Investment Summary

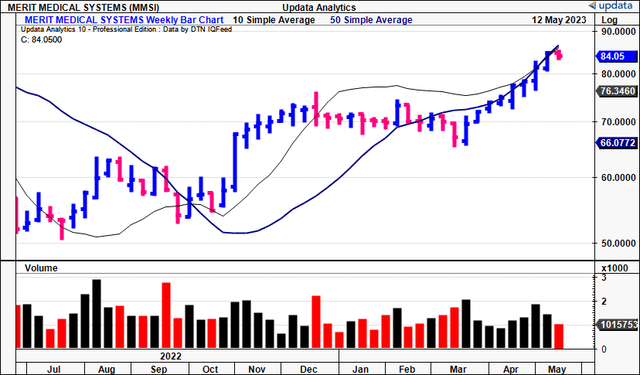

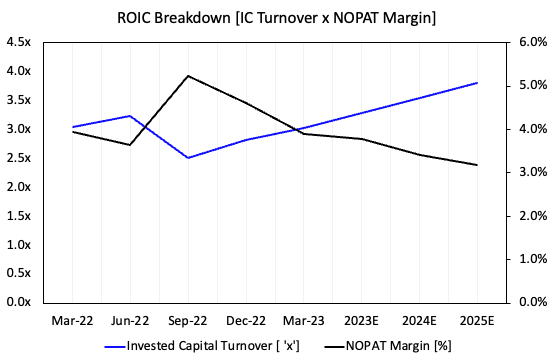

The investment prospects of Merit Medical Systems (NASDAQ:MMSI) continues to beam long-term value in my informed opinion. Looking to MMSI’s Q1 FY’23 numbers, the price response has been overwhelmingly positive and shares now look to break the 50DMA and 200DMA’s, as seen in Figure 1.

Fig. 1

Data: Updata

Further, since the last MMSI publication, shares have rated another 22% to the upside, and broken out of a sideways congestion. There are fundamental reasons for this, when looking to the firm’s latest numbers, combined with the historical evidence. A thoughtful analysis of MMSI’s future suggests there’s more risk capital it can unlock, potentially driving further valuation upsides. Net-net, I continue to rate MMSI a buy, citing profitability, earnings growth and capital budgeting as key reasons why. Based on the culmination of data presented in this report, I’d be looking to $110/share as my next price objective, 30% upside potential at the time of writing.

MMSI is a name covered extensively through my research in the past. I’d encourage you to observe the last 5 publications here:

- Valuation And Performance Heavily Tied To ROIC

- 12% Downside Yet To Be Priced In Amid Flatlining Fundamentals

- No Change To Hold Thesis, ROIC Still One To Watch

- Re-Rate To Buy, Upside Potential On Offer

- Still bullish on Long-term Prospects

MMSI Q1 earnings reiterate momentum

It was another strong quarter for MMSI with particularly strong effort from its cardiovascular segment. The price response from the date of the 10-Q indicates the market’s positive opinion to this. Looking directly to the numbers, my key takeouts above the operating line include:

- Q1 revenue growth of 8% YoY to $298mm was driven primarily by U.S. sales, with another 3% upside outside U.S.

- Cardiovascular division turnover lifted 10% YoY and reflected another strong quarter in endoscopy sales. MMSI continues building momentum around this division. The endoscopy segment gaining another 14% from last year is direct evidence of this.

- Original equipment manufacturer (“OEM”) sales were another driver to CV sales, gaining 24% YoY. In particular, I’d note the 50% gain in EP, CRM kits and intervention products as major drivers to this.

- Gross margins posted another 300bps decompression to 50% for the quarter, the highest Q1 margin in MMSI’s history. I’d say this is a tailwind moving forward, and represents terrific pricing strategy in the fact of inflationary headwinds.

- OpEx stretched up 11% YoY to $115mm produce $48mm in quarterly operating income. Looking at TTM figures, this is $427mm and $109mm, respectively.

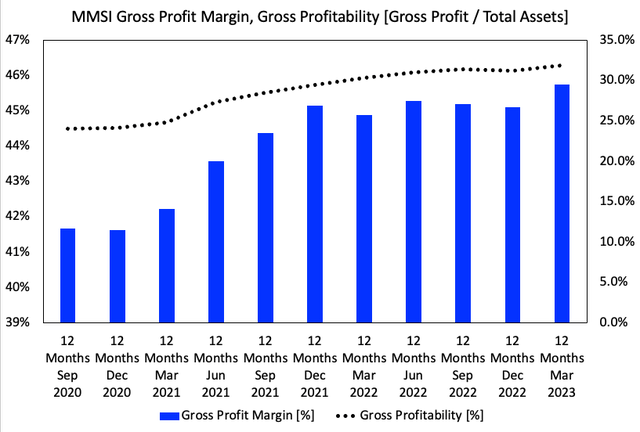

The points on profitability are of importance in the MMSI investment debate. For one, the company’s quarterly gross margin has decompressed ~41% to 50% (41% to 46% on TTM basis), telling me that MMSI can seriously make money. The firm’s gross profitability, taken as the gross profit divided by total assets, is seen in Figure 2. Here, the trailing gross profit is taken with the quarterly asset base on a rolling TTM basis. Similar to the margin, MMSI is generating more gross per $1 in assets than 2-years ago. It now produces ~$0.32 for every $1 in assets, up from $0.24 over the testing period. This is a central point on capital productivity and tells me MMSI is primed to create additional value.

Fig. 2

Data: Author, MMSI 10-K’s

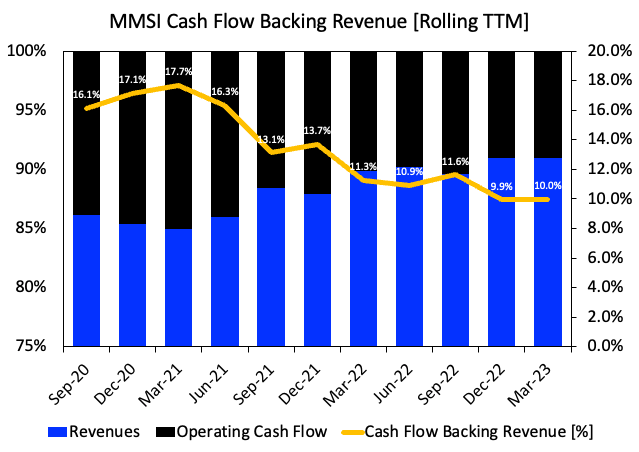

In view of the revenue upsides over the last 12-months I’m looking very closely at the operating cash flow backing MMSI’s revenues. The firm’s TTM revenue and OCF going back to 2020 are observed in Figure 3. The degree of cash flow backing each is then plotted for each period (OCF/Revenue). As seen, it had 10% OCF backing revenues on a trailing basis in Q1. This is down from 16% in 2020, but has held range since Q4 FY’21. As mentioned, I’m watching this very closely. Ideally, we don’t slip below 10% here. I’d be looking to 12-15% as a healthier number for MMSI to work with and demonstrate there’s quality cash earnings on offer well into the future.

Fig. 3

Data: Author, MMSI 10-K’s

Forward estimates point to value unlock

Looking forward, MMSI could do $1.23Bn in top-line revenues this year and bring this down to $550-$555mm in gross, or 45% margin in my opinion. I’d call for $180-200mm in core EBIT on this on $104mm in post-tax earnings for the year. Consensus also calls for $200-$211mm in pre-tax income this year.

Taking a 12% discount rate to evaluate the firm’s steady-state value, it appears the market expects 22.5% growth in MMSI’s pre-tax earnings over the next 5-years, at the $211mm earnings figure (211*1.225^5)/0.12 = $4,850). This is quite the ask but suggests the market has tremendous growth expectations in MMSI’s market valuation should this pull through. Presuming no growth, the $211mm isn’t worth it on the NPV level ($211/0.12 = $1,760). Using this arithmetic, it would appear the market has placed ~$3Bn in MMSI’s future growth prospects, and $1.8Bn on its steady-state, assuming a 12% discount rate and that MMSI produces $211mm in pre-tax income this year.

Management expect 6-7% growth in turnover this year calling for $1.2Bn-$1.3Bn at the upper end of range. I’m aligned with this and was pleased to see management’s revised projections, up from 4-5% growth previously. Within this, it sees 15-16% growth in endoscopy, another tribute to the segment’s importance in the core offering. It also projects $115mm in FCF for the year.

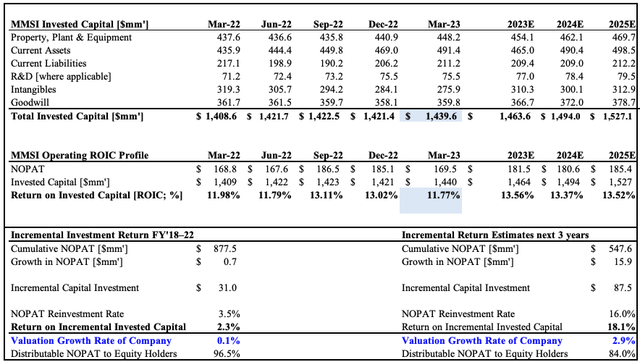

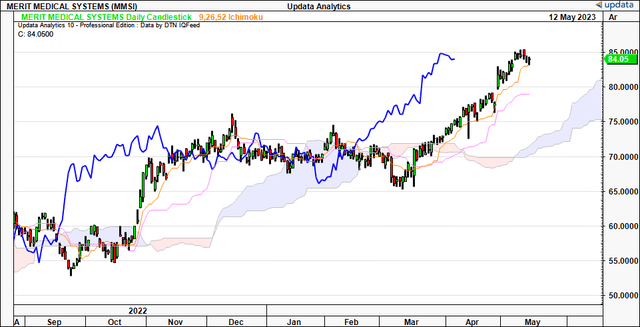

Should MMSI convert on these growth percentages, my estimates project a period of value creation ahead. The company’s capital at risk (invested capital), trailing NOPAT and trailing ROICs are shown in Figure 4. Also shown is the incremental returns and projections into FY’24. Trailing ROIC is calculated as the periodic NOPAT generated on top of the existing capital base, on a rolling TTM basis. The incremental ROIC is taken as the change in NOPAT divided by the incremental investment made each quarter. Meanwhile, MMSI has strengths on the production side versus consumer side, as seen in Figure 5. Here, the firm’s ROIC is broken down into its subcomponents, NOPAT margin and invested capital turnover.

Key observations:

- MMSI produced a 230bps incremental return on investment from Q1 FY’22 to Q1 FY’23.

- This came from a $31mm investment to produce an additional $0.7mm in post-tax earnings.

- On this, the firm generated a cumulative $877mm NOPAT over the year.

- Looking forward, my projections have MMSI to generate another $16mm in NOPAT from $87mm incremental investment.

- This would represent an 18% return on new capital, seeing the firm’s intrinsic valuation increase by 3% over the next 3 quarters.

In that vein, there is plenty of cash to distribute to shareholders or invest at the 18% return, should these numbers pull through. Further, you’ll note the invested capital turnover of 3-3.5x in Figure 5, evidence of tremendously low capital intensity. This tells me MMSI is producing $3-$3.50 in turnover from every $1 in existing capital, a figure that has improved over time. It will continue leveraging this strength moving forward in my opinion.

Fig. 4

Data: Author, MMSI 10-K’s

Fig. 5

Data: Author, MMSI 10-K’s

The technical picture

There’s ample technical data to suggest the latest price rally has legs to continue. Presuming the price contains all of the market’s expectations (correct or not), we can deduce plenty on what’s projected going forward. In Figure 6, your eyes start at the left of the page, where you can see MMSI breaking out of congestion in October 2022. This was short-lived with shares pushing sideways into the cloud from November to March 2023. After the firm’s FY’22 numbers, however, the price response was swift and we’ve now got MMSI at new highs and well above the cloud. We’ve got plenty of room for consolidation and remain bullish in that respect. It could pull back to $80 by June and I’d still be bullish in the medium-term, based on this setup.

Fig. 6

Data: Updata.

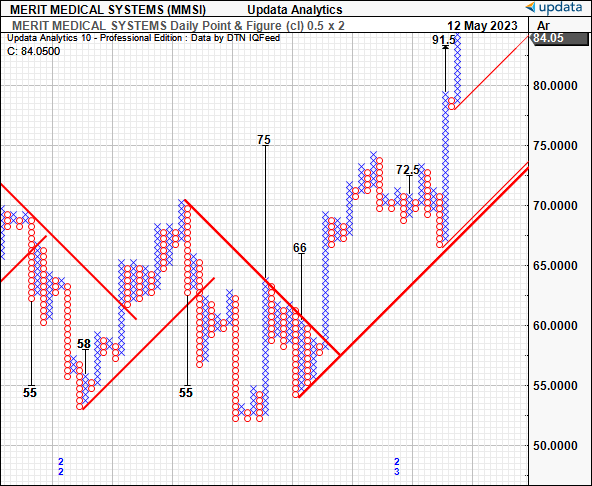

With the trend data in view there’s upside targets thrown off to $91.5 on the point and figure studies shown below. The $72 target has been met with conviction, with the March breakout sending off our $91 figure. I am looking to this number and believe there’s scope we can push there within the next 3-4 months at the current trajectory.

Fig. 7

Data: Updata

Valuation and conclusion

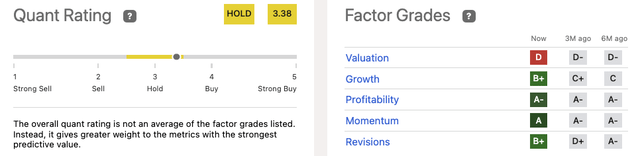

Shares are rated a hold via the quant system and this stems from a low rating on valuation. Otherwise, MMSI in the green using the quantitative composite. Notably, the company is priced at 29x forward earnings (non-GAAP) and 22.8x forward EBIT. At this mark, the firm expects $211 in FY’23 EBIT, as mentioned previously.

Fig. 8

Data: Seeking Alpha

That’s an important point in my opinion. The quant ratings are invaluable, but use available the market data. In other words, it does a magnificent job of capturing the expectations priced into a company’s stock. Our job as fundamentally-oriented investors is to uncover mispricings in the expectations to potential economic reality for a company, i.e., what isn’t captured in the price. In that vein, my numbers have MMSI to throw off $100-$155mm in TTM owner free cash flow over the next 3-quarters. This could amount after a $46-$50mm quarterly CapEx and ~$10-$30mm in quarterly NWC density.

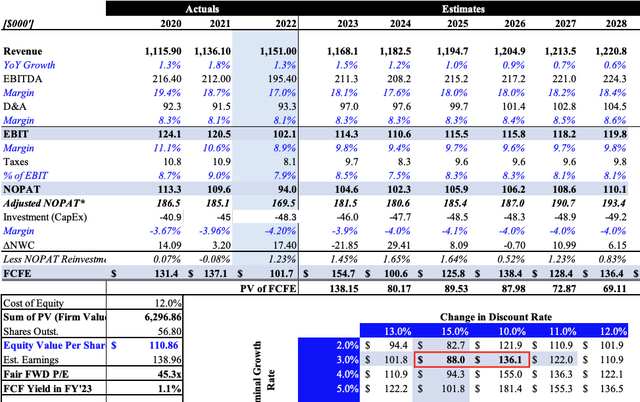

To me, these are fairly impressive numbers and suggest there’s value on offer. Discounting the cash flows at 12%, gets me to a valuation of $110 per share, 30% upside potential at the time of writing. You’d call this 45x forward P/E based on my FY’23 earnings estimates, well ahead of consensus’ 29x multiple. Bringing the discount rate to 15% gets us to the ~$85 mark where MMSI is currently priced. Hence, using my numbers, the market expects 15% hurdle rate, and I believe this is overly compressive.

Fig. 9

Data: Author

In short, I firmly believe there is ongoing value in the equity of MMSI looking forward. Investors are paying $29 for each $1 in MMSI’s earnings at the time of writing, and my estimates suggest it could be worth $45 for each $1 in forward earnings. This is tremendously valuable in my opinion. Coupled with the firm’s returns on capital, it is turning retained earnings into additional profitability at a reasonable pace. We’re seeing this at the gross-net level. As a result, I am looking to $110 as a fair valuation, anticipating MMSI to generate another $100-$155mm in free cash to shareholders over the coming periods. Net-net, reiterate buy.

Read the full article here