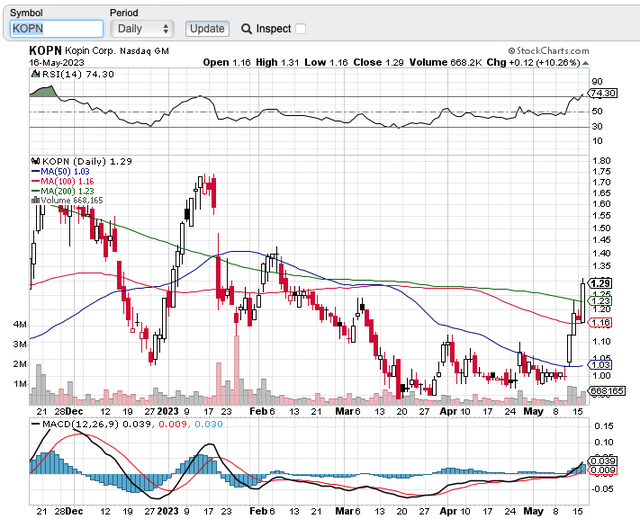

I’m going to start off today’s piece in an unorthodox way, at least for me, by starting with the technicals. As a small-cap value and special situations investor, 90% to 95% of my process and bandwidth are allocated to focusing on the fundamentals. At a high level, this includes synthesizing the conference calls, reviewing the 10-Ks and 10-Qs, speaking with management, thinking about the industry and how a company competes within that ecosystem. My very last step is looking at the technicals.

Incidentally, just yesterday, Kopin Corporation (NASDAQ:KOPN) made a technical breakout. This came after posting a better-than-expected Q1 FY 2023 quarter, and after a super upbeat Q1 FY 2023 conference call, which both took place on May 11, 2023. Albeit with a bit of a lag, Kopin recently pierced its 100 DMA and just yesterday, and on healthy volume, took out its 200 DMA.

StockCharts.com

I’ve been following this company for quite a while, and in February 2023, I even took a drive to Kopin’s corporate H.Q., where I toured the facility and spent over an hour speaking with the CEO of Kopin, Michael Murray.

Seeking Alpha

And by the way, Michael is following the script and doing exactly what he told me was his playbook.

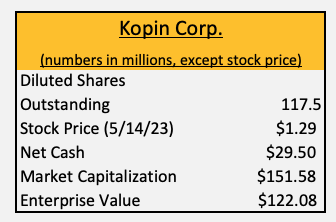

Author’s Chart

Now that we covered the high-level technicals and yesterday’s breakout, over its 200 DMA, let’s talk about the fundamentals. And arguably, the fundamentals haven’t been this good in ages. That said, stock prices are about the future and the rearview mirror financials have been really poor, so the algos don’t understand what this business could be or that it is on the verge of inflecting, in Q4 FY 2023, hence its very low current valuation.

The Thesis

As I wrote a comprehensive piece, back in late February 2023, this section is simply designed to be a quick update.

As of May 16, 2023, at $1.29 per share, Kopin Corporation has a $122 million enterprise value. The company benefits from its strong and patented IP portfolio as well as a strong foothold with its Tier 1 defense customers. However, profitability always eluded the company. In order to course-correct, and under the leadership of its new CEO, Michael Murray (he started in September 2022), the company is on the cusp of exiting Q4 FY 2023, at Adj. EBITDA breakeven. Moreover, as the company moves up the value stack, the company is projecting meaningful revenue growth and crossing the Rubicon of profitability, in FY 2024.

See Kopin’s commentary from its May 11, 2023 Q1 FY 2023 earnings press release:

We believe we are slightly ahead of our strategic initiatives and goals of cash flow breakeven by year end which are the bedrock for significant and sustainable revenue and profitable growth in 2024.”

Lo and behold, the market is asleep at the wheel here, on this story, and the market has lost the scent of this real and increasingly tangible turnaround.

Through a combination of strategic initiatives, the company has taken out a lot of SG&A, executed a clever spinoff of its R&D/capital intensive lightning silicon business, while retaining an equity stake, the ownership of the patents, and a royalty-sharing arrangement upon future commercial success. Moreover, the company’s cornerstone of its turnaround efforts starts with its On Time, In Full initiative, including making strategic capital investments, at the company’s Fab, during Q2 FY 2023, at its corporate headquarters, in Westborough, MA. This initiative and Capex upgrades position the company nicely for near-term and intermediate-term success.

See this excerpt from the May 11, 2023, Q1 FY 2023 Conference Call (emphasis added):

Now touching on some of our strategic priorities, I’ve often commented on the need for Kopin to improve our quality, which we refer to as on time in full, in full is a measure of how often we deliver products to a customer on time in total with full quality and without the customer identifying any quality issues.

This singular focus on quality ultimately leads to a more profitable Kopin by improving margins and higher customer satisfaction. We began to see some dividends from this focus in the first quarter of this year, as our product costs in the first quarter were lower than the first quarter of 2022.

To give you an idea of our progress of on time in full in September of last year, we were around approximately 60% meaning of every 100 products delivered at that time, approximately 40% or 40 relate, I’m happy to report that we are achieving rates in the high-80s to low-90 percentiles as we are continuing to improve. We believe these rates will remain consistently above 90% after the first phase of our new equipment is installed this quarter.

The company has great Tier 1 relationships with major defense companies and has positioned the company to sell integrated solutions, which command much higher ASPs, and much higher gross margins compared to just selling optical displays (50% to 60% GMs compared to 20% to 25%).

The company is technology agnostics, so it can sell its defensive customers an integrated solution. This can take the form of AMLCD, FLCoS, OLED, or Micro LED. Again, it is all about moving up the technology value stack and providing the best bespoke solution for its customers.

Big Upside Optionality – IVAS

In addition to a strong and positive book-to-bill ratio, this company has tremendous upside optionality to the prospect of being involved in (in some way shape or form) the 10-year, and $20 billion plus government-funded R&D program, spearheaded by Microsoft Corporation (MSFT). The program has struggled, at the outset, to bring the vision of lightweight and versatile night goggles to U.S. armed forces (think Oakley’s that have night vision). Kopin’s patented technology offering might be able to help Microsoft bridge the gap.

In fact, on May 11, 2023, during its Q1 FY 2023 conference call, the company mentioned IVAS on the call. If Kopin were to somehow win or be involved/participate in this program, the stock would have a dramatic leg-up. Although participation is far from certain/ known, this upside optionality isn’t reflected in Kopin’s current valuation. In terms of potential timing, there should be some visibility (good, bad, or indifferent), by the summer of 2023, on any type of involvement in IVAS.

Turning to another strategic initiative, the Integrated Visual Augmentation System otherwise known as IVAS, is the United States DoD program to provide soldiers with an augmented reality headset, which provides a wide variety of capabilities to soldiers. The current IVAS program funding is 2.5 billion, with long-term plans for 21 billion. There have been several delays in the program which provides a real opportunity for Kopin to intersect this program.

If you look at the IVAS head mounted display, in essence and essentially, it’s a head mounted display weapons site, where we have the significant expertise and pedigree to serve this market. The IVAS opportunity is significant in this program, so success here would be monumental for the company.

(Source: Kopin’s Q1 FY 2023 Conference Call.)

Incidentally, if you’re really paying attention here and in the weeds, like I am, check out yesterday’s new Business Development hire, Iwan Dodd. Per yesterday’s press release (emphasis added):

“Iwan brings over 30 years of experience in business development with a deep knowledge of microdisplays used in the night vision systems for defense and Aerospace. I am delighted and excited to have him join Kopin – he has a great understanding of our products and customers which will greatly accelerate his contributions to Kopin,” said Bill Maffucci, Senior Vice President of Business Development and Strategy.

You don’t have to be a rocket scientist to work out that they hired Iwan to try and win/get involved in the IVAS contract. Again, Kopin may or maybe will win a seat in the table, but arguably Mr. Market isn’t even aware of IVAS and what it would mean to transform Kopin.

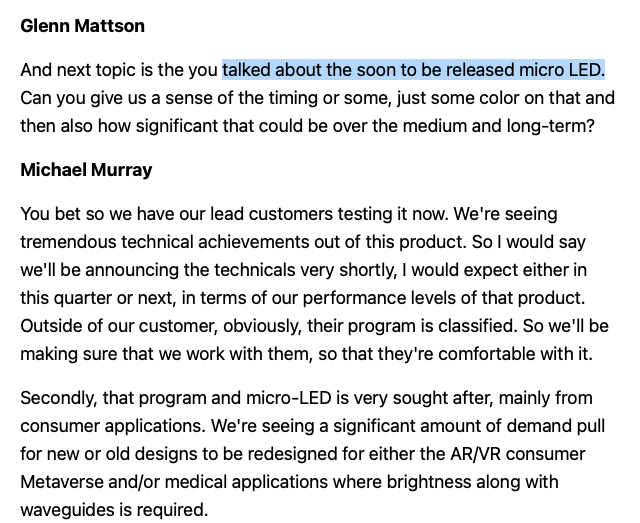

Secondly, on the Q1 FY 2023 conference call, there is another possible major catalyst – micro LED.

See this excerpt below:

Kopin’s Q1 FY 2023 Conference Call Kopin’s Q1 FY 2023 Conference Call

Micro LED is the next generation of optics displays, and it’s like moving from version 1.0 to 2.0, as it has the potential and technology specifications to broaden its appeal to other applications, such as consumer and industrial applications. This potential wider appeal could span applications in the healthcare and automotive markets. Again, Mr. Market isn’t pricing any of this potential into the Kopin Corporation stock price, at least not at current valuations.

Putting It All Together

In closing, Kopin Corporation has a $122 million enterprise value. The business is on the cusp of profitability as management has taken a lot of costs out of the business, while simultaneously building the company’s backlog, moving up the value stack, and enhancing its gross margin profile by offering integrated solutions.

Michael Murray is doing exactly what he set out to do and following the playbook he described to me during our February 16, 2023, one-on-one investor meeting.

Starting in Q2 FY 2022, as the severance and one-time costs associated with its streamlined SG&A structure show up, Kopin Corporation will have a tailwind and show an improving income and cash flow statements. If Kopin successfully crosses the Rubicon of profitability in Q4 FY 2023, KOPN stock is very mispriced. Moreover, there is the potential of big upside optionality, to any Kopin Corporation involvement in IVAS and the roll-out of micro LED, in FY 2024.

Read the full article here