2025 trading behavior prominently featured momentum. Certain categories of stocks soared to new heights while others were left in the dust. Toward the end of the year, investors became locked in the high-fliers for fear of incurring a big tax bill, but with the calendar rolling over they can sell knowing that taxes are 16 months away.

We anticipate significant rotation between asset classes. Some of the formerly forgotten stocks are poised to rebound. Not all that has fallen will recover, but those with the combo of strong fundamentals and attractive valuation are best positioned for an early 2026 bounce.

Specifically, we see 3 categories of stocks with a potent combination of dividends, growth and value. Within each category we will feature an individual stock that epitomizes the opportunity.

#1 sector poised for outperformance: manufactured housing led by Flagship Communities

Manufactured housing’s (MH) core advantage comes from the delta in price point between MH and site-built housing. Both apartments and the monthly cost of home ownership are far too high for a large portion of the population. Manufactured housing is the solution.

The gap in price point is so wide that there is room for rents on sites to be raised about 5%-8% a year for another decade while still providing residents with a better value than the alternatives. Organic rent growth of this nature does not incur extra expenses so it filters straight to the bottom line such that same-store NOI growth for much of the industry hovers around 8%-12%.

MH has been and continues to be the real estate sector with the fastest organic growth rate. Yet, this superior growth is not factored into valuation. Flagship Communities (MHCUF) routinely puts up 10% same-store NOI growth.

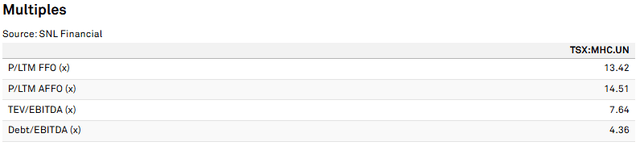

S&P Global Market Intelligence

Yet it trades at just 14.5X AFFO.

S&P Global Market Intelligence

Growth of that magnitude would normally trade over 20X AFFO.

Flagship is well managed and is extending its growth runway by acquiring mismanaged communities to which it can apply a cleaner operating model.

A contributor to why the stock is cheap is that it trades on the Toronto Stock Exchange while owning exclusively U.S. properties. Thus, for U.S. investors it can be a bit of a hassle to trade, but with patience and careful use of limit orders, the reduced liquidity does not harm total return prospects.

Other stocks in the sector are UMH Properties (UMH) Equity LifeStyle (ELS) and Sun Communities (SUN). UMH shares the attractive valuation of Flagship while the other 2 are a bit more fully valued.

#2 sector poised for outperformance: Discounted preferreds with low asset level volatility led by Gladstone Land Preferreds

Preferreds are particularly mispriced right now. Preferreds tend to be small issues in market cap which keeps most institutions out, yet at the same time the structure is complex enough that it begs an institutional level of understanding.

One of the biggest mistakes the market is making in pricing preferreds, is that it is treating them similarly to the common stocks of the same issuers. This is just inherently incorrect because the common and preferred have very different payout profiles.

- Common stock payout cares about magnitude of upside

- Preferred stock payout cares primarily about stability

Common stocks of REITs have tended to languish when growth potential seems limited. In most instances of this happening, the preferreds have fallen along with the common. I see these discounted preferreds as highly opportunistic when the underlying asset class is stable and the capital structure is such that there is a large equity cushion underneath the preferreds.

Gladstone Land (LAND) preferreds, (LANDP) and (LANDO), epitomize this sort of mispricing.

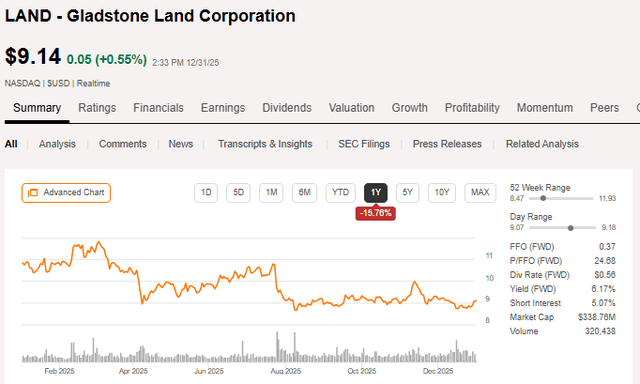

So Gladstone Land owns a large portfolio of farmland, primarily specialty crops grown in California. The market is concerned that the worsening water situation along with commodity volatility can make this business challenging. LAND stock has fallen.

SA

The drop in the common largely makes sense. Perhaps it fell slightly too far making it now cheap, but directionally it was a rational move.

As per the pattern we identified above, LAND preferreds fell with the common.

SA

This move, in my opinion, is entirely irrational.

The preferred payout is unaffected by what appears to be low earnings growth potential in California farmland. The preferred payout is locked at the stated coupon rate and thus only cares that LAND maintains sufficient earnings to pay.

AFFO is calculated AFTER paying preferred dividends, so any AFFO over $0 indicates preferreds are covered.

S&P Global Market Intelligence

LAND’s cashflows easily cover preferred dividend payments.

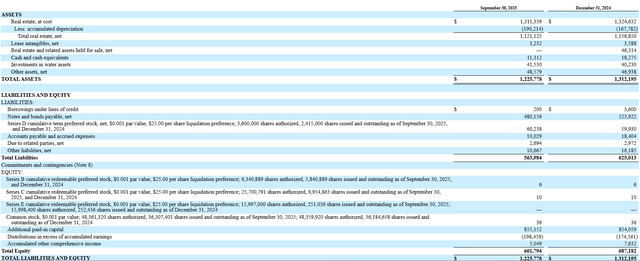

Preferreds also care that their liquidation preference is protected by asset value. LAND has $1.22B of assets (primarily farmland and farm improvements like irrigation).

LAND

Liabilities total $563.9 million which leaves roughly $660 million of assets for the preferreds.

Portfolio Income Solutions

LANDM has mandatory redemption so its liquidation preference is included in that liabilities figure.

Thus, the preferreds have total liquidation preference of $392 million.

Asset value would have to decline quite a bit for the preferreds to not be fully covered. We tend to not like preferreds of companies in sectors with volatile assets. Instead we like preferreds in stable asset sectors like agency backed mortgages and farmland.

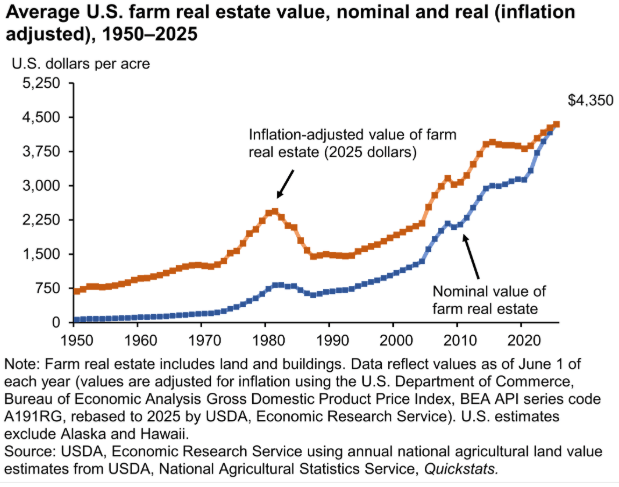

Farmland values are exceedingly stable with a long history of reliable appreciation.

USDA

The worst drop in farmland value in the last 100 years was the dustbowl and even then, the value declines peak to trough would not have been enough to erode the liquidation preference of LAND preferreds given the coverage ratio they have today.

It would take a fairly catastrophic event for farmland assets to decline in value that much. Perhaps some may think water scarcity could be that event. I would agree that it is a real risk, but LAND owns 55,532 acre-feet of water in reserve to largely mitigate that risk.

California farmland has some problems, but I just don’t think the market is recognizing the ways that capital structure and cashflow preference of preferreds over common are protecting LANDO and LANDP.

The current discount affords getting in at an 8% dividend yield and 30%+ upside to liquidation preference.

There are a few dozen highly discounted REIT preferreds right now. Many of them are attached to companies with similarly resilient asset classes.

#3 sector poised for outperformance: triple net led by Broadstone Net Lease

Triple net REITs are a sector where forward returns are largely tied to valuation at the time of entry.

With treasuries the math is very clean. If you can buy a treasury of the same duration at a 5% yield to maturity as opposed to a 4% yield to maturity, it will simply have a higher return.

Triple nets are not quite that locked in, but are similar in that they derive most of the cashflows from long term rental contracts. Many of the triple net REITs have weighted average remaining lease terms in the range of 8 to 10 years. Thus, there is a high degree of visibility into future cashflows.

If you buy a triple net REIT at a high valuation relative to that stream of cashflows, it will probably result in poor forward returns. Toward the end of 2021, triple net REITs were the flavor of the month. With treasuries trading at absurdly low yields, the market was yield starved and starting to pour money into other vehicles that resembled treasuries.

Triple net REITs are equities so they are certainly not the same thing, but if one squinted hard enough it could look like a stable yield replacement for a treasury and even at the high valuation at which triple nets traded at the time, the yield was significantly higher than that of the treasuries.

Nearly every triple net REIT has had a poor return since the end of 2021.

The market is now blaming the asset class and trading the stocks at irrationally low valuations.

The poor returns are not the fault of triple net REITs. Fundamentally they have performed reasonably well with steady earnings coming from the contracted rent.

Low returns were just math in the same way that if someone bought a long duration treasury at sub 2% yield to maturity it would have also had an abysmal return. The treasury didn’t fail. It paid every interest payment on time and still has the same par value. The market simply paid too high of a price relative to the value of the stream of cashflows and so the price had to come down.

Treasuries have enough math focused traders following them that they almost instantaneously adjust to prevailing interest rates.

Triple nets market prices are less efficient at adjusting and in this case they overshot.

The forward returns of a triple net REIT can be thought of as approximating dividend yield + AFFO/share growth rate. The market started pricing triple nets as though the forward AFFO/share growth rate is close to 0%.

That is because it has been close to 0% for the past few years.

Missing from the valuation is the inflection point in growth.

Why growth was near 0 for the last few years

Triple nets operate on the spread between asset yields and cost of capital. Asset yields are largely locked in by the contractual rental streams while cost of capital is dependent on the duration of their debt. In most cases, these REITs ladder their debt maturities with some rolling over each year.

Well, as interest rates rose about 200-300 basis points, debt had to be refinanced higher. Cost of capital rose while the yield on existing assets was locked in (with some escalators). This higher interest expense offset growth from accretive acquisitions and escalators on existing leases. As a result, the sector saw minimal AFFO/share growth.

Why forward growth looks much better

Higher interest rates do not hurt triple net growth rates. Cap rates move, so spreads on acquisitions remain largely the same. It was the change in interest rates that hurt earnings.

Now that most of the triple net REITs have refinanced their debt at the now higher rate, interest expense has stopped rising. With costs roughly flat, triple nets will now see earnings growth from escalators and accretive acquisitions.

The growth rate for the sector is likely to return to historically normal levels in the low-to-mid single digits.

Valuation of 0 growth versus 3-5% growth

A static stream of flat cashflows gets valued very differently than a growing stream of cashflows.

The market seems to be looking at triple net REITs based on the low to 0 growth of the past few years and valuing them accordingly. Specifically, the average triple net REIT is trading at an AFFO yield of 8.1%.

That is a proper valuation for low or no growth.

However, an 8.1% AFFO yield is significantly undervalued for a growing stream of cashflows. If you take that yield and tack on 3%-5% annual growth it will materially outperform the market.

I think that is where the triple nets are positioned today. Broadstone Net Lease (BNL) is one of our high conviction stocks in the sector due to its combination of value and durable growth. It is trading at 11.51X AFFO which is an 8.7% AFFO yield.

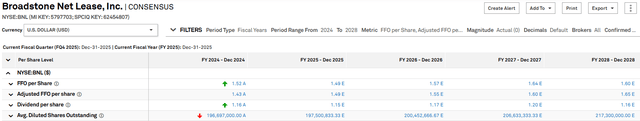

S&P Global Market Intelligence

At the same time it is set up for durable and highly visible growth in the low-to-mid single digits.

S&P Global Market Intelligence

The growth is coming from escalators on existing leases along with already contracted build-to-suit developments as they complete and begin to cashflow.

Frankly, I think the market price of BNL is just too low for the stream of contracted cashflows.

Other triple nets with similar profiles include W.P. Carey, (WPC) Getty Realty (GTY), VICI Properties, which we wrote more in-depth about here, and Easterly Government Properties (DEA).

The takeaway

The turn of the calendar removes the tax related barriers that were inhibiting efficient pricing of stocks. January often features a normalization toward fair value making it a great time to buy high quality, undervalued stocks such as Flagship, LAND preferreds and Broadstone Net Lease.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here