While talk of inflation, rising interest rates, impending recession, and bank failures have dominated headlines in the first half of 2023, long-term investors with a focus on income along with potential capital appreciation are focusing on opportunities in the BDC (business development company) sector. There have been numerous recent articles explaining why BDCs are good investments right now. For example, BDCs that invest in senior secured loans have the best seat in the house during a recession, and are better positioned than banks in many cases. Some BDCs are priced nicely with yields surpassing 11% or more, and because they have been impacted by weakness in the banking sector, there are some good opportunities to invest in them now. After the recent failure of Silicon Valley Bank (OTC:SIVBQ), more companies are turning to BDCs like Trinity Capital (NASDAQ:TRIN) for financing senior secured debt.

Trinity Capital is a relatively new BDC that did an IPO in 2019 and despite the challenges of Covid and post-pandemic inflation, supply chain shortages, a war and rising interest rates, they have managed to generate a growing distribution. From the company website, this is their Corporate Profile:

Trinity, an internally managed specialty lending company that has elected to be regulated as a BDC under the Investment Company Act of 1940, is a leading provider of debt and equipment financing to growth stage companies, including venture-backed companies and companies with institutional equity investors. Trinity’s investment objective is to generate current income and, to a lesser extent, capital appreciation through investments consisting primarily of term debt and equipment financings and, to a lesser extent, working capital loans, equity and equity-related investments. Trinity believes it is one of only a select group of specialty lenders that has the depth of knowledge, experience, and track record in lending to growth stage companies.

Besides TRIN, there are other BDCs that stand to benefit from the shift away from bank lending, especially for venture capital and growth stage funding opportunities. For example, I recently wrote an update on my coverage of CION Investment Corp. (CION). CION invests primarily in the debt of private and middle market companies and also stands to benefit from the transition away from banks.

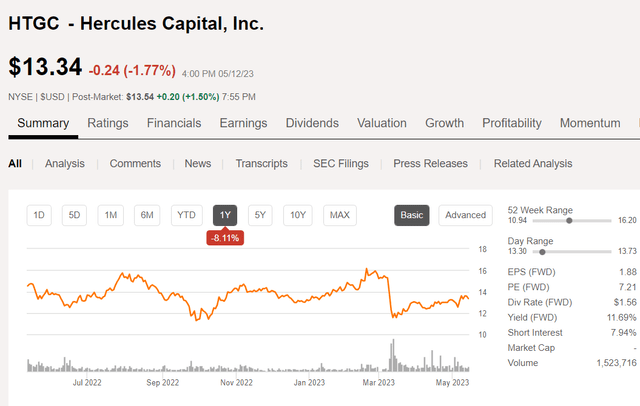

Another popular BDC that specializes in venture capital and growth financing is Hercules Capital (HTGC). HTGC hit a 52-week high of $16.20 in mid-February and then dropped all the way to below $12 a month later. The share price has since recovered a bit and the stock price has risen after a strong Q1 earnings report. Like TRIN, HTGC has also benefitted from the shift towards BDCs for venture stage and growth capital.

Also, similar to TRIN, Hercules is internally managed, pays a quarterly dividend that yields more than 11% annually, and gets mostly Buy and Strong Buy ratings. Unlike TRIN, HTGC trades at a premium to book value, even after the big drop in price that occurred in March.

Seeking Alpha

While many investors like HTGC’s track record and the company’s prospects for continued capital appreciation as well as a high yield distribution that includes another special distribution this quarter, there are some reasons to like TRIN just as much, if not more. As indicated above, TRIN is internally managed (like HTGC), so they do not pay exorbitant management fees to an external entity. And while HTGC trades at a premium, TRIN trades at a substantial discount to NAV, although the NAV did decline slightly in Q1. According to the Q1 press release, NAV declined from $13.15 to $13.07 primarily due to additional shares issued through restricted stock awards. Regarding investor concerns about declining NAV in the BDC sector, the company CEO, Steve Brown addressed this issue during the earnings call:

We have recently heard concerns over NAV decline in the BDC space. In 2022, similar to our BDC peers, we experienced a decline in NAV due to the unrealized losses attributed to multiple interest rate changes, market volatility, and some specific valuation adjustments. Additionally, we had an unusual event in Q1, in which we converted a prior year unrealized appreciation on two public company investments into a historic $50 million net realized gain that resulted in a decline in NAV of approximately $0.67 per share because of that flip. I also would like to remind our investors that $0.60 of the NAV decline in 2022 was related to the special dividends we paid to our shareholders. We have begun, and we believe we will continue to grow our NAV in the long-term.

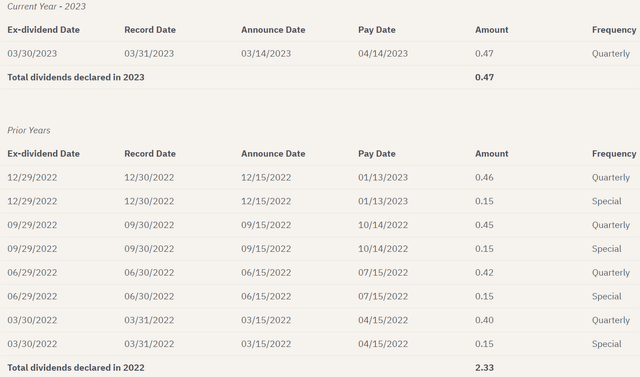

TRIN pays a much higher dividend yield than HTGC and that quarterly dividend has now been raised for 9 consecutive quarters and currently yields about 15%. TRIN also paid a special distribution each quarter in 2022 as shown on the company’s distribution history page.

Trinity Capital

The relationship between TRIN and SVB is unique in the industry and the outcome of the SVB bank failure may have a more lasting positive impact on TRIN than it might have on other BDCs such as HTGC. In fact, during the Q123 earnings call that topic was addressed during the Q&A session at the end of the call. This question from Ryan Lynch of KBW summed up what was on many people’s minds:

First question I had was just relating to the overall fundraising environment. It sounds like your overall portfolio was pretty active and had a pretty healthy level of fundraising into Q1, which was just positive and goes kind of countertrend to I think what we’re broadly seeing in VC investment and broader VC fundraising. I’m just curious though, have you seen any noticeable change in the environment for your portfolio of companies raising capital post the SVB collapse and obviously, that was a pretty big moment for the market. And I wanted to know if VC investors’ sentiment had changed and their willingness to support companies broadly if you’ve seen any changes post SVB.

The company President and Chief Investment Officer, Kyle Brown had this to say in response:

The answer is no. We’ve not seen any significant changes other than what we’ve stated, which is there’s extreme pressure on valuation. There’s a lot of money on the sidelines. It wants to enter, but it wants to enter at the right price. And so there’s this balance right now. You have companies delaying as best they can to increase their valuation prior to taking pain in the form of a dilutive down round. And you have capital that is being patient that wants to deploy but will not do it unless they make the right investments. I mean just — just as I think that we are in a position right now of having incredible opportunity, we need to make sure we make the right investments. I think the equities have — they have that same mindset. They’re going to be judged on some of the investments they make on a go-forward basis.

And so the SVB and the banking volatility have shown us that — and I think the numbers speak to it, that these banks, even SVB who owned 50-plus percent of the market share, they did not have a significant amount of term loans, what we do, right, and some of our peers do. They had $1 billion-ish term senior secured term loans out there. For that type of market share, that’s relatively low.

In further questions regarding the failure of SVB and the longstanding relationship that Trinity had with the bank as a lending partner, CEO Kyle Brown indicated that the company is in talks with several former bank employees who are likely to join TRIN as new hires. He sees that as another opportunity to benefit from the bank’s misfortune.

Q123 Results and Outlook

Diving deeper into the Q1 results for TRIN, the company reported total investment income of $41.5 million, a 30.5% YOY increase. NII of $19.3 million works out to $0.55 per share, a YOY increase of 23.7%. Net increases in net assets resulting from operations equaled $22.5 million, or $0.64 per share. A dividend of $0.47 was declared, which represents a slight increase of 2.2% compared to Q422. Total gross investments funded during the quarter amounted to $70.4 million, including $5.2 million into the recently formed joint venture. Debt principal repayments of $82.8 million included $13.1 million from early repayments and $42.1 million of assets sold to the JV.

Summarizing the Q1 results, Kyle Brown again mentioned the changes in bank financing and how that is positively impacting TRIN:

Trinity is well positioned given recent volatility in the banking industry, which has fundamentally changed the market. Businesses are looking for more stable, non-bank solutions for their financing needs and we intend to capitalize on this opportunity with a combination of on- and off-balance sheet solutions. Our core priorities of portfolio management and credit quality remain firmly rooted in our operating process. We continue to track markets and maintain constant oversight and communication with our portfolio companies as they navigate the current economic environment. Trinity continues to realize its vision as an emerging leader, providing diversified financial solutions to the global growth economy.”

Although HTGC has outperformed TRIN over the past 1-year period, the YTD performance is slightly better for TRIN even with the recent drop in price for both.

Seeking Alpha

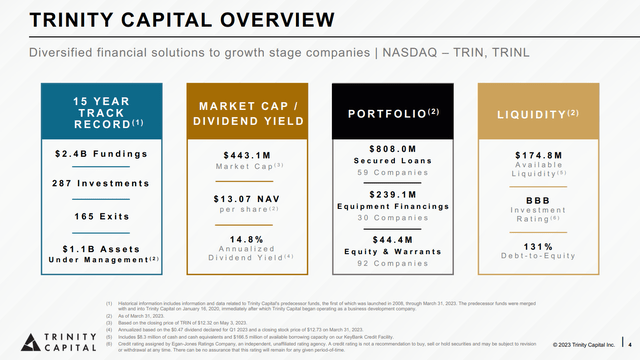

HTGC appears to be catching up in terms of YTD total return and is much bigger than TRIN with a market cap of about $1.8B. The current market cap for TRIN is about $443M and they have about $175 million in available liquidity. The slide below from the Q123 earnings presentation sums up the details.

TRIN Q123 presentation

At the end of Q1 the number of loans on non-accrual remained unchanged at 4.5% of total portfolio debt and 2.3% as percentage of fair value. There was a $6 million adjustment to fair value based on Core Scientific benefiting from improved underlying market conditions. The company finished the quarter with $339 million in unfunded commitments, and signed term sheets for $312 million.

The debt portfolio is well positioned with about 70% of debt investments at floating rates while about 30% on the borrowing side is at a variable SOFR rate contributing to a net interest margin of 11%.

In summing up the first quarter performance, Chairman and CEO Steve Brown indicated that the company had spillover income of $1.64 at 2022 year-end that they can still invest. One possibility for that investment is the potential for special dividends to be paid in 2023.

Now I’d like to turn to a few key highlights from our first quarter performance. Q1 net investment income was $19 million or NII per share of $0.55, providing 117% coverage on our core dividend. Meaningful undistributed NII as of Q1 will be reinvested into our business, both supporting our current portfolio companies and used to fund new commitments. We increased our quarterly dividend by over 2% to $0.47 per share, marking the ninth consecutive quarter that we have increased our dividend. I would also like to remind our shareholders that we had spillover income of approximately $1.64 per share at year-end that we’ll continue to reinvest. Management is diligently evaluating our liquidity position in this market and regularly discusses the various uses of our capital with our Board, including the possibility of special dividends in 2023. However, our Board has not made any affirmative decisions on the special dividend at this time.

Risks and Summary

BDCs are subject to market risk and recession risk like other stocks in the financial industry. If the economy does continue to slow and the Fed is unable to tame inflation with increasing interest rates, the spiral of declining spending and a looming recession could cause some companies to put the brakes on venture capital and other forms of growth financing. If that were to happen, TRIN and other BDCs like HTGC are likely to suffer.

Likewise, there will be increasing competition from other non-bank lenders such as HTGC. However, I believe that based on the reports from other BDCs and the comments and answers to questions in the TRIN Q1 report, there is plenty of cash sitting on the sidelines waiting for the right opportunity to take advantage of the decline in bank lending. Perhaps lower rates will be required to capture some of that business, which could have an impact on future NII and lead to a slowdown in growth. But that is not what the current indications show.

Both HTGC and TRIN appear to be taking advantage of the current opportunities in non-bank lender financing for venture capital and growth stage companies, and I feel that both should be on your watch list. I especially like TRIN and rate it a Buy at a price below $12 due to the spillover income that is yet to be invested, the discount to NAV, and the increasing distribution that remains well covered. I also like HTGC but am more cautious on buying it while the price still commands a premium above NAV. With a longer history and bigger size, HTGC offers a lower yield distribution but also may be less risky than TRIN. An investment in one or both depends on your risk tolerance and investment objectives. Both of these BDCs offer investors a compelling opportunity to generate long-term total returns that are attractive at current prices.

Read the full article here