Following our recent update on International Consolidated Airlines Group, we are back to analyze Deutsche Lufthansa AG (OTCQX:DLAKF, OTCQX:DLAKY). For our new readers, the company is one of the largest players in the world, with a leading position in the EU. Aside from Deutsche Lufthansa airline, the company’s network airlines include Austrian Airlines, ITA Airways, Swiss International Air, Brussels Airlines, and Eurowings (a local low-cost operator). The other segments are Lufthansa Technik and its Cargo division. These divisions offer aviation services such as catering, transportation, maintenance, repair, and overhaul (MRO) and additional business for the entire group functions. We suggest checking our previous publication related to ITA Airways’ upside.

In a nutshell, our previous buy rating was supported by a positive trajectory in demand (post-COVID-19), an agreement with the pilot union, and a better balance sheet with a return to pay a DPS. With today’s follow-up note and the sector development, we see Deutsche Lufthansa as an attractive investment opportunity.

Deutsche Lufthansa Upside

- Starting with a high-level consideration within the EU aviation industry, what is increasingly favorable is the current production challenge of Boeing and Airbus. Capacity constraints and labor shortages will likely provide rational competitive behavior and no new airline players;

- With the US airline industry’s consolidation, we believe the European one will follow. This change has made these companies much more investable. The industry is very competitive; however, Lufthansa is progressing with its expansion in the European skies. After receiving the green light from the EU to enter ITA Airways, the German giant intends to initially acquire 19.9% of TAP Air Portugal, staying below the minimum threshold. Therefore, there is no need to notify the EU regulatory authorities. Lufthansa’s interest in the Portuguese flag carrier is due to its connections with Brazil, where it is the leading supplier, its strong presence in Africa, and its expansion of its network in the North American region;

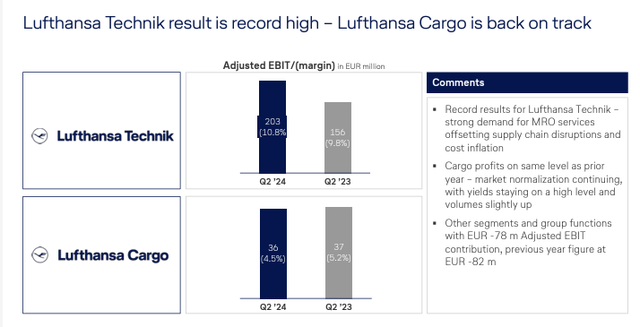

- Looking at the company, approximately 60% of Lufthansa’s EBIT comes from airline transportation, with over 30% from the Technik business and less than 10% from its cargo division. Our buy rating is related to Lufthansa’s sum-of-the-part valuation, particularly regarding the Technik division (MRO). This is the largest MRO worldwide, and even if this is not a massively high-margin segment (with an adj. EBIT margin of 10.8% in the Q2 results – Fig 1) – the division’s profitability is stable (we are assuming 7.5% in our long-term projection) and continues to grow steadily. The MRO division has recorded a growth rate of >6% in the last decade. During the pandemic outbreak, the company considered selling a stake to raise cash. That said, the division was not sold; however, Bain Capital proposed for a minority stake (20%) an EBIT multiple of 15x, valuing the segment at approximately €8 billion. Currently, Deutsche Lufthansa’s market cap is approximately €7 billion. Considering the Q2 debt (€8.1 billion, including pension liabilities), Deutsche Lufthansa’s enterprise value is €15.1 billion. This implied a valuation of below 3x on an EV/EBIT basis for the rest of the business. Our team sees the cargo and airline segments are worth more. To be clear, we are not forecasting an MRO disposal; however, this is a margin of safety that cannot go unnoticed.

Technik Upside

Source: Deutsche Lufthansa Q2 results presentation – Fig 1

Q2 results, Earnings Changes, and Valuation

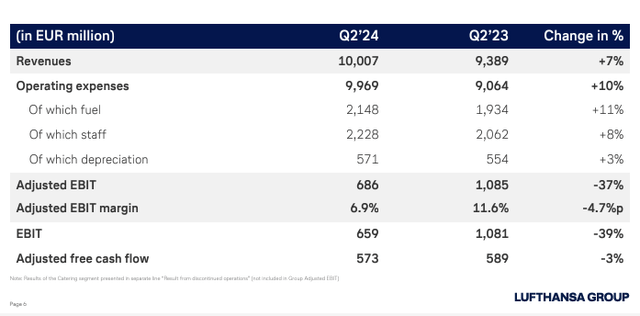

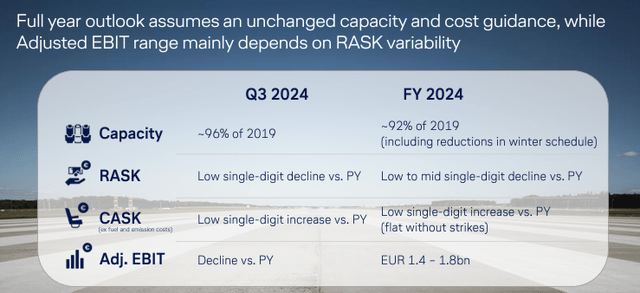

Starting with the Q2 financial performance, the numbers aligned with Deutsche Lufthansa’s previous warning. In the quarter, the group’s net profits halved to €469 million, with a 47% decrease compared to the €881 million achieved in Q2 2023 (Fig 2). The company suffered from a normalization of ticket prices, which remains well above the pre-pandemic level. On the top-line sales, the company reported a plus 7% thanks to higher capacity and the supportive performance of the MRO segment, whose revenues increased by 16% compared to Q2 2023. On a positive note, the company strengthened its balance sheet, reducing net debt from €8.4 billion to €8.1 billion. Lufthansa is now saying that 2024 adjusted core operating profit will be in the €1.4 and €1.8 billion range (Fig 3), with a Q3 earnings expectation to decline by a single-digit percentage point compared to 2023. The company announced a turnaround to regain profitability. This includes measures to optimize the network, such as reducing long-haul aircraft types. This aims to lower cost complexity and streamline the group’s operation. Considering lower fuel costs but incorporating lower yields (the company recorded a minus 3.7% in Q2), we adjusted our EBITDA to €3.9 billion and our core operating profit to €1.7 billion. Despite forecasting higher sales growth, we anticipated an EBIT margin below 4.5% (the company achieved 7% in 2023 core operating margin). This is due to ongoing headwinds and strikes. Therefore, we do not anticipate that pricing power will be sufficient to support the company’s 8% EBIT margin target. That said, we see a positive upward trajectory in 2025. In our estimates, the 2024 strike impact was over €500 million (€350 million effect was recorded in Q1). In addition, thanks to a more conservative approach to the balance sheet and the FCF results, we continue to de-gear the company in our forecast period. This is another margin of safety.

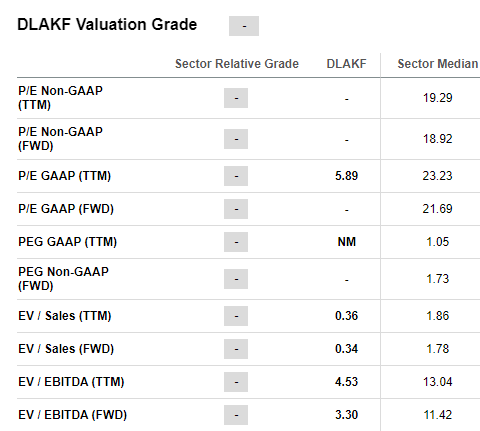

Even when applying lower estimates (also aligned with the company’s guidance), we continue to consider Deutsche Lufthansa’s valuation inexpensive. Considering the transformation program and subdued demand, the company trades at an FWD EV/EBITDA of 3.3x (Fig 4) vs. a historical range between 3.6x and 7x. In our estimates, continuing to apply an EV/EBITDA of 4.5x, we arrive at an enterprise value of €17.55 billion. Including the debt consolidation, our equity value is set at 9.45 billion. Therefore, there is a 35% in potential capital appreciation. We rate the shares with a buy and a target price of €7.9.

Deutsche Lufthansa Q2 Financials in a Snap

Fig 2

Deutsche Lufthansa 2024 Guidance

Fig 3

SA Valuation Data

Fig 4

Risks

Downside risks include revenue volatility, which is a function of consumer willingness to pay, and unpredictable business travel spending. Other risks include terrorist actions and natural catastrophes. We should also report potential strikes, ticket price normalization, and ramping up capacity from low-cost players. In addition, airline companies’ profitability is impacted by FX changes and fuel price volatility.

Conclusion

Airflight production constraints and flag carrier mergers reduce competition and favor ticket prices. In addition, the company is progressing with a de-leverage path and recording record results in the MRO business (Fig 1). The valuation is lagging, so we continue to overweight Deutsche Lufthansa.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here