Shares of Dave & Buster’s (NASDAQ:PLAY) have been battered, falling 23% in the past year and are down over 50% from their April highs as disappointing 1Q24 results coupled with concerns about soft consumer spending and elevated financial leverage have caused investors to flee the stock. While I don’t love Dave & Buster’s balance sheet and there is a high likelihood of further weakness in results over the next year if consumers continue to pull back, I think shares are just too cheap to ignore at current levels. Moreover, while just four months ago, investors enthused about the prospects for management’s profit improvement plan, at less than $32 per share, investors are giving no credit to profit improvement initiatives.

While shares are not without risk, I see the risk / reward as being favorable for contrarian investors. Should management make good on only some of its initiatives, I believe Dave & Buster’s shares could easily double or better. Even assuming a weakened economy with little offset from management’s plans, I see little downside in the stock. Given what I see as an asymmetric situation, I’ve taken a position in Dave & Buster’s shares.

Recent Results

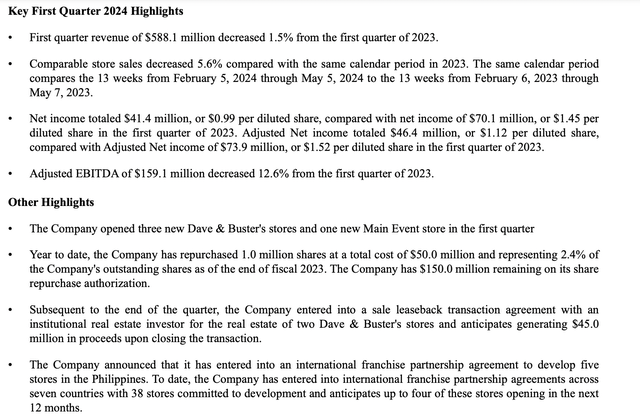

1Q24 Results (Earnings Release)

As shown above, 1Q24 results continued to see soft same-store sale growth (same-store sales were down 6.2% in 2023) likely lead by negative traffic/transactions (Dave & Buster’s doesn’t break out traffic/transactions comps) given that the company began implementing some of its price initiatives (discussed below). The decline in same-store sales coupled with some incremental spend (related to a new menu roll-out, which management doesn’t expect to recur) lead to a 12.6% year-over-year decline in 1Q24 EBITDA.

While management cited improving trends early in 2Q24, we’ve seen some evidence of a softening consumer spending environment in 2Q24, which could persist through 2024/into 2025 and lead to continued weakness in same-store sales and EBITDA. While I expect macroeconomic headwinds, management isn’t standing still and has several initiatives to improve revenue and EBITDA (see below).

Management Profit Improvement Initiatives

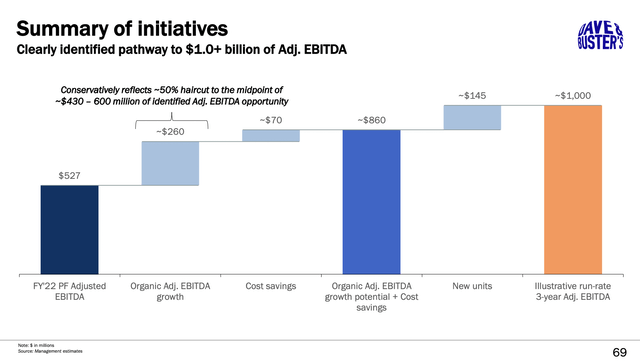

$1 billion EBITDA target (2023 Investor Presentation)

As shown above, in 2023, current management put forth what I considered to be an audacious Adjusted EBITDA target of $1 billion by 2025. I think it is probably fair to say that this won’t be achieved.

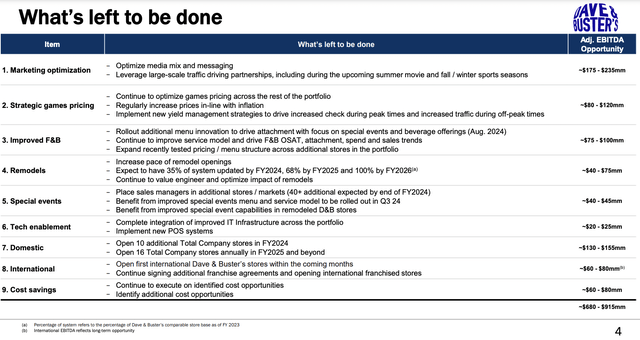

Profit Improvement Initiatives (June 2024 Investor Presentation)

That said, I think many of the initiatives (shown above) can produce meaningful EBITDA gains over the next 2-3 years. I think we can reasonably expect $200-300 million in improvement. New domestic store openings, international franchising, and store remodels should conservatively produce a minimum of $150 million in incremental EBITDA over the next 3 years. Moreover, I believe there is merit to expected EBITDA gains from pricing initiatives on games and food, where Dave & Buster’s has been slow to take price despite inflationary pressure over the past few years. Similarly, I think the company’s digital marketing initiatives (member/loyalty program) should help to drive same-store sales / EBITDA growth.

Valuation

As we sit today, at $32 per share, Dave & Buster’s trades just under 5x TTM adjusted EBITDA of $535 million on base of 220 stores. This gives no credit for management’s profit improvement program but also does not take into account the likelihood of future same-store EBITDA declines from a weakened consumer spending environment.

Over the past decade (excluding COVID), EBITDA per location has ranged between $2.1 and $2.7 million for Dave & Buster’s (adjusted for Main Event; 2022 and 2023 were $2.7 and 2.6 million, respectively). Assuming that Dave & Buster’s opens 50 new locations by the end of 2026, and assuming just $2 million of EBITDA per store (-23% versus 2023) gets me to $540 million in EBITDA in 2026/27 (essentially equal to TTM). This seems to be a reasonable downside case. If D&B continues to trade at a draconian 5x EV/EBITDA multiple on what I’d consider depressed results, investors should come out about flat.

If we assume $2.4 million in EBITDA per location (midpoint of historical range), I get to $650 million in 2026/27 EBITDA (using 270 stores). Applying a 7x EV/EBITDA multiple (has historically traded at 7-8x over the past decade) and deducting net debt, I get a value of $80 per share (+150% upside).

Lastly, what if management’s profit improvement initiatives are a success? Assuming $3 million per store, this gets me to $810 million in 2026/27 (still ~20% below management’s $1 Billion target). At a 9x EV/EBITDA multiple (Dave & Buster’s traded north of 10x in 2016-17), this gets me to $150 per share (after deducing net debt) which works out to 368% upside.

Risk Factors

– Dave & Buster’s has more debt than I would like. While current leverage levels (2.4x Net Debt to TTM EBITDA) aren’t overly concerning, Dave & Buster’s is operationally leveraged (high fixed cost burden means that EBITDA may decline at a faster rate than same-store sales) and this ratio could quickly head north of 3x. I say ‘may decline at a faster rate’ rather than ‘will decline at a faster rate’ as it is entirely possible that management initiatives offset a meaningful portion of any same-store sales weakness.

– In addition to the debt on its balance sheet, Dave & Buster’s has lease commitments in excess of $200 million annually. I estimate a fixed charge coverage ratio of 2.2x. Again, this isn’t overly concerning, but faltering same-store sales could push this higher.

– Rather than pay down debt, Dave & Buster’s is using discretionary cash flow to open new locations (50-60 new locations by end of 2026), remodeling existing locations, and repurchasing stock (Dave & Buster’s has bought back over ~20% of outstanding shares over the past couple years). While the new locations and remodels will almost certainly increase cash flow, I’ve been less enthused by the share repurchases and would have preferred debt paydown. Of course, if management’s profit improvement initiatives are successful, the buybacks could look prescient in hindsight.

– Dave & Buster’s is sensitive to consumer spending trends, in particular lower income consumer spending trends (37% of Dave & Buster’s customers have household incomes below $50,000 per year and another ~39% earn $50-100,000 per year). Lower-income consumers, who benefitted disproportionately from COVID-related stimulus’ in 2021-2022, have been harder hit by inflationary pressures over the past two years.

Conclusion

While investors have fled Dave & Buster’s given a weakening consumer outlook coupled with operational and financial leverage, I see the shares as offering an asymmetric payoff at $32 and have taken a long position in the stock.

Read the full article here