Thesis

The ClearShares Ultra-Short Maturity ETF (NYSEARCA:OPER) is an exchange traded fund that falls in the ‘cash parking vehicles’ category. The fund is actively managed, and it seeks to generate current income by investing its cash in repurchase agreements collateralized by U.S. Treasuries and U.S. Government backed Securities. This set-up is highly unusual since retail investors are used to funds that purchase Treasuries or T-Bills and pass the return of the underlying collateral to fundholders. Not here. In effect, the best way to think about OPER is as a lender in the institutional market, where the fund acts somehow as a ‘mini-bank’ and lends investors’ cash against extremely safe securities such as Treasuries and Agency MBSs.

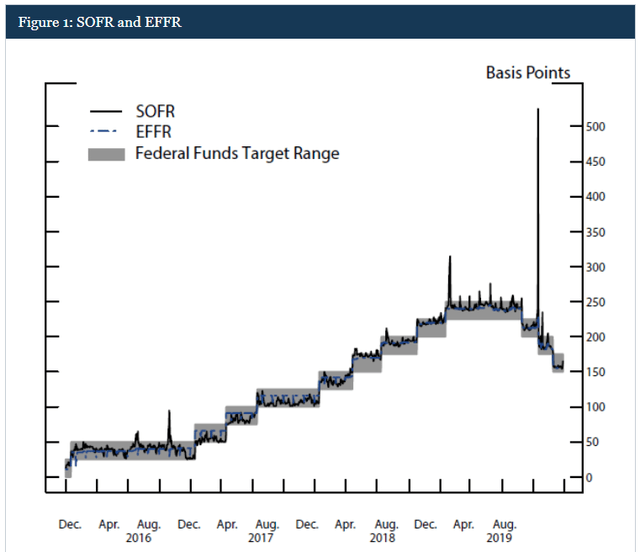

The difference between a traditional cash-parking ETF that holds T-Bills or Notes versus OPER is the ability to capture idiosyncrasies in the funding markets. Technically short term Repo rates are very much correlated to Fed Funds and the short end of the curve, but liquidity crunches can, and have occurred. For example, in September 2019, the repo rate briefly spiked to 10% due to a combination of factors, including corporate tax payments and new Treasury debt issuance:

SOFR vs Fed Funds (The Fed)

At the same time, the yield on Treasury bills was around 2%. This means that investors were willing to lend money at a higher interest rate in the repo market than they were to buy Treasury bills.

As a visual representation, an investor should focus on the Secured Overnight Financing Rate (SOFR) in the graph above. SOFR is based on overnight repo, and the fact that historically SOFR occasionally spikes above the Federal Funds target rate should give investor a good grasp on how a fund such as OPER can speculate the occasional liquidity crunches.

We think 2023 will be a year where we will see more outside events consistent with liquidity events. We have already witnessed one during the recent regional banking crisis, where the Fed had to create a new facility, namely the Bank Term Funding Program, in order to inject liquidity in the system and avert a run on the banks.

The best way for a retail investor to play today’s environment and potential liquidity crunches is through an instrument such as OPER. The fund will be able to monetize higher repo rates if and when they occur, on the back of significant risk-off events. We saw a spike to 10% in the repo rate in 2019, and one can only imagine the profits a fund like OPER can make if it takes advantage of another similar occurrence. Until then, OPER will clip a high short term rate, in line with the front end of the curve. We have seen this in its historic performance, with OPER outperforming in the past year both (BIL) and (SGOV), which we cover.

Performance

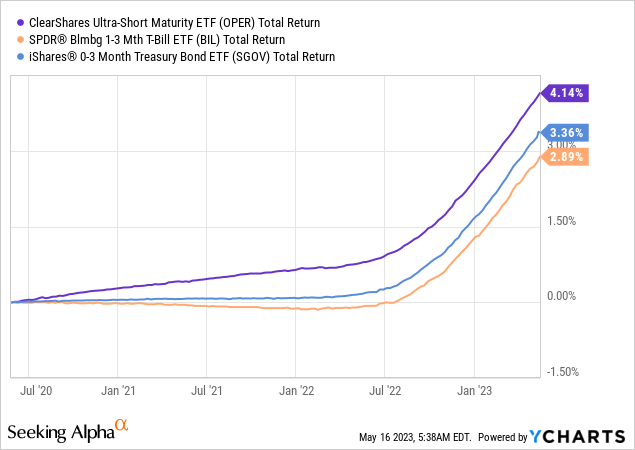

OPER is the clear outperformer here when looking back three years:

We are employing a total return metric here, which we believe is the right approach for cash parking vehicles.

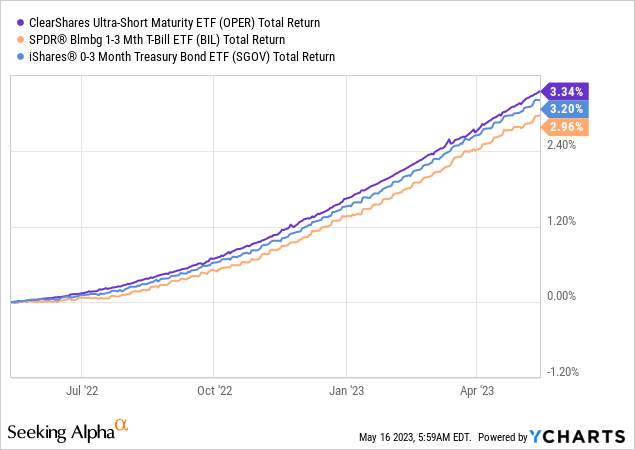

In the past year, as rates have risen, OPER has still outperformed:

The net outperformance here is lower, but the fund still manages to deliver a higher total return than its peers. We like this fund for its optionality, basically its ability to punt on potential liquidity crunches.

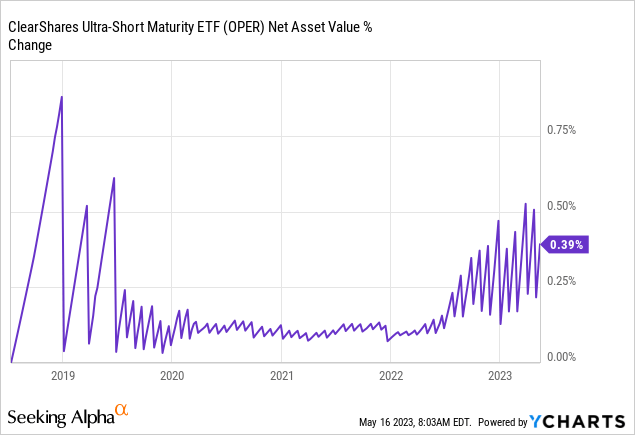

The fund makes sure to disclose it is not a money market fund, yet when we look at its NAV we can observe it is extremely stable:

Looking back four years, we can notice the NAV does not move by more than 0.5%, outside the repo rate spike in 2019 when the fund had a high positive NAV move of 0.75%.

Holdings

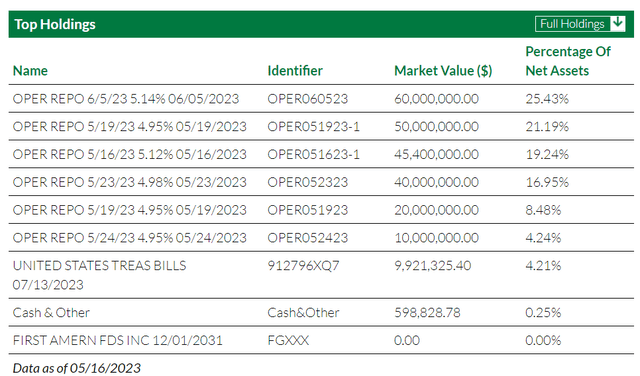

As discussed in the thesis section, the fund does not hold securities, but lends money out via repo transactions:

OPER lends money in the institutional lending markets as opposed to owning securities in order to achieve it’s investment objectives. These lending transactions (repurchase agreements or “repos”) are collateralized by fixed income securities issued by the US Treasury and government agencies. A third-party custodian holds the collateral on behalf of OPER and ensures the account is collateralized based on the market value of all pledged securities. OPER should continue to be a beneficiary of a rising rate environment, and may be an attractive option for investors seeking current income and portfolio stability in fixed income holdings:

• OPER primarily accepts collateral issued by the US Treasury and government agencies

• OPER receives a minimum of 2% excess collateral pledged against each lending agreement

We can see a breakout of the current lending facilities employed by the fund below:

Holdings (Fund)

So let us have a look at the first line of the collateral pool. This is a repo facility with a June 5, 2023 maturity date and a rate of 5.14% (the fund receives this fixed rate). The fund does not specify the exact CUSIP of the security it lends against, but as per its mandate it will be a Treasury or Agency MBS.

The fund will continue to take advantage of the best execution points in the short end funding markets, and if we do see significant spikes in repo rates the vehicle will be able to take advantage of them.

Conclusion

OPER is a fixed income exchange traded fund. The vehicle focuses on the short end of the funding markets and employs an innovative repo lending strategy. Unlike other cash parking vehicles, OPER does not hold securities, but rather acts as a cog in the short term funding market by lending the cash it receives from investors. Said cash is collateralized by Treasury or Agency MBS securities (hence no credit risk) and will benefit from both the credit worthiness of the counterpart as well as the market value of the underlying securities. The best way to think about OPER is as a ‘mini-bank’ that focuses on very short term loans (overnight to three months) that are collateralized by Treasury notes and MBS bonds.

We think this is a great structure for 2023, given its ability to take advantage of any liquidity crunches. We have seen repo rates spike to 10% briefly in 2019, and we might see similar outside events this year. This fund is akin to a money market fund in our opinion with the added optionality of being able to take advantage of black swan events in the short term funding markets. OPER has outperformed both BIL and SGOV in the past year, and we expect it to continue to do so. We are a strong buy for this name here for the rest of 2023.

Read the full article here