Investment overview

I wrote about Semrush Holdings (NYSE:SEMR) previously (29 May 2024) with a hold rating, as I felt that the valuation was no longer attractive when compared to peers. SEMR 2Q24 results were full of positives and have made me feel more optimistic about the potential for more growth acceleration over the medium term. However, I want to see more evidence that the strategies employed today can continue to work. As such, considering that the near-term upside has been priced in, I remain hold-rated.

Another round of solid performance

Total 2Q24 revenue (announced on August 5th) saw $91 million, with a $1 million contribution from the Brand24 acquisition. This performance was slightly above consensus estimates of $89.7 million. On a y/y basis, total revenue grew 21.8% in 2Q24, a 70bps acceleration from 1Q24. Adj gross margin also expanded by 60bps y/y. Strong growth and an expanded gross margin led to adj EBIT expansion from 3.1% in 2Q23 to 13.4% in 2Q24.

The notable point is that annual recurring revenue [ARR] showed stronger strength. Total ARR grew 23% (reported 25%, but 2% was from inorganic contribution) in 2Q24, representing a 200bps organic y/y growth acceleration from 1Q24 (saw 21% y/y). Net new ARR addition, on an organic basis, was also sustained at ~$16 million (similar to 1Q24 of $17.1 million).

Growth potential from up/cross-sell got better

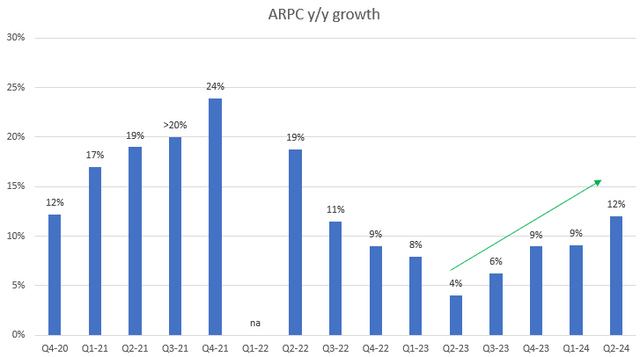

The key highlight from the 2Q24 result is that the potential growth contribution from up- and cross-selling got a lot better. Based on the ARR growth reported and that SEMR only added ~4.1 net new paying customers in 2Q24 (which is a 12% y/y growth), this implies that a sizeable amount of ARR growth was driven by an increase in ARPC (average revenue per paying customer)—about 12%.

May Investing Ideas

This marks the first quarter of ARPC growth in the >10% range since 3Q22, supporting the fact that SEMR is seeing a lot of success in executing on its cross-sell and up-sell strategy. With the acquisition of Brand24 and Ryte, I see a solid path for SEMR to march towards mid-to-high-teen ARPC growth. Based on my assessment, SEMR will be able to expand its footprint within the mid-market and enterprise customers (these are upmarket customers) as both of these assets fit strategically into the SEMR product ecosystem (Brand24 expands SEMR capabilities in social media and brand marketing; Ryte enables SEMR to extend its capabilities in technical SEO). Here is the most important thing for investors to note: Ryte could potentially drive another 5x ARPC uplift (for SEMR’s core enterprise solution) from the previously guided 10 to 15x to 15 to 20x to 15x-20x.

We believe Ryte enables us to expand our Enterprise portfolio footprint beyond SEO and content marketing by engaging website developers within our current and prospective customer base. It is our expectation that over time, these additional features will further increase our average ARR per paying customer. We talked previously about our Enterprise SEO product increasing our average ARR for enterprise accounts by 10 to 15 times and we estimate Ryte could further extend that increase by 15 to 20 times. Company 2Q24 earnings

That said, the timing of these uplift contributions is unlikely to happen in the near term. In particular for Brand24 and Ryte, which are guided to grow at a similar rate to the SEMR average over the near term, until the cross-selling efforts take hold.

To help you with your modeling, I’d make a few additional comments. We expect that the combined total of Brand24 and Ryte will have a revenue growth rate similar to our corporate average over the near-term, before our cross-selling efforts kick-in. Company 2Q24 earnings

Solid traction in penetrating upmarket

Recalling my prior post, in which I noted SEMR should start to see benefits from its Enterprise GO product (which went into general availability in the previous quarter), indeed, the results have shown up very nicely in 2Q24. The total number of customers with >$10k ARR grew by 37% in the quarter, a 500bps acceleration from 1Q24, and this marked the 3rd consecutive quarter of acceleration. Hence, I am optimistic about the potential here, as the cross-selling efforts from Brand24 and Ryte have not even started yet.

Valuation

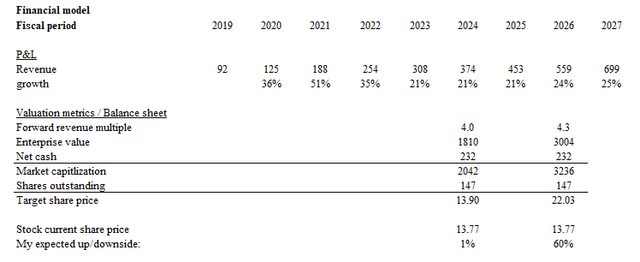

May Investing Ideas

The near-term upside is not that attractive if we are just focusing on FY25 numbers, as the upsides from cross-selling Brand24 and Ryte products are not going to materialize in the near term (as management mentioned). Any benefits from a macro recovery will only get more material, probably in 2H25 (even after a few rate cuts in the coming quarters, rates are still considerably high vs. pre-covid levels). With growth not expected to accelerate in FY25, I believe valuation will trade at 4x forward revenue (as the market comps SEMR against DoubleVerify Holdings (DV), which is expected to grow at low teens, has a higher adj EBITDA margin, and trades at 4x forward revenue).

However, if an investor is able to invest for the medium term, the upside may be attractive as SEMR should start to see growth acceleration (from all the contributing factors mentioned above), and at that point, the market should start to attach a higher multiple to the stock (I assumed SEMR will be able to trade at where it is trading today, 4.3x forward revenue, a premium to where DV is trading today).

For myself, I like to monitor for a few more quarters to see if SEMR is able to continue penetrating the upmarket (metrics to monitor: ARPC growth and number of customers with >$10k ARR growth) and whether the cross-selling strategy will continue to work (metric to monitor: ARPC growth, and any qualitative comments about this, especially regarding the Brand24 and Ryte products, will be greatly appreciated). With this mindset and the near-term upside being priced in (per my model), I am still sticking to my hold rating.

Conclusion

I give a hold rating for SEMR. While 2Q24 performance was great, marked by strong revenue growth, expanded margins, and accelerated ARR growth, and the strategic focus on upselling and cross-selling has yielded positive results, the near-term upside appears to be largely priced in. I prefer to monitor for a few more quarters if the underlying strength is sustainable, which will give me more confidence in the timing of growth acceleration; hence, I maintained my hold rating.

Read the full article here