Microsoft (NASDAQ:MSFT) received some major good news on Monday after regulators in the European Union finally approved of the software company’s acquisition of video game maker Activision Blizzard (ATVI). Microsoft announced its intention to acquire Activision in a deal valued at $69B more than a year ago. The deal is meant to advance Microsoft’s push into the video gaming industry and is set to make the software company the third-largest gaming company, by revenue, in the world. Considering that Microsoft continues to earn billions of dollars in free cash flow each quarter and Microsoft now has a catalyst for cloud gaming growth, I believe Microsoft shares are set for a continual upside revaluation!

A strategic win for Microsoft

Microsoft over the years has been a heavy investor in the video gaming industry and most notably achieved growth through its XBOX division. However, the acquisition of Activision Blizzard, which owns some of the most renowned video game franchises in the world including names such as Call of Duty, Candy Crush and Warcraft, could not only boost Microsoft’s gaming revenue growth, but turn the software company into a predominant player in cloud gaming industry. European regulators approved of Microsoft’s acquisition of Activision Blizzard on Monday and EU approval comes just weeks after the competition regulator in the U.K., the Competition and Markets Authority, blocked the acquisition due to concerns over Microsoft’s strength in the cloud gaming market.

The European Union, however, gave the go-ahead for the transaction after Microsoft made concessions to alleviate concerns over a dominant position in cloud gaming. For example, Microsoft agreed that a purchased Activision video game could be played on any cloud gaming platform, not only on Microsoft’s. The company agreed, as an example to bring Activision’s Call of Duty franchise to Nintendo for a period of ten years. Microsoft offered a similar deal to Sony which dominates the console market with its highly popular PlayStations.

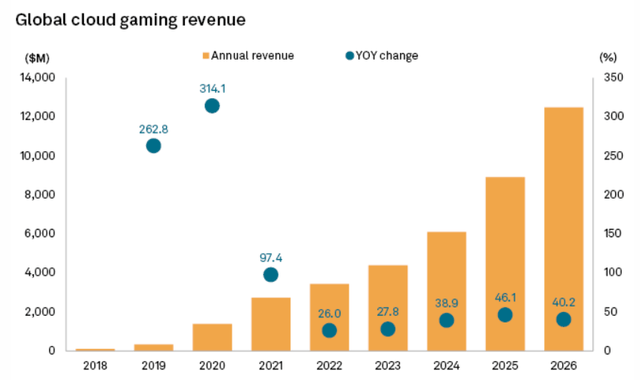

By making this concession, Microsoft addressed regulator concerns that the company could develop a monopolistic position in the rapidly growing cloud gaming market. According to S&P Global Market Intelligence, the global cloud gaming market is set for rapid growth in the coming years as the segment is expected to grow between 28% in FY 2023 and up to 46% in FY 2025. The biggest players in the market are Microsoft, Sony, Nintendo, and Chinese tech/gaming giant Tencent.

Source: S&P Global

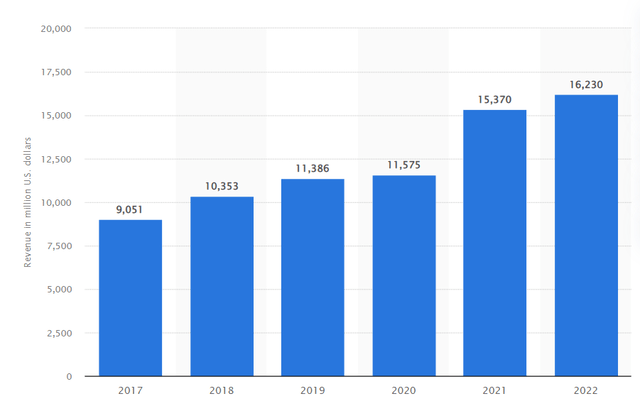

The chart (Source) below shows Microsoft’s historical growth in gaming revenues as well as annual revenue levels for the years 2017 to 2022. In FY 2022, Microsoft generated $16.2B in revenues from its gaming business, showing 6% year over year growth and 12% average annual growth since FY 2017. The pandemic obviously helped Microsoft’s gaming revenue growth because, due to economic lockdowns and COVID-19 restrictions, many consumers turned to online games to spend their free time. With the growth of cloud gaming, I believe the Activision Blizzard transaction is enormously beneficial for Microsoft as it strengthens the company’s gaming position in the cloud market and also adds an accelerant to Microsoft’s revenue growth.

Source: Statista, Microsoft Gaming Revenues FY 2017-2022

Microsoft’s valuation

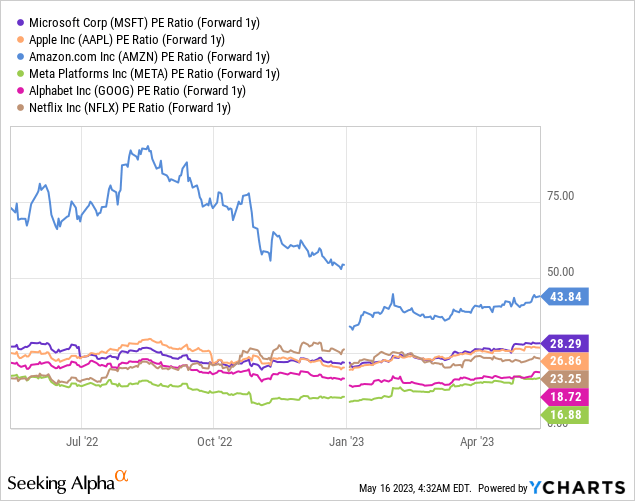

In my work “Microsoft: Breaking Out After Q3 Earnings” I made the point that Microsoft’s shares were not necessarily expensive given the enormous amount of free cash flow the company earns on a quarterly basis and given Microsoft’s strong growth in its Intelligent Cloud business. Shares of Microsoft are currently valued at a P/E ratio of 28X which makes MSFT one of the more expensive tech/FAANG stocks: only Amazon’s shares are more expensive with a price-to-earnings ratio (on a forward basis) of 44X…

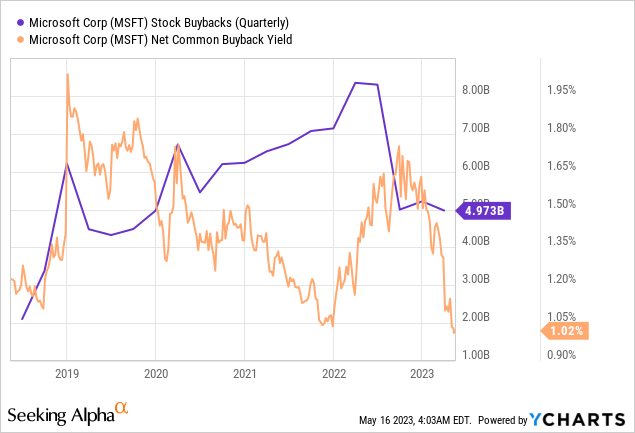

However, Microsoft is an enormously free cash flow-strong enterprise which generated $17.8B in free cash flow just in the third fiscal quarter which calculated to a 34% FCF margin. Since Microsoft is also returning a large percentage of its free cash flow to shareholders through stock buybacks, I believe Microsoft’s valuation remains attractive for investors… especially after the EU approved of the Activision deal.

Risks with Microsoft

From a commercial point of view, I believe the biggest risk for Microsoft is slowing growth in the Intelligent Cloud business. There is an additional risk that relates to the slowdown in the PC market which has affected Microsoft’s Personal Computing division negatively in recent quarters, especially regarding Windows OEM revenues. What would change my mind about Microsoft is if the company saw slowing growth in its Azure (Cloud) business and falling free cash flows.

Final thoughts

Regulatory approval from the European Union for the acquisition of Activision Blizzard is a major strategic win for Microsoft which comes just at a time when investors have been concerned about the company’s slowing growth in Intelligent Cloud/Azure. The transaction opens up a new pathway for sustained growth in the cloud gaming market and allows Microsoft to reduce its reliance on hardware sales. Gaming revenues have grown strongly in the last five years and the acquisition of Activision Blizzard is going to add major franchise names to Microsoft’s content library. While shares of Microsoft are not totally cheap based off of earnings, I believe Microsoft’s strong free cash flow, increasingly diversified business and growing content strength in the cloud gaming market make shares a strong buy nonetheless!

Read the full article here