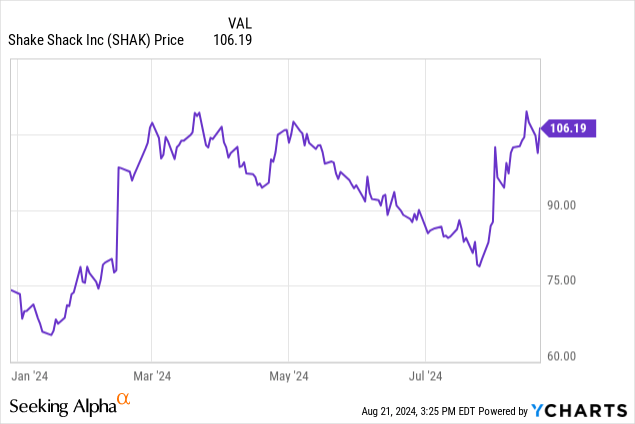

Despite the threat of a looming recession, 2024 has been a successful year in the stock market for many fast-casual restaurant brands. Shake Shack (NYSE:SHAK), the burger concept invented by Michelin-lauded restauranteur and chef Danny Meyer, is no exception. Year to date, Shake Shack stock has rallied more than 40%, energized by new leadership as the company brought on the former CEO of Papa John’s Pizza to lead the company.

Shake Shack has a number of core initiatives under its belt. Expansion is chief among them: the company continues to open more company-operated locations within the U.S., particularly outside of the East and West coasts where the brand is already well established (and where, by the way, sales growth is most muted: more on that in the next section). It operates all of its store locations within the U.S., but is actively pursuing licensing deals (on which it earns franchise fees) for overseas store openings.

It’s also laser-focused on cost. Even amid a very inflationary environment, the company’s supply-chain practices as well as labor optimization programs have helped the company bring down expenses as a percentage of revenue over time. Adjusted EBITDA and GAAP profit metrics are soaring, helping to justify Shake Shack’s considerable valuation.

With all this considered, I’m initiating Shake Shack at a buy rating. In my view, Shake Shack manages an enviable brand position as a premium, chef-sanctioned burger using top-quality ingredients that clearly distinguishes it against fast-food names. Despite a hefty price (and here I’m talking about both Shake Shack stock versus peers, as well as Shake Shack burgers versus its competition), I’m willing to buy.

Strong sales trends despite a darkening macro

We’ve read plenty of headlines over the past few months that consumers are starting to pinch their budgets more, going out to eat less and trading down to less-expensive options in all categories. If this is true, we haven’t seen it in Shake Shack’s results.

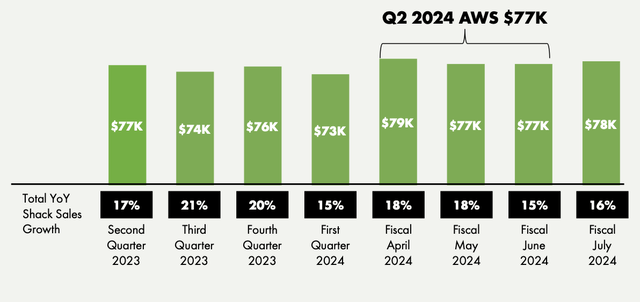

The chart below shows the trend of the company’s systemwide revenue growth. As shown, the company’s average weekly sales per location has continued to hover in the $77-$78k range, while the most recent month (July, the first month of Q3 which has not yet been reported) saw a slight acceleration in total revenue growth to 16% y/y.

Shake Shack monthly sales trends (Shake Shack Q2 shareholder letter)

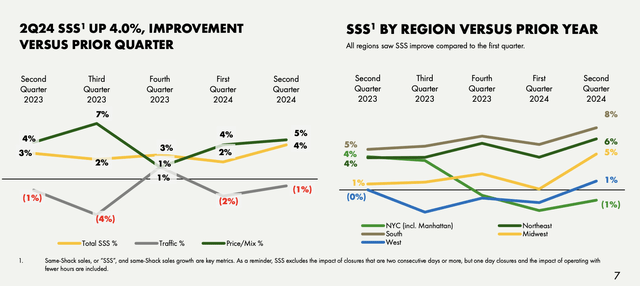

On a same-store sales basis (which excludes the impact of new store openings), Q2 same-store sales growth accelerated to 4%, which was double the pace of Q1 and the best showing in five quarters.

Shake Shack same-store sales growth trends (Shake Shack Q2 shareholder letter)

The company noted that the 5% lift was all driven by pricing, while traffic slightly declined (-0.8% y/y) in Q2. However, the company noted that July traffic trends turned positive again.

To me, these strong mid single-digit SSS growth results amply demonstrate that despite price increases, consumers remain loyal to this brand and traffic is at least consistent, if not growing. Shake Shack’s menu prices now exceed $8-$9 for a standard “Shack Burger,” depending on location – and yet diners are still coming. Management has also noted success at seasonal, limited-time menu items in encouraging traffic growth, such as offering Summer BBQ-spiced fries.

What we find particularly encouraging is that same-store sales growth has been strongest in the South, Midwest, and Northeast regions – where we’ve in fact seen an accelerating trend. These are typically less-wealthier demographic regions than New York and the West Coast, and yet Shake Shack is still demonstrating an ability to penetrate these markets and resonate with its customers despite systemwide price increases.

The company also continues to push growth and expansion activities, planning for 40 company-operated location openings in the U.S. and an additional 40 licensed stores overseas. The company noted as well that it’s on track to reducing its build costs per new location by 10%.

Improving cost trends

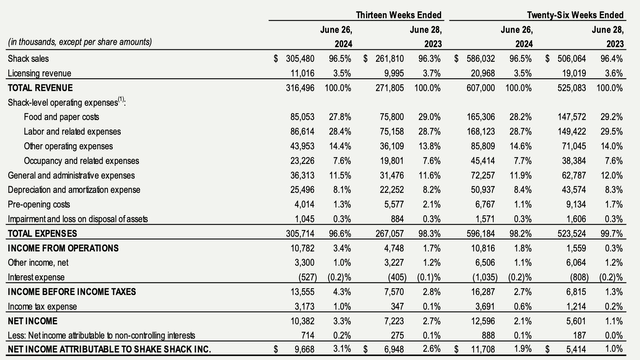

The even more appealing angle for Shake Shack, however, is its laser focus on costs amid a tough inflationary environment. It should be noted that on a GAAP basis, the company has a very thin margin: as shown in the financials below, operating income was 1.7% of revenue in Q2:

Shake Shack Q2 results and margins (Shake Shack Q2 shareholder letter)

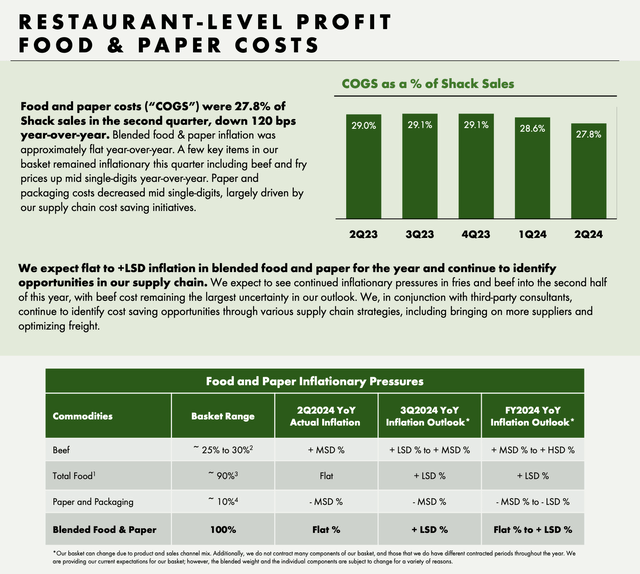

In other words, every percentage point of cost matters. The company’s largest two expense categories are food and paper, as well as labor. On both fronts, the company has been making substantial progress.

The chart below shows the company’s trend on food costs as a percentage of revenue over time. We can see below a clear declining trend in cost, with the most recent quarter seeing 120bps y/y of food cost leverage to 27.8% of revenue.

Shake Shack food costs (Shake Shack Q2 shareholder letter)

Note that these cost reductions are in spite of mid-single digit inflation in the price of beef, which has been offset by lower paper/packaging costs as well as the company’s supply chain and sourcing execution.

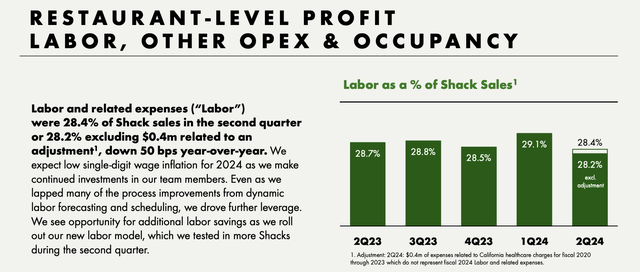

Similarly, the company has done a great job at bringing down its labor costs, hitting 28.2% (excluding a one-time consulting adjustment) in Q2, down 50bps y/y and 90bps sequentially.

Shake Shack labor cost trends (Shake Shack Q2 shareholder letter)

Again, it’s important for us to recognize that the company is driving this improvement in spite of single-digit wage inflation pressures. The company is reducing its labor footprint overall by testing out a new labor model, which revolves primarily around installing more self-order kiosks to reduce the number of staff that’s needed at the counter.

Management has also noted that kiosks have the added advantage of being able to more successfully upsell customers than human cashiers. Per new CEO Rob Lynch’s remarks on kiosks during the Q&A portion of the Q2 earnings call:

When I think about the kiosks business, I think about two primary contributions to our business. One is upsell. When you go through a kiosk experience, we can guarantee that the upsell opportunities are made. Sometimes, we have amazing team members, but sometimes that is not always a priority, when you’ve got 40 people in line, you’re trying to get through it as quick as possible.

So there is, I think, a strong opportunity to continue to optimize the way we execute that, to drive items per check and mix improvement. And then the second piece is how we think about our labor model, and how we think about taking orders and how many people we need to do that, and how we execute enlightened hospitality in the best way, right? We may redistribute that labor from taking orders once the kiosks have proven to be the optimal way to making sure that those folks are out in the dining room, taking care of our guests or contributing to the team in the kitchen. So upsell, mix benefit and labor optimization are two long-term benefits for the kiosk business.”

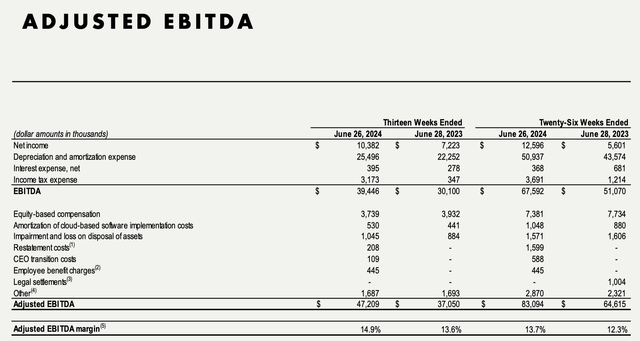

As a result of both strong same-store sales growth and cost improvements, adjusted EBITDA margins rose in the most recent quarter to 14.9%, 130bps higher y/y:

Shake Shack adjusted EBITDA (Shake Shack Q2 shareholder letter)

Valuation and key takeaways

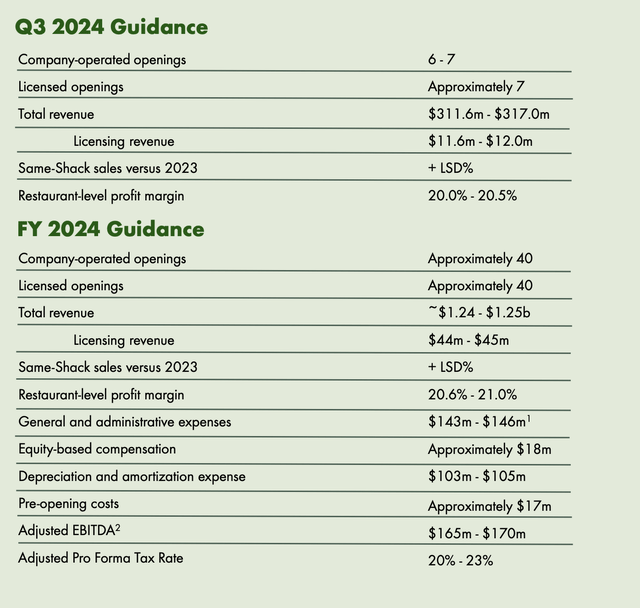

For the current year, Shake Shack has guided to $1.24-$1.25 billion in revenue (+14% y/y, of which a small ~4% of total revenue is driven by licensing fees and the remainder is company-store revenue) and $165-$170 million in adjusted EBITDA, or a 13.4% margin at the midpoint.

Shake Shack outlook (Shake Shack Q2 shareholder letter)

Meanwhile, for next fiscal year FY25, Wall Street analysts are expecting Shake Shack to generate $1.45 billion in revenue (+16% y/y), and if we assume 100bps of further adjusted EBITDA margin expansion (roughly in line with the current pace of margin improvements, which is quite reasonable if we also consider slowing inflation), adjusted EBITDA next year would be ~$209 million (+25% y/y).

Meanwhile, at current share prices near $106, Shake Shack trades at a market cap of $4.52 billion, and netting off the $304.4 million of cash and $246.2 million of debt on the company’s latest balance sheet gives us an enterprise value of $4.46 billion.

This puts Shake Shack’s valuation multiples at:

- Revenue: 3.6x EV/FY24 revenue and 3.1x EV/FY25 revenue

- Adjusted EBITDA: 26.6x EV/FY24 adj. EBITDA and 21.3x EV/FY25 adj. EBITDA

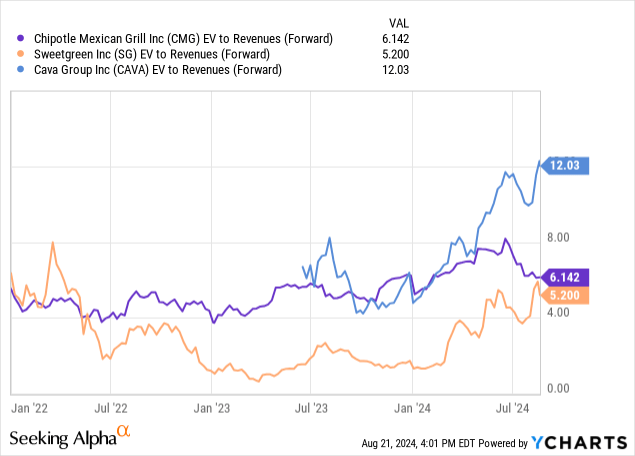

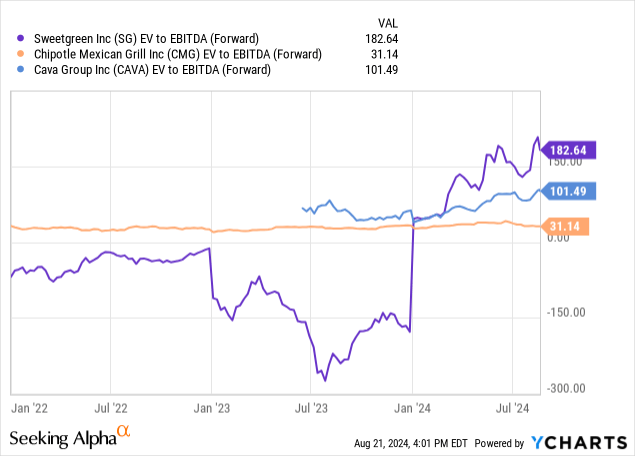

Against broader market metrics, Shake Shack certainly isn’t cheap. But against other fast-growing fast casual peers, we note that Shake Shack has cheaper revenue and adjusted EBITDA multiples than industry competitors Chipotle (CMG), Sweetgreen (SG) (which has been hyped up this year driven by its investment into robotic kitchens), and CAVA (the Mediterranean chain that has seen tremendous bullishness after its IPO earlier this year):

In my view, with its combination of strong same-store sales growth, improving cost trends, plus a reasonable (though not cheap) valuation that still positions Shake Shack for growth, this stock is a great buying opportunity.

Read the full article here