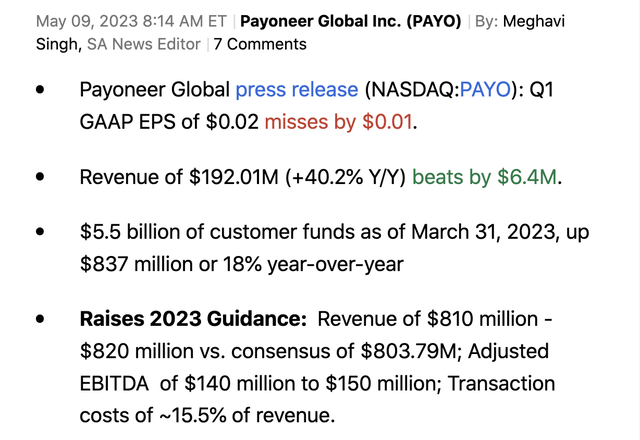

Payoneer reported another strong revenue beat during Q1 2023, and the company guided up for the year as follows:

Source: Seeking Alpha

A big key to understanding a stock is knowing how a management team guides. Some executives are very aggressive on forecasting quarterly numbers, leading to constant investor disappointment with quarterly results, while some companies guide to weak numbers to only leap past those estimates.

Payoneer fits the latter case, with the company constantly leaping past conservative guidance. In Q1, the global payments company reported a revenue beat of $6.4 million after the company only guided to 2023 numbers at the end of February with just a month left in the quarter.

The company originally guided to 2023 revenues of $800 to $810 million, and the updated guidance is now $810 to $820 million. Payoneer only beat the Q1 ’23 targets by $6 million and the company guided up for the year by $10 million.

The global payments company has beaten revenue estimates ever since going public, including the period in 2022 after initial weak guidance following the invasion of Ukraine by Russia impacted a large customer base. Yes, the management team discussed slower growth rates for the rest of the year, but Payoneer was always going to struggle growing at a 40% clip quarter after quarter.

While an investor needs to comprehend the implications of slower growth in the 2H of 2023, one also needs to understand the corporate trends. Payoneer originally guided to 2022 revenues of $535 million due to a $46 million revenue impact from the removal of revenues from Ukraine, Russia and Belarus.

Ultimately, a lot of revenue in Ukraine didn’t leave the payments platform as the Russian invasion quickly reverted to only the Eastern part of the country. Payoneer ended up reporting 2022 revenues of $628 million, nearly $100 million above the original guidance.

Any guidance for 2023 revenues above $800 million should’ve been a home run for shareholders. Payoneer has overcome global covid disruptions and a war in Ukraine for the 2023 revenue target to exceed the initial 2022 revenue target by ~$280 million.

The mind-boggling part of the story is that the stock only traded around $4 on the initial Russian hit. Payoneer trades near the levels where the business was being impacted to a great degree by a war and now the stock is trading at these levels again due to growth rates not maintaining 40%.

On the Q1’23 earnings call, CFO Bea Ordonez hinted at weak growth rates while announcing an $80 million share buyback:

Our revenue growth expectations, excluding interest income, are slightly softer relative to our prior guidance, reflecting a slight deceleration in volume growth in the first four months of the year and ongoing macro headwinds that could constrain consumer and business spending.

Big Catalysts

Payoneer Global Inc. continues to discuss the massive opportunity ahead in the global payments market. The company gets 400K SMB applications on a monthly basis, with limited accounts approved due to the nature of the business and the issues with fraud from blindly approving random customers. In fact, the fintech talked about an Ideal Customer Profile of only 500K existing accounts in an example of the scale at this business.

Per CEO John Caplan on the Q1’23 earnings call:

As we shared in February, we believe pricing will be a multi-quarter transformation that will drive improved monetization and reduce our CAC. To more efficiently capture the opportunity from the extraordinary inbound interest we get from prospective customers I remind shareholders that over 400,000 SMBs apply for Payoneer accounts every month. We have begun rolling out new machine learning models to predict registering potential profitability. When these are fully rolled out, this will enable more scalable and efficient operations. We will be able to quickly filter applications, identify the highest value potential customers and reduce our cost to process.

As the global payments company improves the onboarding process, Payoneer can theoretically ramp up the new customers added to the platform while reducing the cost to process all of this demand. In addition, a lot of existing products have limited usage.

Payoneer suggests the average customer only uses the product with which the company joined the platform. The corporate card and checkout products only have single digit penetration rates from existing customers.

Whether or not the global economy impacts payments volumes in the 2H of the year, Payoneer maintains an incredible growth story. The stock only has a market cap of $1.8 billion while the company targets 2023 revenues of $815 million.

Payoneer now has a cash balance of $545 million, with the forward EV/S multiple dipping below 1.5x. The stock trades with an EV at about 10x 2023 EBITDA targets of $150 million.

Takeaway

The key investor takeaway is that Payoneer Global Inc. could well face slower growth in the 2H of the year, but investors shouldn’t be dumping the stock. The global payments company is likely to beat financial targets yet again, leaving Payoneer Global Inc. growth rates in the 20%+ range and making the stock extremely cheap here.

Read the full article here