Abercrombie & Fitch Co. (NYSE:ANF) reported the company’s fiscal Q2 results on the 28th of August in pre-market hours. Despite top-of-the-line results that exceeded Wall Street’s estimates, the stock has crashed -17% to the results.

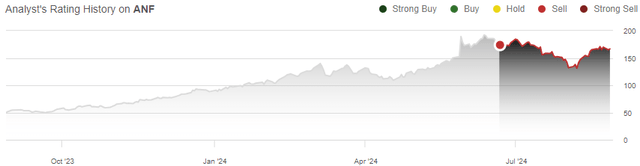

In my previous article on the stock, I initiated the stock at a Sell rating as the impressive Abercrombie & Fitch brand turnaround was overshadowed by a too tight valuation, especially considering the possible shift in fashion trends that acts as a major risk to the long-term earnings turnaround. After the article was published on the 21st of June, the stock has lost -21% of its value, compared to the S&P 500’s return of 2% in the same period.

My Rating History on ANF (Seeking Alpha)

Q2 Financials Came In Above Expectations, Again

Abercrombie & Fitch reported revenues of $1.13 billion in Q2, growing 21.2% year-on-year through great growth in especially Americas and EMEA. The growth was again carried by Abercrombie brands’ growth at a great 25.9% pace, while Hollister brands still also grew at an increasingly good 16.7% pace as both brands’ marketing campaigns have continued paying off, also discussed in the Q2 earnings call.

Notably in the brands’ sales performance, Hollister brands are showing increasing improvements compared to Abercrombie brands’ already decelerating growth – sequentially, Hollister brands’ growth showed a 4.4 percentage point acceleration from Q1 while Abercrombie brands showed quarter-on-quarter growth deceleration of 9.8 percentage points.

With such a trend between the brands, in the mid-term, Hollister brands could start to carry growth as much as Abercrombie brands that have been the leader in the turnaround so far; Abercrombie brands are likely to see stabilization sooner in my opinion, with the turnaround already further ahead. Both brands still grew incredibly well once again, and Abercrombie brands are expected by the company to carry growth going forward as well. The total sales growth showed around a small 0.9 percentage point deceleration sequentially.

The increasingly good sales also drove impressive bottom-line growth with the EPS coming in at $2.50, over doubling from the prior Q2 EPS of just $1.10 – the gross margin expanded by 2.4 percentage points enabled a better brand perception and good cost control, partly offset by higher freight costs. The great comparable growth of 18% mainly drove the Q2 operating margin up by 5.9 percentage points into 15.5% through great operating leverage.

The Q2 results came in clearly above Wall Street’s expectations – the revenues beat Wall Street’s consensus by $40 million, and the adjusted EPS beat the consensus by $0.28.

Raised FY2024 Guidance Disappointed Investors’ Too High Expectations

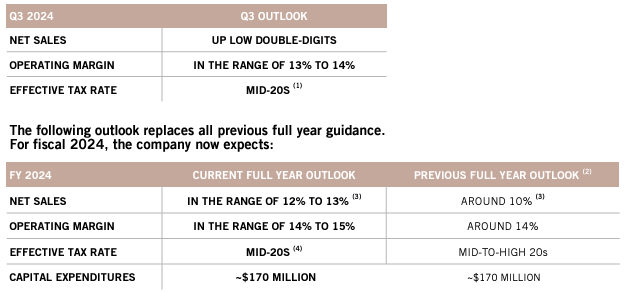

Despite the clear Q2 financial beat, the stock is down dramatically at the time of writing. The crash seems to be a result of both investor exuberance that has set expectations too high, and a FY2024 guidance that may not have satisfied the market’s anticipations. With the better-than-expected Q2 results, Abercrombie now raised its FY2024 outlook slightly, now anticipating 12-13% revenue growth instead of 10% previously and an operating margin of 14-15% compared to an around 14% margin previously, seemingly not satisfying the market.

ANF Q2/FY2024 Investor Presentation

While no consensus for the operating margin is available, the increased revenue outlook beats Wall Street’s 11.4% growth consensus. Abercrombie & Fitch now expects Q3 sales to be up low double-digits compared to Wall Street’s 8.6% estimate, also providing no metric where the report missed analysts’ expectations – the market clearly expected better growth than analysts. The raised FY2024 outlook also still expects a very large growth deceleration in H2 after a 21.6% growth in H1, likely being a large factor behind the market’s negative reaction in addition to extremely high-set investor expectations.

The slowing H2 growth anticipation does include $90 million in adverse effects from a shift in the company’s fiscal year period, but doesn’t explain most of the guided H2 growth deceleration.

On the other hand, amid the impressive turnaround, Abercrombie & Fitch seems to have repeatedly guided very conservatively, also represented by the still standing FY2025 targets that were already beat in FY2023 and the Q2 results also beating the previous guidance by a wide margin – I believe that Abercrombie & Fitch’s momentum can still very possibly provide ground for another beat in Q3 and beyond. The company continues optimizing and slightly expanding the retail network with an approximate 60 openings, 60 remodels/rightsizings, and 40 closures, providing space for growth as well.

Still, with the market setting expectations seemingly way too high prior to the report, I think a fall to the quarterly report is constituted to correct the extraordinarily high valuation despite the report not having any notable weak points.

Updated Valuation: ANF Isn’t As Expensive Anymore

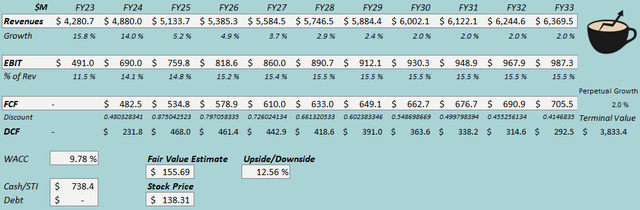

I updated my discounted cash flow [DCF] model slightly. I now estimate a 14% growth in FY2024, above Abercrombie & Fitch’s new guidance and my prior 10% estimate amid the great momentum. The total revenue CAGR estimate stands at 4.1% from FY2023 to FY2033 now, up from 3.8% previously.

I have also slightly raised my short-term margin estimates, now expecting a 14.1% operating margin in FY2024 and 14.8% margin in FY2025. Afterward, though, I have adjusted the long-term level down to 15.5% from a bullish 16.0% estimate previously to provide a better margin of safety to the estimates. The cash flow conversion outlook still stands as good after Q2.

For more thorough explanations, I refer to my previous article on the stock.

DCF Model (Author’s Calculation)

The estimates put Abercrombie & Fitch’s fair value estimate at $155.69, 13% above the stock price at the time of writing – after the stock’s crash, I believe that the stock is now nearly fairly valued with a small margin of safety. While the stock doesn’t seem cheap with a 12.0 trailing EV/EBITDA, the continuously improving performance makes up for an expensive-seeming valuation.

The fair value estimate is up slightly from $143.31 previously.

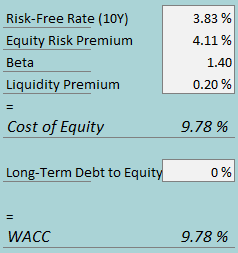

CAPM

A weighted average cost of capital of 9.78% is used in the DCF model, down from 10.76% previously. The used WACC is derived from a capital asset pricing model:

CAPM (Author’s Calculation)

With Abercrombie & Fitch redeeming its secured notes, I now estimate no interest-bearing debt going forward. To estimate the cost of equity, I use the 10-year bond yield of 3.83% as the risk-free rate. The equity risk premium of 4.11% is Professor Aswath Damodaran’s estimate for the US, updated in July. I have kept the beta estimate at 1.40. With a liquidity premium of 0.2%, the cost of equity and WACC both stand at 9.78%.

The Longer-Term Fashion Risk Remains

Despite the more forgiving valuation now, Abercrombie is by no means cheap yet, and the fashion risk that I outlined in my previous article still stands – if the brands’ well-improved demand doesn’t stand, as it is very possible for apparel brands, the earnings outlook could turn sour making the current valuation way too tight.

Still, as the reported results and Abercrombie & Fitch’s & Hollister’s Google trends charts showing very healthy demand and search term growth, I don’t foresee such a risk to realize at least in the very short term.

Takeaway

Abercrombie & Fitch’s Q2 results and the revised FY2024 outlook exceeded Wall Street analysts’ expectations once again, but the market reacted extremely negatively as expectations were simply set way too high by the market, as I previously outlined in my stock valuation. With a good outstanding growth outlook, and a more reasonable valuation, I upgraded my rating on Abercrombie & Fitch into a neutral Hold.

Read the full article here