Investment update

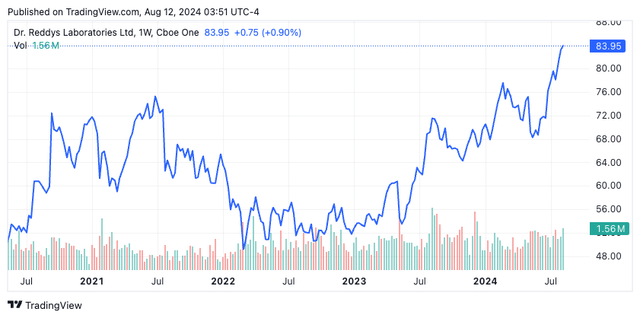

Following my last publication on Dr. Reddy’s Laboratories Limited (NYSE:RDY), the stock has advanced another 29% to the upside. Shares are now +20% this year to date, and there are now multiple additional tailwinds adding to the business momentum. These include 1) the company’s Q1 FY’25 numbers and 2) the legislative tailwinds made possible by the Affordable Prescriptions for Patients Act passed in the US Senate in July ’24.

I continue to rate RDY a buy due to 1) the business’s enduring competitive advantage as a generics pharmaceutical manufacturer that give it cost advantages with higher capital turnover on equally as high operating margins, 2) expectations are fair [momentum is contained, business growth is steady, multiples are more than fair], and 3) valuations supporting ~$107/share intrinsic value of the business. Net-net, reiterate buy.

Note: (1). All figures are in USD at the exchange rate of 1 USD = 83.95 INR unless otherwise stated; (2). RDY’s Q1 ’25 coincides with Q2 CY 2024.

Figure 1.

Tradingview

Q1 FY’25 insights

RDY did ~$921mm of business during the quarter (+14% YoY) underscored by the generics business with strong contributions from the in-licensing of Sanofi’s (SNY) vaccine portfolio in India. It pulled this to EBITDA of $259mm (+1% YoY, +15% sequential) mm) on ~28 operating margins, down ~360bps YoY due to base effects in FY’23.

Geographical takeouts

The geographical breakdown for the quarter was as follows:

-

U.S. generics continues to outperform as evidence of the company’s competitive advantage (it’s no secret US pharmaceuticals carry far higher prices than global peers) – it booked sales of $463mm (+19% YoY and +18% sequential). Growth was volume-driven which squares off with the economics of the business – lower margins vs. peers, made up with 1) lower operating costs vs. peers, and 2) equally high ROICs vs peers. The key difference is that RDY doesn’t always have to take on the execution and/or pipeline risk of bringing new products as the formulations exist albeit in a non-generic form. This is a secondary competitive advantage.

-

Revenues from Europe reached €59mm (+4% YoY) underlined by higher base business volumes and launches. It launched 12 new products during the quarter in this market. Critically, RDY is one of the only US-listed companies that will have Russia exposure (sales there were +12% YoY).

-

Finally the India business grew 15% YoY due to 1) additional revenues from the recently in-licensed vaccine portfolio from SNY and 2) the launch of 13 new brands during the quarter.

My view of the quarter was that it is in keeping with the company’s growth trajectory, its competitive advantages as a generics manufacturer (knocking the froth off the US and EU competitors) and the high-quality business characteristics it comes with – including its capital budgeting plans.

Language on the Q1 earnings call illustrated a management ready to deploy surplus funds into growth initiatives and create more economic profits by throwing of attractive cash flows consequent to these deployments. For instance, outgoing CFO Parag Agarwal’s comments on this:

The reason the free cash flow is a bit on the lower side is because of fluctuation in factoring…But overall, the operational cash flow generated from the business is in line with the normal trends…

…[I[n this quarter, as usual, we are investing in new business initiatives.

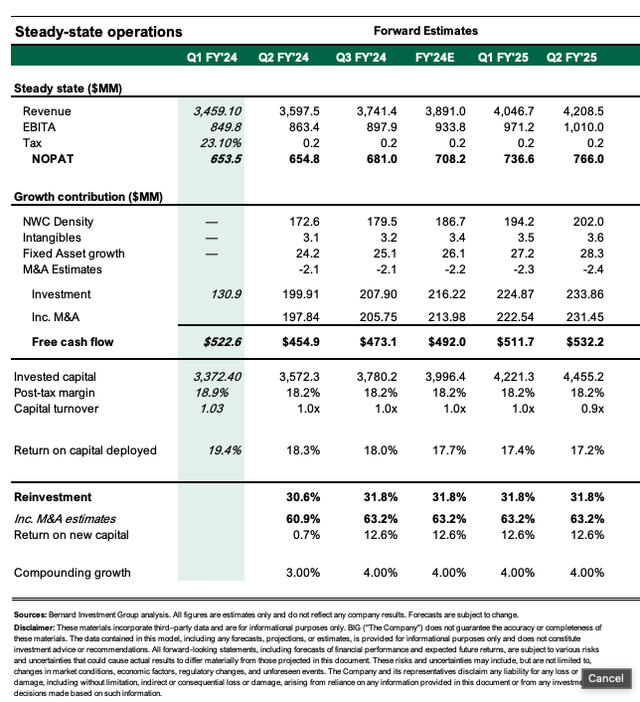

I’ve updated my FY’24–’FY’26E estimates [see: Appendix 1] to reflect these changes and now see ~$3.9Bn sales in FY’24 [in line with consensus], stretching to ~$4.2Bn by FY’25 [ahead of consensus].

Economic highlights

Regarding the economic contributions of the company’s operations (that is, what extra/less be taken out of it moving forward as a result of the quarter), my view is the company’s business advantages provide several investor-specific advantages, namely:

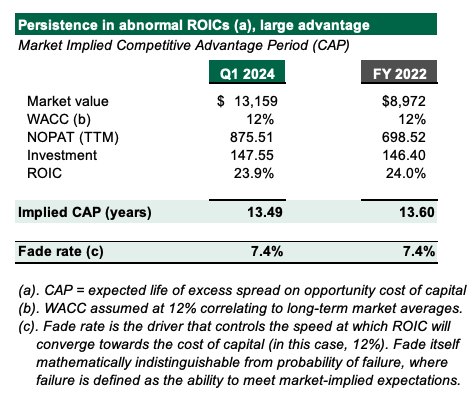

- Returns produced on the capital employed into its operations are 1) abnormally high and 2) persistently so. The business operates on ~$3.4Bn of capital, ~$2Bn of which is tied up in WC due to large receivables pull through with the massive revenue growth [revenue growth = order growth]. RDY routinely earns ~20-25% on this operating capital whilst reinvesting ~20% of NOAT every rolling 12mo to exhibit ~5% compounding growth in the business. My view is the company’s competitive advantage period (“CAP”) – that duration in which it can earn abnormally high economic profits [defined here as all ROICs >12%] is ~13yrs, unchanged from FY’22. This evidences its enduring competitive advantage and hard-to-replicate business advantages.

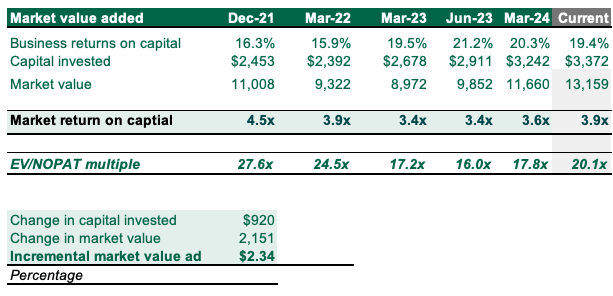

Figure 2.

Company filings

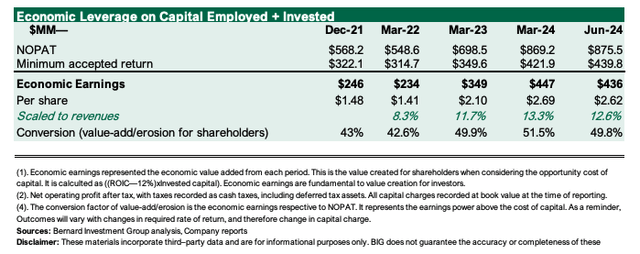

- This is highly relevant to the investment debate as 1) pharmaceuticals is tremendously competitive, 2) patents are valuable, and 3) RDY overcomes both of these factors – it does so given it enjoys pricing advantages as the ‘low-cost alternative’ as a generics provider [gross margins ~60% are well below peer avgs. – some return 100% gross on sales in this industry, but strong operating margins >22% on capital turns ~1x. So $1 invested in the business operations returns ~$1 in sales]. These economics square off with that of cost leadership firms that turnover capital at higher rates to produce equally high returns on capital, where the investment required to produce $1 of incremental capital is low. This produces a highly valuable situation where 1) the post-tax earnings are valuable above a specified hurdle rate of 12%, so there’s no opportunity cost, and 2) ~12-13% of sales + 50% of NOPAT falls through as economically valuable earnings to the investor (Figure 3).

Figure 3.

Author

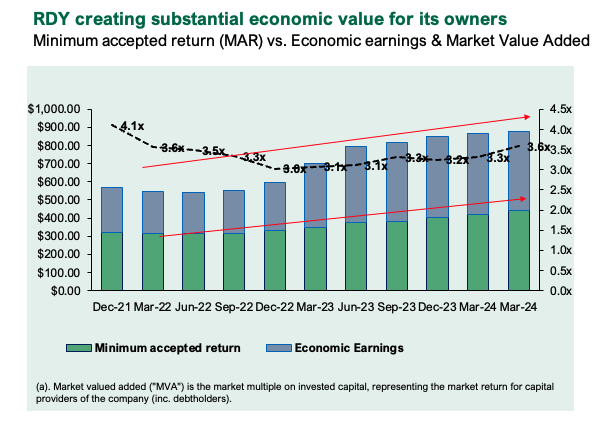

- The market values this highly, where $1 of RDY’s operating assets is valued ~$4 in the market. Critically, EV/IC multiples are +3x vs. FY’22 as economic profits stretch to ~$22/share since then. My view is management has created this amount in economic value since ’22, ($3.7Bn in total). The stock is +$31.20/share since December ’22 thus investors paid a 1.4x multiple on these economic profits.

Figure 4.

Company filings, author

The key takeout from the quarter in my opinion is that RDY’s economic characteristics are of high calibre and the business has an extensive runway ahead of itself to redeploy freely available cash into its operations to expand via 1) new launches, 2) market share gains and 3) efficiencies.

Valuations, embedded expectations fair

The business trades fair ~4x EV/IC in my view, with ~$4 in market value paid for every $1 of the business capital asset. This is fair in my view as a hypothetical dollar placed with the company in FY’21 will have compounded 2.8x more vs. our 12% hurdle rate ($9.83 + $3.47) and there’s a lengthy runway for management to reinvest for growth. The market expects ~$9.8Bn in economic profit from RDY in the foreseeable future and this is achievable in my view, as the value of the business distributed evenly in 1) the value of current operations, and 2) the present value of future growth opportunities. Alas, 4x EV/IS is fair in my view.

Figure 5.

Seeking Alpha, Author

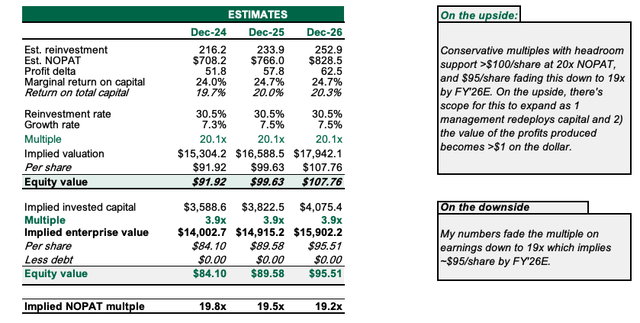

Valuation insights

- Conservative multiples with headroom support >$100/share at 20x NOPAT, and $95/share, fading this down to 19x by FY’26E. On the upside, there’s scope for this to expand as 1) management redeploys capital and 2) the value of the profits produced becomes >$1 on the dollar (Figure 6).

Figure 6.

Author

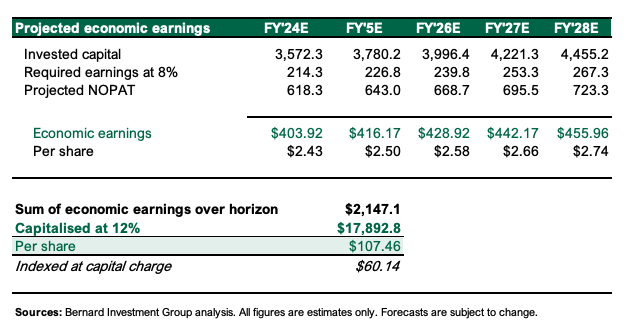

- Under these same assumptions, the discounted value of freely available cash produced on capital at a rate above an opportunity cost threshold and discounted at 12% arrives at ~$107/share, corroborating the above. My view is the business is worth this much as 1) ROICs are ~2x our threshold, which resembles market opportunity costs, and 2) the business is in possession of hard-to-replicate advantages that enable to compound capital at above-market rates of return. I’d be happy leaving my funds with RDY’s management, more so than many fund managers, as they are producing the kind of returns I am after for our portfolios on their investments.

Figure 7. The opportunity cost, a hypothetical investment earning 12% on capital and reinvesting 100% of those earnings, is valued ~$60, illustrating the value on a ranked-basis.

Author estimates

Risks to thesis

Key risks to the investment thesis include 1) Sales growth of <5% as this nullifies the thesis, 2) RDY earning less than $0.20 on the dollar with its operating capital, as this will reduce economic profits and likely the multiple on invested capital, 3) Unforeseen legislation that would block out generic manufacturers (I give this a 5% probability), and 4) the greatest set of macroeconomic risks that must be factored into all equity evaluations. At this point in time, this includes the ruder geopolitical risks and economic risks that could spill over into broad equity markets.

In short

RDY remains a buy in my view as it is a high-quality enterprise producing equally high returns on operating capital, reinvesting surplus funds back into the business to remain competitive and grow earnings. It has many hard-to-replicate business advantages which see it produce abnormally high business returns on a persistent basis, meaning the duration which it can earn excess returns above an opportunity cost of capital is tremendously wide, around 13 years in my estimation. Reiterate buy.

Appendix 1.

Author’s estimates

Read the full article here