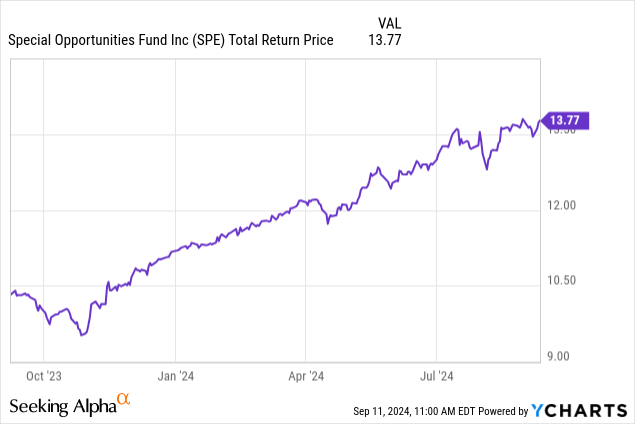

The Special Opportunities fund (NYSE:SPE) published their semi-annual shareholder report last week. They reviewed their first half 2024 market performance of 15.45% which slightly beat the S&P 500 performance of 15.29%. The market outperformance was helped by a small narrowing in the discount of 1.28%.

During the first six months, SPE repurchased 709,728 shares of the common and 91,948 of the convertible preferred at a discount which were accretive to the NAV. Since June 30, 2024, they repurchased another 91,372 shares of the common and 4,181 shares of the SPE-C convertible preferred.

Phil Goldstein provided some commentary on the first half of 2024-

1) The IPO market for SPACs improved, so SPE increased their portfolio allocation to pre-business combination SPACs from 14.7% to 16.2%. This is the safest portion of the portfolio because these SPACs are basically invested in T-Bills. But there is also some potential for some upside. To make room for the SPACs, they slightly reduced the allocation to discounted CEFs and BDCs.

2) Phil commented on the NYSE proposal to eliminate the requirement for CEF shareholder meetings:

“Believe it or not, the NYSE has proposed eliminating a requirement that CEFs have an annual meeting of shareholders to elect directors. See 34-100460.pdf (Home). If the SEC approves the NYSE’s proposal, shareholders will have almost no way to hold the directors of a CEF accountable for anything. If you think that prospect is appalling, as I do, I urge you to submit a comment about the NYSE’s proposal to the SEC.”

3) Phil commented about a successful activist outcome with CMU and CXH, which agreed to conduct modest self-tenders and to provide a liquidity event unless the discount shrinks to no more than 7.5% by mid-2025. As of Sept. 4, 2024 the CMU discount was -8.86% and CXH was -8.98%.

4) SPE has a fairly large position (about $1.8 million) in (DMA) which has more than half of its assets in unquoted private investment vehicles. Last spring, when the DMA discount widened out to >50%, SPE contacted the fund to discuss ways to enhance shareholder value. In October 2023, the fund announced it would dissolve in 2027 unless certain targets are met. Saba was given a seat on the board, which likely means the valuations are reasonable and management will not renege on its promise to dissolve if the targets are not met. The DMA discount has narrowed to 27%, Phil thinks there will be further narrowing, or SPE may advocate for an earlier windup.

5) SPE has a significant exposure to term trusts or other funds (like CMU, CXH and DMA) with a limited life and have committed to either dissolve or provide a liquidity event if certain conditions are not met. Recently, shareholders of term trust JPI accepted a proposal to eliminate the fixed life. To encourage shareholders to vote for the proposal, management promised to conduct a self-tender for 100% of the shares at NAV. The self-tender was completed in August. JPI is now a perpetual fund, but anyone who wanted to get out (including SPE, which sold all of its shares) was able to exit at NAV.

6) In the year-end letter, SPE said they submitted shareholder proposals to PGZ, NDP, TPZ and ZTR. Phil provided a progress report:

- (PGZ): Nothing definite announced yet, but management is open to strategic alternatives to enhance shareholder value.

- NDP and TPZ proposed a merger with a third Tortoise CEF which would then merge into a newly formed ETF. Discounts for NDP and TPZ have narrowed from double digits to less than 3%.

- ZTR announced a series of up to three 10% tender offers at 98% NAV by the end of 2025 which should reduce the discount over time.

7) In a June proxy contest, SPE succeeded in electing three directors to the board of DMF. The shareholders overwhelmingly approved a non-binding proposal to allow them to monetize their shares at or near NAV. Phil is hopeful they can persuade the other directors to approve that proposal.

8) SPE invested in new position in Magellan Global Fund (MGF.AU), an Australian-based CEF that mainly owns US large cap stocks. They purchased shares in March 2024 at a 5% discount because it seemed likely it would convert to an open-end fund. That did happen a short time later, and SPE sold its shares in late July at prices very close to NAV.

9) (TPL) is the fund’s largest investment in an operating company. It is an asset-rich firm that owns land in West Texas, mainly in the Permian basis. It got a nice boost on June 7 when it was announced it would be included in the S&P Mid Cap 400 Index.

10) Phil commented about Cannae Holding (CNNE). Phil feels the shares are undervalued. CNNE is a holding company and is somewhat similar to a CEF. The discount is almost 40% below NAV. Its largest investment is 69 million shares of DNB, which announced it “has received inbound interest from third parties and has retained Bank of America to assist with those inquiries.”

SPE management believes the monetization of CNNE’s holding of DNB stock could be a catalyst to a higher stock price for CNNE. If CNNE stock continues to languish far below NAV, SPE is likely to take an activist approach to enhance shareholder value.

SPE Portfolio Changes Between December 31, 2023 and June 30, 2024

I went through the year-end and mid-year SPE portfolios in detail, and found many significant changes. I’ve summarized the larger changes below:

I. Closed-End Fund Portfolio Changes

A. Closed-End Funds: Large Sells or Trims

1) AGD: Sold all 465,823 shares. Largely due to narrowing discount.

2) AIF: Was merged into MFIC which was sold to capture the discount.

3) BFZ: Trimmed from 229,380 shares to 57,423. Discount narrowed.

4) ECAT: Sold all 73,787 shares. Discount narrowed due to Saba.

5) BGB: Sold all 86,455 shares. Discount narrowed.

6) CCIF: Sold all 153,336 shares. Discount -> premium.

7) CEM: Sold all 8,213 shares. Fund merger.

8) KTF: Trimmed from 1,117,608 shares to 612,979. The fund will liquidate 11/30/2026.

9) FTHY: Sold all 71,825 shares. Discount narrowed.

10) MSD: Sold all 175,052 shares. Discount narrowed.

11) NBXG: Trimmed from 535,671 shares to 436,931. Discount narrowed.

12) JFR: Sold all 242,798 shares. Discount narrowed.

13) NXG: Sold all 65,522 shares. Discount narrowed. Rights offering.

14) TWN: Trimmed from 223,819 shares to 57,019. Discount narrowed.

15) ZTR: Trimmed from 805,935 shares to 388,231. Discount narrowed.

B) Closed-end Funds: Large New Positions or Adds

1) DCF: Increased shares from 46,559 -> 54,458. (Term fund)

2) EMO: Increased shares from 2,349 to 14,534.

3) CTR: Increased shares from 186 -> 5,344

4) KSM: Increased shares from 256,315 -> 322,797 (Liquidation 11/30/2024)

5) GDV: Increased shares from 123,595 -> 133,595. Attractive discount.

6) CUBA: Increased shares from 1,941 -> 20,443 (Small special situation)

7) Magellan Global (Australia CEF): In March 2024, took an opportunistic new position of 3,182,844 shares in this fund which was expected to open-end. This fund did indeed convert to an open-end fund and was then sold in late July.

8) HIE: Increased shares from 8,331 -> 132,868 (term fund)

9) NBH: Increased shares from 30,225 -> 278,884. Saba involved.

10) HYB: Increased shares from 91,191 -> 198,535. Will be open-ended.

11) JPI: New position 85,424 shares. Tender offer/ term fund.

12) SDHY: New position 20,310 shares. Attractive discount.

13) TPZ: Increased shares from 147,267 -> 175,844. Discount narrowed.

14) CBH: Increased shares from 17,054 ->161,186 (liquidated 8/30/2024)

II. BDC Portfolio Changes

1) BBDC: Sold all 403,900 shares.

2) FSK: Trimmed from 213,874 shares to 171,024.

3) (RWAY): New position of 145,403 shares.

III. Other Stocks Portfolio Changes

1) (TPL): Trimmed from 4,400 shares to 9,900 shares after 3-for-1 split on March 7, 2024.

2) Macy’s (M): New position of 50,000 shares.

3) (CNNE): Increased shares from 12,980 -> 221,441.

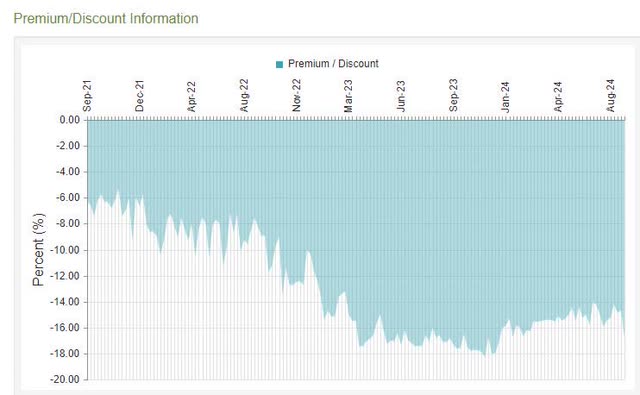

SPE – Three-Year Discount History

SPE Discount History (cefconnect)

Special Opportunities Fund, Inc. (SPE)

- Pays Managed Distribution- 8% NAV

- Total Investment Exposure= $230 Million

- Total Common Assets= $174 Million

- Last Monthly Distribution= $0.0954

- Annual Distribution Rate= 8.33%

- Baseline Expense ratio= 1.93%

- Discount to NAV= -15.3%

- Average Daily Volume= 27,301

- Average Dollar Volume= $375,000

- Effective Leverage: 24.4% (from SPE preferred)

Summary

Overall, SPE has been performing fairly well lately, and many of their activist activities have been paying off. In some cases, Bulldog and Saba are like tag team wrestlers who team up as activists in a given fund.

I am positive on SPE here at a 15% discount or greater. I own long-term positions in both SPE common and the SPE-C convertible preferred.

The (SPE-C) preferred has less upside, but is quite safe since in the worst-case scenario, it should be redeemed for $25.04 on January 21, 2027. The current YTM is above 6%.

The SPE convertible is still “out of the money”, but if SPE continues to perform well over the next two years, the convertible feature of SPE-C may be worth something, and SPE-C could trade at a premium above $25. It is currently convertible into 1.4297 shares of SPE. This ratio increases every time SPE pays out a monthly distribution.

SPE-C is very illiquid and hard to trade. The Fund has been a steady buyer of the SPE-C preferred with their share buyback program, so it is difficult to buy it at a real bargain price.

Read the full article here