Introduction

If there’s one thing I get from the comment sections under my articles and my many chats and conversations with readers, it’s that people dislike this market.

I feel the same.

While my portfolio and most picks (not all of them) have done very well recently, it is very hard to deploy new capital. The S&P 500 is back at its all-time high, investors have priced in a very dovish Fed, and economic growth remains an issue.

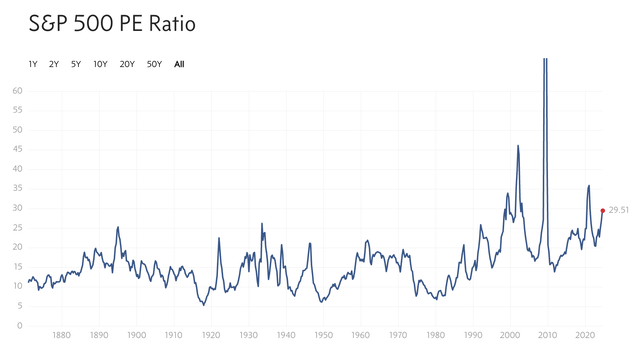

As a result, the market’s valuation is lofty. In fact, it’s one of the three “most expensive” markets in history.

Multpl

Don’t get me wrong. This does not mean we’re close to a 1929-style market crash. As long as earnings growth remains elevated, the market can sustain elevated valuations.

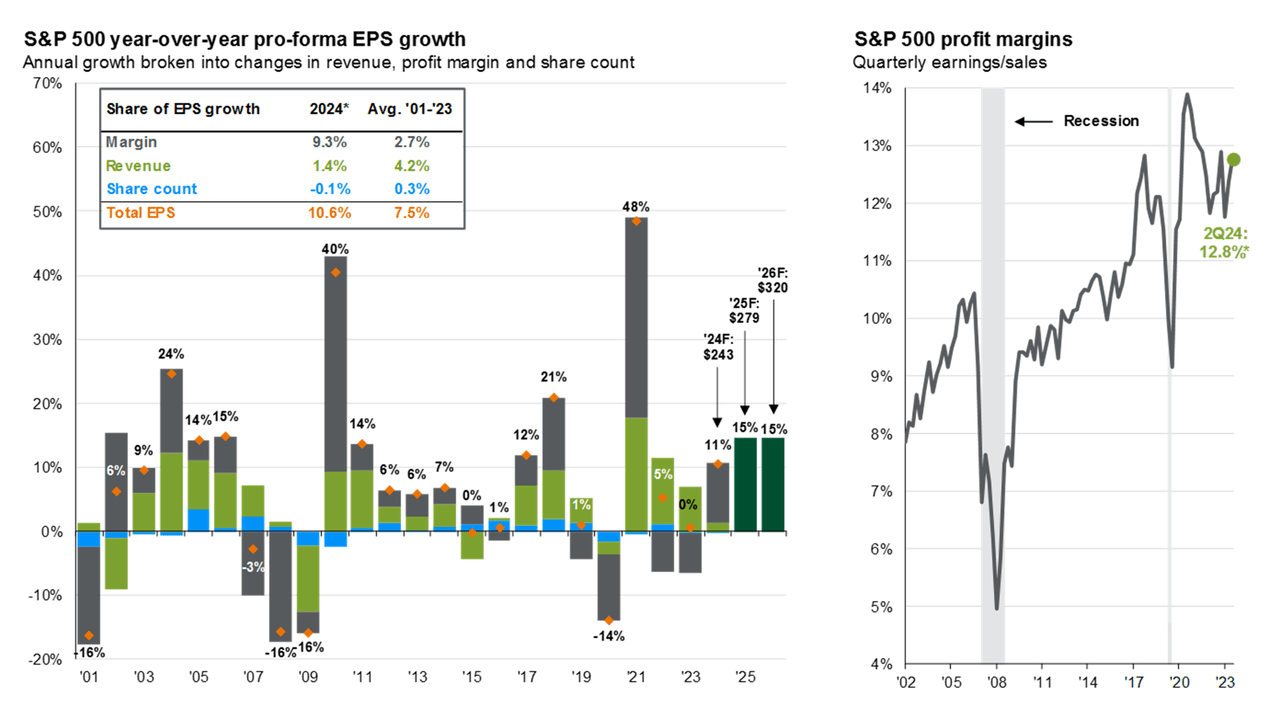

According to JPMorgan (JPM), earnings growth is expected to remain high, with both 2025 and 2026 expected to see 15% EPS growth.

JPMorgan

While all of these numbers are subject to change, it explains why investors waiting for a bargain haven’t been very busy recently (except for early August).

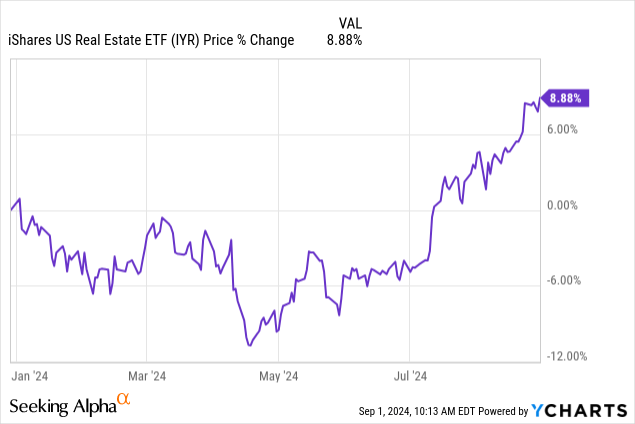

It’s hard to find bargains, as even previously undervalued sectors like real estate have done rather well the moment investors started to price in aggressive rate cuts in 2H24 and 2025.

Excluding dividends, the real estate ETF (IYR) went from a loss of almost 12% in April to a gain of 9%. While the sector is still home to some great deals, it has become harder to find a real “bang for your buck.”

That’s where energy comes in. As almost everyone knows by now, I have been an aggressive buyer of energy stocks this year. This includes landowners like Texas Pacific Land (TPL) and LandBridge (LB), which are now my largest and third-largest investments.

I also like midstream companies that come with juicy income and highly efficient drillers enjoying low breakeven prices and often very attractive valuations.

One of the reasons why energy seems to be the cheapest sector is the fact that both oil and natural gas prices have come down. Especially natural gas has been hit hard, as the clean-burning fuel keeps suffering from last year’s mild winter, lower LNG demand from markets like Europe, and the fact that it is a much more abundant commodity than oil.

Hence, this is the sector I have been covering more frequently, as I believe it’s a highly attractive place to be due to the poor sentiment.

One of my favorites in this sector is the American producer Range Resources (NYSE:RRC).

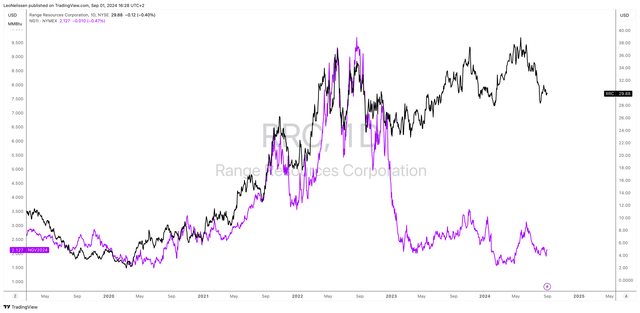

My most recent article on this company was written on August 5, when I called it a potential “Buyback Machine” in the title. Since then, shares have dropped 14%, mainly pressured by the significant natural gas price decline.

Both natural gas prices and the RRC stock price are visible in the chart below.

TradingView (RRC, NYMEX Henry Hub)

Although this is a bad performance, the bulls are returning.

On August 20, Scotiabank came out making the case that both Antero Resources (AR) and Range Resources are undervalued. I could not agree more, as I recently wrote a bullish article on AR as well.

This is what the Canadian bank wrote about Range Resources:

The analyst continues to see Range Resources as one of the higher quality, lower-risk names in the group, and believes the recent weakness in the stock has created a good entry point.

Range’s multiple has retreated to the group median, its free cash flow yield sits above the group average on current strip, and its balance sheet and capital intensity are best in class in the U.S. gas sector, so Bean believes it is a good time to get back into the stock. – Seeking Alpha

So, in light of a lofty S&P 500 valuation, the decline in natural gas prices, and Range Resources’ fantastic business model, I’m using this article to update my thesis and explain why I believe RRC is an extremely undervalued (dividend) stock.

However, before I continue, please do not buy any natural gas producers if you are usually a conservative dividend investor. Conservative investors seeking natural gas exposure are much better off buying midstream companies. Although these companies do not have the same pricing benefits, they offer yield and have much more stable cash flows. This includes companies like Antero Midstream (AM), Kinder Morgan (KMI), ONEOK (OKE), and many others.

Why Range Resources Is So Special

Antero Resources and Range Resources are very similar. If I had to summarize the difference in one sentence (painting with a very broad brush), I would say the main difference is that RRC hedges some of its production and pays a dividend.

Other than that, the two producers have a lot of similarities. One of these similarities is owning a lot of reserves at very low breakeven prices.

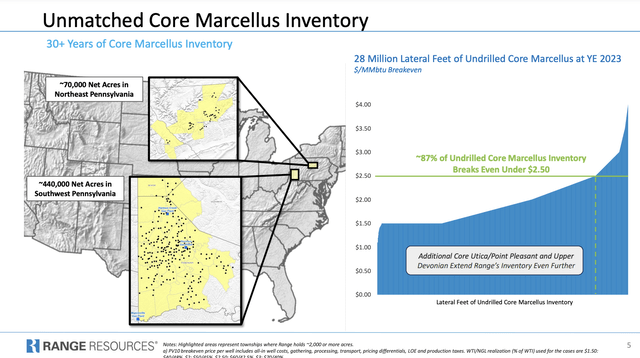

As we can see below, the company operates in the Marcellus Basin, one of the biggest natural gas formations anywhere in the world. In this basin, it enjoys more than 30 years of core reserves, most of which are breakeven below $2.50 Henry Hub, which is extremely low.

Range Resources

On top of that, not all production is natural gas.

The company’s focus on liquids-rich inventory has turned out to be highly beneficial, as higher-margin liquids accounted for roughly 30% of its production in the second quarter.

In the second quarter, the company received $24.35 per barrel for NGLs (natural gas liquids), which represents a $1.26 per barrel premium to the Mont Belvieu equivalent. Mont Belvieu is the most important hub for NGLs in the United States.

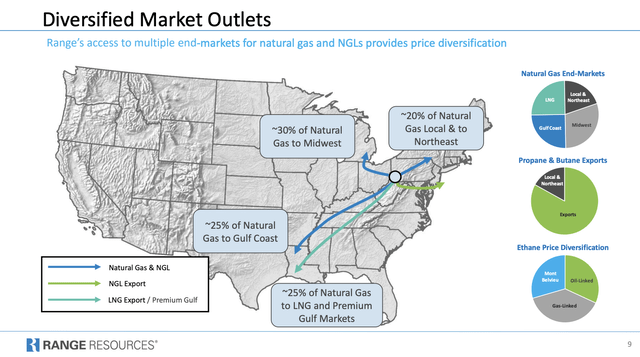

In general, the company sells a lot of its natural gas to attractive markets with pricing benefits, including LNG producers.

Range Resources

As a result of pricing/mix benefits, Range Resources realized a price of $3.10 per Mcfe in the second quarter. This is $1.22 above the NYMEX Henry Hub prices.

It also helped that the company decreased its cash unit costs to $1.88. This is down from $1.95 in the first quarter. This decline was supported by lower interest expenses, lower general & administrative costs, and reduced processing costs due to lower natural gas prices.

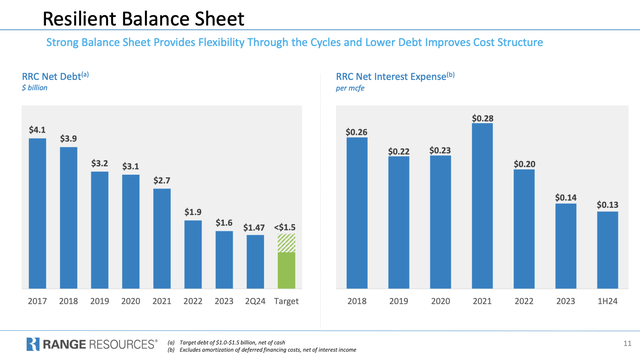

Speaking of interest, the company has lowered its net debt to $1.47 billion in 2Q24, below its target of $1.5 billion. It also reduced its interest spending to $0.13 per Mcfe. That is down from $0.28 in 2021. In other words, its balance sheet is another reason it has a much stronger business with lower risks.

Range Resources

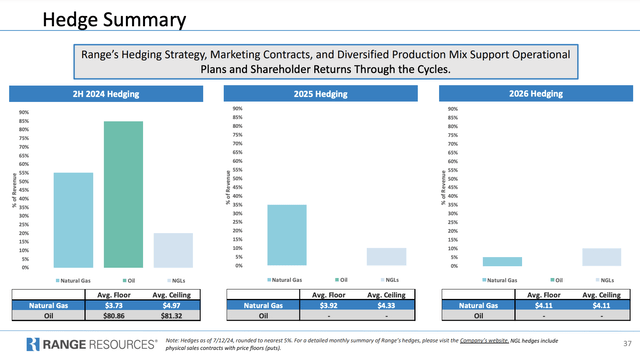

Moreover, hedging is an important factor.

Roughly 55% of its natural gas in the second half of 2024 is hedged at an average floor price of $3.70. For 2025, 35% of its production is hedged at $3.90.

This hedging protects it somewhat against subdued natural gas prices like we are currently seeing (on top of having low breakeven prices) without limiting the potential to benefit from potentially accelerating prices in the years ahead.

Range Resources

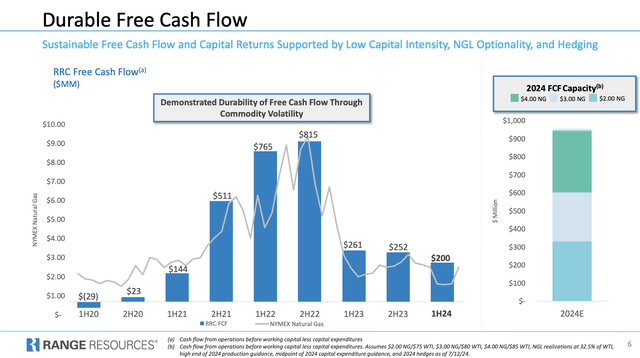

Based on this context, the company did relatively well in the first half of this year, generating $200 million of free cash flow, 3% of its $7.2 billion market cap.

This brings me to the next part of this article.

Sky-High Shareholder Distribution Potential

On top of being protected against subdued natural gas prices, the sky is the limit at elevated natural gas prices.

At $4.00 Henry Hub, the company has the potential to generate roughly $950 million in free cash flow. This assumes $85 WTI and NGL price realizations at 32.5% of WTI. It is also based on 2024 production and CapEx guidance.

To put things in perspective, at $4 Henry Hub, the company could generate 13% of its market cap in free cash flow!

Range Resources

At $3 Henry Hub ($80 WTI), that number is north of 8.0%

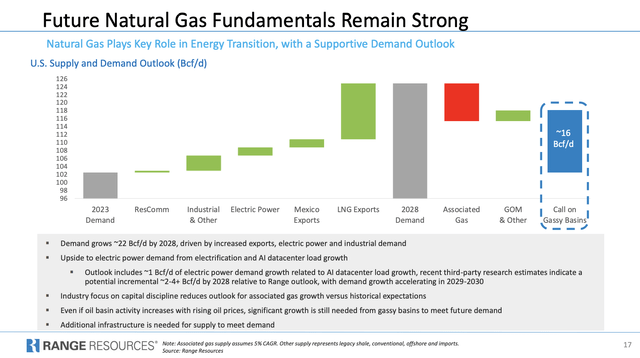

Needless to say, these numbers protect its 1% dividend and provide a lot of room for aggressive distributions down the road, especially considering that we are looking at a 16 billion cubic feet per day supply shortage by 2028, as we can see in the data below. Rapid growth in LNG exports and industrial demand will make it close to impossible for current production to keep up.

Range Resources

With regard to the timing of buybacks, we can assume the company is going to be opportunistic. After hitting its debt target, it will likely use stock price weakness to buy back stock. This is what it said in its 1Q24 earnings call:

It has been an opportunistic program by design from the very beginning.

[…] Certainly, the way I would put it is if we see a pullback in the stock price, we would certainly be more apt to lean in and repurchase more aggressively. – RRC 1Q24 Earnings Call

Right now, I believe the timing is perfect to buy back stock, as RRC is very cheap. I would even say “dirt cheap.”

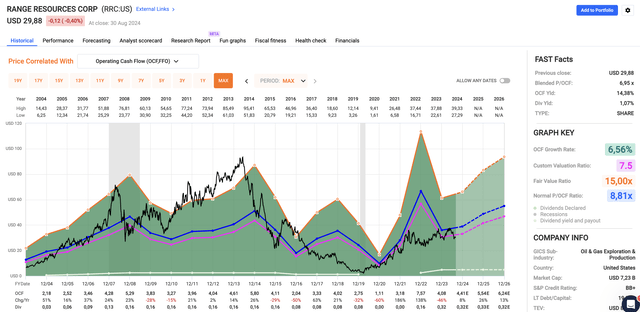

Besides its elevated implied free cash flow yield, which is the biggest reason the stock is cheap, it trades at a blended P/OCF (operating cash flow) ratio of just 7.0x. Historically, it has an average OCF ratio of 8.8x, although this has been subject to a number of wild OCF and stock price swings.

FAST Graphs

Using the FactSet data in the chart above, analysts expect a path to $6.24 in per-share OCF by 2026. Using a conservative 7.5x multiple gives us a fair stock price of $47 (+56%), $2 above the Scotiabank target. This is based on an environment of subdued natural gas prices.

On a longer-term basis, I am much more bullish than that, especially because I agree with Goehring & Rozencwajg’s latest 2Q24 comments:

While delays such as this postpone one source of new short-term demand, our mediumterm outlook remains unchanged. U.S. natural gas trades at an 84% discount to its energy equivalent, making it the cheapest molecule of energy on the planet. Gas for delivery in Europe remains $12 per mcf, while Asian LNG fetches $13.50 per mcf, compared with $2.00 in the U.S. As new LNG demand comes online and production continues to disappoint, inventories will continue to tighten, pushing prices towards the global benchmark. We cannot recall a more asymmetric investment opportunity than U.S. natural gas. – Goehring & Rozencwajg (emphasis added)

With regard to RRC, G&R believes RRC could be worth $200 per share, almost 7x its current value.

At current levels, we calculate Range Resources is pricing in a realized price of $2.62 per mcf, in line with the depressed spot price. If Henry Hub gas prices rebounded to only $4.00, Range’s debt-adjusted SEC-PV10 value would exceed $80 per share compared with $36. At $8.00 gas, in line with world prices, Range would be worth over $200 per share. – Goehring & Rozencwajg (emphasis added)

Although I do not believe that $8 Henry Hub is sustainable, as it would likely trigger a global wave of investments in more output, I do believe we will see $8 natural gas. Hence, on a longer-term basis, $200 should be possible. It may sound like a crazy target, but the data backs it up.

Investors with a long-term horizon who can stomach volatility could make a lot of money with RRC. Everyone else should be very careful, please.

Personally, I’m in the process of assessing my natural gas picks and could make a significant investment over the next 1-3 months.

Takeaway

This market is tough, as it’s hard to find bargains.

However, while energy stocks, especially those in the natural gas industry, have taken a hit recently, I’m very upbeat.

Range Resources, with its low breakeven prices, strong balance sheet, and opportunistic buyback strategy, stands out as an undervalued gem in a lofty market.

Although it is not without risks, especially in the volatile natural gas space, RRC offers significant long-term upside potential.

For those willing to ride the waves, I believe RRC provides a terrific opportunity with room to $200 per share.

Pros & Cons

Pros:

- Strong Fundamentals: RRC operates in the Marcellus Basin, with extremely low breakeven prices. This provides a significant cost advantage.

- High Free Cash Flow Potential: At $4 Henry Hub, the company could generate free cash flow equal to 13% of its market cap. This provides room for aggressive buybacks.

- Valuation: RRC is trading at a compelling valuation, with a P/OCF ratio of just 7.0x. My conservative price target is $47. The best case is $200.

- Hedging Strategy: With a significant portion of production hedged at attractive prices, RRC is better protected against current price volatility.

Cons:

- Volatile Natural Gas Prices: Natural gas prices are highly unpredictable and very volatile.

- Risk Exposure: The stock is not for conservative investors, as it has been through a lot of ups and downs. Despite my bullish outlook, it will remain as volatile as the commodities it produces.

- Sector Sentiment: Energy stocks, especially in natural gas, remain out of favor. It could take a few months until the bull case unfolds.

Read the full article here