Thesis

I have been following the YieldMax covered call ETFs ever since their YieldMax TSLA Option Income Strategy ETF (NYSEARCA:TSLY) caught my attention. A few weeks ago I wrote an article explaining how to hedge it. Even though its distribution for May was significantly under the average yield, I still consider it an appealing investment. I still rate TSLY ETF a buy.

Background

TSLY is one of several covered call ETFs managed by YieldMax. Their goal is to harvest income from Tesla’s (TSLA) volatility. Its yield varies, but as of May 15th, 2023, it was at 39.69%. It has only been trading for a few months, so its presently listed ttm yield of 30.3% does not tell a complete story.

Holdings

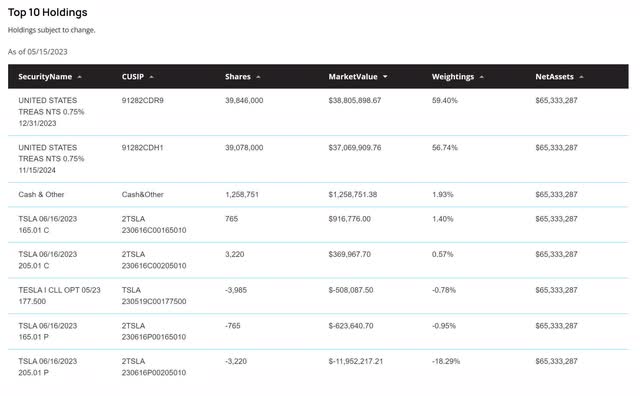

TSLY employs a synthetic covered call strategy. They buy calls and sell puts in pairs at the same strike price, this is often referred to as a synthetic long position. The profit/loss behavior on this type of position is identical to owning shares, except the position can be achieved with significantly lower amounts of capital. They harvest income from TSLA’s volatility by selling covered calls against their synthetic long positions.

By looking over their holdings, we can see they presently have two pairs of calls and puts. One pair has a strike price of $205, the other one has a strike price of $165. Currently, they are selling calls with a strike of $177.5 which expire on 5/19/23.

TSLY Holdings (elevateshares.com/tsly)

Alternatively, this can also be looked at as a bull call spread, except they are also harvesting theta by selling puts.

Correlation

When looking over their synchronicity with TSLA, it’s clear the fund has a very high degree of correlation with its underlying.

TSLY vs. TSLA Shorter-Term Correlation (TradingView via Seeking Alpha)

TSLY is expected to slowly degrade over time when compared to TSLA. This is because of the covered call strategy. By selling calls, not only are they harvesting cash flow out of the position, they are limiting their maximum gain during periods where TSLA experiences rallies that carry it above the strike of the calls they sold. Although their behavior over short time frames is highly correlated, I expect TSLY to slowly fall out of sync with TSLA over long time frames.

TSLY vs. TSLA Longer-Term Correlation (TradingView via Seeking Alpha)

It is a relatively new fund so it will likely take several more months before we have enough data to produce a reliable estimate for its average long-term NAV erosion.

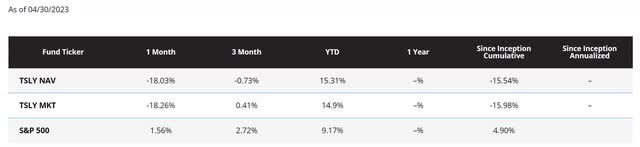

TSLY NAV Erosion (elevateshares.com/tsly)

Not only does the fund miss out on a portion of significant TSLA rallies, TSLY also suffers from drops in value every month on its ex-dividend date. This is the second factor which leads to TSLY slowly falling out of sync with TSLA over longer time frames.

TSLY vs. TSLA Distribution Effects (TradingView via Seeking Alpha)

Distribution History

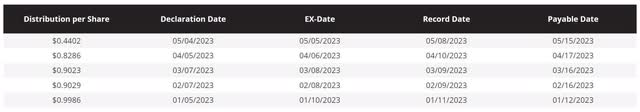

Their distribution varies greatly. After listening to a couple of interviews with the fund manager on Youtube, a couple aspects of their strategy became clear. When they enter their synthetic positions, they chose strikes that are 5-15% above the current price. This allows them to collect value from the theta on the calls they sell, while harvesting some value from rises in the share price of TSLA. This means during periods where the volatility of TSLA goes down, TSLY will experience lackluster distributions.

TSLY Distribution History (elevateshares.com/tsly)

The sum of these five existing distributions is 4.0726. This comes out to an average distribution of $0.8145 per share.

It is possible for its annual yield to temporarily spike up to unheard of values. An example would be if TSLA were to suddenly dip to the $80-$100 per share range, and then enter a period where indecision was rampant and price swings wildly within a range. The distributions that result from violent barcoding at lows have the potential to pay out monthly distributions large enough that they might equate to over 100% annual yield. While I expect most months to fall somewhere in the 50-70% range, I believe outlier months like this are possible.

The reason I cited the 50-70% value is because it was brought up as a rough estimate during one of the interviews with the fund manager. It is also supported by its present dividend history. With the fund currently sporting a ttm yield of 30.03% from only 5 monthly distributions, I have to come to the conclusion that extrapolating an additional 7 months of payouts on to that will eventually produce a ttm annual yield that is somewhere in the ballpark of 72.07%.

Risks

This is an actively managed fund, so human error is always a possibility. Synthetic covered calls have been popular for many years, so the details behind managing this strategy are well understood by a fairly large base of options traders. Even though the human running TSLY can always be replaced by another competent trader, the potential for human error will never be removed.

The fund has removed the risk of getting exercised by using European style options to build its synthetic long position.

By investing into TSLY instead of TSLA, one is accepting a trade-off where they know they will miss out on a portion of any future gain TSLA makes. They are effectively replacing price appreciation with cash flow.

Catalysts

The same catalysts that will affect TSLA will also affect TSLY. Although I believe it is currently overvalued, Tesla faces multiple long-term catalysts.

Conclusions

Although its variable yield is unpredictable in value, because of Tesla’s consistently high volatility, I expect it to stay relatively high. The months where TSLA experiences high volatility, but only gains 5-10% in valuation, have the potential to gain TSLY holders the most value.

Before I talk about ways to hedge TSLY I have to add a warning. Leveraged ETFs are notorious for value degradation over longer time frames. While they are designed to perform a certain way compared to the daily performance of their underlying, enough investors have misunderstood or misjudged the effects of their long-term behavior that FINRA and the SEC have both issued warnings. Because of their value erosion, it is incredibly unwise to be long a leveraged ETF over longer time periods. Thankfully, one of the most efficient things for us to do is to short a bullish leveraged ETF, so instead of working against us, its long term value degradation should work in our favor.

Nothing in this paragraph will help against TSLY’s long term NAV erosion but anyone who is wanting to own TSLY on margin should be able to stave off margin calls by purchasing an appropriate amount of TSLA puts, Direxion Daily TSLA Bear 1X Shares ETF (TSLS), or AXS TSLA Bear Daily ETF (TSLQ). Alternatively, it may be more efficient to enter a short position on TSLA directly, Direxion Daily TSLA Bull 1.5X Shares ETF (TSLL), or another bullish leveraged asset such as the Leverage Shares 3x Tesla ETP (TSL3). Please thoroughly research these margin hedging methods before employing them, each of them have their own nuances and each of them carry their own unique risks.

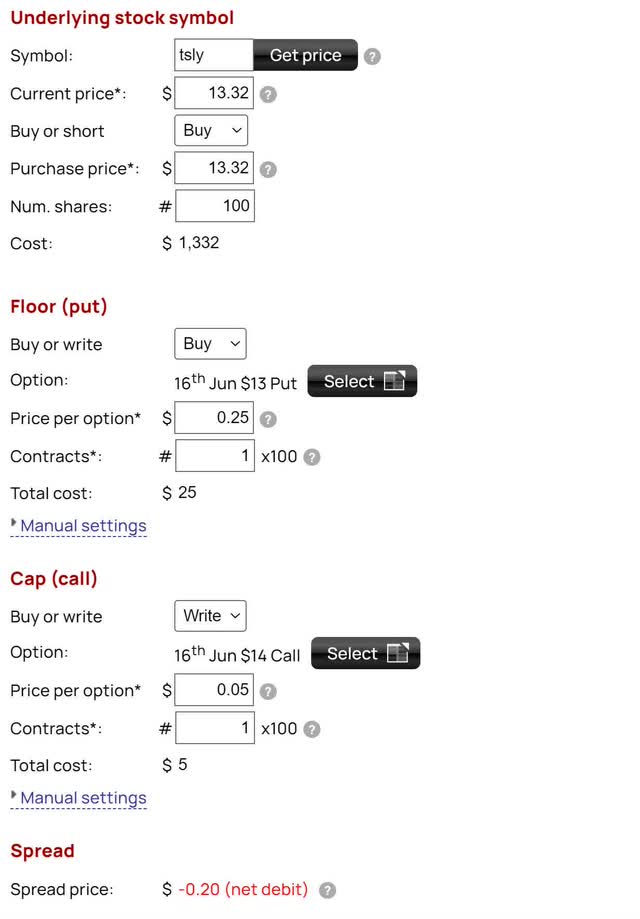

Until I get more data on its rate of long-term NAV erosion, and because I believe TSLA is overvalued, I continue to encourage TSLY investors to consider hedging against price drops through options. Because the options market for TSLY is rather thinly traded, I had difficulty producing an attractive collar.

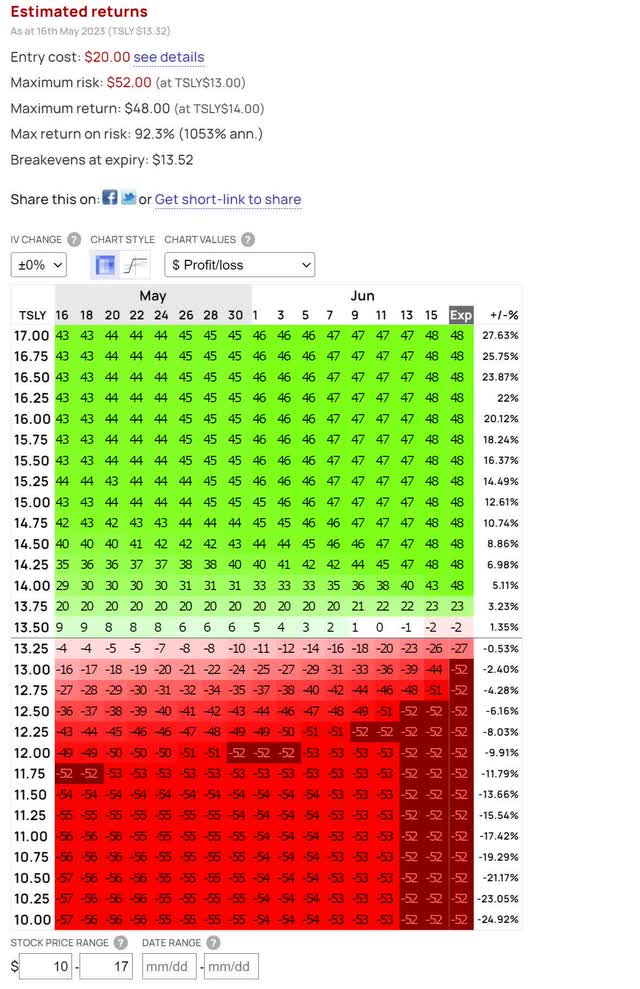

TSLY Options Collar (Optionsprofitcalculator.com) TSLY Options Collar 2 (Optionsprofitcalculator.com)

Collars are fairly straightforward, the long put caps your losses in the event of a significant decline, while the short call helps pay for the put. This trade resolves on June 16th, but can be closed or rolled earlier. Assuming the early June distribution reverts to its mean of $0.8145 and including the entry cost, the position has an expected range of profit of $9.45 to $109.45. Considering the total entry cost of $1,352, this produces an expected range of return of 0.69% to 8.09% by June 16th.

If the distribution doesn’t return to its average and instead repeats another $0.4402 per share payout, then the expected range of profit is -$27.98 to $72.02. This produces an expected range of return of -2.06% to 5.33% by June 16th.

Because I expect it to continue paying rather fat distributions, and it’s highly unlikely for TSLY to go to zero in the foreseeable future, it’s also reasonable to adopt a ‘buy every dip’ attitude. After looking over the long term behavior of TSLY, and comparing it to my estimate for annual yield, I believe holders who drip their distributions are likely to end up ahead of the long-term NAV erosion, but it is unclear to me by how much. Instead of running option collars, selling calls and using the premium to buy more shares is a viable strategy.

I do not currently have a position on TSLY, and do not plan on entering one within the next few days, but I may enter one before the next ex-dividend date.

Read the full article here