While United Parcel Service, Inc. (UPS) and FedEx Corporation (FDX) usually get a lot more attention, competitor DHL Group (OTCPK:DPSTF), which changed its name to Deutsche Post AG about a year ago, is rather pushed to the background, although all three rivals are generating more or less a similar amount of revenue annually.

I covered DHL Group the last time in January 2024 and was cautiously optimistic, but still rated the stock as a “Hold”. In my last article, I wrote:

We could make the argument that DHL Group is fairly valued at this point or even slightly undervalued. However, the scenario above does not really take into account the risk of another major recession or depression. And as I lean rather towards the side of caution and as we don’t know what will happen, I will rate the stock rather as a “Hold”

In the meantime, the stock declined from almost €45 (the price it was trading for when my last article was published) to slightly below €40 right now. This is a decline of 11% and is not only a huge underperformance of the S&P 500 (SPY), which gained about 15% in the same timeframe, but seems also enough to take another look at DHL Group and ask the question if it is a good investment now.

Latest Results

When looking at a company and stock and trying to assess if it is a good investment or not, I usually start with the last quarterly results, which tell us a little bit about how the business is performing. In the case of DHL Group, we see a similar picture as in the last fiscal year, with the top and bottom line rather declining.

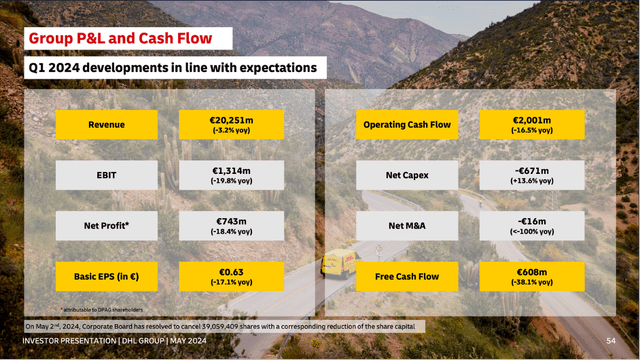

In the first quarter of fiscal 2024, DHL Group generated €20,251 million in revenue and compared to €20,918 million in revenue, this is a decline of 3.2% year-over-year. Profit from operating activities (EBIT) also declined from €1,638 million in the same quarter last year to €1,314 million this quarter – resulting in a 19.8% year-over-year decline. And finally, diluted earnings per share also declined 17.1% year-over-year from €0.76 in Q1/23 to €0.63 in Q1/24.

DHL Group Roadshow Presentation May 2024

And while the income statement is characterized by double-digit declines for most items, the cash flow statement is showing a similar picture. In our case, it is especially the free cash flow, which declined from €983 million in Q1/23 to €608 million in Q1/24 – resulting in a 38.1% year-over-year decline.

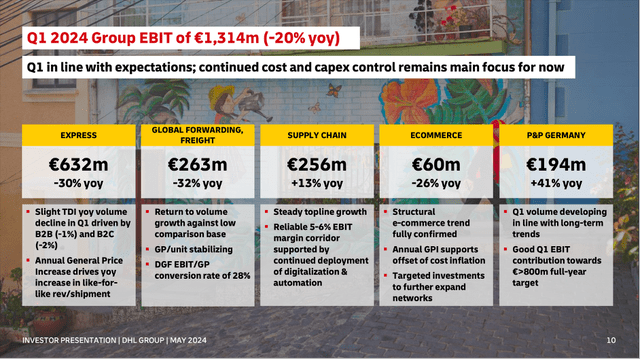

We can also look at the different segments and see not all the five different segments contributing to declining revenue and/or declining EBIT. The most important segment for DHL Group is the Express segment, which generated a total revenue of €6,006 million in the first quarter of fiscal 2024. Not only is the segment responsible for almost 30% of total revenue, it generated €632 million in EBIT and was therefore responsible for 48% of total EBIT. However, the segment had to report declining revenue (4.4% YoY decline) as well as declining EBIT (30.0% YoY decline).

Aside from the Express segment, DHL Group has three segments, generating between €4 billion and €4.7 billion in the first quarter. This includes the segments Freight, which generated €4,617 million in revenue, Supply Chain, which generated €4,333 million in revenue, as well as Post & Parcel Germany, which generated €4,266 million in revenue. And while Supply Chain (13% year-over-year growth to €256 million in EBIT) as well as P&P Germany (41% year-over-year growth to €194 million) could grow, the Freight segment had to report declining EBIT (32% YoY decline to €263 million).

DHL Group Roadshow Presentation May 2024

The last segment, which is growing at a rather high pace, is eCommerce. In Q1/24, this segment generated €1,633 million in revenue, resulting in 8.5% year-over-year growth. But while the top line was increasing, EBIT declined 26% year-over-year to €60 million.

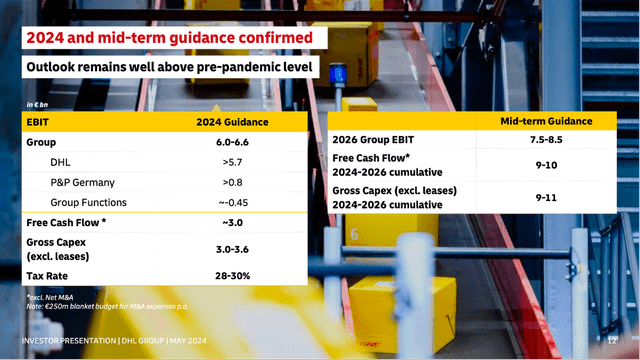

Return On The Path Of Growth?

Although DHL Group had to report declining revenue and declining EPS in the last few quarters, management confirmed its guidance for fiscal 2024. EBIT is still expected to be between €6.0 billion and €6.6 billion – and at least €5.7 billion will stem from DHL (including all segments aside from P&P Germany) and at least €0.8 billion in EBIT will stem from Post & Parcel Germany. Free cash flow for 2024 is expected to be around €3.0 billion (according to the company’s own mid-term guidance).

DHL Group Roadshow Presentation May 2024

DHL Group also issues a short-to-mid-term guidance for the fiscal years 2024 until 2026. In total, the expected free cash flow is ranging between €9 billion and €10 billion for these three years cumulated.

DHL Group Roadshow Presentation May 2024

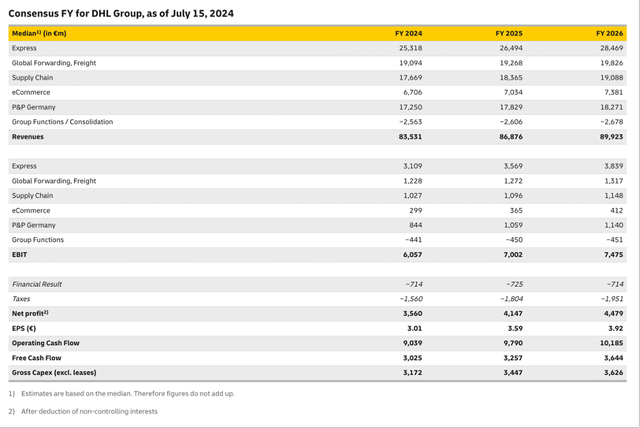

And when looking at consensus estimates of analysts, they are similar optimistic as management – or maybe even a little more optimistic. In case of free cash flow, analysts are expecting rather high-growth rates and the estimates range at the upper end of management’s guidance range.

DHL Group Investor Relations

Overall, I think we can expect DHL Group to grow at least in the low-to-mid-single digits. When looking at the performance in the last ten years, revenue increased with a CAGR of 4.03% while operating income increased with a CAGR of 7.98% and finally, earnings per share increased with a CAGR of 6.24%. And according to Seeking Alpha, analysts are expecting revenue to increase with a CAGR of 3.07% in the next nine years until fiscal 2033. When combining the top-line growth with slightly improving margins and continuing share buybacks, 5% growth certainly seems realistic.

And when looking at different studies for the global logistics and freight market, expected growth rates range between 4% CAGR for the freight forwarding market to 5.11% CAGR for the freight and logistics market. Another study sees growth rates around 4.5% annually for the years to come.

Global Crash Getting Nearer?

For the long term, I think we can expect the market to grow with a solid pace in the low to mid-single digits. However, for the next few years the picture might look a little bit different and as I have explained in my last article about Morningstar, Inc. (MORN), I see the picture slowly getting worse and the U.S. economy is headed for a recession.

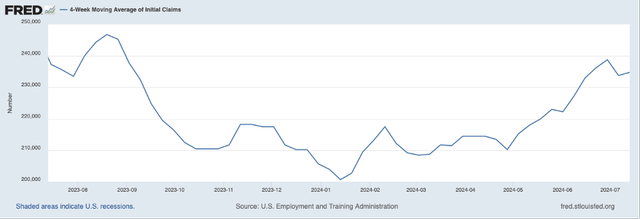

One of the numbers we are looking at are the initial claims for unemployment insurance and since January 2024, we see the number creeping higher, which could be a warning sign. However, we must be very cautious in interpreting these numbers as fluctuations are normal and in 2023, we see a similar rise without a recession occurring, and we are already seeing the number declining again a little bit. On the other hand, it is not just the initial claims increasing in the last few months, the unemployment rate is also constantly increasing from 3.4% in April 2023 to 4.1% in June 2024.

FRED

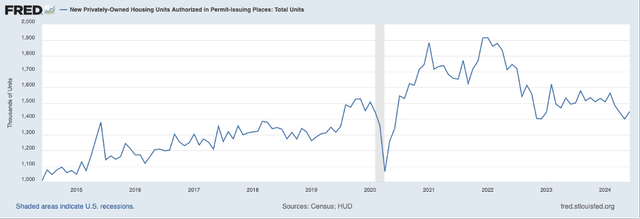

A second metric worth mentioning here are the new privately owned housing units authorized in permit-issuing places. When looking at the housing market, this metric is one of the best early warning indicators, as permits are among the first steps people have to take when building a house. This metric already started declining in 2022 and after declining for one year, it was stabilizing at a lower level and remained in a narrow corridor in 2023 and early 2024. Now, the number started declining again in the last few months; however, the last reported number was a slight improvement again.

FRED

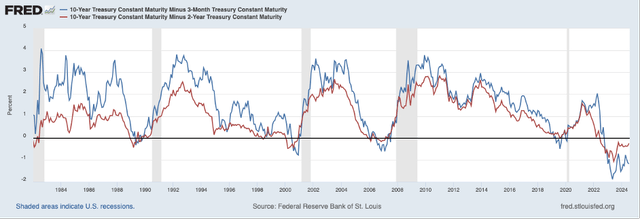

And finally, the yield curve itself is also interesting. As mentioned above, the yield curve is giving us an early warning sign about a potential recession when the yield curve is inverting. However, the yield curve is not just giving us one signal – we often get a second signal before the recession actually occurs. Not only does the yield curve invert before the recession occurs, the yield curve usually also gets back to normal before the economy enters the recession.

FRED

In my article Why The Yield Curve Is Not Broken I argued in more detail what I expect in the coming quarters and why I still think we are headed for a recession despite the yield curve being inverted for a really long time.

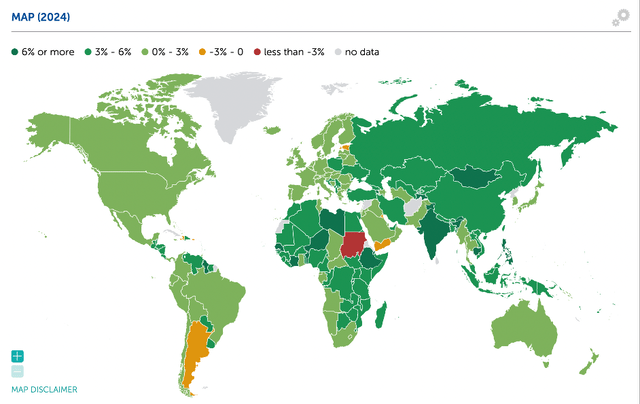

We should also point out that we are mostly talking about the United States here, but DHL Group is also operating in Europe and has a huge market share in many European countries. According to the IMF, the United States will grow GDP still 2.7% in 2024. However, most European countries are expected to grow much lower – Germany for example is expected to grow 0.2%, France is expected to grow 0.7% and the United Kingdom is expected to grow 0.5%.

GDP Growth Rates Fiscal 2024 (IMF)

And when looking at the last three recessions, we see DHL Group declining steeply in every single one. In 2020, DHL Group also declined steeply, but recovered quickly (similar to many other stocks) – especially as it became obvious that DHL Group might be one of the companies profiting from the pandemic. In the other two recessions – Dotcom Bubble crash and Great Financial Crisis – the stock declined extremely steep, and it took years before it recovered. Especially during the Great Financial Crisis, the stock lost 75% of its previous value.

Intrinsic Value Calculation

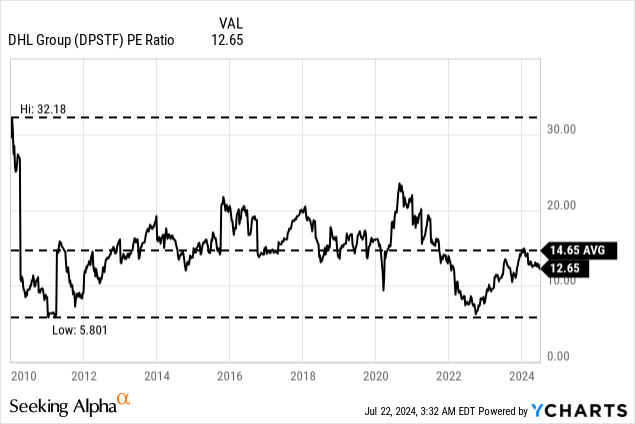

A final step – as always – is determining an intrinsic value for a stock. For starters, we can look at the price-earnings ratio. Right now, DHL Group is trading for 12.6 times earnings, which does not seem so expensive and is below the average P/E ratio of 14.65 since 2010 (the timeframe for which we have data). Especially when keeping in mind that DHL Group should be able to grow at least in the low-to-mid-single digits in the years to come and the company also having an economic moat around its business (as explained in a previous article), the P/E ratio of 12.6 seems rather cheap. And the wide economic moat cannot prevent the business declining during recessions, but it will protect DHL Group from losing market shares to new competitors. Of course, DHL Group has to compete with UPS and FedEx, and we also have to watch Amazon (AMZN) if the company will be able to take market shares away from competitors. But due to the necessary distribution network, it is extremely difficult for small companies to enter the market.

Another way to look at DHL Group and determine an intrinsic value is by using a discount cash flow calculation. In such a calculation, we are using the last reported number of outstanding shares (1,173 million in case of DHL Group) and a 10% discount rate (as always). As basis for our calculation, we can use €3.0 billion in free cash flow and in my opinion, we can argue for at least 4% growth until perpetuity as a realistic assumption for DHL Group. When calculating with these assumptions, we get an intrinsic value of €42.63 for DHL Group, and the stock would be slightly undervalued at this point.

However, we can also make the case for assumptions being a little more optimistic. In my last article, I calculated with 5% growth, and I think assuming 5% growth again is not unreasonable. Additionally, we can use the free cash flow assumptions by analysts for the years 2024 until 2026 (see chart above). When calculating with these assumptions, we get an intrinsic value of €55.99, and the stock would be clearly undervalued at this point and a “Buy”.

Conclusion

I think we can call DHL Group a “Buy” at this point. The stock seems to be undervalued and is probably a good long-term investment. However, we should not ignore the risk of lower stock prices in the next few quarters as I see the risk of a global recession on the horizon and such a scenario would clearly have an impact on DHL Group. The business is in some ways dependent on the state of the economy, and in previous recessions we saw the stock declining steeply.

When buying the stock right now, we should hold the stock for the long term (at least ten years) and be prepared for stock price fluctuations in the next few years. In the meantime, we can collect dividends and with a current dividend yield of 4.6% for DHL Group, the stock is certainly interesting for dividend investors.

On August 01, 2024, Deutsche Post will report its half-year results for fiscal 2024 and the earnings release as well as earnings call will provide some information about DHL Group as well as the economy. Global shipping and freight are often among the first industries to get into trouble when the economy is in decline and UPS, which reported quarterly results a few days ago, which rather disappointed investors. On the other hand, FedEx generated optimism among its investors and could beat revenue as well as EPS estimates at least slightly. It remains to be seen what results DHL Group will report on Thursday.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here