Investment Thesis

Doximity’s (NYSE:DOCS) reported fiscal Q4 results that were somewhat mixed. I believe that investors didn’t look too kindly to its EPS figure in Q4 2023 being down. More specifically, its non-GAAP EPS figures were down 4.8% y/y.

Then, on top of that, even though Doximity’s guidance for fiscal 2024 came in ahead of expectations, its guidance for fiscal Q1 2024 came in below expectations.

When a stock is priced at more than 40x forward EPS, investors want to be bedazzled. And that didn’t happen here.

Why Doximity? Why Now?

Doximity is a networking service for medical professionals. It’s rapidly expanded its products from just a place for medical professionals to network to a platform where physicians can collaborate, be more productive, and ultimately provide better care for their patients.

Meanwhile, Doximity’s clients also include the top 20 pharmaceutical companies, allowing sales reps an easy means to inform and sell drugs to doctors.

There are many secular trends that provide a tailwind for Doximity. Not only is it a digital enabler but it also allows for increased flexibility, ease of communication with other medical professionals, as well as increasing physicians’ productivity.

Revenue Growth Rates for Q1 Are the Problem

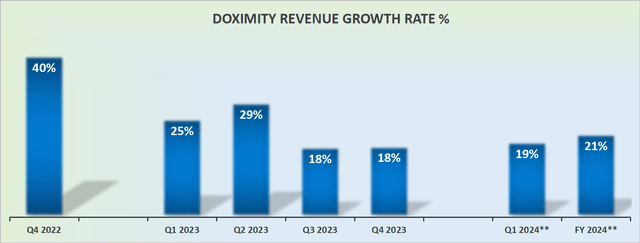

DOCS revenue growth rates

Doximity’s guidance for fiscal Q1 2024 points to approximately $108 million at the high end. This is lower than the $112 million that analysts had been expecting to see. Meaning that rather than Q1 2023 growing at around 23% y/y, the high end of Doximity’s guidance in actuality points to 19% y/y growth rates.

The problem for investors then is not so much what will fiscal Q1 2024 grow at, but rather, how much confidence can investors seriously have that Doximity will meet its fiscal 2024 targets.

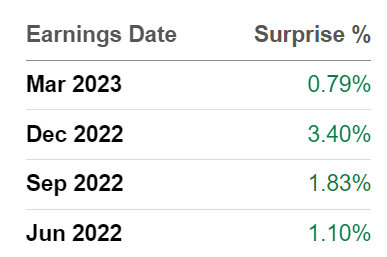

SA Premium

After all, the size of Doximity’s revenue beats has by and large become smaller.

Along these lines, Doximity’s management declared on its earnings call that it was prepared for a “tough year on upsell as we expect macro belt-tightening to continue”.

Profitability Profile Discussed

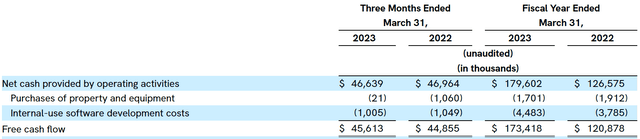

DOCS Q4 2023

The crown jewel of this investment thesis used to be its very strong free cash flow margins.

Case in point, last year’s fiscal Q4 2023, its free cash flow margin was 48%. While in the most recent quarter, Doximity’s free cash flow margin dropped by approximately 700 basis points to 41%.

Looking through its cash flow statement it appears to be the biggest use of cash turned came from its receivables. For astute short sellers, this is a very significant yellow flag. Short sellers can forgive a lot about a company that is making a lot of free cash flow. But when receivables end up being a large use of cash flow, that’s not a great sign.

DOCS Q4 2023

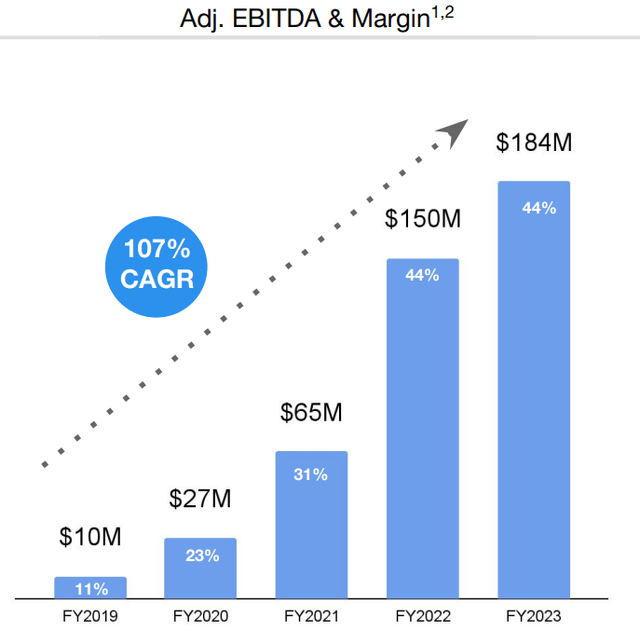

From another perspective, consider that Doximity’s guidance for fiscal 2024 points to around a 21% y/y increase on its EBITDA line.

Even if we allow some room for conservatism, it appears that the progress in Doximity’s EBITDA from fiscal 2022 into fiscal 2023 of 23% y/y growth isn’t going to be matched in the upcoming year.

Capital Allocation Considerations

Over the trailing twelve months, Doximity was able to leverage its strong free cash flows to repurchase shares. Doximity’s shares were repurchased at approximately $32 per share.

Naturally, with the share price now falling below this figure, I believe that Doximity will continue to repurchase its shares. Indeed, here’s a quote from the earnings call echoing that assumption:

I think we are very comfortable with the level of investment we have and we’re also very comfortable with the fact that we’re able to generate high enough free cash flow to continue to deliver value to our shareholders via share repurchases as well.

Accordingly, given that Doximity holds more than $800 million of cash and equivalents and no debt, I suspect Doximity will be keen to move even more aggressively to repurchase its shares than it did in fiscal 2023.

The Bottom Line

The bull case for Doximity hasn’t changed. Investors are going to continue to latch onto this highly free cash flow-yielding business, with a very strong balance sheet that holds more than $800 million in cash and equivalents.

For bears, they’ll be quick to point out that fiscal Q1 2024 isn’t likely to live up to expectations, therefore what trust can they put in Doximity’s full-year fiscal 2024 guidance?

For my part, I’m neutral on this name. I recognize both sides of the argument, but I also feel that the stock isn’t so cheap that investors will forgive these blemishes either.

Read the full article here