Investment Thesis

Beijing-based Chinese e-commerce company JD.com (NASDAQ:JD) (OTCPK:JDCMF) is one of the two largest online retailers in China that reported its Q2 earnings results late last week, the other being Chinese e-commerce behemoth Alibaba (NYSE:BABA).

While both companies reported seemingly mixed results, with the e-commerce companies missing their respective consensus estimates for total sales, it was JD’s earnings report that caught my attention, with management’s confidence in pointing the way to more than doubling its margins from current levels.

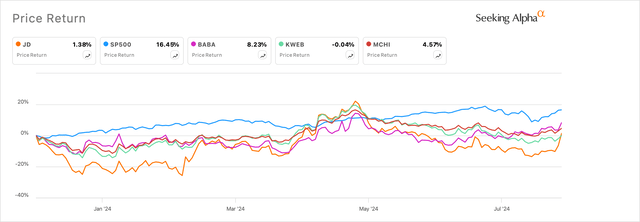

Chinese stocks have struggled to perform on the stock markets, and there is no shortage of information about why this cohort of companies has been left in the dumpster.

Exhibit A: JD underperforms its e-commerce peer Alibaba as well as global markets (Seeking Alpha)

But apart from the strong outlook that JD’s management gave, the company’s progress on moving forward with its share buybacks pleasantly surprised me.

JD’s outlook appears to impress me the most out of many Chinese internet retailer companies, and I believe JD is poised to benefit from a boom in rapidly expanding margins.

I recommend a Strong Buy on JD.com.

JD’s Supply Chain Investments Have Turned The Tide

In the Q2 quarterly report announced last week, JD managed to etch out revenue growth of 1% y/y to RMB 291.4 billion and $40.1 billion. With this performance, the company delivered another quarter of growth, albeit at marginal gains, after revenues had contracted for the majority of 2023. Still, this performance was not enough to get the company past the market’s expectations of the company’s Q2 revenue of ~$40.8 million.

One of the main reasons for the marginal underperformance was the revenue contraction seen in the company’s Electronics & Home Appliances product category, which declined 4.6% y/y to ~$20 billion. Management had warned at the start of the year about contraction in this segment due to stronger comps if one compares this category’s performance to the 11.4% growth seen in the same period last year. Simultaneously, management had also warned that they would not be pursuing their discounts and subsidy program at the 618 e-commerce shopping festival this year.

The robust performance put up by the General Merchandise category, however, more than offset the revenue contraction seen in the Electronics category, with sales rising 8.7% y/y to $12.2 billion.

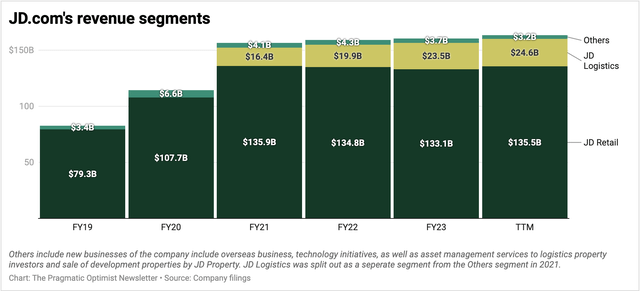

On a segment level, JD’s Retail segment revenues grew by 1.4% to RMB 257.1 billion, or $35.4 billion, which points to growth on a TTM basis, as seen in Exhibit B below.

Exhibit B: JD.com’s revenue by segments which does includes inter-segment benefits (Company filings)

However, it’s really JD’s Logistics segment that has been the growth catalyst for JD in the past few years. In Q2, JD Logistics delivered a 7.7% increase in total sales, rising to RMB 44.2 billion, or $6.1 billion.

The investments that JD had been making in expanding its supply chain business were crucial in scaling the efficiency of both its 1P, first-party business, where it sells products directly to buyers, as well as its 3P, or third-party business, where merchants use JD’s infrastructure to sell products to JD’s buyers.

Management did not just note increased onboarding of more merchants on their 3P platform but also saw “an accelerated year-on-year growth of active buyers who purchased from 3P merchants on our platform.” Management also revealed shopping frequency among users had increased, leading to “an over 20% year-on-year increase in our 3P order volume in Q2, its fastest pace in the last two years.”

Marketplace, marketing, and logistics services revenues rose 6.3% in Q2, led by strong efficiencies seen in the company’s logistics services. Plus, JD’s Retail segment was also able to harness the synergies from JD’s supply chain efficiency and expansion, as management reported “double-digit growth” in JD Retail’s advertising revenues generated from 3P merchants. The strength in advertising revenues has given management enough confidence about their 3P business putting up a stronger show in the back half of this year. When asked to explain their reasons for the conviction, here is what management had to say:

So we anticipate that commission revenue will recover an increase in the second half of the year as 3P GMV continues to grow. And for advertising revenue in Q2, it grew faster than the GMV. We believe advertising is merchants’ response to the platform’s performance. So we have been enhancing our advertising products and models and to help our brands and SME merchants to grow their business on our platform. So this in turn, we believe will drive higher advertising revenues to us.

JD’s Strong Margin Expansion Sets The Course Ahead

This is where JD’s outlook starts to get more attractive.

In Q2, JD reported adjusted earnings of $1.29 per ADS, beating estimates by 42 cents and rising 74% y/y. In contrast, Alibaba reported adjusted earnings of $2.26 per ADS, beating estimates by 17 cents and falling -0.6% y/y. GAAP net income for JD came in at $1.74 billion, or $1.13 per ADS.

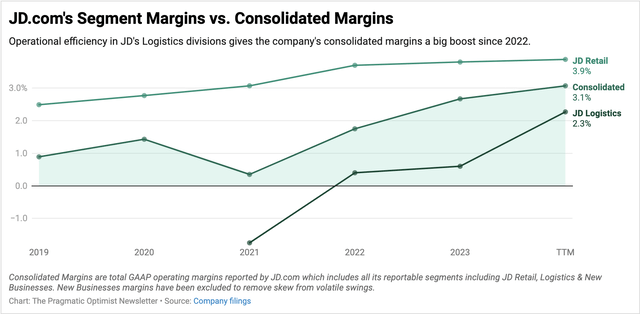

One of the reasons JD has been posting superior growth rates in its net income is due to the strong operating leverage demonstrated by management, where operating income has been consistently rising at very strong double-digit growth rates since early last year. This has allowed management to deliver 272 bp of operating margin since 2021, with GAAP operating margins now standing at 3.1% on a TTM basis after factoring in JD’s Q2 results, as can be seen in Exhibit C below.

Exhibit C: JD.com’s rising margin performance bodes well for its outlook. (Company filings)

So far, the operating margin expansion delivered by JD’s Retail segment has been crucial to the company since it accounts for a significant majority of JD’s consolidated operating income.

However, with the additional operational leverage that management has unlocked in JD’s Logistics business, as seen by the 410 bp of margin expansion in the latter segment, the boost to JD’s consolidated operating margins is highly noticeable. The increase in revenue streams that management expects in areas such as 3P advertising, as I noted in the previous section, will only add more firepower to the margin expansion story. All this outlook does is further accelerate its net margins as the company benefits from the scale of its 3P business.

Management spelled this out in terms of future guidance:

Our mid to long-term goal, to achieve a profit margin in high single-digits, and we are optimistic about reaching this target. And our key growth driver includes the growth of our platform ecosystem, category mix optimization, and profit margin improvements across various categories.

And as our business and operational efficiency continue to improve, we believe that we will achieve a high single-digit profit margin in the long-term. Its long-term profitability will be anchored by our strong market position and focus on user experience.

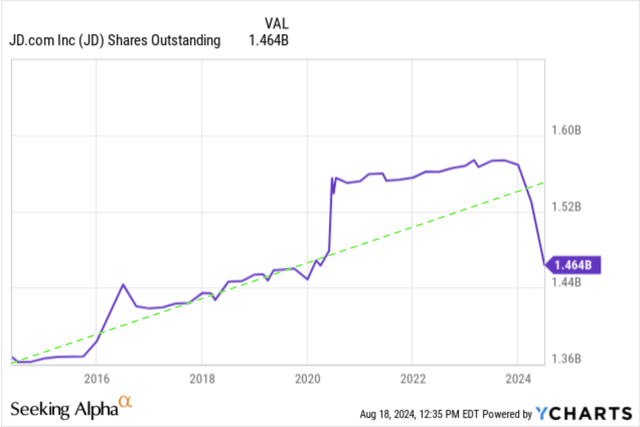

What further bakes the cake in this outlook is the robust progress of its share buyback program. Earlier this year, management announced a share repurchase program to “buy back USD 3 billion worth of company shares over the next three years.” That would result in the company buying back ~7.7% of the company’s market cap if they decided to execute on their buyback program at the time of the announcement.

In the Q2 call, management revealed they have already bought back $2.1 billion worth of shares and may buy back more. Management may have seen immense value in JD’s stock if they deployed 70% of their buyback authorization at current levels. To me, this signals high levels of confidence, backed by strong performance in the company’s earnings and a robust outlook.

Exhibit E: JD.com’s management executed $2.1 billion of their $3 billion buyback program since the start of the year. (YCharts)

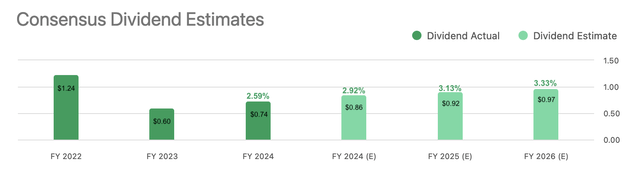

It’s also important to note here that management is buying back stock with a strong balance sheet on record and a respectable dividend yield. While JD carries ~$11.9 billion in debt, it holds ~$11.6 billion in cash & equivalents, with another $16.2 billion in ST investments. At the same time, the stock yields 2.59% in dividends, which is expected to cross the 3% mark by next year.

Exhibit F: JD.com’s dividend outlook in terms of consensus estimates. (Seeking Alpha)

Valuations point to Strong Upside in JD

There are a few ways to value JD’s stock, and in both cases, it points to a strong upside.

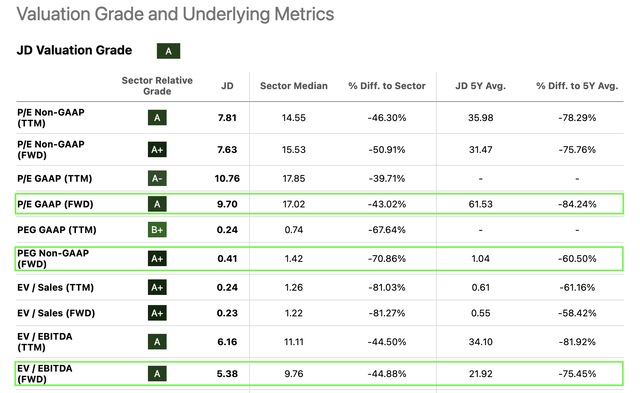

First, by comparing JD’s valuation levels to its own history and to the sector in which it operates.

Exhibit G: JD.com’s valuation metrics show strong upside (Seeking Alpha)

Take the case of its current forward GAAP earnings multiple of 9.7x. This looks incredibly cheap when compared to the sector valuation level and trades at a 43% discount to the sector. JD also trades at an 84% discount to its own relative valuation levels, as seen in Exhibit E above.

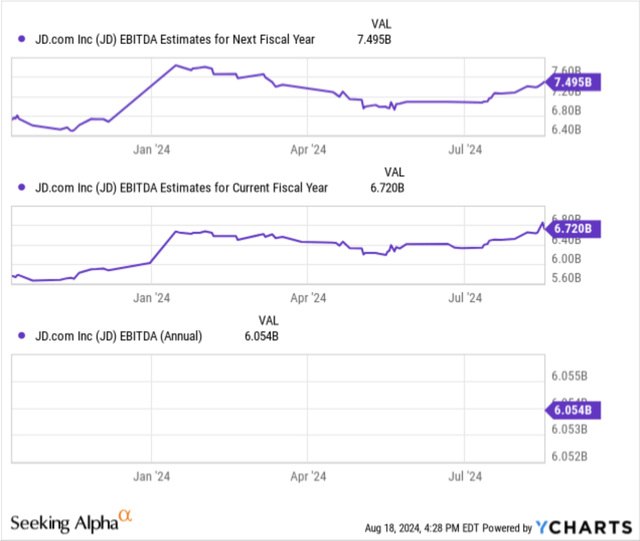

Another way to rationalize JD’s attractive valuation levels is to compare them to the MSCI China Index, which trades at a forward PE of 9.1x. For a company like JD that is expected to grow its EBITDA by 11% in 2024 and 11.5% in 2025, as seen in Exhibit H below, JD’s forward valuation levels look extremely attractive.

Exhibit H: JD.com’s EBITDA is expected to grow by 11.3% on average this year and next year. (YCharts)

Risks & Other factors to consider

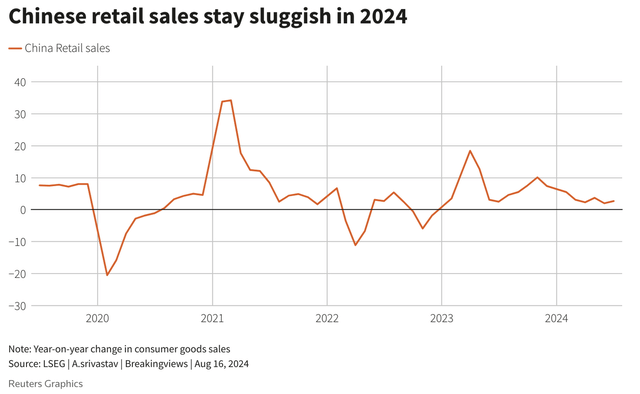

The global macro uncertainty, especially in the soft demand seen in China, has depressed valuation levels for most Chinese stocks, including JD.

So far, in my view, China’s retail sales haven’t really taken off yet, but they at least look a lot better in 2024 than the volatile trend seen since 2020. This is the broader reason why investors are pessimistic towards Chinese stocks, and JD’s current valuation captures much of those elevated levels of pessimism.

Exhibit I: China’s retail sales are still slow to recover in 2024 (LSEG via Reuters Graphics)

The efforts demonstrated by Alibaba’s and JD’s management to revitalize growth are showing some strong signs of reinvigoration, and I believe JD would be poised to benefit from the upcycle.

Competition is another factor that always exists for JD. I had noted earlier that JD is benefiting from surging ad revenue on its 3P platform. On Alibaba’s earnings call last week, their management announced a competing ad product called Quanzhantui. Since its early days, the full impact is unknown for now.

Takeaway

JD.com stock looks extremely attractive at current levels, especially as the company’s margin profile gets stronger and growth appears to be returning to the company’s top line. JD is benefiting from strong tailwinds in its Logistics business as well as its merchant business, and these growth rates should aid the 2x margin boost that management has called for in the mid-to-long term.

Based on my analysis of the company’s Q2 report, I recommend a Strong Buy on JD.

Read the full article here