Introduction

It’s time to talk about an airline. In this case, Texas-based American Airlines (NASDAQ:AAL). While I have been skeptical about airlines in the past (I still am), there are at least two good reasons to assess the health of the world’s largest airline.

- Is AAL a good buy, as COVID has now faded almost completely?

- What does AAL tell us about the health of the global aviation industry?

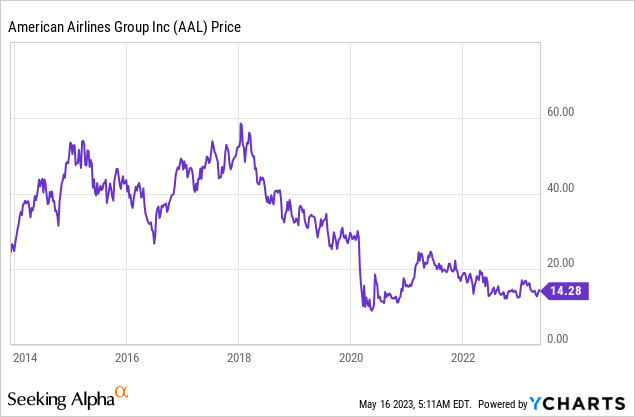

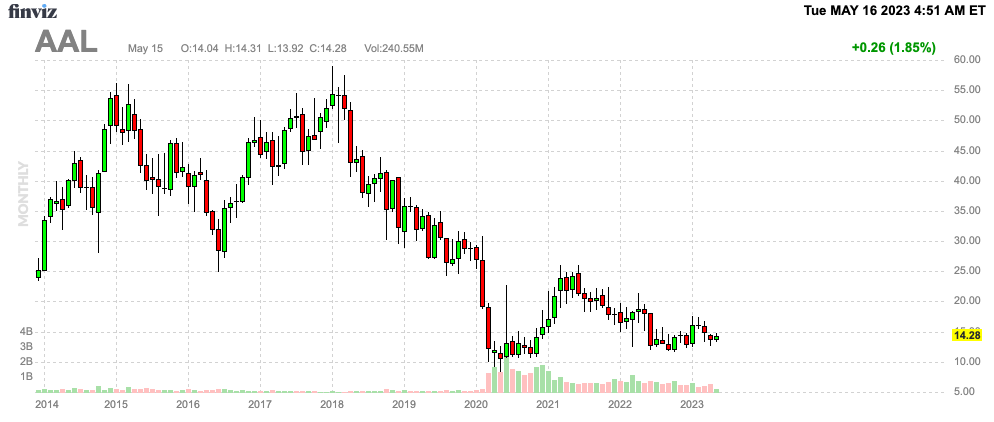

While COVID has been gone for a while, American Airlines is still trading below $18 as it remains more than 40% below its 2021 highs – let alone its 2018 highs.

In this article, I will give you one big reason to buy AAL and one big reason to avoid the company.

I’m doing this to show different investor types how I would deal with AAL. After all, there are multiple ways to benefit from AAL’s improving financial situation.

So, let’s get to it!

COVID Is Gone – The Recovery Is Here

Writing this header gave me 2021 feelings when the first companies were somewhat going back to normal. Airlines, however, are just now starting to see pre-pandemic conditions. The simple reason is the complexity of the pandemic and the fact that long-haul airlines like AAL have to deal with a wide variety of international COVID restrictions.

Last month, when airlines reported their earnings, headlines like the one below started to pop up.

Wall Street Journal

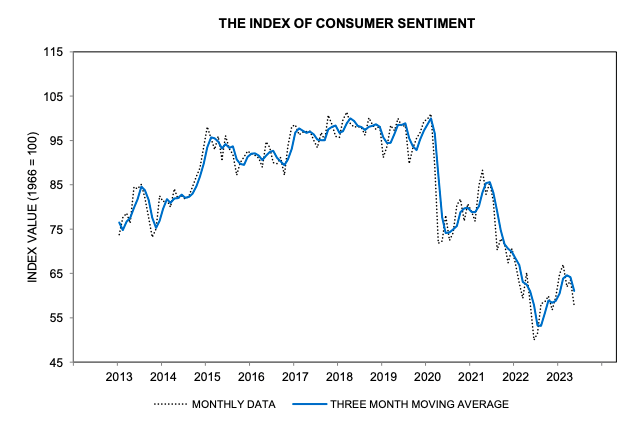

What’s important to note here is that airlines aren’t that concerned about a potential recession. As most readers know by now, economic growth is in a steep decline, with weakness in both manufacturing and services.

This is what consumer confidence looks like:

University of Michigan

However, as noted by the Wall Street Journal, despite recession, layoff, and inflation fears, airlines like American and Southwest (LUV) are projecting profits and strong demand for the spring and summer. While travel appetite has calmed compared to last summer’s “revenge travel” trend, there are no signs of macroeconomic uncertainty affecting bookings.

Furthermore, domestic traffic, which was always lagging behind domestic demand growth due to foreign COVID rules, is now accelerating. This is what Bloomberg reported on April 27:

United Airlines Holdings Inc. said last week that global travel is expanding at twice the rate of domestic, while Delta Air Lines Inc. is increasing international seats by more than 20% this quarter over a year ago.

This was confirmed by American Airlines’ latest earnings release and earnings call.

American Airlines

The company reiterated its full-year target of $2.50 to $3.50 in adjusted earnings per share.

While this is a very wide expectations range, which could incorporate a wide number of potential scenarios, the company expressed confidence in the industry’s recovery and a strong demand environment for the second quarter and summer.

Bookings for the period after 1Q23 exceeded those of the same booking period in 2019, including robust international bookings. In other words, AAL is back to normal.

The company expects second-quarter total revenue per available seat mile (“TRASM”) to be down 2% to 4% year-over-year on increased capacity and second-quarter cost per available seat mile excluding special items (“CASMx”) to be up 3.5% to 5.5% year-over-year.

The second-quarter operating margin is projected to be between 11% and 13%, based on current demand and fuel price forecasts.

Furthermore, roughly 80% of the company’s second-quarter capacity growth was already allocated early in the quarter, with strong yield performance continuing into the summer months. Notably, demand for their premium cabin surpassed 2019 levels, reflecting a strong performance in various categories and a return to pre-pandemic levels.

A Reason To Buy: American Airlines Is Making Tremendous Progress

In addition to favorable demand trends, American Airlines is making tremendous progress in improving its business.

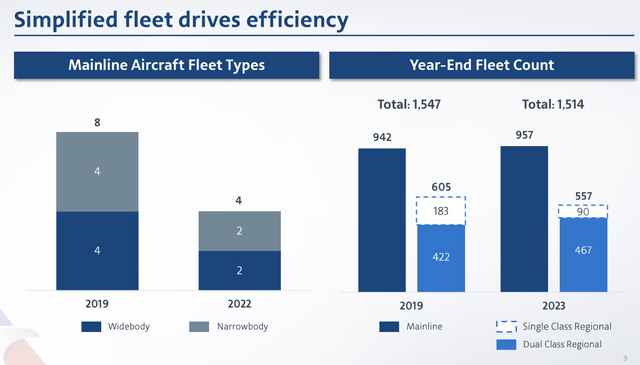

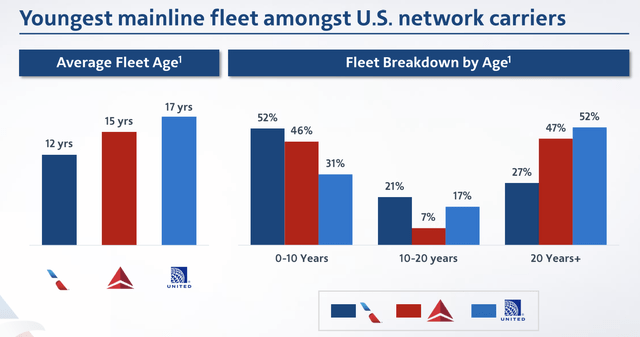

A big part of its improvements is becoming more efficient. During the JPMorgan (JPM) 2023 Industrials Conference, the company mentioned the rationalization of its fleet, as it has reduced its fleet to two types of narrow bodies and two types of wide bodies. This simplification has resulted in operational and scheduling efficiencies. The airline has also improved its regional fleet, further improving efficiency.

Fleet simplification is smart. Ryanair is a good example of this. While Ryanair isn’t a long-haul operator like American Airlines, it only operates one airplane model (Boeing 737). This way, it saves a ton of costs on training employees, maintenance, and so many other things.

American Airlines

Related to this, American Airlines continues to operate the simplest and youngest fleet among US network carriers. The company expects to reactivate nine 737s from long-term storage and take delivery of 23 new aircraft in 2023, with financing agreements expected to be finalized soon.

American Airlines

These are huge factors that not only contribute to operating efficiencies but also to customer satisfaction, which drives (long-term) revenue growth.

According to the airline, its reward programs also continue to make progress as customers continue to favor American Airlines’ direct channels and travel rewards program, with co-brand growth outperforming consumer spending and AAdvantage enrollment reaching approximately 60% higher than 2019 levels.

Thanks to improving demand, the company is finally able to accelerate balance sheet debt reduction, which is a major post-pandemic task.

During the first quarter of 2023, American Airlines generated an operating cash flow of $3.3 billion and a record quarterly free cash flow of $3 billion.

The company’s total available liquidity at the end of the quarter was $14.4 billion, $2.4 billion higher than the year-end 2022 balance.

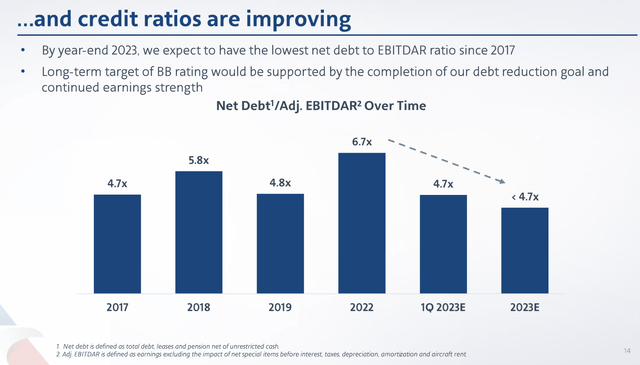

American Airlines (JP Morgan Industrial Conference – March 2023)

This allowed American Airlines to reduce total debt by more than $850 million in the quarter, leading to a $3.4 billion decrease in net debt. The net debt to EBITDA ratio at the end of the first quarter was 4.5x, lower than the ratio at the end of 2019. The company remains committed to reducing total debt by $15 billion by the end of 2025.

Please note that debt reduction is going faster than expected. During the aforementioned JP Morgan conference in March, the company expected the net leverage ratio to be 4.7x at the end of 1Q23, which is the number visible in the screenshot above.

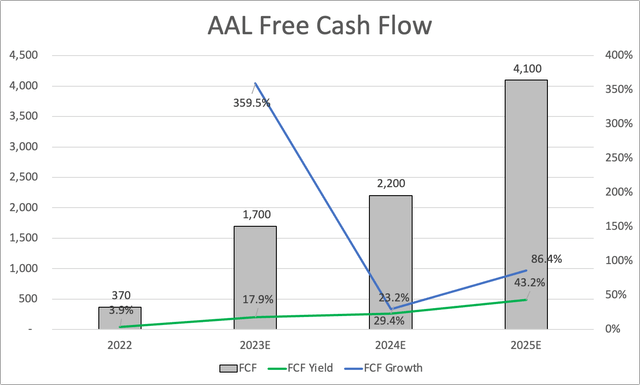

Furthermore, while capital expenditures are expected to rise from $2.3 billion in 2023 to $3.7 billion in 2025, free cash flow is expected to rise to more than $4.0 billion in 2025. This year, free cash flow is expected to be $1.7 billion. These CapEx and FCF estimates are analyst estimates, not company guidance.

With that said, looking at the raw numbers, we see that AAL has an implied free cash flow yield of almost 30% using 2024 numbers. In 2025, that number could rise to 43%. This is based on its $9.5 billion market cap.

Leo Nelissen (AAL FCF Yield – Based On Market Cap)

This could indicate that AAL is extremely undervalued. After all, if it were to distribute its free cash flow to shareholders, it could (technically) pay a 20% dividend next year.

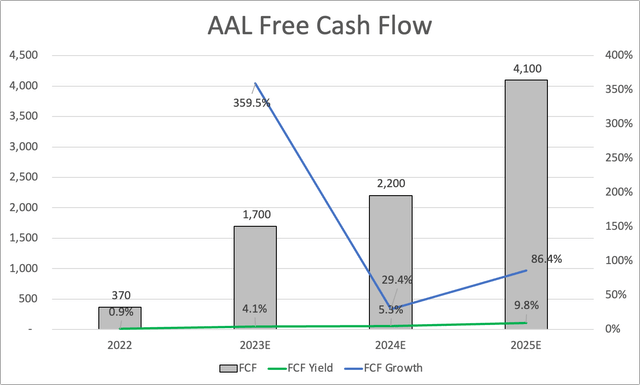

However, these numbers need to be taken with a grain of salt. After all, the company had to take on a lot of debt during the pandemic. When calculating these yields based on the company’s enterprise value, which includes 2023E net debt of $28.3 billion and pension liabilities of $2.7 billion, we’re dealing with a different picture. Now, the free cash flow yield remains below 10%. This indicates that AAL is fairly valued on a short-term basis.

Leo Nelissen (AAL FCF Yield – Based On Enterprise Value)

That said, AAL is quickly repaying debt. In 2025, net debt is expected to be $23.4 billion. This would imply a potential free cash flow yield of 11.5%.

While I’m fully aware of the long-term economic risks that could change this outlook, the company’s expected recovery makes AAL attractive.

The same goes for its implied EBITDA multiple.

AAL is trading at 4x 2025E EBITDA of $9.0 billion.

Based on these numbers, I would estimate that AAL’s fair value over the next three years is roughly 130% above its current price – meaning a price target of approximately $35.

FINVIZ

In order to get to this target, the airline recovery needs to proceed as expected without any major bumps in the road.

With that in mind, there’s a reason not to buy AAL.

A Reason Not To Buy: Airlines Are Terrible Investments

I minored in Aerospace Management & Operations. One of the first things we learned is how tough the airline business is. There are so many factors involved. And while global aerospace demand has been stellar since the commercialization of long-haul travel post-WWII, airlines aren’t great investments.

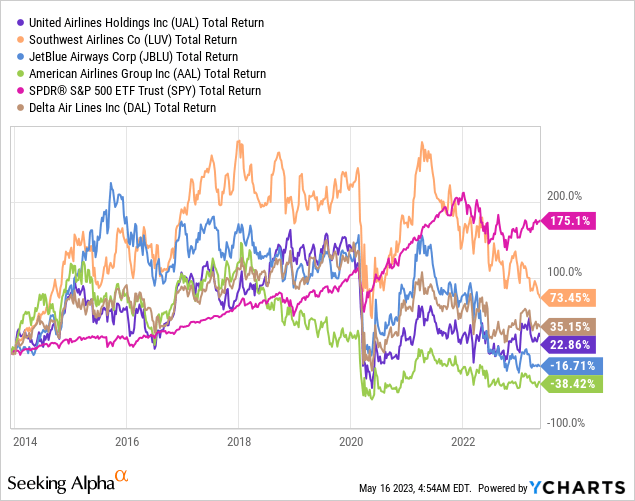

Over the past ten years, all major airlines have underperformed the S&P 500 by a wide margin. While this is obviously amplified by the pandemic, they didn’t do so well prior to the pandemic either. American Airlines, for example, peaked in 2018, two years prior to the pandemic.

Moreover, this selection includes only high-quality carriers. We cannot backtest the many airlines that went bankrupt.

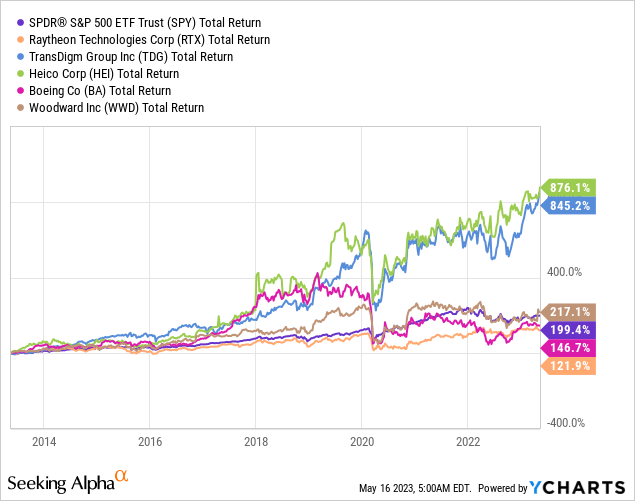

I prefer suppliers of aerospace supplies or producers of planes like Boeing (BA). I own Raytheon Technologies (RTX) due to its 50% commercial exposure, as suppliers often have strong pricing power and long-term demand growth due to rising commercial travel demand. They do not come with the risks airlines face, like competition, labor shortages, and weather issues.

This is why I am not buying AAL despite the fact that I believe that it is undervalued. I’m a long-term investor and do not like the long-term risk/reward that comes with owning any airline.

I added this part as food for thought. I’m not trying to get anyone to sell their AAL shares. It’s just a look into my thought process.

Furthermore, given AAL’s comments, I believe that aerospace suppliers will continue to do well, as demand for airplanes will likely see an acceleration in the years ahead.

Takeaway

American Airlines shows signs of improvement and potential as the global aviation industry recovers from the impact of COVID-19. The airline has reported strong demand and projected profits for the spring and summer, with domestic traffic accelerating and international bookings rebounding.

AAL has made progress in fleet rationalization, resulting in operational efficiencies, and its reward programs have gained traction among customers. The company is also focused on reducing debt and improving its balance sheet.

While AAL appears significantly undervalued based on free cash flow yields and implied EBITDA multiples, investing in airlines carries inherent risks, such as competition, labor shortages, and weather-related challenges.

Long-term investors may prefer aerospace suppliers or aircraft manufacturers due to their stronger pricing power and less volatile industry dynamics.

It is essential for investors to carefully consider the long-term risk/reward profile of airline investments.

Read the full article here