FiscalNote Holdings (NOTE), a SaaS-based provider of legislative and regulatory intelligence, has capitalized on the AI growth trend, but that’s not the main appeal with this stock.

On a stock screener, FiscalNote Holdings (NYSE:NOTE) shares do not appear cheap. However, take a closer look, and you may start to believe that there is “hidden value” with NOTE stock. This Washington, D.C.-based technology company, which operates several subscription-based policy management platforms, has yet to reach consistent profitability.

But given how much one of FiscalNote’s non-core businesses fetched in a divestiture earlier this year, it’s possible that, to the right strategic buyer, what remains of this company could be worth far more than the current NOTE stock price.

Then again, maybe not. Taking several factors into account, the market’s current valuation again makes sense. Although there may be an eventual path to higher prices, buying now on that possibility may not necessarily be a worthwhile move.

With this in mind, let’s take a closer look, and see why NOTE may appear to be “hidden value,” yet for now, remains a value trap stock to avoid.

FiscalNote Holdings: Overview And Recent Moves Into AI

Through its eponymous platform, as well as other platforms owned by the company, FiscalNote provides intelligence and insight on legislative and regulatory developments. End-users for these products include corporations, non-profits, and governments.

Alongside FiscalNote, other SaaS-based platforms owned by the company include the following:

- Curate: Curate is a policy management platform focused on local government legislation.

- Dragonfly: Dragonfly provides geopolitical and security intelligence and insights.

- Oxford Analytica: Another geopolitical intelligence platform owned by FiscalNote.

- TimeBase: TimeBase is a platform that provides intelligence on Australian legislation.

Alongside these platforms, FiscalNote also owns two venerable publications that focus on reporting/analyzing the latest developments from the U.S. Congress:

- Congressional Quarterly (CQ)

- Roll Call

Although classified as a publication, CQ operates largely like FiscalNote’s main platform, as a SaaS-based provider of legislative intelligence.

More recently, FiscalNote has been attempting to capitalize on the generative artificial intelligence growth trend, with the launch of several “Copilot” AI assistant platforms, including FiscalNote CoPilot and FiscalNote StressLens.

However, while “AI mania” briefly hit the stock in 2023, it hasn’t been enough to turn the tide for this poor performer, which has fallen considerably since its public market debut.

NOTE Stock Has Tanked Since Going Public

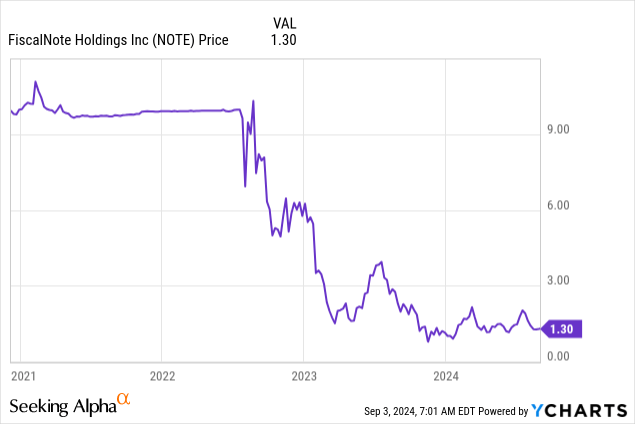

Privately held for the first nine years of its existence, Fiscal Note went public via a merger with Duddell Street Acquisition Corp., a SPAC, in 2022. However, much like other SPAC deals at that time, those who bought in at the onset, and have held on since, have experienced massive losses.

Since the 2022 merger, NOTE stock has fallen from its original $10 per share SPAC price, to around $1.30 per share today. Late last year, NOTE briefly fell to prices as low as 65 cents per share. So far this year, though, shares have made a moderate move higher. Chalk this up to the asset sale hinted at earlier.

Back in March, FiscalNote sold its Board.org unit to Executive Platforms, a private equity-backed event management company, for $95 million in cash, plus $8 million in potential post-closing earn out compensation.

This deal, which both bolstered NOTE’s balance sheet, as well as helped to highlight the stock’s “hidden value,” sent shares back to prices above $2 per share. Since then, NOTE has pulled back, and it’s easy to see why.

NOTE Stock Valuation

If Board.org, which made up a small percentage of FiscalNote’s overall business, sold for $95 million, sure what remains of the company is worth a far lot more than the current NOTE stock price, right?

Back-of-the-envelope, it appears that way. As Seeking Alpha contributor Faizan Muhammad discussed in his February write-up on this stock, FiscalNote trades at a bargain valuation, when valued using the enterprise value-to-sales (EV/sales) metric. Flash forward seven months later, this is still the case.

With an enterprise value of $317.9 million, against trailing-twelve month (TTM) annual revenue of $129.6 million, NOTE stock currently trades at an enterprise value to sales (EV/Sales) ratio of 2.45. As Muhammad mentioned in his aforementioned FiscalNote article, similar SaaS-based information providers trade at much higher multiples, with an EV/Sales ratio of 5 being a conservative valuation for this business.

Using this metric, FiscalNote’s underlying enterprise value should be around $648 million. Subtracting $145.8 million in outstanding debt, along with $24.8 million in capital leases, and adding back $37.7 million in cash and short-term investment, this provides an estimated value of around $515.7 million for the company, or around $3.70 per share based on the current share count.

Nevertheless, while it may appear that there’s a material amount of underlying value waiting to be unlocked with NOTE, don’t assume it will happen anytime soon.

3 Reasons Why A Juicy Takeover Offer Isn’t Likely To Emerge

Based on the aforementioned calculation, it may seem like a financial or strategic buyer could come in, make an offer to buy all outstanding shares of NOTE stock at a 100% premium, and still get a promising business at a dirt cheap price.

However, there are three key reasons why FiscalNote isn’t likely to be a takeover target anytime soon. First, while cheap on an EV/Sales basis, remember this company has yet to reach consistent profitability. Despite a big pivot towards AI, overall growth has stalled. Excluding the impact of the Board.org sale, Q2 2024 revenue growth was basically flat when compared to the prior year’s quarter.

Although FiscalNote did improve its adjusted growth margins last quarter by 500 basis points, further cost-saving and other efficiency measures may only go so far. To really move the needle in terms of profitability, organic growth will need to once again re-accelerate.

Second, when taking into account FiscalNote’s share count on a fully diluted basis, upside for a potential buyer is much smaller than in our initial calculation. Per the company’s latest earnings presentation, current share count may be at 139.2 million.

However, add in outstanding seller earn out, employee RSUs and options, as well as outstanding convertible instruments, and at prices just slightly above present price levels, NOTE’s share count balloons to 157.4 million. This reduces our underlying value calculation from $3.70 to around $3.28 per share, or by 11.35%.

Third, and most importantly, FiscalNote is a controlled company. Insiders like CEO Timothy Hwang, Gerald Yao, along with Manoj Jain from SPAC sponsor Maso Capital, control 47.59% of the company’s outstanding common stock. Due to their ownership of Class B supervoting shares, they also control 77.47% of the voting power.

With this, it’s debatable whether another strategic buyer active in the legislation and regulatory intelligence business could make a successful bid for the company. Nor could an activist investor come in and push for a sale. As Muhammad also mentioned in his NOTE stock article, Timothy Hwang last year explored the possibility of taking FiscalNote private, but so far, this has not led to a management buyout offer.

Bottom Line: Hold Off On NOTE Stock, As It’s Likely To Languish For Now

Given how far NOTE has fallen from its original SPAC price, it’s doubtful that outside shareholders will be up for a go-private offer from Hwang and other insiders. Likewise, it’s not as if FiscalNote insiders are going to be open for a competing firm to snap up the company at what in hindsight could prove to be a bargain-basement price.

With this, expect FiscalNote to continue “going it alone,” staying public as it keeps on pushing to capitalize on GenAI to fuel another growth wave. Yet despite Hwang’s view that the company could eventually scale into an enterprise 5-15 times its current size, such scaling up will undoubtedly require far more capital than the company currently possesses.

Hence, don’t rule out the potential for shareholder dilution down the road. Yes, when FiscalNote’s next quarterly earnings release, scheduled for early November, could show that an AI-fueled growth resurgence is starting to take shape.

Even so, until such results emerge, consider it best to stay on the sidelines. In the meantime, NOTE stock is likely to languish, as excitement about possible “hidden value” keeps fading, leaving shares at risk of falling back toward their 52-week low.

Read the full article here