Investment Thesis

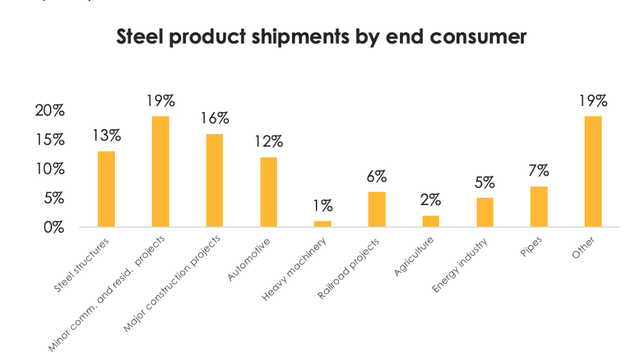

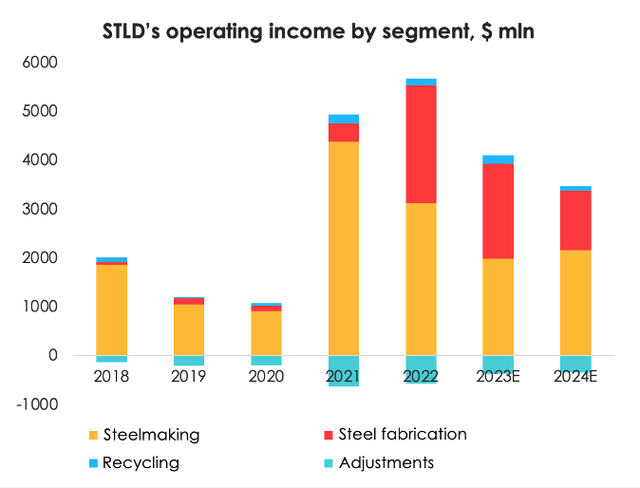

Despite HRC Midwest downside rally in 2022 Steel Dynamics (NASDAQ:STLD) share prices reached new highs. It happened because of ultra-marginal Steel Fabrication segment, that contributed 20% of revenue and extreme 60% of operating income. Steel fabrication prices, unlike hot-rolled steel prices, remain at historical highs, driven by the high rate of construction and reconstruction of infrastructure projects. But with the looming USA recession and problems with debt ceiling (not likely that such high infrastructure spending will continue) we can see further compression of hot-rolled steel prices and steel fabrication prices. That will compress EBIT dramatically.

Negative Outlook

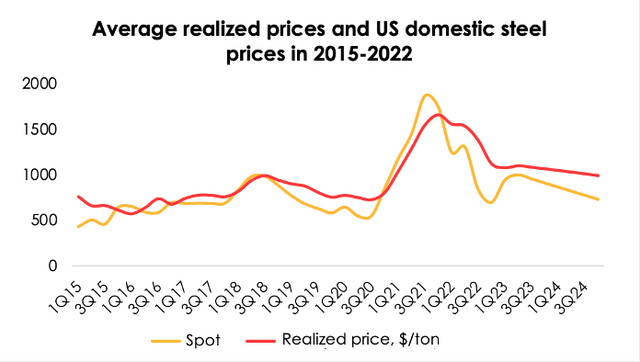

US hot-rolled steel prices averaged $940 a ton in 1Q 2023. As the Chinese economy is re-emerging from lockdowns and domestic consumption is building up, global steel prices started to rise, which also affected US prices. However, we still expect that, with the onset of a recession, demand for steel will decrease, causing prices to fall.

STLD’s realized steel prices continue to undergo a correction, even as spot prices are fluctuating. We expect the trend to continue, following global prices.

Invest Heroes

However, the company continues to report high volumes of product shipments. As we wrote before, Steel Dynamics is one of the main beneficiaries of the acceleration of infrastructure projects. At a time of a recession, projects like this are initiated by the government, which will support the volume of shipments. But with looming USA recession and problems with debt ceiling, it is not likely that such high infrastructure spending will continue. We can see steel fabrication prices downside rally in the future.

Invest Heroes

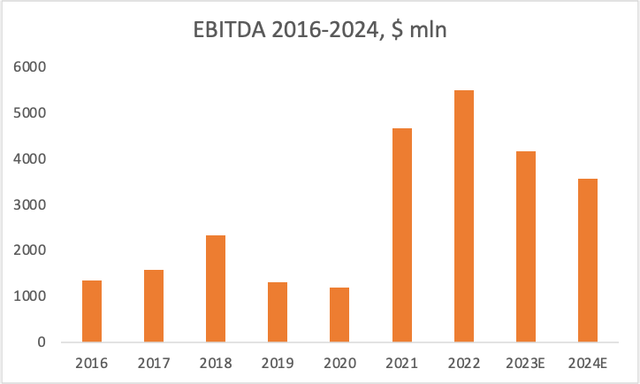

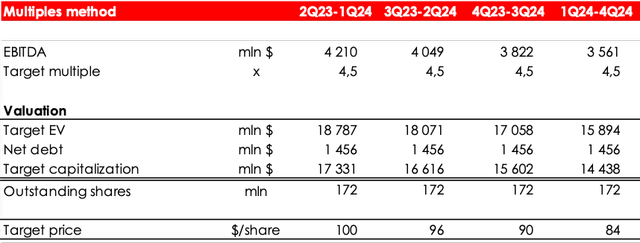

We expect that EBITDA of Steel Dynamics will drop by 24% in 2023 to $4.164 billion and in 2024 by 14% to $3.561 billion.

Invest Heroes Invest Heroes

Valuation

We assess STLD on the basis of EV/EBITDA. The fair value price we reach is $93. Our base-case valuation reflects the future decline of prices in 2023-2024 by the averaging of fundamental estimates for the coming two years, from 2Q 2023 – 1Q 2024 to 1Q 2024 – 4Q 2024.

Invest Heroes

Risks

- The rapid opening of China’s economy, which will provoke an internal growth in demand for steel

- Falling scrap prices during the recession, which will support margins

- Higher investment in infrastructure projects in the US

Conclusion

We believe it’s too early to invest in STLD stock just yet. First of all, that’s because during a recession US steel prices could fall faster than we expect. That would have an adverse impact on the company’s financial results and share prices. Rating is SELL.

Read the full article here