Dear readers/followers,

For a foreign analyst, I do a fair bit of coverage on the otherwise undercovered (in my view at least) firearms industry. One of the main names that’s publicly traded in this sector is Sturm, Ruger & Co. (NYSE:RGR). It’s fair to say that my previous coverage of this particular sector and this business has not yet been profitable. You can find that latest article, and the associated negative returns since that time, here.

Does this bother me?

Well, it’s always suboptimal to invest in a business at the “wrong” valuation and the returns are negative for the time being. But I’ve long since stopped caring in a significant way about short-term negative results if my long-term thesis is intact. If I cared too much about the former, I would probably be hindered in investing the way that I want because I’d be so bothered by the state of some investments.

So it all comes down to the value that I believe an investment actually has. Sturm, Ruger & Co., as of the time of writing this article, is trading at $45/share, with a pre-market move of going down 2.5%.

I believe the company is worth more than this, and I’ll show you why here.

Sturm, Ruger & Co. – The fundamentals are very solid

Firearms, in the same way that defense/military investments are, will always be a bit of a controversial subject. It’s one that investors, in my view, should at least have an opinion on – regardless of what that opinion is. Some avoid them – some don’t. I do not. I believe it can be viewed as just as controversial to invest in a consumer goods company that has been accused of profiting off child labor as it is to invest in a manufacturer of tools used for warfare or defense.

As investors, I believe that while we actively manage our investments as well as we can, we must in the end put some faith in the management of those companies to follow relevant laws.

I can also admit to once upon a time being quite selective and excluding certain companies, even sectors, from my spectrum for such reasons. I have ceased doing so, however, for exactly the reasons mentioned above.

But investing, you need to understand that this is both a politically loaded and otherwise volatile segment to invest in. I’ve been using options trading and other strategies to try and maximize and squeeze out what upside I can from these investments, which means that I’m actually in the green at the moment. However, this is not one of my better investments – yet.

Sturm, Ruger & Co. remains the largest manufacturer of firearms in the US – and having lived in the south of the USA for over a year many years back, I fondly remember trips to the range, hunting, and other activities here. Sweden also has a very active hunting scene, but it’s hard explaining this to investors or people from other nations without such an active scene with much “tighter” firearms control.

As I’ve said before, for the long term, this is actually a very good investment (I’m talking 20-year trends). I also believe that the fundamentals of the company speak for themselves.

What do I mean here?

I mean that RGR has some of the best profitability in the sector. The company’s low debt allows for excellent return KPIs in an interest-heavier world, along with a near-8% net income margin and a TTM EBITDA margin of 12.19%.

Growth metrics are always tricky for such companies because for a market leader like RGR with a limited market to turn to (due to legislation), the growth potential is muted to say the least.

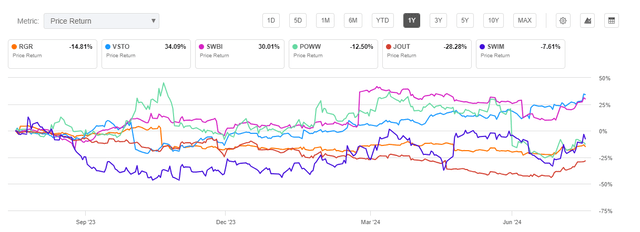

Sturm, Ruger & Co. plays in a segment that also includes Smith & Wesson (SWBI), AMMO (POWW), and outdoors companies if you want to go that way. RGR has, thus far for the last year, lagged most of the return of these. Most importantly, RGR has significantly lagged SWBI by ~45% in the last year.

RGR Return (Seeking Alpha)

This is also a good time to remind you that I, since mid-2023, have a position in Smith & Wesson as well, although I went “HOLD” following the massive spike in that peers results in March of this year (and the company has mostly performed flat since then).

So it’s all about valuation relative to both expected and actual performance. From a fundamental perspective, there’s a decent argument to be made for Smith & Wesson above Ruger – but in this case, I believe both of the companies have an upside worth considering here. SWBI has been an investor favorite for some time, reflected in the trends you see above, because of concrete plans to move HQ’s to a different state (TS), which is not only likely to result in better operating margins/lower OpEx, but also in far less regulatory issues given the state of things in Tennessee versus Massachusetts.

The positives for RGR here include a better 2Q24 than 1Q24 – and this is a positive I believe the market is not taking into consideration here. Sales were down for the quarter, but productivity and other KPI’s were up instead.

Macro trends and demand trends for firearms continue to impact how the company’s products and results are “working”. In this case, there’s a high-level reduction in demand for firearms since last year. However, despite this, the sell-through of products from independent distributors to retailers is up 1%. This is compared to a NICS-statistic change (background checks) of 6-8% compared to last year.

In short, RGR products are selling more despite a decline in this – and this in turn results in reduced company inventory, down by over 100,000 units, with only 13,000 at warehouse level.

Like SWBI, RGR’s current focus is on margins and profitability. It’s increasing production during 2H24, which will leverage fixed costs and result in better margins.

This is a market where you often see the “New is better” logic. When new products come out, customers are likely to gravitate toward them. We can see this by looking at the percentage of new sales in relation to all sales, which is over 30%.

There’s no doubt in my mind that RGR is facing and is likely to face some more challenges. This company is not just going to “shoot back” up, as it did in 2021 when earnings on an adjusted basis went up 72% in a single year. It’s been declining since then, first 44% in 2022, another 45% in 2023, and it’s expected to decline 5% this year, according to current analyst forecasts.

However, beyond that, we’re expected to see a reversal as some of the company’s efficiencies and better margins lead to better results. We’re talking about things like a 16% forecasted adjusted EPS growth in 2025E.

This makes it possible to see a favorable scenario for the company.

Let’s look at valuation.

Sturm, Ruger & Co. – the upside is there, but does require a bit of premiumization

Some analysts might consider the company a more difficult investment to justify than say, Smith & Wesson. Given the valuation difference between the two businesses however, I consider this one “easier” to invest in at this time.

This is especially after the 4%+ decline yesterday (as of the time of writing this article).

Sturm, Ruger & Co. typically trades at a P/E between 18-30x P/E – a very wide gap, showing off the volatility typical to a business such as this. It’s unquestionable that during an upswing, this company has potential that is nothing short of “massive.” It’s shown this before, and it could conceivably happen again. Despite firearms being products that don’t exactly “go bad” with an expiration date, customers and aficionados do want to “update” their collection and what they use frequently, given sales trends.

It’s therefore, as I see it, not unrealistic to expect a significant upside in the case of geopolitical events or uncertainty, which there is currently a lot of. This is how I use firearms (as well as defense) company investments. Normalized 20-year P/E for this company is almost 30x. We can discount this by almost 33% to a 20x P/E and still get a 30%+ annualized upside for this business. (Source: Paywalled F.A.S.T Graphs link).

Even going down to 17-18x, that’s still around 21% annualized upside in the case of 2025E earnings growth of 16% on an adjusted basis, and an implied share price of $55/share at this time – and this is not at all something “outlandish” here.

Realize also that RGR’s setup in terms of fundamentals is extremely favorable. The company is essentially a net cash business, with less than 0.65% Lt/debt to capital (yes, 0.65%). The company is small by comparison, only having a market cap of $750M, but there’s still a lot to like about it.

Previously, I’ve mostly been focused on options plays on this company, and while this is still possible here, I believe the company is now favorably valued for an entry into the common share.

It’s far from the best option I have available to me today – but it’s an option.

Risks are as follows.

Risks to Sturm, Ruger & Co.

There’s a whole slew of investment risks to RGR here – and at any time you’re looking to invest in a firearms or defense company. As you might expect, the primary impacts to these businesses are related to macro and politics and the general/overall perception of safety as it relates to its operating geographies. These have seen incredible volatility over the past few years, and I believe this is likely to continue.

There’s also the clear risk of regulation and regulatory pressures. That’s why you see some companies move operations and even headquarters to other states.

Other than that, it’s all a demand/supply/inventory question, and what the company can “get” for its products. There’s also the potential impact of a presidential election, positive or negative, as it comes. The forecast here is uncertain, and here is the company’s response when this question was put in the latest earnings call only yesterday.

Christopher Killoy

Good question. I don’t know what to expect. I mean, we’re ready either way. I mean, our production is going to be moving forward based on what we have for new products in the pipeline. So we’re going to be increasing our production regardless.

And if there is an unexpected spike in demand, we’ve got inventory, distributors have inventory. It’s lower than it was last year at this time, which is a healthy thing, but there’s still inventory to support that. So again, we’re not banking on it or planning on it, but we’ll be ready for it if it comes.

(Source: RGR earnings call, C. Kilroy)

Based on this, I would say that RGR remains an interesting speculative play, with the following thesis having a very decent risk-adjusted sort of upside. I say the thesis is as follows.

Thesis

- This is an absolutely solid business despite the lack of a credit rating and the choppy, volatile earnings and dividend history as well as political instability.

- If bought at the right price, RGR is a proven candidate to deliver solid Alpha over both short and long periods of time. I have seen this before, and successfully played the “Options” road here.

- You’re also investing in a timeless segment. As long as humans have been around, we have fashioned weapons to defend ourselves and our loved ones with, as well as for sport. This is a modern iteration of this, and that’s why I invest in it at the right price.

- RGR is a “BUY” with a PT of $72 for the long term, not changing my PT here. I’m impairing heavier for inflation, input, and the fact that I expected demand to stay somewhat higher than we’re seeing here.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

This means that the company fulfills every single one of my criteria except it being cheap, making it relatively clear why I view it as a “BUY” here.

Read the full article here