A Quick Take On TrueCar

TrueCar (NASDAQ:TRUE) Q1 2023 financial results on May 8, 2023, missing both revenue and EPS consensus estimates.

The firm connects buyers of new or used automobiles with dealer sellers in the United States.

Given the fierce competition TRUE faces, a still-high cost of capital environment, and reduced consumer demand as macroeconomic conditions slow, I’m Neutral [Hold] on TrueCar for the near term.

TrueCar Overview

Santa Monica, California-based TrueCar was founded in 2005 to enable consumers to research and purchase cars via its online marketplace.

The company also provides online services to its network of automobile dealers.

The firm is headed by President and CEO Michael Darrow, who was previously Chief Sales Officer at Edmunds.com and Executive Director of Corporate Strategy at Nissan Motor Corporation.

The company’s primary offerings include the following:

For Consumers:

-

Pricing research

-

Buying assistance

-

Financing

For Dealers:

-

Online lead generation

-

Pricing transparency

-

Marketing and advertising

The firm acquires consumers via online marketing and partnerships and pursues dealer relationships through its direct sales and marketing efforts.

TrueCar’s Market & Competition

According to a 2022 market research report by Mordor Intelligence, the U.S. market for used automobiles was estimated at $196 billion in 2021 and is forecast to reach $302 billion by 2027.

This represents a forecast CAGR of 7.51% from 2022 to 2027.

An important driver for this expected growth is a return to normalcy after supply chain shocks as a result of the pandemic and other factors.

However, a rising interest rate environment has reduced automobile affordability for certain consumers, leading to variability in demand and price in recent months.

Major competitive or other industry participants include:

-

Cars.com (CARS)

-

CarMax (KMX)

-

CarGurus (CARG)

-

CarBravo

-

AutoNation

-

AutoTrader.com

-

KBB.com

-

Edmunds.com

-

CarsDirect.com

-

CarFinder.com

The company also connects consumers with dealers of new cars.

TrueCar’s Recent Financial Trends

-

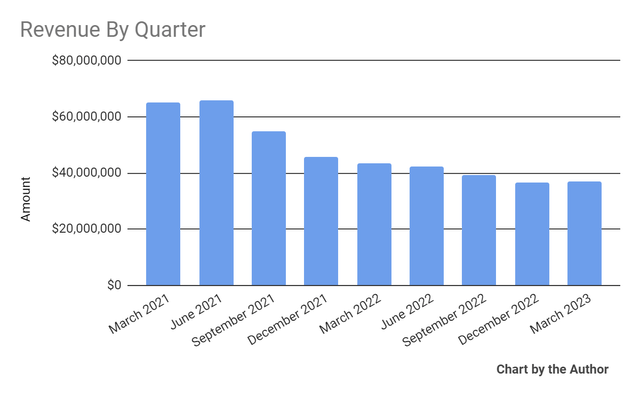

Total revenue by quarter has dropped per the following chart:

Total Revenue (Seeking Alpha)

-

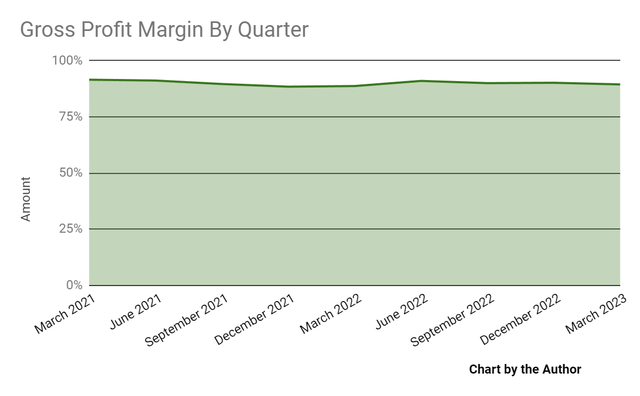

Gross profit margin by quarter has remained largely flat:

Gross Profit Margin (Seeking Alpha)

-

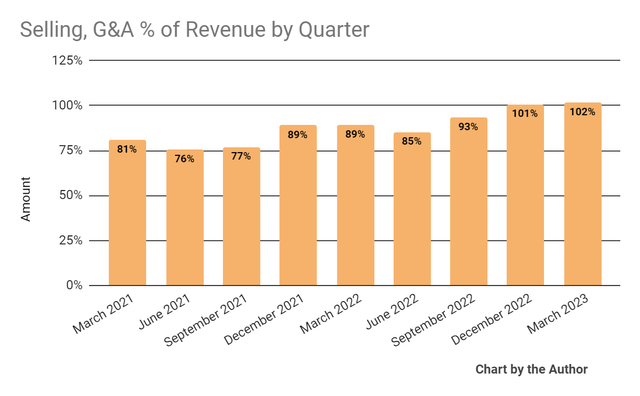

Selling, G&A expenses as a percentage of total revenue by quarter have risen markedly in recent quarters:

Selling, G&A % Of Revenue (Seeking Alpha)

-

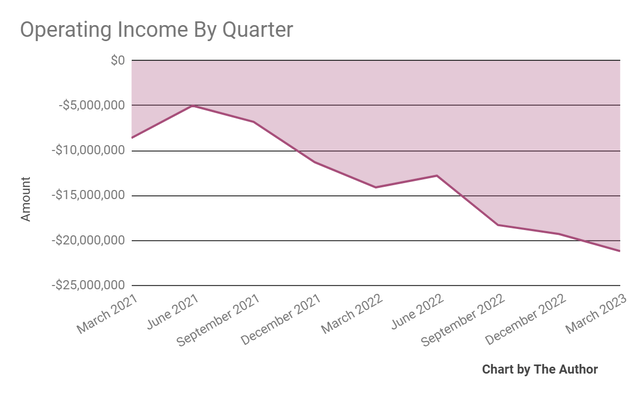

Operating losses by quarter have worsened more recently:

Operating Income (Seeking Alpha)

-

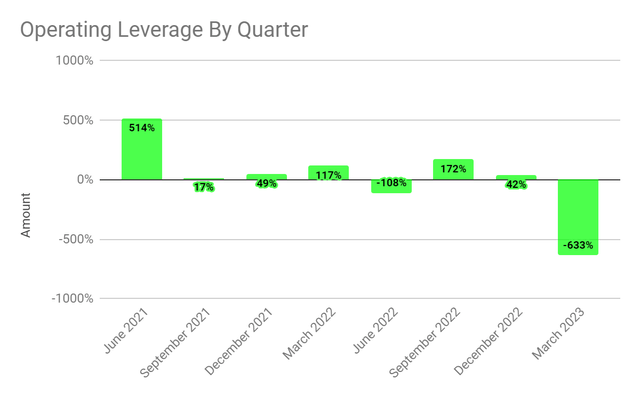

Operating leverage by quarter dropped sharply in Q1 2023:

Operating Leverage (Seeking Alpha)

-

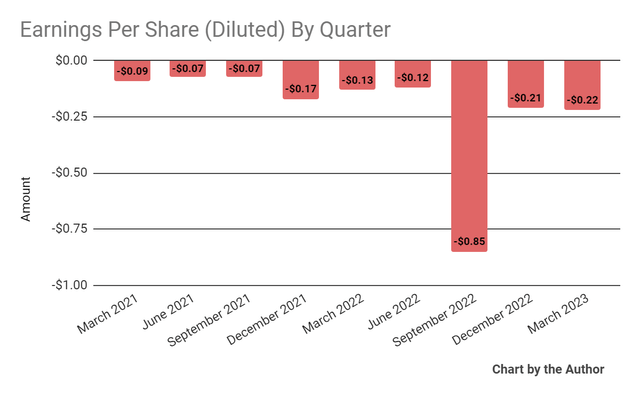

Earnings per share (Diluted) have remained heavily negative in recent quarters:

Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP)

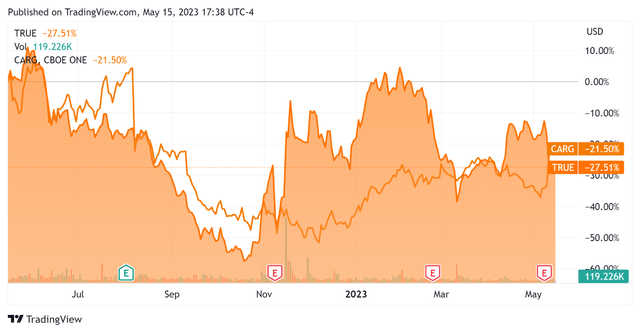

In the past 12 months, TRUE’s stock price has fallen 27.51% vs. that of CarGurus’ (CARG) drop of 21.5%, as the chart indicates below:

52-Week Stock Price Comparison (Seeking Alpha)

For the balance sheet, the firm ended the quarter with $156.6 million in cash and equivalents and no debt.

Valuation And Other Metrics For TrueCar

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

0.4 |

|

Enterprise Value / EBITDA |

NM |

|

Price / Sales |

1.3 |

|

Revenue Growth Rate |

-26.3% |

|

Net Income Margin |

-81.2% |

|

EBITDA % |

-46.0% |

|

Market Capitalization |

$194,400,000 |

|

Enterprise Value |

$59,560,000 |

|

Operating Cash Flow |

-$29,140,000 |

|

Earnings Per Share (Fully Diluted) |

-$1.40 |

(Source – Seeking Alpha)

As a reference, a relevant partial public comparable would be CarGurus; shown below is a comparison of their primary valuation metrics:

|

Metric [TTM] |

CarGurus |

TrueCar |

Variance |

|

Enterprise Value / Sales |

1.4 |

0.4 |

-71.9% |

|

Enterprise Value / EBITDA |

14.8 |

NM |

–% |

|

Revenue Growth Rate |

20.3% |

-26.3% |

–% |

|

Net Income Margin |

18.7% |

-81.2% |

–% |

|

Operating Cash Flow |

$229,390,000 |

-$29,140,000 |

–% |

(Source – Seeking Alpha)

Commentary On TrueCar

In its last earnings call (Source – Seeking Alpha), covering Q1 2023’s results, management highlighted growth in its new car dealers, but a drop in used car dealers as consolidation continued to hit the used car dealership space due to lack of inventory over the past several quarters.

Additionally, the rising interest rate environment has affected automobile demand and smaller, independent dealers have been hard hit by the rising cost of floor inventory financing.

On the plus side, management reported a 19% increase in consumer website traffic and wants to enhance its conversion efforts among consumer categories such as economic buyers, convenience buyers and EV (Electric Vehicle) buyers.

In the coming months, leadership expects to expand its TrueCar+ offering to key metro areas in ten more U.S. states.

Total revenue for Q1 2023 dropped 14.9% year-over-year and gross profit margin rose 0.7 percentage points.

Selling, G&A expenses as a percentage of revenue grew 12.4 percentage points, pointing to worsening efficiency, and operating losses also increased by more than 50% year-over-year.

Looking ahead, consensus estimates put 2023 revenue growth at only 0.26% and earnings per share of negative ($0.48), indicating a continued dismal environment for the firm in the near future.

The company’s financial position is moderate, with ample liquidity and no debt, but TRUE is still burning a significant amount of free cash, so management will need to reduce its cash burn to extend the company’s runway.

And this is at a time when the company needs to continue to improve its offerings and benefits to retain dealers, as other online marketplaces are doing.

Regarding valuation, the market is valuing TRUE at significantly lower valuation multiples than those of CarGurus.

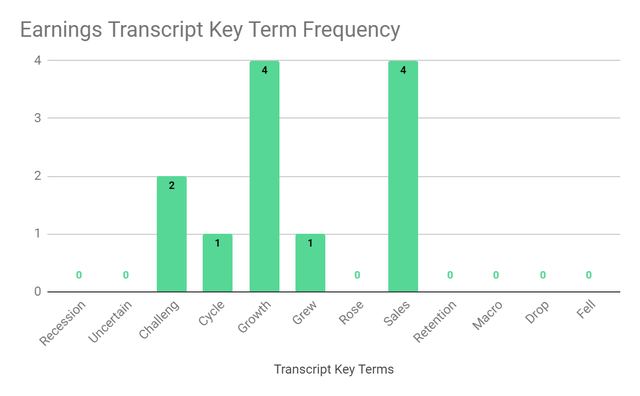

From management’s most recent earnings call, I prepared a chart showing the frequency of key terms mentioned (or not) in the call, as shown below:

Earnings Transcript Key Term Frequency (Seeking Alpha)

I’m most interested in the frequency of potentially negative terms, so management cited ‘Challeng[es][ing]’ two times.

The negative terms refer to the difficult operating environment TRUE finds itself in as a result of the upheaval in the new and used car industry in recent years.

A potential upside catalyst to the stock could include a material drop in financing costs, which would help independent dealers, but I don’t see this occurring anytime soon.

Given the fierce competition TRUE faces, a still-high cost of capital environment, and softening consumer demand as macroeconomic conditions slow, I’m Neutral [Hold] on TrueCar for the near term.

Read the full article here