Introduction

Telecommunication companies are often viewed as stable or safe investments. These companies enjoy an oligopoly with arguably less elastic demand. Even in economic troubles, nearly every consumer and business need a wireless connection. Thus, high debt loads and slow growth has been tolerated by the investors in this industry. However, more and more, Verizon (NYSE:VZ), in my opinion, is becoming less favorable. The company has not only been losing its customers for the past few quarters, but Verizon is also significantly more leveraged than its competitors: T-Mobile (TMUS) and AT&T (T). This puts the company in a precarious position. Verizon has to do more to solve the current problem of customers fleeing, which includes cutting the prices of its services, investing more in 5G infrastructure, or adding additional perks within its plans. With declining customers and a high debt load, all of the potential solutions could be detrimental to Verizon. Therefore, I believe Verizon is a sell.

Customers Leaving

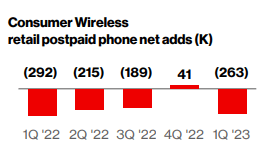

Excluding the fourth quarter in 2022, Verizon lost consumer wireless retail and postpaid customers. As the chart picture shows, in the most recent quarter, 2023Q1, the company lost 263 thousand customers, which was a continual trend throughout 2022 where the company lost a total of 655 thousand customers. The negative trend for the company is not showing signs of a turnaround.

Verizon

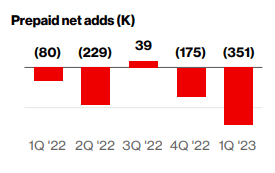

Further, prepaid customer numbers are not any better for Verizon. As the picture shows, the company lost 351 thousand customers in 2023Q1 after losing a total of 445 thousand customers. Even when considering that prepaid customers tend to have a higher churn than postpaid customers, the numbers are showing a clear trend: Verizon’s customers are leaving.

Verizon

T-Mobile, on the other hand, in 2023Q1, reported a postpaid phone net customer additions of 583 thousand, and AT&T reported positive growth as well by having 424 thousand postpaid phone net additions in 2023Q1. These results come after positive customer additions in 2022, unlike Verizon.

As such, the recent earnings report trend shows that Verizon is losing customers at an alarming rate to AT&T and T-Mobile, and this trend, for the time being, is not showing signs of stopping.

Consequences

I believe the current negative trend for Verizon stems from a fundamental problem. Relative to AT&T and T-Mobile, Verizon’s services are too expensive without providing meaningful value to consumers. When consumers choose a wireless service, two factors, price and speed, are often the most importantly considered. Thus, having a competitive advantage in either pricing, service, or both is necessary to stay relevant.

Comparing the prices of all three companies, for mid-tier unlimited plans from AT&T, a family of 4 will have to pay $160 plus various taxes and fees. For T-Mobile, the same family will have to pay $155 with various taxes and fees included. Finally, for Verizon, the same family will have to pay $180 plus various taxes and fees. Although T-Mobile should be significantly cheaper as the company’s plan includes taxes and fees, even when disregarding this, Verizon is 12.5% and 16.3% more expensive than AT&T and T-Mobile, respectively. For a family of 3, Verizon is 10% and 27% more expensive than AT&T and T-Mobile, respectively.

Overall, Verizon demands a premium from its customers compared to AT&T and T-Mobile. However, Verizon is struggling to justify this pricing structure as the company’s 5G service is arguably worse than AT&T and T-Mobile. First, Verizon significantly lags behind 5G availability. While T-Mobile boasts 49.7% and AT&T at 20.5%, Verizon’s 5G availability stands at merely 8.8%. For download speed experience, T-Mobile was the fastest of the three by a wide margin at 79.5 Mbps while AT&T scored 38.2 Mbps above Verizon’s 31.3 Mbps. When looking at a pure download speed, Verizon does beat AT&T at 84.9 Mbps as AT&T scored 71.1 Mbps. However, this level is still lower than AT&T’s 186.3 Mbps. Verizon may be better in some regions of the United States; however, for the majority of consumers, especially in urban regions with 5G infrastructure, Verizon is lagging behind its competitors.

Therefore, while Verizon demands a premium from its customers, the company’s 5G offering is extremely weak compared to its competitors, and I believe this to be the reason for continual customer departure away from Verizon.

Potential Solution

Verizon spent about $6 billion in CapEx with a “step down in the pacing of overall CapEx throughout the remainder of the year.” Although this comes as the C-band-related spending is coming to an end, the management team during the earnings call stated that there are no intentions for the company to step up spending to justify the current high pricing Verizon is demanding from its consumers. Thus, I believe there are 3 potential outcomes for Verizon.

The first potential outcome is likely the simplest approach to solving a problem. Verizon can cut prices to be more competitive. Second, the company can increase the perks and benefits of its data plans. Verizon, for some of its plans, already offers free Disney Plus (DIS) or Apple (AAPL) Arcade subscriptions. To make the company’s services more enticing, Verizon could increase the perks. Finally, Verizon can increase CapEx spending to provide better 5G services to justify its premium pricing relative to competitors. Unfortunately, any of these solutions will likely be detrimental to Verizon due to the company’s financial health.

Financials

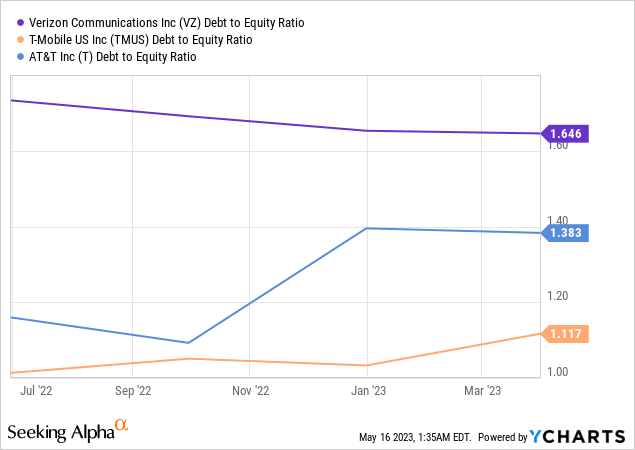

Verizon has two heavy burdens: debt and dividends. Starting with debt, the company has a long-term debt of $140 billion with a debt maturing within a year of $12 billion bringing the company’s total interest expenses to $1.2 billion for the quarter, which is about 25% of the company’s net income. Further, as the chart below shows, Verizon has the highest debt-to-equity compared to its competitors.

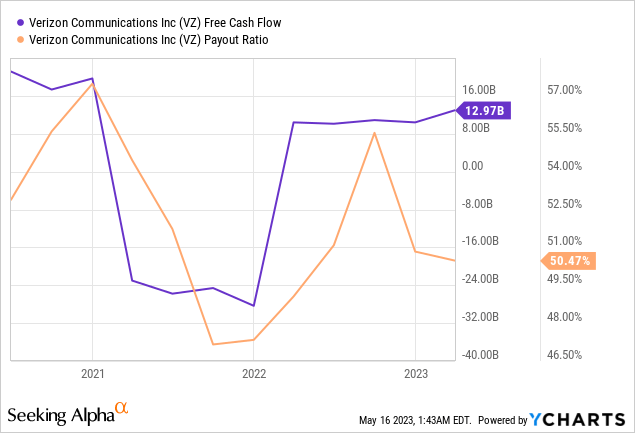

Further, as the chart above shows, Verizon has a dividend payout ratio of about 50%. For the company, this is a sustainable and healthy level. But, given the possibility for the company to cut prices or even increase CapEx to overturn the current negative trend, Verizon’s annual dividend increases and a high dividend payout could be a burden for the company.

Overall, because Verizon is a telecommunication company, having a dividend and debt burden is manageable as the cash flow outlook is very stable; however, with a fundamental risk of losing customers requiring the company to likely increase spending to upend this trend, I believe there will be detrimental damage to the investor sentiment and the stock price as margins could get squeezed.

Summary

Verizon operates in an industry where a dividend and financial burden is widely accepted by investors; however, given that Verizon is facing a fundamental problem of customers leaving the company for its competitors, the pressure seen in Verizon’s operations could be more than investors could tolerate and potentially damage the company’s stock price performance further. The continual trend of customers leaving, in my opinion, shows that consumers are not willing to pay a premium for Verizon anymore, which means two things. One, Verizon may have to pay more for a 5G network, more than expected. Two, Verizon may have to include perks like T-Mobile. Three, cut costs. Therefore, with the financial and dividend burden not leaving the company room for aggressive capital investments for a turnaround, I believe Verizon is a sell.

Read the full article here