International Petroleum (OTCPK:IPCFF) is a Canadian company that reports in United States Dollars. This is one of the Lundin Group of companies where a Lundin, William Lundin, is President, CEO, and a board member. There are two members of the Lundin family on the board of this company. The Lundin organization is actually much larger than this company. That means far more resources are available than the company size would indicate. The Lundin Group of companies has an excellent reputation with investors. Therefore, the investment risk is somewhat lower than would be the case for a normal upstream company of this size. Like many of the companies in the portfolio, this company is growing through a combination of acquisition and organic growth (and will likely be sold at some point in the future or merged).

The last article noted that the company was expanding its thermal production. That expansion appears to be continuing as planned.

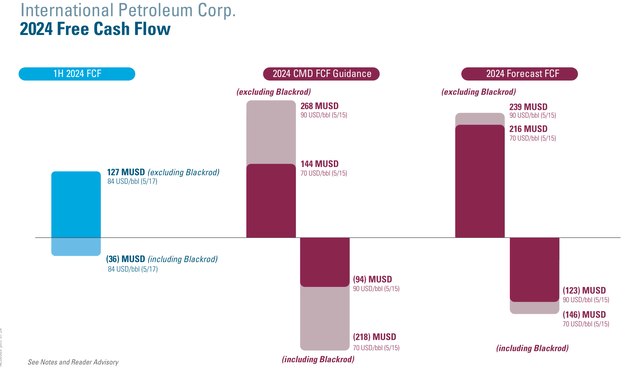

Free Cash Flow

The company will be borrowing to finish the heavy oil expansion project. Many of these projects require a large capital expenditure before production can begin. Once production beings, they often cash flow quite well, even when the company is losing money due to that large upfront cost that needs to be recovered.

International Petroleum Free Cash Flow Guidance (International Petroleum Second Quarter 2024, Corporate Presentation)

This project is nearing completion. However, the above slide demonstrates that existing production is generating a fair amount of free cash flow in the current environment.

The first oil is expected in fiscal year 2026 with construction expected to complete probably towards the end of the next fiscal year.

With a lot of these projects, once the initial production is established, it is often very easy to expand production later without the huge cash needs of the start of the project.

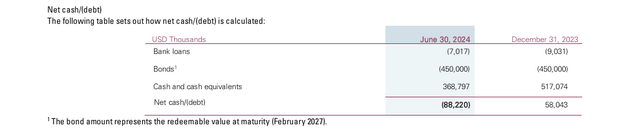

Net Debt

This project began probably about a decade ago. The construction started rather recently, but it took a lot of work to get to the point where construction could begin.

International Petroleum Net Debt Position (International Petroleum Second Quarter 2024, Earnings Press Release)

As shown above, the cash needed for the project has been raised. So far, it is apparent that no more debt is needed. Since debt ratios are typically calculated against EBITDA, which is higher than cash, it would appear that the net debt level remains at a conservative debt ratio when the project completes before production begins.

The bonds represent about one-times current production cash generated. When this project begins to produce in 2026, that figure could drop significantly.

Blackrod Production

The initial Blackrod production and average production for fiscal year 2026 will depend upon many factors. The peak production is so far planned for 2028 when it should reach 30,000 BOED (and that will be probably just thermal oil for all intents and purposes with little else).

Therefore, the company is going to see significant growth from this project based upon the current forecast of slightly less than 50,000 BOED.

Project Cost

The estimated cost of the Blackrod Project is in the $850 million range. The company is clearly using its cash flow to fund a significant part of the project. This should be the peak year of capital expenditures, with those expenditures falling significantly in the next fiscal year as the project completes. There is a chance that the company may have free cash flow in the next fiscal year after the project expenses are considered.

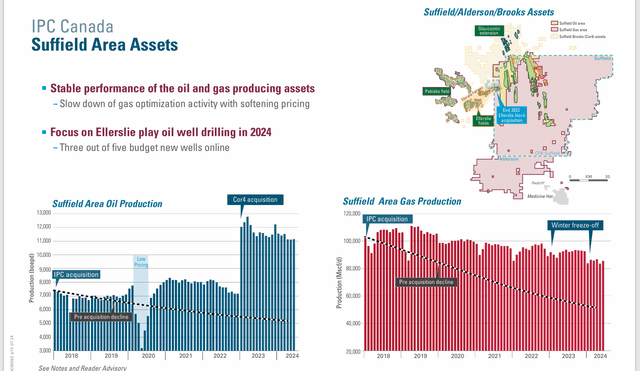

Southern Oil & Gas Play

The company has exposure to natural gas. Like many in the industry, it is cutting back on natural gas activity until prices recover.

International Petroleum Suffield Oil & Gas Business Summary (International Petroleum Second Quarter 2024, Corporate Presentation)

Shown above is the play that gives the company some natural gas exposure. The company already benefits from the startup of the Trans Mountain Pipeline expansion because that is decreasing the discount on heavy oil pricing from WTI. It may benefit more as the natural gas prices recover in the future, as the industry expects.

The company has another thermal play called Onion Lake thermal that does not have any natural gas exposure but has a similar amount of thermal oil production.

Light Oil

Long time readers will remember that this company acquired Granite Oil for light oil exposure. So far, these reserves have proven to be a challenge to produce commercially. However, there was an announcement of three infill wells that give hope to the idea that eventually this light oil play would achieve the expectations management had for the project.

There are some other small interests in both Malaysia and France. But most of the business (by far) is in Canada.

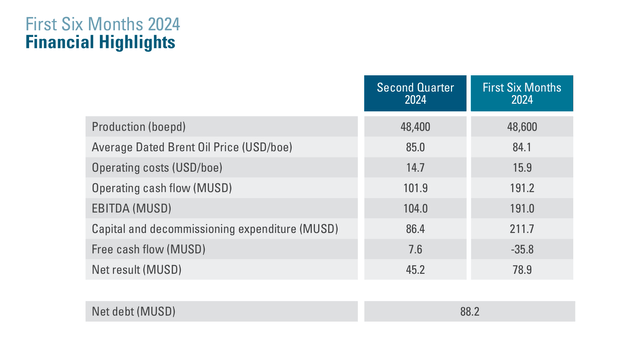

Finances

The second quarter results were decent. But they were overshadowed by the Blackrod project, which promises to enlarge the company production significantly.

International Petroleum Summary Of Six Month Results (International Petroleum Second Quarter 2024, Corporate Presentation)

Since the focus is on heavy oil production, this company’s earnings may not be as highly valued as some unconventional producers because heavy oil is a discounted product. That discount can widen during downturns to dry up the corporate cash flow.

On the other hand, a thermal company typically cash flows at rates that are near the top of the industry under current conditions.

The net debt ratio is currently close enough to zero for the time being. But that ratio will rapidly expand in the current fiscal year as capital is spent on the Blackrod project. Management was very conservative when it raised the cash needed for the project. So, there is a very good chance that not all the debt will be needed to complete the project.

Once production begins and the project cash flows, there could be an early retirement of some of those bonds.

In the meantime, management has been buying back some stock because cash flow has been running ahead of budget projections for the project. Therefore, management felt comfortable retiring some stock. That may or may not continue in the future, depending upon commodity price levels and stock price levels.

Summary

International Petroleum is a thermal oil producer with some interests in natural gas and a potential future light oil project. There are also some small interests overseas.

This management is expanding the thermal production at the same time that the Trans Mountain Expansion Project is beginning to operate. Not only is current production benefitting from a lower discount, but a fair amount of future production could come online to take advantage of world prices for heavy oil.

The main story here is the continuation of a very large project that took a very long time to get to the construction phase. That construction will end next year, with first production expected sometime in the second half of 2026.

The Blackrod project far overshadows current results unless something major happens with current operations. This is one of the very few heavy oil producers that have a major expansion project underway (for the size of the company).

Finances appear to be in good shape, and they likewise are projected to remain in good shape despite floating bonds to complete the Blackrod Project.

Any heavy oil or thermal oil producer has earnings that are more volatile than much of the industry because of the discount to light oil pricing. Therefore, this has to be considered a speculative idea that is likely a strong buy. The Lundin Group of companies have a good reputation with investors. There are far more resources available to this company from the much larger Lundin Group of Companies organization than it typically the case for a company of this size. This is a company that will be built and likely sold or merged in the future.

Risks

As noted before, heavy oil producers have very volatile earnings swings because the discount to light oil can expand during industry downturns to affect cash flow much more than is the case with light oil.

Upstream producers in general are exposed to volatile and low visibility future commodity prices.

The loss of services of key personnel or the Lundin organization could have a material effect upon the future of the company.

This company has a significant history of successful acquisitions. While that reduces the risk of future acquisitions, any acquisition can fail to meet management expectations.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here