KBR, Inc. (NYSE:KBR) has slightly outperformed the broader markets since my previous bullish article in February. Earlier this month, the company reported better-than-expected results with both revenues and EPS beating estimates. I believe the company should see a meaningful growth acceleration over the next couple of years given strong demand and ramp up of HomeSafe Alliance work. The company’s margins should also benefit from an improving mix with high margin STS business growing at a faster pace. The company’s valuation looks attractive given its strong growth prospects, and I continue to maintain a buy rating on the stock.

Revenue Analysis and Outlook

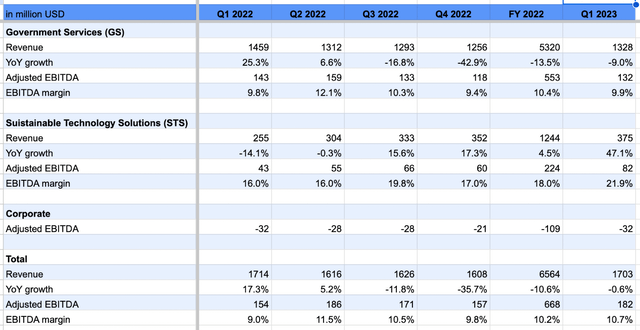

In Q1 2023, the company reported a slight decline of approximately 0.6% Y/Y in its revenue, reaching $1.703 billion. However, it’s important to note that the company’s revenue in the previous year benefited from the Operations Allies Welcome (OAW) program, which involved low-margin humanitarian work related to bringing U.S. military personnel and their allies from Afghanistan after the U.S. decided to withdraw. If we exclude the impact of the OAW program, the company’s revenue actually increased by 18% year-over-year.

Segment-wise, Government Services revenue experienced a 9% year-over-year decline. However, excluding the one-time benefit from the OAW program last year, segment sales increased by 12% year-over-year. The underlying sales in the Government Services segment continue to benefit from increased geopolitical tensions, particularly the Russia-Ukraine conflict. This has led to a heightened focus on defense spending, with countries around the world increasing their defense budgets, thereby benefiting KBR. The company’s science and space business also performed well, achieving 10% year-over-year growth in the last quarter, driven by increased NASA and commercial mission activities.

Sustainable Technology Solutions (STS) demonstrated exceptional organic growth, with a remarkable 47% year-over-year increase. This growth reflects the strong demand for the company’s technology and services related to Ammonia/Hydrogen, olefins, clean refining, plastic recycling, and other sustainable services. KBR holds a leadership position in Ammonia Technology, with over 50% market share, and this market is experiencing significant demand. In Q1 alone, the company secured seven ammonia awards, including three in green ammonia, one in blue, and three in gray. Additionally, KBR was awarded BP Plc’s (BP) hydrogen development work, indicating a positive outlook as BP ramps up its hydrogen investments. A strong working relationship with BP suggests the potential for more projects in the future.

KBR’s Segmentwise Revenue and adjusted EBITDA margin (Company Data, GS Analytics Research)

Looking ahead, I am optimistic about the company’s prospects due to its healthy backlog and the secular growth drivers in the market.

At the end of last quarter, KBR, Inc.’s total backlog and award options stood at $20.89 billion, representing a year-over-year increase from $18.55 billion in Q1 2022 and a sequential increase from $19.76 billion in Q4 2022. Both segments experienced year-over-year increases in backlog, with the STS segment’s backlog nearly doubling. The trailing twelve-month book-to-bill ratio was 1.4x, and the book-to-bill ratio for STS was 1.9x, indicating strong order momentum. This high backlog provides good visibility, with approximately 85% of the company’s current year revenue guidance already in its backlog. The company has provided revenue guidance for this year in the range of $6.9 billion to $7.1 billion, which represents approximately 6.6% year-over-year growth at the mid-point. Considering this strong visibility, there is a good chance that the company can achieve results at the upper end of the guidance range or even higher.

The medium-term drivers for the business remain intact. In addition to strong end-market demand in sustainability, defense, and space, the company’s revenue should benefit from the ramp-up of the HomeSafe Alliance work in 2023 and beyond. HomeSafe Alliance is a joint venture led by KBR, holding the Global Household Goods contract from the U.S. Transportation Command. This contract has a ceiling value of approximately $20 billion over nine years and involves transporting household goods for the U.S. Armed Forces, DoD civilians, and their families. The project is expected to ramp up in the latter half of FY23 and FY24, making a meaningful contribution to the company’s revenue. This makes me optimistic about the company’s margin growth prospects.

Margin Analysis and Outlook

The company reported an adjusted EBITDA margin of 10.70% last quarter, reflecting a year-over-year increase of 170 basis points (bps). Both segments experienced improvements in their adjusted EBITDA margins. The Government Services segment saw its EBITDA margin rise from 9.8% last year to 9.9%, aligning closely with management’s long-term margin target of approximately 10% for this segment. The Sustainable Technology Solutions segment experienced a more significant improvement, with its EBITDA margin increasing from 16% in Q1 2022 to 21.9% in Q1 2023. This increase can be attributed to the growing proportion of license revenue, placing the margin at the upper end of management’s target range of 17% to 22%.

Looking ahead, I anticipate two factors that will contribute to the company’s margin growth. First, the Sustainable Technology business is expanding at a much faster rate than the Government Services business. As the margins for Sustainable Technology are nearly twice as high as those for Government Services, this shift in the business mix should continue to enhance overall margins. Additionally, the HomeSafe Alliance project, which boasts a favorable margin profile, is set to scale up over the next few years, further benefiting the company’s margins.

Valuation and Conclusion

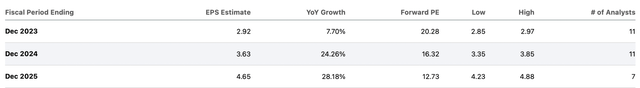

KBR, Inc.’s earnings is expected to ramp up meaningfully over the next couple of years.

KBR Consensus EPS Estimates and P/E (Seeking Alpha)

KBR, Inc. is trading at a P/E multiple of 20.28x, 16.32x and 12.73x based on consensus EPS estimates of FY23, FY24 and FY25, respectively. With solid growth drivers in place, the sell-side consensus is expecting the company’s EPS to grow 24.26% in FY24 and 28.18% in FY25. I believe the company should see very strong growth over the next few years, and medium to long-term investors can consider buying KBR, Inc. stock at the current levels.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here