The stock price of Kimco Realty Corporation (NYSE:KIM) has surged since July, indicating that passive income investors have warm up again to shopping center-focused real estate investment trusts.

Kimco Realty is growing its net operating income and funds from operations, and the portfolio has strong lease metrics as well, particularly with respect to occupancy and rents.

I think that Kimco Realty offers passive income investors a very high quality 4.2% dividend yield that has a high margin of safety, given a pay-out ratio of just 60%, and the trust has considerable potential to grow its dividend moving forward.

My Rating History

My last stock classification on Kimco Realty was Buy as strong lease activity as well as net operating income and funds from operations growth were supportive of the investment thesis. Kimco Realty revised its forecast for FFO upward in the last quarter and is soon poised to announce a dividend hike.

Kimco Realty is also growing its funds from operations at double digits, partially because of acquisitions, and I see more growth potential in the future.

Well-Leased Shopping Center Portfolio With Growing Rents

Kimco Realty owns and operates a grocery-anchored shopping-center portfolio consisting of 567 U.S. shopping centers and mixed-use properties. These real estate assets reflected a total gross leasable space of 101 million square feet as of June 30, 2024.

Kimco Realty has seen a nice 13% bump in sales to $500 million in the second quarter, which relates to the trust’s acquisition of RPT Realty at the start of the year.

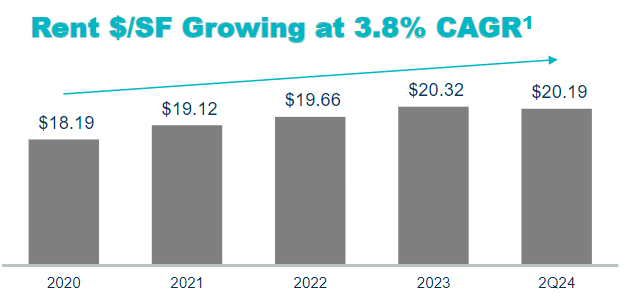

Besides acquisition effects, the shopping center real estate investment trust profited from 3% same-store net operating income growth as well as high rents. Rental growth has been a potent catalyst for Kimco Realty’s funds from operations in the last three years. In 2Q24, Kimco Realty rents totaled $20.19 per square foot, reflecting an 11% increase over 2020 base rents. Rents in 2024 have so far flat-lined, however, and are essentially at the same level as they were at the end of 2023.

Same-Store Net Operating Income Growth (Kimco Realty Corporation)

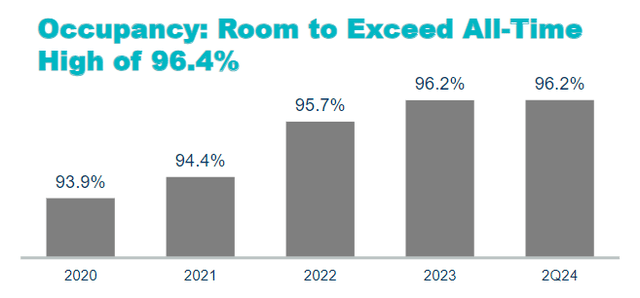

The recovery in the shopping center real estate market after the pandemic allowed Kimco Realty to successively release properties at higher rents and improve its occupancy metrics at the same time. In 2Q24, the portfolio was 96.2% leased, which is in striking distance of the trust’s previous occupancy high.

Occupancy Metrics (Kimco Realty Corporation)

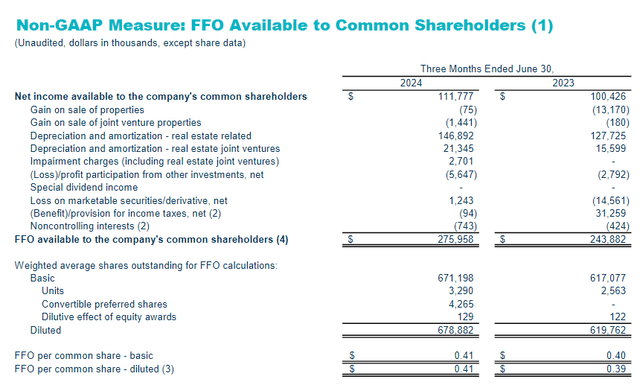

In 2Q24, Kimco Realty produced funds from operations of 276 million, up 13% YoY due to the acquisition of RPT Realty. I detailed the benefits of this acquisition in my piece Kimco Realty: 4.8% Yield, Strong Dividend Coverage, And A Catalyst.

Though Kimco Realty’s funds from operations rose a more moderate 5% (on a diluted per-share basis), the trust has no problems whatsoever to cover its dividend with FFO and has one of the best dividend pay-out ratios I have ever encountered in the REIT industry.

Funds From Operations (Kimco Realty Corporation)

Dividend Pay-Out Ratios And Yield

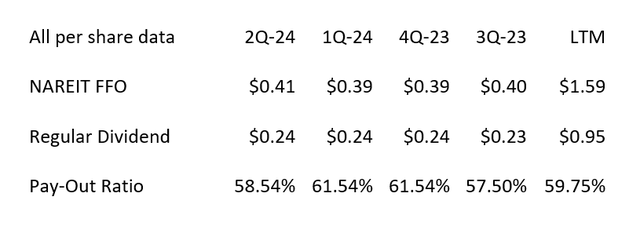

One of the best aspects of an investment in Kimco Reality is that the shopping center real estate investment trust has a very low dividend pay-out ratio based on funds from operations.

In the second quarter, the trust earned $0.41 in funds from operations compared to a $0.24 per share dividend, which equates to a 59% dividend pay-out ratio.

In the last twelve months, Kimco Realty paid out 60% of its funds from operations whereas Realty Income Corp. (O), a retail-focused, though not shopping center-focused net-lease trust, paid out 75% of its adjusted funds from operations.

Dividend (Author Created Table Using Trust Information)

Kimco Realty raised its dividend in October of last year to $0.23 per share per quarter, representing a dividend hike of 4.3%. I anticipate that the real estate investment trust will further increase its dividend in October 2024.

My guess is that the trust will raise its dividend to $0.25 per share per quarter, which would lift the annualized pay-out to $1.00 (from $0.94 per share today), reflecting a hike of 4.2%. Kimco Realty’s stock presently pays passive income investors a very well-covered yield of 4.2%.

Guidance And Funds From Operations Multiple

Kimco Realty raised its funds from operations forecast from a range of$1.56-1.60 per share to $1.60-$1.62 per share due to expectations of strong lease activity and high portfolio occupancy. Based on a stock price of $23.11 at the time of writing, the shopping center real estate investment trust is selling for 14.4x this year’s estimated FFO.

Realty Income, a net-lease rival with a large real estate footprint in the U.S. itself, is selling for 14.9x this year’s projected adjusted funds from operations.

I think that Kimco Realty, if the U.S. avoids a recession, could possibly deliver strong FFO growth, particularly if the trust were to get a little bit more active in terms of acquisitions. The trust’s funds from operations growth has been driven primarily because of Kimco Realty’s last acquisition, so I think acquisition-driven growth could be a catalyst for a rerating.

In addition, with interest rates set to decline in the near-term, acquisitions could become cheaper from a financing perspective. With new acquisitions, I think that Kimco Realty could sell for at least 15-16x FFO, which equates to an intrinsic value between $24.00 and $25.55.

With the market presently being fearful of a recession and investors seemingly losing interest in growth stocks like Nvidia Corporation (NVDA), I think that real estate investment trusts could potentially benefit from a re-routing of investment dollars into the REIT sector.

I think that Kimco Realty, if the U.S. avoids a recession, could possibly deliver strong FFO growth, particularly if the trust were to get a little bit more active in terms of acquisitions.

The trust’s funds from operations growth has been driven primarily because of Kimco Realty’s last acquisition, so I think acquisition-driven growth could be a catalyst for a rerating.

In addition, with interest rates set to decline in the near-term, acquisitions could become cheaper from a financing perspective. With new acquisitions, I think that Kimco Realty could sell for at least 15-16x FFO, which equates to an intrinsic value between $24.00 and $25.55.

Why The Investment Thesis May Not Work Out

Kimco Realty’s shopping centers are grocery-anchored, which ensures a fairly steady amount of foot traffic. Though Kimco Realty still has very good occupancy, rental growth has been slowing lately.

If the U.S. economy slides into a recession, commercial real estate values could take a hit and lease performance could suffer.

Kimco Realty’s occupancy suffered during the last pandemic as major restrictions went into effect. Thus, a new pandemic that leads to wide-spread shutdowns of shopping centers is a risk that passive income investors should be aware of.

My Conclusion

Kimco Realty’s stock price has steadily climbed higher as of late, but the business itself is still in pretty good shape.

High occupancy, rising rents and growing funds from operations underscore the value proposition for Kimco Realty here, which points to dividend upside as well as a potentially higher FFO multiple if the trusts keep its present funds from operations trajectory going.

Kimco Realty has a well-leased portfolio. With a dividend hike also potentially in the cards next month, I think that Kimco Realty’s 4.2% yield is worth buying.

If you are a passive income investor looking to secure recurring income from your REIT investments, I think that the trust’s low pay-out ratio equates to a very high margin of safety for passive income investors.

Read the full article here