Record Throughput With More Volume To Come

Six months ago, I upgraded Western Midstream Partners (NYSE:WES) from Buy to Strong Buy. The partnership units had finally broken over $30 in a convincing manner after a long sideways stretch in the $20s.

Western Midstream also guided for a large distribution increase in February, to $0.875 quarterly from $0.575 previously. This would bring the calendar year 2024 payout to $3.20. At that time, I stated the only thing keeping WES from having a double-digit yield would be an increase in the unit price. It quickly appreciated to over $42 in mid-July before pulling back some in the overall market correction.

Seeking Alpha

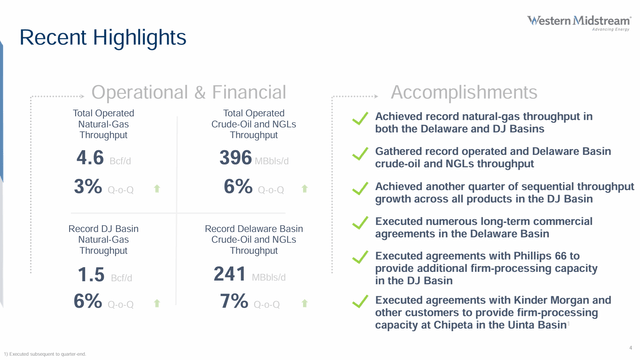

This large distribution hike showed confidence in continued growth, which WES demonstrated in the second quarter. The partnership once again hit throughput records in key basins. WES also announced several agreements to provide firm processing capacity to its upstream customers, setting the stage for continued volume growth.

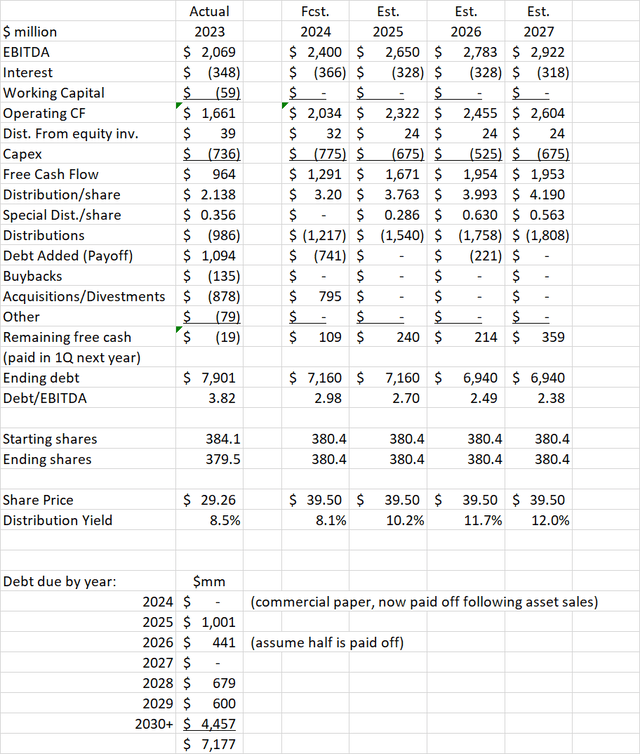

These deals underpin the EBITDA and free cash flow projections I made in my last article. The key improvement in my forecast is that WES has continued to improve its balance sheet. The partnership paid off the short-term debt issued to complete the Meritage Midstream acquisition in the Powder River basin of Wyoming. They also bought back long-term debt opportunistically below par in the open market. With the increase in the unit price, this has been a better use of capital than stock buybacks. It also increases the chances of getting debt/EBITDA leverage below 3.0 by the end of 2024, setting up the partnership to declare a special distribution in 1Q 2025. WES does not really need to delever further, allowing for stronger special distributions in later years as well.

While the yield based on the 2024 payout has fallen to 8.1% based on the higher $39.50 unit price, WES should be able to increase the regular distribution in line with EBITDA growth going forward. I see the yield based on current price again exceeding 10% in 2025. I am moving the rating back to Buy due to the recent fast increase in unit price, but WES remains among the best investments in the midstream space.

Sources Of Growth

For those newer to the partnership, WES engages in gathering and processing of natural gas, NGLs, crude oil, and produced water mainly in two basins, the Delaware in West Texas and the DJ in Colorado. The partnership has also become the biggest midstream provider in the Powder River basin following the Meritage deal. They also operate smaller systems in southwest Wyoming, Utah, and South Texas. Finally, WES has non-operated stakes in some long-distance pipelines. They sold out of some non-operated stakes in pipelines and gas gathering systems in other areas to concentrate in their core geography.

In 2Q 2024, WES increased natural gas volumes by 3% and liquids (crude and NGLs) by 6% sequentially (compared to 1Q 2024) at sites they operate. Natural gas throughput was a record in both the Delaware and DJ Basins. Liquids throughput was also a record in the Delaware.

The WES commercial team was busy during Q2 finishing deals with customers for additional firm processing capacity. It is important to remember that while Occidental (OXY) is still the general partner of WES, they own less than a majority of the limited partnership units and allow WES management to operate independently. Much of the growth in 2Q came from third-party customers outside of Oxy. WES closed multiple deals on third-party volume in the Delaware basin. They increased volumes with Phillips 66 (PSX) in the DJ basin from 175 to 200 MMCFD. They also signed up more firm volume commitments at the Chipeta facility, located in the Uinta basin of Eastern Utah. These include an agreement with Williams Companies (WMB) for up to 110 MMCFD, and a deal with Kinder Morgan (KMI) for up to 150 MMCFD.

Western Midstream Partners

The added volumes in the Delaware are expected to start in the second half of 2024 and ramp up in 2025. WES has prepared for these volumes by executing growth projects in gas processing plants at North Loving and Mentone Train 3. This 550 MMCFD of new capacity (300 already online this year and 250 in 2025), represents about a third of WES’s capacity in the Delaware before the Mentone 3 startup. This supports several years of future growth in the Delaware. The new deals in the Uinta and DJ basins could fill up plants in these areas by 2026, however.

Earnings Model Update

I updated the EBITDA projections from my last article only slightly. For 2024, I now expect WES to hit the top end of their EBITDA guidance, or $2.4 billion. In the later years, EBITDA continues to grow, but I conservatively left the values approximately the same as in the prior model. That results in 10% growth in 2025 and 5% per year growth in 2026 and 2027. Interest expense is slightly lower as WES bought back additional debt in 2Q. For capex, I am still assuming the midpoint of company guidance, or $775 million in 2024. I allow this to come down in 2025 and 2026 as the big expansion projects in the Delaware basin will be online by 2025. For 2027, I increased my capex assumption from the last model, as WES may look to expand in Utah and Colorado if those facilities are full.

I continue to expect WES to grow the regular distribution each year in line with EBITDA growth. With the credit rating now investment grade at BBB- and debt/EBITDA leverage below 3 by the end of 2024, I do not see the company lowering debt as much going forward. I also assume no buybacks in 2027 with the possible increase in capex that year. With these changes in capital return, I now expect WES to pay attractive special distributions after Q1 of each of the next 3 years.

Author Spreadsheet

Peer Comparison

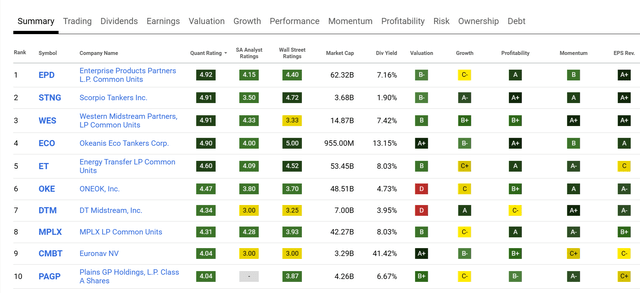

Looking at the 54 stocks in the Oil and Gas Transportation and Storage industry, WES has moved up to third place in the Seeking Alpha Quant Ratings. Note that the top 4 are all in Strong Buy territory, and only 0.02 rankings points separates #1 from #4. Two of these 4 are smaller-cap tanker companies, but WES has a close peer at #1 with Enterprise Products Partners (EPD). With its better dividend growth and potential for special distributions, WES looks like a better pick for income-focused investors. WES is also a smaller cap than EPD or #5 on the list, Energy Transfer (ET). I believe this leads to WES getting more overlooked by Wall Street than its larger-cap peers, leading to more opportunity for price moves on positive surprises.

Seeking Alpha

Conclusion

Western Midstream Partners, LP had a productive first half of 2024, processing record volumes and working on projects to expand capacity in its key Delaware basin. The partnership also signed agreements in the Delaware and elsewhere to increase processing volumes starting in the second half of this year. These deals increase confidence that WES can deliver EBITDA at the high end of the range in 2024 with further growth over at least the next three years.

WES also continues to keep its balance sheet in good condition. I now expect the partnership to hit its 3.0 debt/EBITDA leverage target in 2024, allowing a special distribution to be paid in 2025. The lower debt also allows for increased special distributions in 2026 and beyond.

The base distribution is the best thing about owning WES, however. The partnership is paying out $3.20 in calendar 2024, or 8.1% yield on a share price of $39.50. In future years, distributions should grow in line with EBITDA, resulting in yield on cost results of over 10% in 2025 and 12% in 2027 based on the current price.

With the large increase in unit price over the last few months, I now rate WES a regular Buy, but Seeking Alpha Quant Ratings still consider it a Strong Buy and just 0.01 ratings point from the top of its industry. For income investors, the distribution yield, growth, and potential for specials make WES the best in the midstream.

Read the full article here