Investment Summary

Diana Shipping Inc (NYSE:DSX) operates as a global shipping company that is specialized in the transportation of dry bulk commodities. The company boasts of a diverse fleet of vessels and operates in various international trade routes to serve customers across industries such as mining, agriculture, and energy. Diana Shipping has successfully positioned itself as a leader in the dry bulk shipping industry.

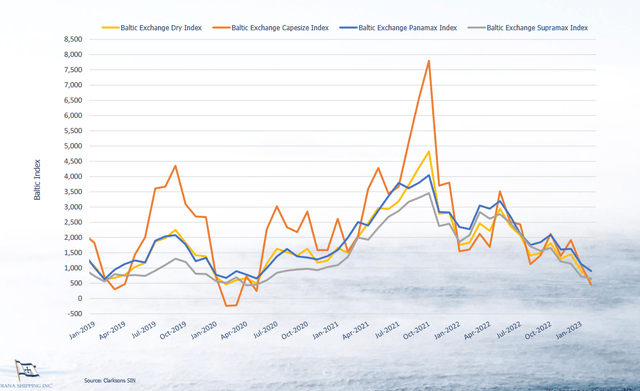

Shipping Rates (Earnings Presentation)

The company has despite the challenging market environment with dropping shipping rates been able to grow revenues compared to 2021 when they were peaking. With both a growing top and bottom line the company sits in a relatively stable financial position right now and I expect them to be able to continue holding up a dividend, but perhaps not to the same degree as before. The recent announcement of one has me optimistic though. I think we will eventually return to higher shipping rates as the trend is reversing slightly and suggesting a bullish 2H2023 – 2024 for rates. I think that the quality that comes with Diana Shipping is enough to rate them a buy for now, not only for the potential share appreciation, but the very strong dividend too.

Shipping Market Outlook

During the pandemic, the shipping market saw a sharp rise in demand and prices. However, a recent report by spglobal indicates that the trend is now reversing and normalizing, with an estimated annual fleet growth of only 2% in the near future.

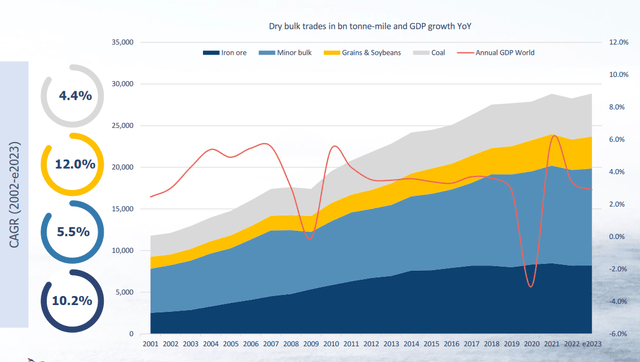

Market Growth (Earnings Presentation)

Seeing as DSX focuses on dry bulk some of the broader trends that seem to be true for the market is that we will continue having a strong demand for many of the products they are shipping. With strong demand for the products often comes more companies willing to ship and to buy the goods. Giving DSX more potential work.

Industry experts predict that as supply chain issues ease up and delays become less common, prices will decrease and the market will return to a natural cycle of ups and downs. While prices may trend upward in the long term, the high prices experienced in 2021 and 2022 are unlikely to be repeated anytime soon. I think that for the coming few quarters, it will be key to see the development of the contracted revenues for the company. So far they have secured $162 million in revenues for 2023, which represents 68% of the ownership’s days. A clear increase it this should help bring comfort to investors.

Risks

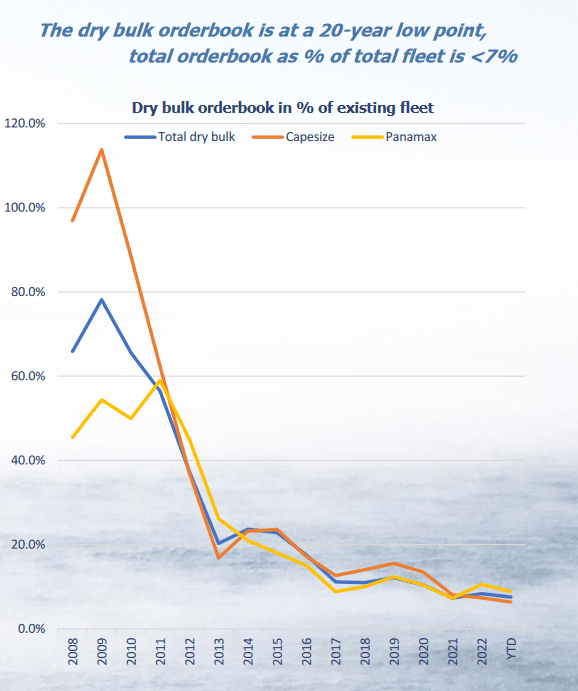

One of the major risks I see with DSX is that they haven’t been able to get their order book back to where it used to be in 2008 and 2009. It has reached 20-year lows and the total order book as % of the fleet is just around 7%.

Orderbook History (Investor Presentation)

A reversal of this trend is necessary in my opinion to help with future revenue growth and bring more confidence to investors. Where there might be some hope though is that currently 98.9% of the fleet is being utilized which hasn’t led to lower margins, as seen in the last earnings report, the EPS more the doubled in the full year of 2022 compared to 2021, with EPS reaching $1.42. Estimates ahead seem quite pessimistic though which I think has to do with the uncertainty of the market and whether or not DSX will be able to keep up margins or not. So far the trend seems to be upwards for their margins but I am worried the low orderbook will cause some volatility in the quarterly results.

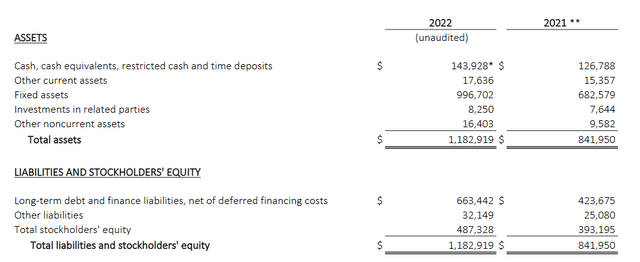

Financials

Looking at the development of the assets for the company they seem to be in fantastic condition as they are clearly trending upwards. Total assets went from $841 million to around $1.1 billion in 2022, primarily due to a large increase in fixed assets. Besides this, the company also saw a decent increase in the cash position, a nice move as I think the coming few years will be uncertain, and keeping a strong cash position is vital. Going by the 2022 numbers though, this cash position would only be enough to cover operating expenses for 2 years if they stay at around $73 million.

Company Balance Sheet (Earnings Report)

Where I do see some risk with the balance sheet is the long-term debt increased by a fair bit. Up over $200 million to just under $700 million. The cash position won’t do to much effect on this and for this reason, I would like to continue seeing cash being diverted to build up this. I mentioned before that I wouldn’t be surprised if we see a decrease in the dividend, the company has some things it needs to fix before resuming a large and generous dividend. Like an improvement for the order book and stability with the margins. This will significantly help the company maintain a flexible balance sheet where the debt won’t become an issue.

Valuation & Wrap Up

Diana Shipping Inc has been able to grow its revenues a fair bit compared to the 2021 numbers as margins seem to be trending in the right direction at least. Moving forward hover it will become very important to see a clear increase in the order book for the company to help secure revenues and investor confidence. Otherwise, I do believe DSX will continue trading at lower earnings multiple than the sectors. Even if the company might look like a steal at some prices, you might only be able to realize those gains if the company gets a raise in valuation.

Stock Price (Seeking Alpha)

Where I see the potential right now for DSX is first and foremost the large dividend and the continuous demand for dry bulk goods like iron ore, wheat, and soybeans, all things that DSX ships. The company seems to be quite active however with securing contracts with key parents to help stabilize revenue estimates and give a clearer picture as to the potential of the company. I think the dividend yield is too good to pass up on and the downside seems limited from here given the forward p/e sits at just under 6. With that said I will be rating the company a buy. They offer exposure to an industry that I dont see going out anytime soon as freight shipping is still one of the most viable and efficient ways of transporting goods.

Read the full article here