My monthly series 10 Dividend Growth Stocks presents ten picks from Dividend Radar for further analysis and possible investment. To highlight different aspects of dividend growth (DG) investing, I use different screens stocks every month.

This month, I screened for high-quality discounted stocks with 5-year trailing total returns of at least 10%. I used three different valuation screens. Each stock is discounted based on my fair value (FV) estimate, trades below my risk-adjusted Buy Below price, and has a forward yield that tops the stock’s 5-year average yield.

As always, I rank candidates by sorting them in descending order by quality score and using tie-breaking metrics where necessary. My quality scoring system employs widely used quality indicators from independent sources to assess the quality of dividend growth stocks.

Screening and Ranking

For this month’s article, I used the following screens:

- Stocks in Dividend Radar

- High-quality stocks (quality scores: 21-30)

- Stocks with 5-year trailing total returns of at least 10%

- Stocks trading below my FV estimate

- Stocks trading below my risk-adjusted Buy Below prices (see below)

- Stocks whose forward dividend yield exceeds the 5-year average dividend yield

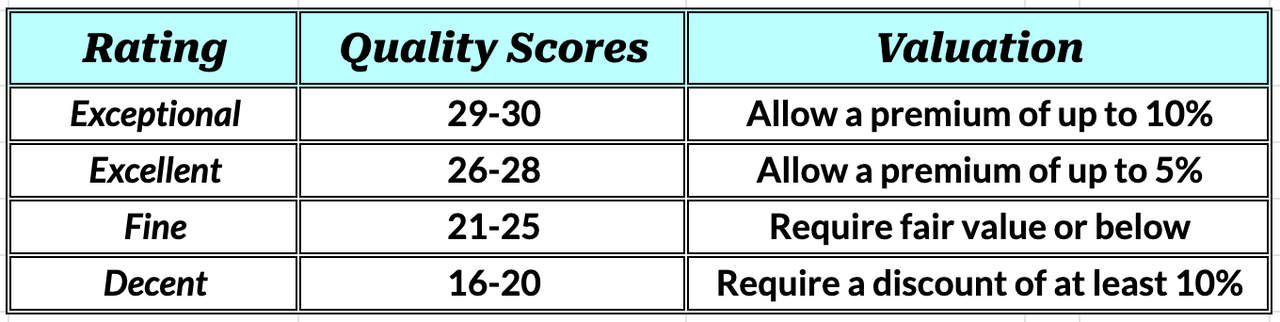

My risk-adjusted Buy Below prices allow premium valuations for the highest-quality stocks but require discounted valuations for lower-quality stocks:

Created by the author

To estimate fair value (FV), I reference fair value estimates and price targets from several sources, including Portfolio Insight, Morningstar, and Finbox. Additionally, I estimate fair value using the five-year average dividend yield of each stock. With up to 11 estimates and targets available, I ignore the outliers (the lowest and highest values) and use the average of the median and mean of the remaining values as my FV estimate.

The latest Dividend Radar (dated May 12, 2023) contains 729 stocks. Of these, 235 stocks have high-quality scores (21-30), 281 have 5-year trailing total returns of 10% or higher, and 452 pass all my valuation screens. Only 63 Dividend Radar stocks pass all these screens.

I ranked these candidates by sorting their quality scores in descending order and breaking ties using the following metrics, in turn:

- Simply Safe Dividends Dividend Safety Scores

- S&P Global Credit Ratings

- Forward Dividend Yield

Top 10 Dividend Growth Stocks for May

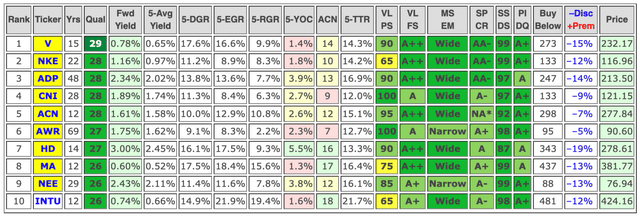

Here are this month’s ten top-ranked DG stocks in rank order:

I own all of the highlighted stocks in my DivGro portfolio.

The following company descriptions are my summary of company descriptions sourced from Finviz.

1. Visa (V)

Headquartered in San Francisco, California, V operates as a payments technology company worldwide. The company facilitates commerce through the transfer of value and information among consumers, merchants, financial institutions, businesses, strategic partners, and government entities. V provides its services under the Visa, Visa Electron, Interlink, V PAY, and PLUS brands.

2. NIKE (NKE)

Founded in 1964 and headquartered in Beaverton, Oregon, NKE is engaged in the design, development, marketing, and selling of athletic footwear, apparel, equipment, and accessories. The company’s portfolio brands include NIKE, Jordan, Hurley, and Converse. NKE sells its products to retail accounts, through NIKE-owned retail stores and websites, and through independent distributors and licensees.

3. Automatic Data Processing (ADP)

ADP provides technology-enabled human capital management solutions and business process outsourcing solutions. These offerings include payroll services, benefits administration, talent management, HR management, time and attendance management, insurance services, retirement services, and tax and compliance services. ADP was founded in 1949 and is headquartered in Roseland, New Jersey.

4. Canadian National Railway (CNI)

CNI was founded in 1922 and is headquartered in Montreal, Canada. The company operates the largest railroad in Canada and the only coast-to-coast railroad in North America. CNI offers transportation services that include rail, intermodal container, and trucking services. It also warehousing and distribution, logistics parks, freight forwarding, customs brokerage services, industrial development, and marine services.

5. Accenture plc (ACN)

Founded in 1989 and based in Dublin, Ireland, ACN provides management and technology consulting services to clients in various industries and geographic regions, including North America, Europe, and Growth Markets. ACN’s operating segments are Communications, Media & Technology; Financial Services; Health and Public Services; Products; and Resources.

6. American States Water (AWR)

Founded in 1929 and based in San Dimas, California, AWR provides water and electric services to residential and industrial customers in California through a holding company, Golden State Water Company. AWR provides water and wastewater services to military installations in the United States through American States Utility Services, another holding company.

7. Home Depot (HD)

Founded in 1978 and based in Atlanta, Georgia, HD is a home improvement retailer that sells an assortment of building materials, home improvement products, and lawn and garden products. HD provides installation, home maintenance, and professional service programs to do-it-yourself, do-it-for-me, and professional customers.

8. Mastercard (MA)

MA, a technology company, provides transaction processing and other payment-related products and services in the United States and internationally. The company offers payment solutions and services under the MasterCard, Maestro, and Cirrus brands. MA was founded in 1966 and is headquartered in Purchase, New York.

9. NextEra Energy (NEE)

NEE generates, transmits, distributes, and sells electric power to retail and wholesale customers in North America. The company generates electricity through wind, solar, nuclear, coal, and natural gas facilities. It also develops, constructs, and operates assets focused on renewable energy generation. NEE was founded in 1925 and is based in Juno Beach, Florida.

10. Intuit (INTU)

INTU provides financial management and compliance products and services for consumers, small businesses, self-employed, and accounting professionals in the United States, Canada, and internationally. The company operates in three segments: Small Business & Self-Employed, Consumer, and Strategic Partner. INTU was founded in 1983 and is headquartered in Mountain View, California.

Please note that the top ten DG stocks are candidates for further analysis, not recommendations.

Key Metrics and Fair Value Estimates

Below, I present key metrics of interest to dividend growth investors, along with quality indicators and fair value estimates:

-

Yrs: years of consecutive dividend increases

-

Qual: Quality score out of 30

-

Fwd Yield: forward dividend yield for a recent share price

-

5-Avg Yield: 5-year average dividend yield

-

5-DGR: 5-year compound annual growth rate of the dividend

-

5-EGR: 5-year compound annual growth rate of EPS

-

5-RGR: 5-year compound annual growth rate of revenue

-

5-YOC: the projected yield on cost after five years of investment

-

ACN: Adjusted Chowder Number

-

5-TTR: 5-year compound trailing total returns

-

VL PS: Value Line Price Stability

-

VL FS: Value Line Financial Strength ratings

-

MS EM: Morningstar Economic Moat

-

SP CR: S&P Global Credit Ratings

-

SS DS: Simply Safe Dividends Dividend Safety Scores

-

PI DG: Portfolio Insight Dividend Quality Grades

-

FV: my fair value estimate

-

-Disc +Prem: discount or premium of the recent share price to my FV estimate

-

Price: recent share price

|

Color-coding

|

Created by the author from a personal spreadsheet

Created by the author from a personal spreadsheet. Key metrics and fair value estimates of ten top-ranked DG stocks for May.

| Rank | Company (Ticker) | Sector | Supersector |

| 1 | Visa (V) | Financials | Cyclical |

| 2 | NIKE (NKE) | Consumer Discretionary | Cyclical |

| 3 | Automatic Data Processing (ADP) | Industrials | Sensitive |

| 4 | Canadian National Railway (CNI) | Industrials | Sensitive |

| 5 | Accenture plc (ACN) | Information Technology | Sensitive |

| 6 | American States Water (AWR) | Utilities | Defensive |

| 7 | Home Depot (HD) | Consumer Discretionary | Cyclical |

| 8 | Mastercard (MA) | Financials | Cyclical |

| 9 | NextEra Energy (NEE) | Utilities | Defensive |

| 10 | Intuit (INTU) | Information Technology | Sensitive |

Commentary

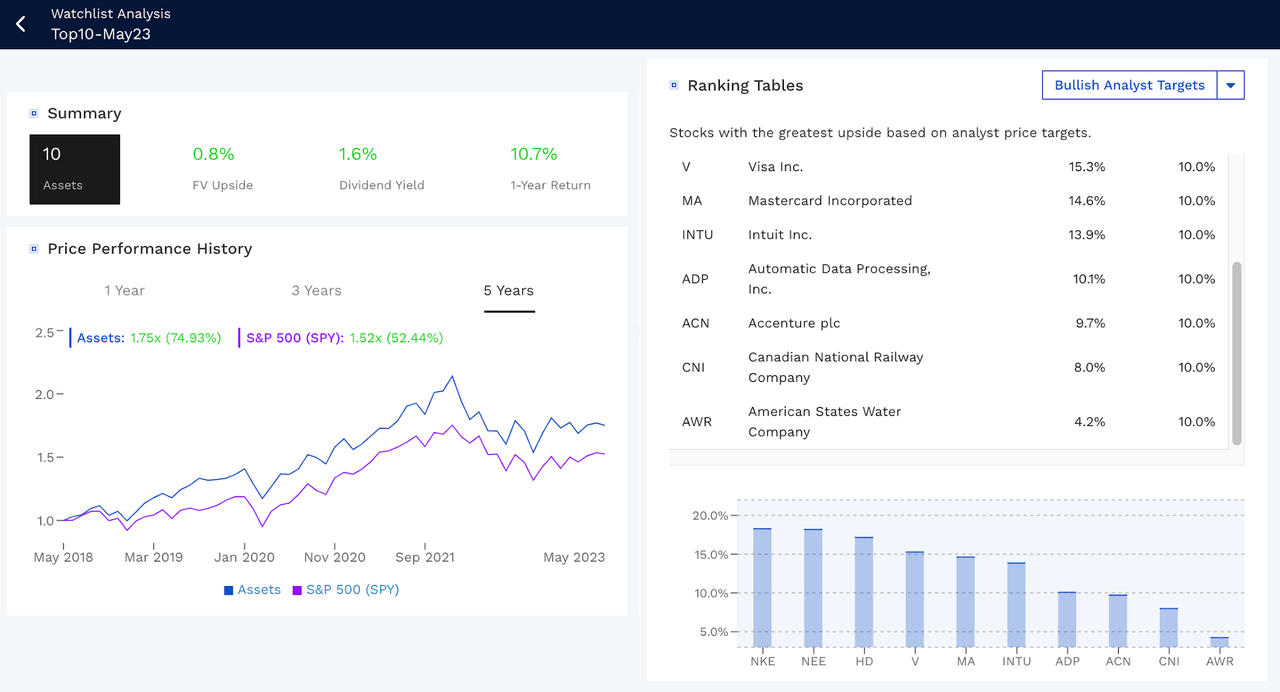

Here’s a comparative analysis of an equal-weighted portfolio of this month’s top ten DG stocks, courtesy of Finbox.com:

Finbox.com

From a price-performance perspective, the portfolio would have outperformed the S&P 500 (as represented by the SPDR S&P 500 ETF Trust (SPY)) over the last five years, returning 75% versus SPY’s 52%. NKE, NEE, and HD have the highest upsides based on analyst price targets.

HD (3.00%) offers the highest forward yields, while V (17.6%) and MA (17.5%) have the highest 5-year DGRs.

INTU (18), MA (17), and HD (16) have the highest ACNs, and INTU (21.7%) has the highest 5-year trailing total returns.

Only one of the stocks (HD) passes all five of my stock selection criteria for adding new positions to my DivGro portfolio:

- Stock Quality: Quality scores ≥ 21 (Exceptional, Excellent, or Fine ratings)

- Stock Valuation: Price ≤ Buy Below price (trades below my risk-adjusted Buy Below price)

- Growth Outlook: Green ACN (likely to deliver annualized returns of 8%)

- Income Outlook: 5-year YoC ≥ 4.00% (likely to have high YoCs after 5 years of ownership)

- Dividend Safety: Dividend Safety Scores > 60 (dividends deemed Very Safe or Safe)

HD is a Dividend Contender with a dividend increase streak of 14 consecutive years.

Portfolio-Insight.com

HD’s earnings and dividend growth histories are impressive, and the stock’s earnings and free cash flow payout ratios are “low for most companies” (according to Simply Safe Dividends).

Based on my preferred portfolio target weights, my HD position is overweight by about 31 shares, which means I won’t be adding shares to my HD position in the near future. However, HD is undervalued and trading 19% below my risk-adjusted Buy Below price. This is confirmed by the following valuation charts:

Portfolio-Insight.com

Portfolio Insight’s Blended Fair Value combines up to five FV estimates, two P/E-based and three dividend-yield-based estimates. Which estimates are used depends on the growth characteristics of a stock, whether it is considered a hyper-growth, growth, or slow-growth stock. In the case of HD, a slow-growth stock, all five FV estimates are equally weighted to determine the blended fair value of HD ($347.07). Analyst consensus estimates are used in determining the two P/E-based FV estimates.

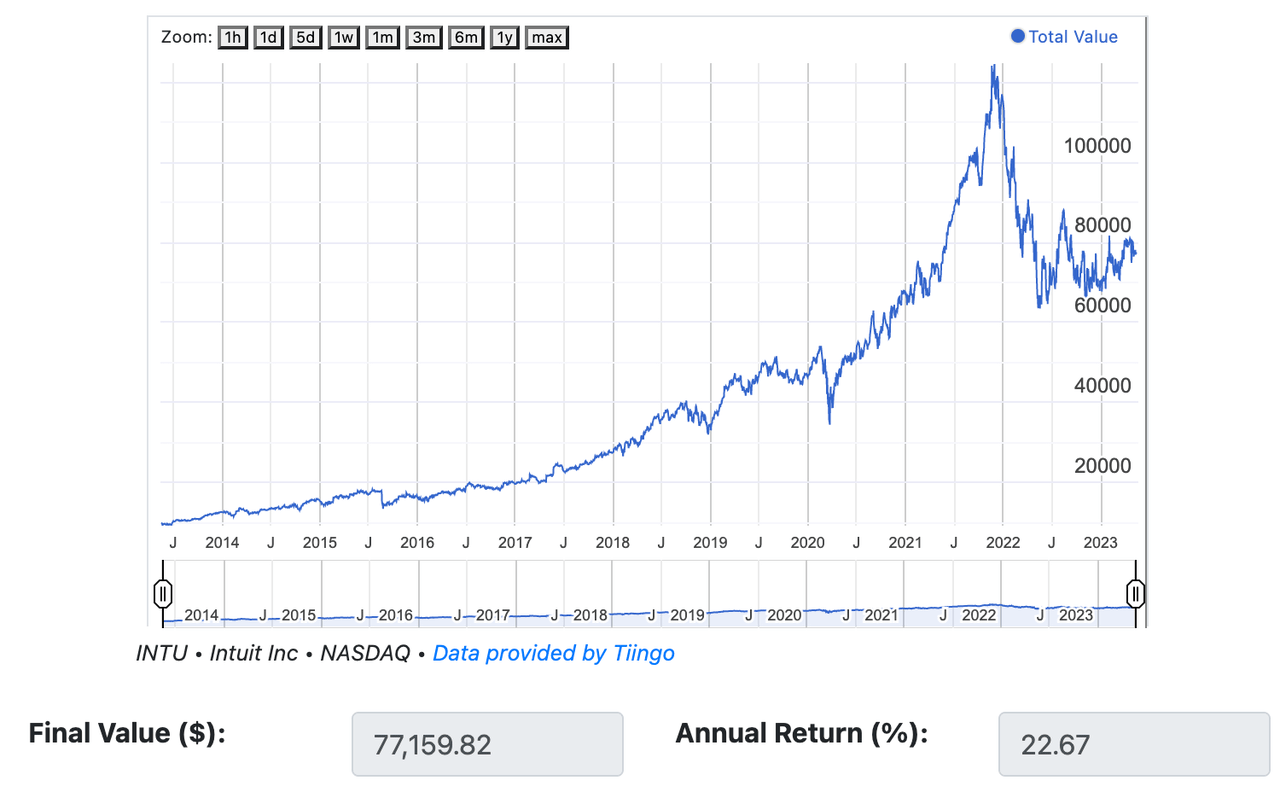

INTU is the only stock in this month’s top-ranked stocks I don’t own. Many dividend growth investors would balk at the idea of investing in a low-yielding stock such as INTU, especially given the current high rate of inflation. With its 5-YOC of 1.6%, INTU has a poor income outlook, but it’s the top-performing stock based on its 5-year trailing total returns.

Using a Stock Total Return and Dividend Reinvestment Calculator, a $10,000 investment in INTU ten years ago, with dividends reinvested, would be worth $77,160 today, for an annualized return of 22.67%:

DQYDJ stock return calculator

Those are remarkable total returns!

Concluding Remarks

In this article, I ranked 63 high-quality discounted Dividend Radar stocks with 5-year trailing total returns of at least 10%.

I own all but one of the stocks in this month’s top 10. The exception is INTU, a low-yielding but high dividend growth stock with impressive trailing total returns.

HD looks like a solid choice this month, with INTU an interesting candidate for dividend growth investors looking for high total return prospects.

Based on your investment style, you may want to focus on the following stocks first:

- For income investors: HD

- For value investors: HD and V

- For dividend growth-oriented investors: V, MA, HD, and INTU

- For very safe dividends: V, NKE, and NEE

As always, I encourage readers to do their due diligence before buying any stocks I cover.

Thanks for reading and take care, everybody!

Read the full article here