I first wrote about my investment thesis on KE Holdings (NYSE:BEKE) (Beike) in June 2024. Since then, the stock has been mostly flat, while the stock prices of most Chinese real estate developers have further declined amid the continuing slump of China’s real estate market. BEKE reported its earnings for Q2 FY2024 on August 12th before the bell. The company’s Q2 results demonstrated the resilience of its business model. Along with the earnings release, the company also announced a significant increase in the share-repurchase program. At today’s valuation, BEKE still has plenty of upside. Therefore, I am maintaining my “buy” rating for BEKE.

BEKE’s Q2 2024 Results

BEKE reported Q2 2024 results on August 12th before the market open. According to the company’s press release, highlights of the quarter include:

- Gross transaction value (GTV) increased 7.5% year-over-year.

- Net revenues increased 19.9% year-over-year.

- Adjusted operating margin increased to 12.0% in the second quarter of 2024, compared to 11.0% in the same period of 2023.

- Adjusted net income increased by 13.1% year-over-year.

Detailed Analysis Of Net Revenues

I believe for Beike, investors should pay close attention to not only the net revenue trend, but also the net revenue mix. As a recap, Beike has two new rapidly growing businesses – home renovation and furnishing, and home rental services. During Q2 of 2024, both business segments continued very strong growth momentum.

Net revenues from home renovation and furnishing increased by 53.9% to RMB4.0 billion ($0.6 billion). This implies that the segment’s contribution to Beike’s total revenue has increased to 17.2%, compared to about 13.3% in Q2 of 2023.

Net revenues from home rental services increased by 167.1% to RMB3.2 billion ($0.4 billion) in Q2 of 2024, representing 13.7% of net revenue. In Q2 of 2023, home rental services only accounted for 6.2% of net revenue.

The growth rates of Beike’s new businesses are truly impressive. However, Beike’s old business, namely the home transactions service, reported mixed results. On one hand, net revenues from existing home transaction services increased by 14.3% mostly due to the 25% growth of the GTV of existing home transactions. On the other hand, net revenues from new home transaction services decreased by 8.8% due to the 20% decline of GTV of new home transactions. Although Beike’s GTV of new home transactions declined 20%, it still outperformed the market. As reported by China’s real estate association, China’s overall sales of new home transactions declined 21.5% in Q2 of 2024.

When asked about BEKE’s outperformance during the earnings call, BEKE’s CFO Tao Xu explained in details the reasons why BEKE’s done better than the market. In summary, there are four factors contributing to BEKE’s market share gain.

First of all, “in a buyer’s market, helping downstream agents with special incentives for new home sales can facilitate more efficiency sell-through in the current market”.

Secondly, Beike “further expanded the coverage of the core state-owned developers and high-quality leading real estate companies better meeting their needs with innovative new home services.”

Thirdly, Beike used technology tools “to help agents better identify high potential new home buyers who are likely to make a new near-term purchase, thus boosting the new home sell-through”.

Lastly, BEKE increased the number of agents on its platform and “expanded the role of the comprehensive agents so that more agents can engage in both new and existing home business in parallel”.

Overall, considering China’s horrendous real estate market, I think Beike’s net revenue growth for the quarter is very strong. BEKE’s management noted that the year-over-year sales decline in Q2 narrowed month-by-month. This is a good sign for China’s real estate market and for BEKE as well.

Strong Balance Sheet And Updated Share Repurchase Program

Unlike Chinese real estate developers who are bleeding cash, BEKE is still a cash cow. For Q2 of 2024, the company generated RMB4.8 billion ($0.66 billion) of operating cash flow and had RMB59.7 billion ($8.2 billion) of cash, cash equivalent and short-term investments. The company used $100 million to repurchase shares during Q2.

Beike’s strong operating cash flow gives management the confidence to boost the share repurchase program. Along with the earnings release, BEKE announced the increase in share repurchase program from $2 billion to $3 billion. Obviously, this is good news for BEKE’s shareholders.

Financial Projections And Valuation

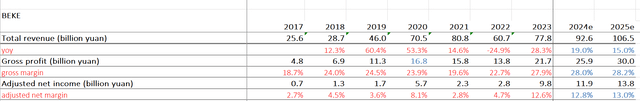

In terms of financial projections, I have updated my model to incorporate BEKE’s Q2 results. I am still assuming that new home sales in China will decline in the next two years, but sales of existing home sales will rebound. To be conservative, I am also assuming Beike will maintain its current market share in both existing and new home markets, even though Beike has grown its market share in Q2. Furthermore, I’ve revised up Beike’s margins, as Beike’s Q2 margins are much better than I expected. Based on these assumptions, I arrived at my 2025 revenue and adjusted net income projections.

author’s estimate

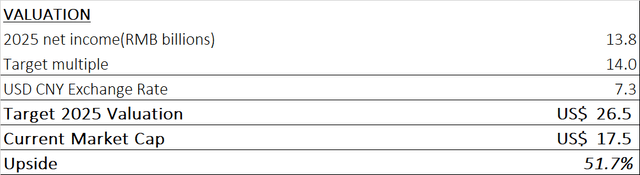

In terms of valuation, I am applying 14 times P/E multiple, which is a 60% discount to the sector median P/E multiple to account for Beike’s risk as a Chinese ADR.

author’s estimate

Based on these assumptions, it looks like Beike is undervalued at the current level.

Conclusion

For Q2 of 2024, Beike has managed to increase its market share during an extremely difficult period of China’s real estate market. The rate of decline of China’s new home sales has stabilized, while China’s existing home sales returned to growth. Meanwhile, Beike’s new business initiatives have strong growth momentum. Overall, I believe Beike’s price has more than 50% upside from today’s price. Therefore, I am maintaining BEKE’s “buy” rating.

Read the full article here