Sarepta Therapeutics, Inc. (NASDAQ:SRPT) was founded in 1980 and is based in Cambridge, Massachusetts. The company is focused on developing RNA-based therapeutics and gene therapy against Duchenne muscular dystrophy, or DMD.

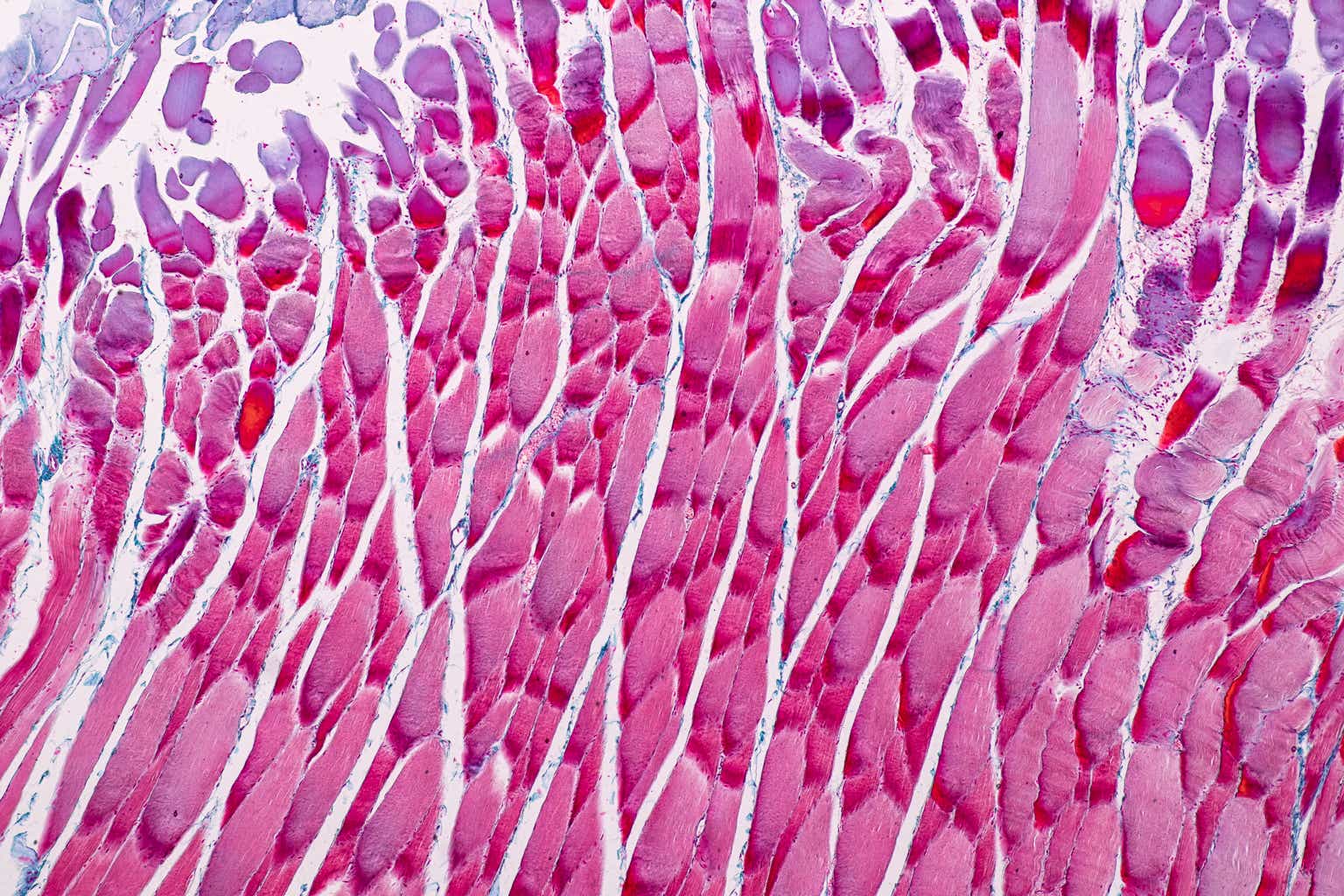

DMD is a genetic disorder due to alterations in a protein called dystrophin that keeps muscle cells intact. It is characterized by progressive muscle, degeneration, and weakness, which usually starts between ages two and three in early childhood and primarily affects boys. The prevalence of DMD is estimated to be one in every 3500 live births in the US or 1000 existing cases.

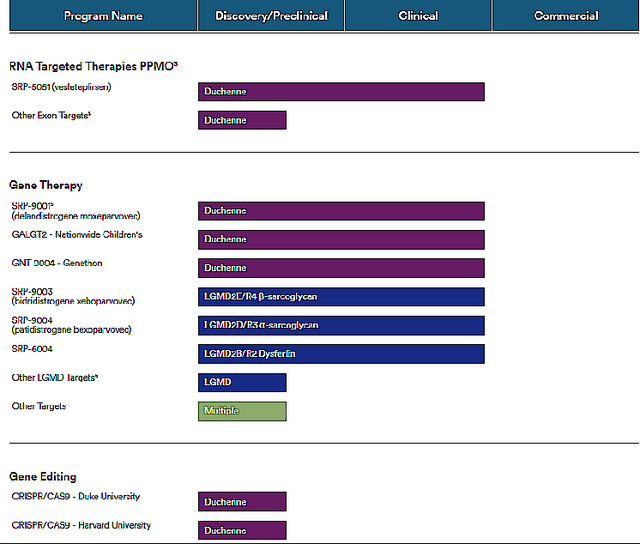

Sarepta Therapeutics’ RNA therapeutics drug Exondys5 was the first FDA-approved therapy to treat DMD due to exon 51 mutations. Other FDA-approved RNA-based therapies in DMD include Vyondys53 to treat DMD due to exon 53 skipping and Amondys 45 to treat DMD due to exon 45 skipping.

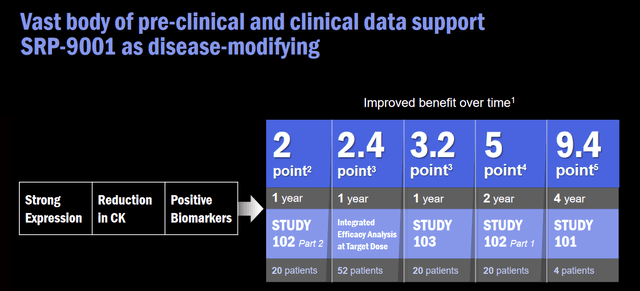

SRP-9001 is a gene therapy against DMD which is developed in partnership with Roche Holding AG (OTCQX:RHHBF). It acts by delivering a shortened, functional form of dystrophin to the muscles. SRP-9001 has been studied in multiple studies. In the clinical data from more than 80 patients, it has shown positive disease-modifying results at multiple time points, including up to four years after the treatment. Longer-term data showed disease-modifying effects and improvement in muscle strength over time to 9.4 points at 4 years. A global multicenter randomized placebo-controlled trial, called EMBARK trial, recruited 125 DMD patients between the ages of 4 to 7 and its data is expected by the end of 2023.

Investor presentation

Under the Roche deal, Sarepta received $1.15 billion in an upfront payment and an equity investment; and is eligible to receive up to $1.7 billion in regulatory and sales milestones; and mid-teens royalties on net sales. Sarepta retains all rights to SRP-9001 in the United States, and ex-U.S. rights are licensed to Roche.

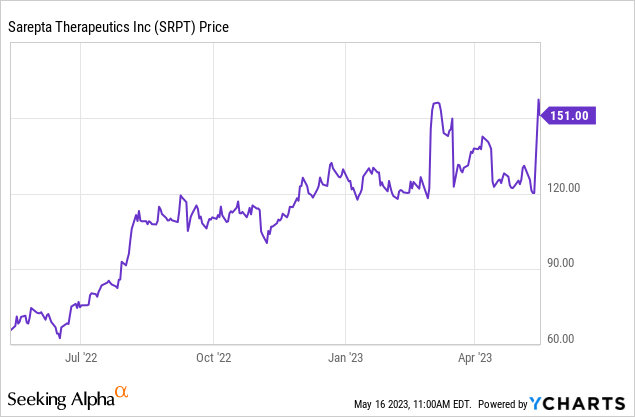

Last week, an FDA advisory committee voted in favor of approving SRP-9001 for treating DMD. Importantly, the therapy is effective against, all forms of DMD caused by different mutations. The BLA is scheduled for May 29. If approved, the therapy will be marketed under the accelerated pathway, with the EMBARK trial acting as the post-marketing confirmatory trial.

Sarepta Therapeutics, Inc. also has a pipeline against Limb-Girdle muscular dystrophy, which causes weakness and wasting of the muscles starting around hips and shoulders and progressing to arms and legs. Its global prevalence is 1.63 cases per 100K individuals or approximately 5,400 existing cases in the U.S. The company is developing gene therapies called SRP-9003, SRP-9004, and SRP-6004 against limb-girdle muscle dystrophy.

The company also is active in CRISPR gene editing by acquiring the CRISPR CaS9 pipeline against DMD from Duke University and Harvard University.

Company website

Sarepta Therapeutics, Inc. had $2 billion in cash reserves at the end of 2022, which is expected to last at least for the next two years. The operating cash burn was $210 million in Q1 this year. The company had $1.2 billion of long-term debt at the end of Q1 this year. Quarterly revenue was $253 million at the end of Q1 this year which increased by 32% year over year.

At an average price of $2 million per patient for SRP 9001 (in line with gene therapies), the peak revenue opportunity just in the U.S. in treating DMD is $2 billion per year. In addition, Sarepta Therapeutics, Inc. has a shot at a $10 billion/year U.S. revenue opportunity in treating LGMD. The current enterprise value of the company is $14 billion.

Institutional holders in the stock include Avoro Capital, EcoR1 Capital, etc. The average sell-side analyst price target is $180 or a 20% upside from Seeking Alpha. The Street high price target of $218 or 44% upside was issued yesterday by a five-star analyst from RBC Capital.

In summary, Sarepta Therapeutics, Inc. stock has more upside in the near term due to the positive AdCom vote for SRP-9004 till the BLA. The company is also a good long-term investment due to its monopoly in treating DMD and additional revenue opportunity in LGMD.

__________

Risks in a Sarepta Therapeutics, Inc. investment include delay in BLA due to FDA refusing accelerated approval or issues like manufacturing and labeling, etc. Data from the ongoing programs may disappoint, and side effects may be seen. This may cause Sarepta Therapeutics, Inc. stock to fall. Investing in biotech/pharma stocks is risky and may not be suitable for all investors. This note represents my own opinion and is not professional investment advice.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here