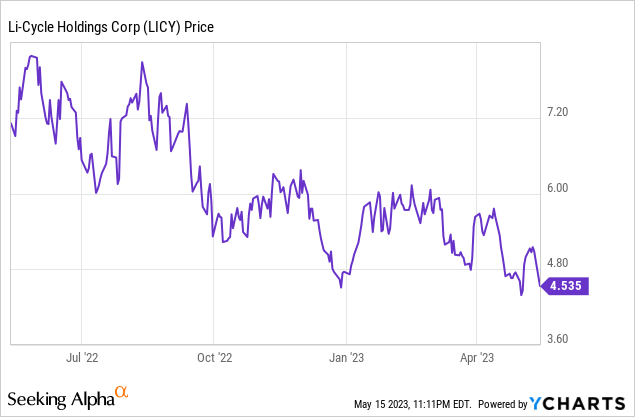

Li-Cycle (NYSE:LICY) still holds a lot of promise for investors despite negative returns of 34% over the last year. The critical battery materials recycler remains one of the only ways to build portfolio exposure to this fledging industry and is currently amidst a material buildout of a global lithium-ion battery recycling network. The company’s long-term bull case is its construction of a sustainable closed-loop battery supply chain that would help minimize the overall negative externalities of our fast-decarbonizing world. These externalities are centered on the material expansion of the current global mining capacity for critical battery metals. Li-Cycle through its hydrometallurgical process is able to create battery-grade lithium-ion materials from any type of spent lithium-ion battery and is able to process all types of lithium-ion batteries.

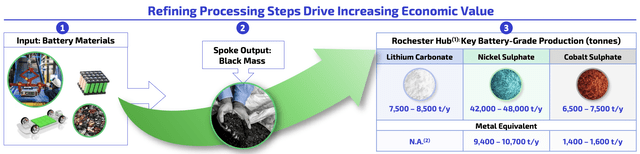

Whilst the stock’s weakness over the last year has been heavily impacted by broader macroeconomic factors from a rapidly rising Fed funds rate and stagflation fears, current revenue remains anemic as the company races to build out its network of Spokes. These facilities turn batteries and scrap into black mass whilst its Hub will process the mass into lithium, cobalt, and nickel. The prize here is vast with around 15 million tons of spent lithium-ion batteries expected to reach the end of their lives by 2030. Addressing this creeping environmental issue will present an immense economic opportunity for Li-Cycle as the global transition towards green energy drives heavy demand for critical battery metals.

Fiscal 2023 First Quarter Earnings

The company recently reported fiscal 2023 first-quarter earnings that saw revenue come in at $3.6 million, a roughly 55% decline versus its year-ago quarter and a miss by $2.73 million on consensus estimates. Li-Cycle currently has four operational Spokes in North America with a combined 51,000 tonnes of total annual processing capacity. The company is currently building another three spokes in Germany, France, and Norway for a further 50,000 tonnes of annual processing capacity. Most of this processing capacity is set to come online this year apart from the Spoke in France whose main line is targeting the first half of 2024 for its start of operations. Overall, Li-Cycle is set to see its total processing capacity increase to 106,000 tonnes per year with its Ontario spoke also set for an upgrade.

These capital-intensive projects have placed Li-Cycle’s near-term liquidity position into view. The company held cash and equivalents of $409.2 million as of the end of its first quarter, down sequentially from $517.9 million in the prior quarter. This is set to be boosted by a conditional $375 million loan from the U.S. Department of Energy. The loan is set to close towards the end of June and is being made from the DoE’s Advanced Technology Vehicles Manufacturing program. Critically, the loan is a strong vote of confidence in the company’s Rochester, New York Hub. This Hub is currently being constructed with operations set to start toward the end of 2023.

Li-Cycle

The commencement of commercial operations from the Rochester Hub would form a watershed moment for Li-Cycle and would allow them to start realizing actual sales from their multiyear off-take commercial contracts. The company is estimating between 42,000 to 48,000 tonnes per year in nickel sulfate output, 6,500 to 7,500 tonnes per year in cobalt sulfate output, and 7,500 to 8,500 tonnes per year in lithium carbonate output. Hence, the potential revenue figures begin to look substantial once you compare the projected end-of-year prices for these metals against the metal equivalent of Li-Cycle Hub output.

Revenue Set To Ramp

Li-Cycle

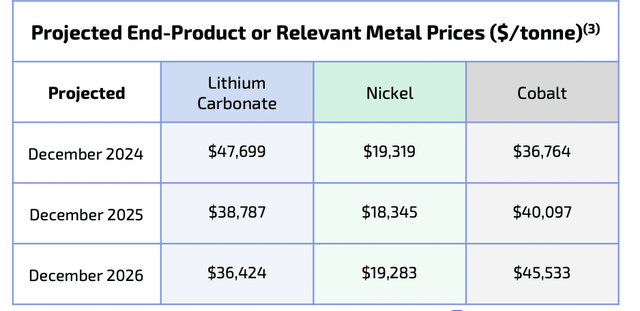

The company provided some projected figures for the price per tonne. These place potential revenue from fiscal 2024 at a material difference from its current revenue run rate. Hence, we could see sales of around $182 million from just Nickel sales and around $51.5 million from Cobalt sales. These ballpark figures are subject to a high level of risk though. Actual metal prices at the end of 2024 could be substantially lower than current estimates and production from the Rochester Hub could also be subject to some bottlenecks that don’t reflect management expectations for output.

However, whilst the company’s current market cap at $800 million looks substantial against current revenue figures, Li-Cycle is in essence pre-revenue and sales are set for an inflection point once the Rochester Hub fully comes online. This is as the company announced plans for a second commercial Hub in Italy. This will be via a partnership with Glencore. It’s expected the new hub will have a processing capacity of between 50,000 to 70,000 tonnes of black mass per year. Whilst it’s not yet a buy, I like Li-Cycle here and have decided to consider a position later this year. The company looks to have found an incredible niche in the wider decarbonization story with a unique position as both a recycler for electrification and a supplier of critical metals for the zero-carbon shift.

Read the full article here