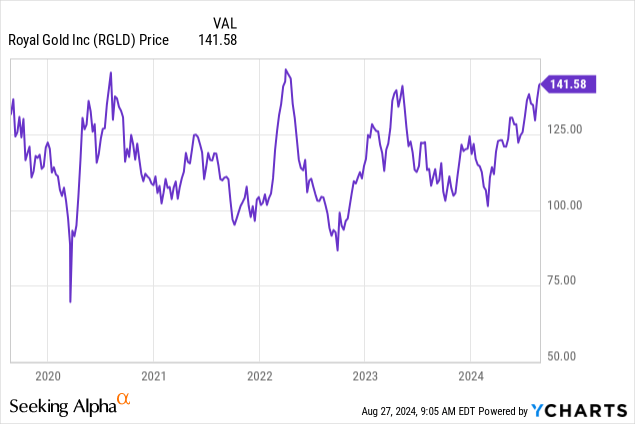

Shares of Royal Gold, Inc. (NASDAQ:RGLD) (TSX:RGL:CA) are up 17% year-to-date, quietly approaching a new all-time high. The backdrop of a record gold price and strong sentiment towards precious metals prices has marked a turnaround for the streaming and royalties giant, which had struggled with weak growth in recent years.

There’s a lot for investors to get excited about between the company’s improving outlook and the bullish sentiment towards the sector. Even following the recent rally, we believe the stock remains undervalued with significant upside going forward.

RGLD Q2 Earning Recap

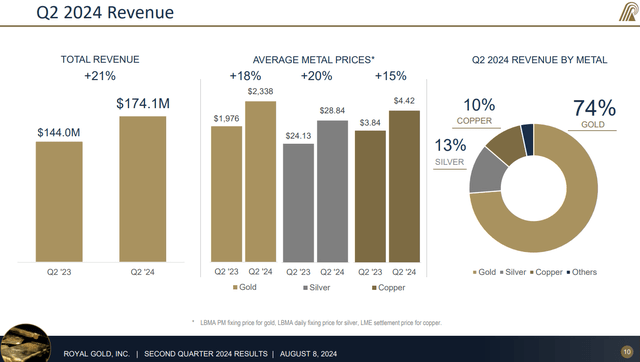

Royal Gold reported its second-quarter earnings (for the period ended June 30) with the headline adjusted EPS of $1.25 representing a quarterly record for the company and up from $0.88 last year.

Revenue of $174 million increased by 21% year-over-year, capturing higher gold, silver, and copper prices, and climbing contributions from key royalty and streaming interests. At the operator level, several high-profile assets delivered a strong performance, covering higher ore grade and site-level expansions. Gold equivalent ounces sold at 74,500 compared to 72,900 in Q2 2023.

The adjusted EBITDA margin at 81% ticked higher from 80% in the prior-year quarter. Notably, Royal Gold reached a net cash position on its balance sheet, for the first time since 2021 with over $1 billion in total liquidity highlighting overall solid fundamentals.

source: company IR

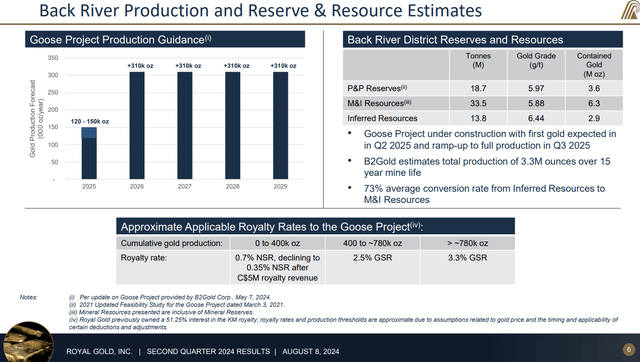

Maybe the biggest development this quarter was Royal Gold’s acquisition of additional Back River royalties in a $51 million deal. The mine in Canada, operated by B2Gold Corp. (BTG) features the open-pit Goose Project claim under construction set to begin production in Q2 2025.

A ramp-up into 2026 should be accretive to Royal Gold earnings, considering an incrementally higher royalty rate based on cumulative production milestones. Overall, management is optimistic for a strong second half of the year, citing not only operating and financial momentum but the macro picture supportive of higher precious metals prices.

source: company IR

What’s Next For Royal Gold?

The attraction of Royal Gold in the precious metals royalties and streaming space is the recognition that the business model offers several advantages over a direct equity stake in traditional mining companies. Investors get the cash flow stability from recurring pre-determined agreements, often with an upside for production targets.

They have the diversification into multiple projects while avoiding operational risks. Several high-profile mining disasters from miners with concentrated operations in recent years, including the collapse of SSR Mining (SSRM) as an example, highlight the often uncertain nature of the sector.

On one hand, with a “very bullish” outlook on the price of precious metals, it’s possible the most speculative junior mining names could outperform the upside with the biggest returns.

At the same time, Royal Gold provides exposure to gold and silver through a more balanced profile that has been proven to work through various market cycles, recognizing the inherent uncertainties of the sector.

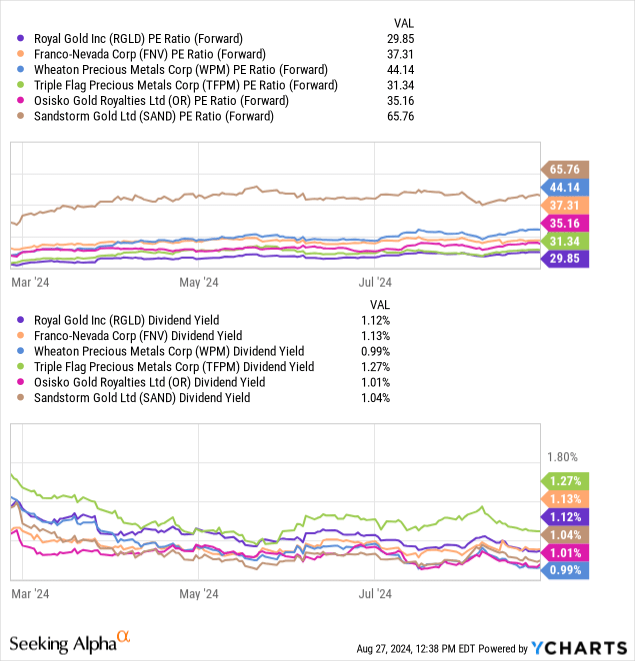

Where Royal Gold stands out is its apparent valuation discount relative to streaming and royalty peers. The stock is trading at a 30x forward P/E multiple which represents a discount compared to the average closer to 40x in names like Franco-Nevada Corp. (FNV), Wheaton Precious Metals Corp. (WPM), Triple Flag Precious Metals Corp. (TFPM), Osisko Gold Royalties Ltd (OR), and Sandstorm Gold Ltd. (SAND). RGLD’s dividend yield of 1.1% is also among the highest in the group.

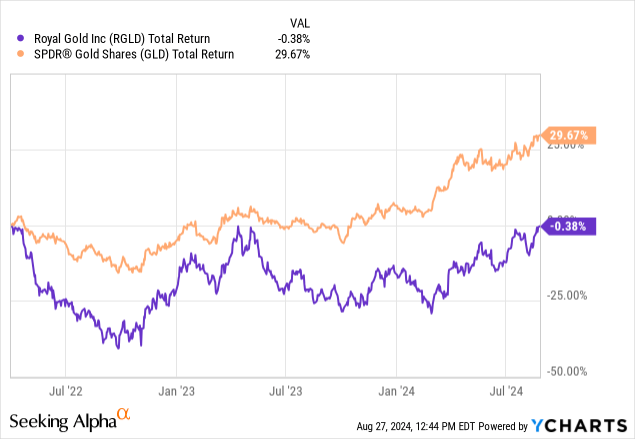

We can also highlight how shares of RGLD appear undervalued relative to the price of gold. In this case, using the SPDR Gold Shares ETF (GLD) as a proxy, RGLD has returned a modest 14% over the past five years compared to a 61% gain in GLD.

Even as RGLD is trading nearly flat from its all-time high setback in April 2022, GLD has climbed by more than 30%. Our interpretation is that there is room for Royal Gold to catch up and converge that performance spread during the next stage of the bull market. Macroeconomic developments, including an outlook for Fed rate cuts and a weaker U.S. Dollar should be positive for precious metals prices.

Is RGLD a Buy Now?

We rate RGLD as a buy with a $180 price target for the year ahead, implying a forward P/E multiple of 38x against the current 2024 consensus EPS. This assumes just flat precious metals prices from here, where in a scenario gold climbs even higher, the stock could have even more upside with the company being leveraged to climb streaming and royalty earnings.

Monitoring points over the next several quarters include performance metrics such as GEOs sold and the adjustment EBITDA margin. New acquisitions will also be key to expanding Royal Gold’s long-term potential.

In terms of risks to consider, a large and sustained correction to those same precious metals prices would undermine the bullish outlook. While gold is seen as benefiting from macro uncertainty, a deep deterioration of financial market conditions met with constrained liquidity would likely introduce volatility into the sector.

Read the full article here