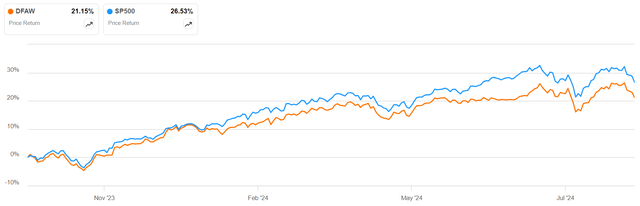

The Dimensional World Equity ETF (NYSEARCA:DFAW) laps its first year since inception this month. This diverse global equity fund has, thus far, failed to generate any alpha over broad-market U.S.-domestic ETFs, but that’s not surprising since the U.S. market has been dominated by the meteoric rise of the Magnificent 7, and that’s the essence of my Hold (don’t buy) thesis for DFAW right now.

SA

Cheap Fund Focused on Historical Outperformance

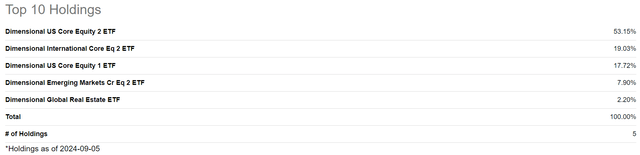

This 0.25% expense ratio fund’s strategy is literally academic, meaning years and years of academic data is used to tweak the fund’s holdings on a periodic basis. Technically, this is a fund of funds, because DFAW only holds other Dimensional ETFs in its portfolio, so I expect the ‘rebalancing’ is more of a reallocation within these 5 funds.

DFAW Holdings

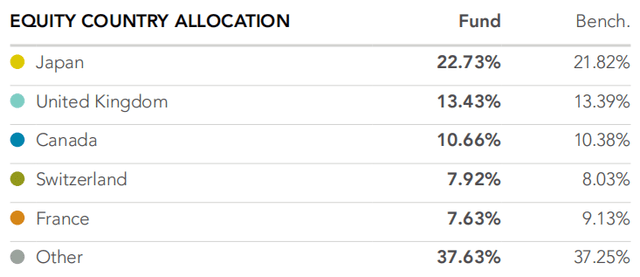

One point I’d like to draw your attention to is the fact that this is not a truly global ETF. Emerging markets, for example, are hardly representative of those economies and only make up about 10% of the fund. It’s still geared to U.S. and International, which is another term for ‘developed’ markets. As an example, the Dimensional International Core Equity 2 ETF (DFIC), which comprises about a fifth of DFAW’s holdings, has the following country allocations.

DFIC Holdings by Country

That’s one plausible reason why DFAW is almost mimicking SP500 but unable to generate alpha over it and unable to offset it in periods of decline. It’s not really designed to do that. It’s simply meant to follow historical trends where alpha has been generated. I don’t think that’s a very good strategy, and I have my reasons.

First, the market we see now is nowhere close to being a conventional market mix where the cyclicality of sectors makes itself known very clearly at different periods of time. For instance, in boom times and near-zero interest rates, markets tend to be buoyant, uplifting all ships like a rising tide but primarily driven by growth stocks; on the flip side, high interest rates, uncertain political outcomes, global conflict, etc. tend to spook investors into rotating funds into value stocks. That’s not really happening right now, which also means a traditional market mix – even a global one – isn’t very likely to generate alpha in such an irrational market environment.

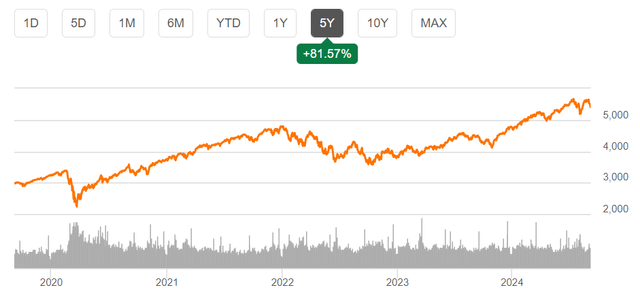

SA

If you need proof of that, just look at SP500 since the pandemic. Where’s the reaction to the initial conflict flaring up in Europe? Where’s the effect of the Fed’s QT effort that started in early 2022? What marks the first move by the Hamas against Israel? Aside from what I can only call a sideways movement between 2022 and 2024, this looks nothing like a disturbed or panicked market. My view is that the ‘new normal’ everyone was talking about after the pandemic has truly set in, and most of us don’t even know it.

The second reason I think DFAW’s strategy is ineffective in this market is what I’ve been saying about the Mag 7 for several months now. As long as these giants of tech, communications, and consumer discretionary continue to dominate all other segments, it’s going to be hard to generate alpha over that from any other sectoral or geographic mix of equities.

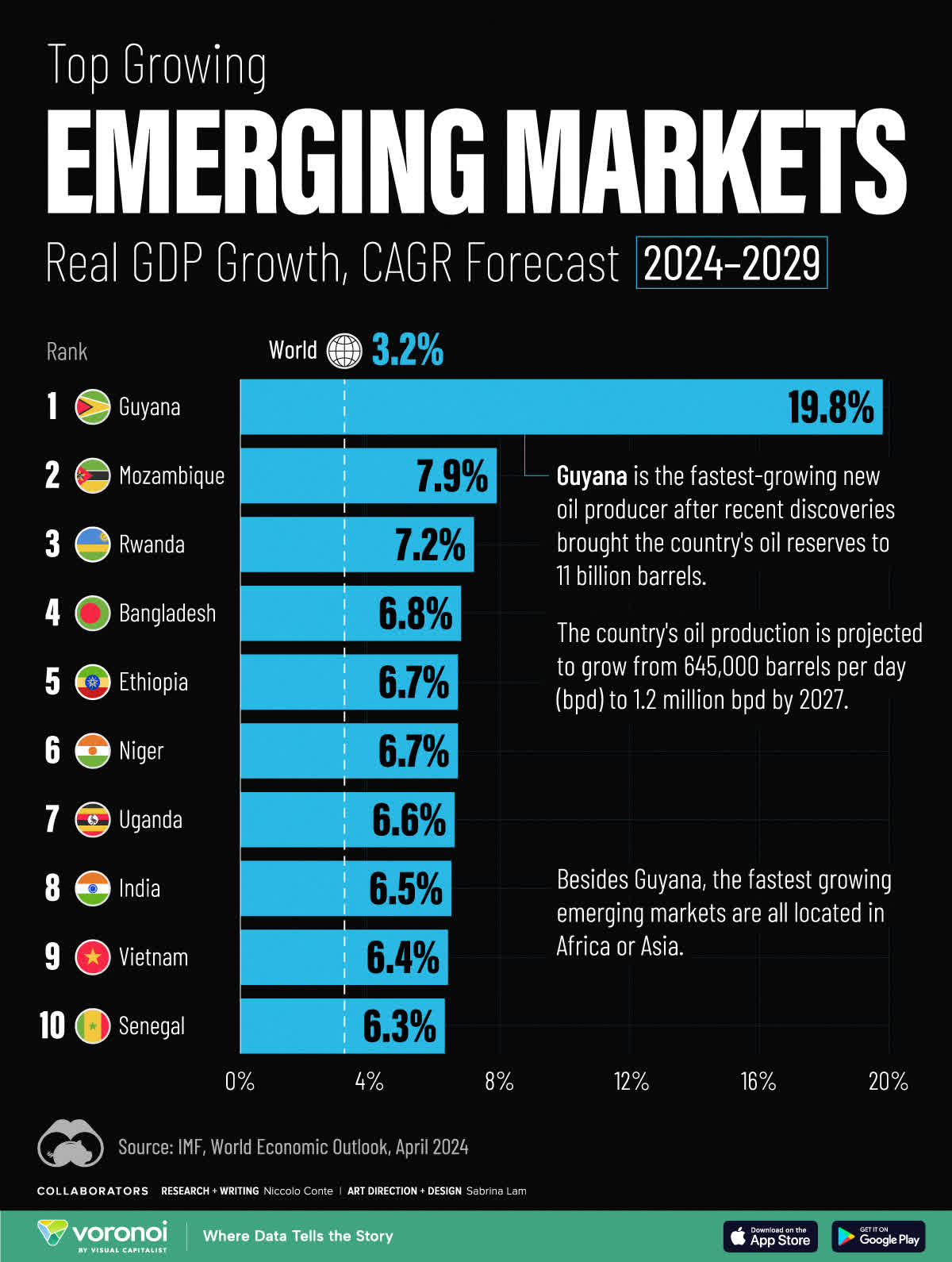

Overall, I would say that DFAW might theoretically be designed for outperformance, but without adequate tweaks to its ETFs’ holdings to include real growth from emerging markets such as Africa, South Asia, and Southeast Asia, I don’t believe this ETF is going to outperform the domestic U.S. market.

Visual Capitalist

My Thoughts on DFAW

In closing, I do like the approach that DFAW is using. Although historical performance can often be a mirage when projected forward, it’s equally true that companies that have a history of strong performance are likely to continue in that vein, ceteris paribus, of course.

The problem is, there’s nothing to suggest the ‘all else being equal’ part. Nothing is as it was before the pandemic, and with the advent of AI, I believe the investment landscape has undergone an even more significant transformation to a more risk-on scenario and a greater dependence on a few securities to carry the weight of the market.

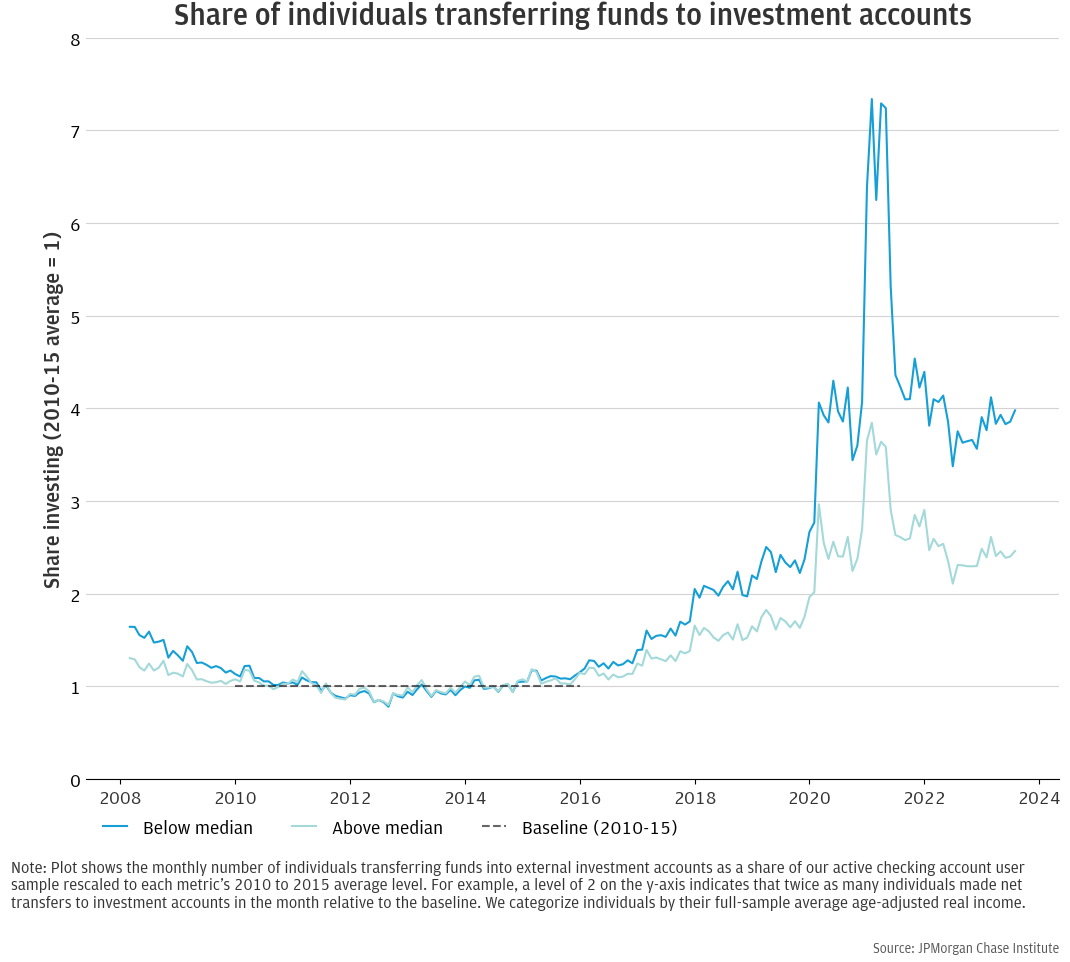

One possible reason could be the gush of retail investors now participating in secondary markets. This graph from JPMorgan Chase does speak a thousand words.

JPMorgan Chase

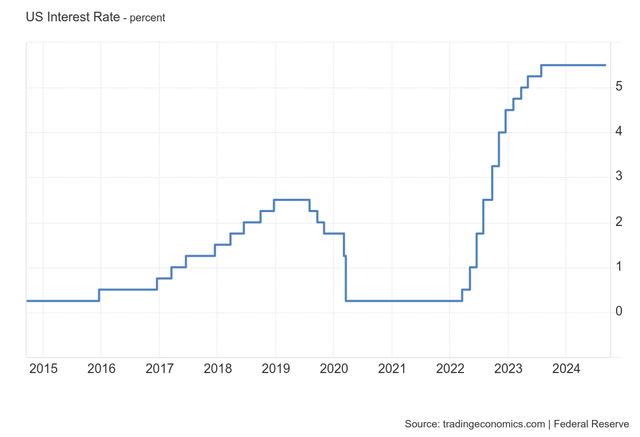

As more people pour money into the investment pool, those funds are naturally going to gravitate toward high-performance securities – both from a yield perspective as well as from a capital appreciation one. Look a little closer and you’ll see that inflation and resulting higher interest rates managed to put a damper on equity investments because fixed income products were starting to yield relatively higher rates, and still are. Even so, the optimism is shining through; investors are clearly still seeking alpha from a market that bounced back so quickly from the post-pandemic dip.

Trading Economics

However, I also posit that this was not necessarily a post-pandemic development. If you superimpose the Fed Funds Rate chart over the retail investor chart, you’ll see that the slow cadence of interest rate hikes starting in 2016 triggered the initial flow of funds into investment accounts. From there, the pandemic triggered a massive surge in investment interest that still persists today.

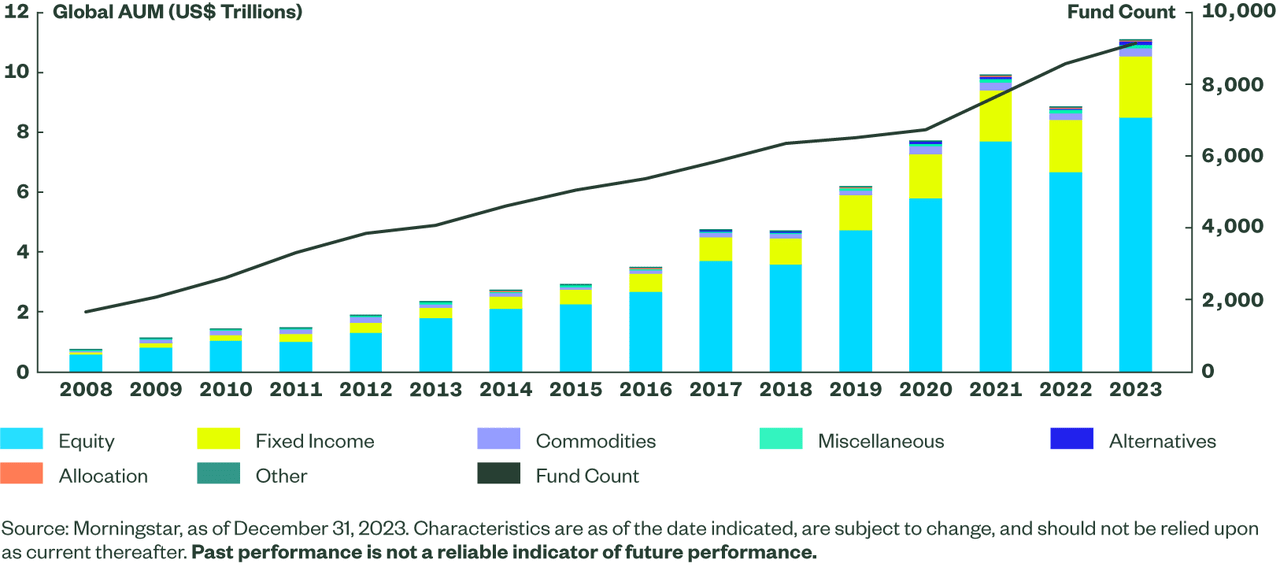

There’s a problem associated with that, unfortunately. As more funds flow into investment accounts, the pool of uninformed investors rises. That’s given impetus to the ETF market, which is why we’re seeing this.

State Street Global Advisors

You can see the surge in the ETF count reflecting investor interest in equity funds since 2020. There’s been growth in other areas such as fixed income as well, but apart from the 2022 dip in equity ETF AUMs and count, growth has been steady.

And that brings us back to why DFAW is unable to outperform the market. In a scenario where market movements are dictated by an elevated few (Mag 7), investors relying on fund managers are naturally going to see strong allocations to these big winners. For instance, the Dimensional U.S. Core Equity 2 ETF (DFAC), which is DFAW’s largest holding at 53%, has Apple (AAPL), Microsoft Corp (MSFT), Nvidia Corp (NVDA), Meta Platforms (META), and Amazon (AMZN) as its top 5 holdings, weighted at a combined +17%.

And that skews the market in a way where other sectors are forced into the background, having only minimal impact against the movements of the Mag 7. That’s why I wouldn’t recommend DFAW right now. At some point, once the Mag 7 have exhausted their growth fuel and their valuations come down to more digestible levels, it might well provide that elusive alpha. For the foreseeable future, however, I don’t see that happening.

Read the full article here