Last month, I discussed why Newmont (NYSE:NEM)(TSX:NGT:CA) was one of my top gold stocks for this gold bull market.

The summary thesis was as follows:

Poor Performance Resulted In Big Discount

- NEM had been the worst-performing senior gold producer over the prior few years and one of the poorest-performing mining stocks overall.

Highest Quality And Most Diverse Portfolio In the Sector

- Newmont is by far the largest gold producer in the world and has the highest-quality portfolio of assets in the sector. In addition, the Newcrest acquisition seriously beefed up Newmont’s portfolio of copper operations and projects.

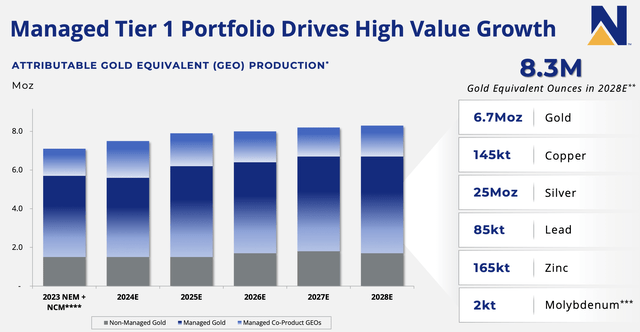

Continued Increases In Production And Wide Margins

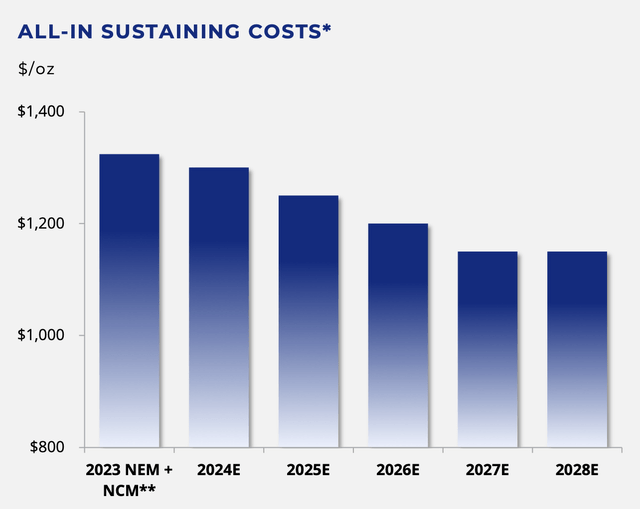

- The company expects incremental annual production growth to over 8 million GEOs by 2028. Even assuming continued high inflation only results in flat AISC over the next five years instead of declining AISC as Newmont forecasts, it still translates into ~$1,000 per ounce margins at current gold prices.

Meaningful Turnaround In Cash Flow + Asset Sales

- Newmont would see a notable improvement in OCF and FCF in Q2 2024. The dramatic free cash flow generation and upcoming asset sales would mean rapid paydown of the ~$6.8 billion of net debt and an even lower enterprise value.

Minimal Downside

- The downside for NEM was minimal with gold above $2,000, while the upside potential was anywhere from 30% with no movement in the gold price to 80% if gold heads even higher over the next year.

Best Buying Opportunity This Decade

- It was the best buying opportunity in the stock this decade and arguably the most compelling risk/reward play in the sector.

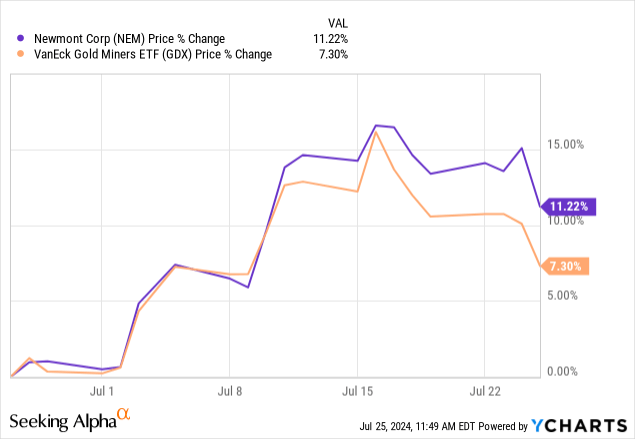

Since then, the stock has increased 11%, outperforming the VanEck Gold Miners ETF (GDX). NEM is down 3% today after the company reported earnings. Gold is also quite weak and under extreme selling pressure. Either way, I’m buying this dip in NEM.

Q2 2024 Results Review

Realized Gold Price And Cash Flow

The second quarter metrics that I focused on in my previous research note on the company were almost exactly as I forecast.

As I mentioned in my article last month, when NEM was still in Q2:

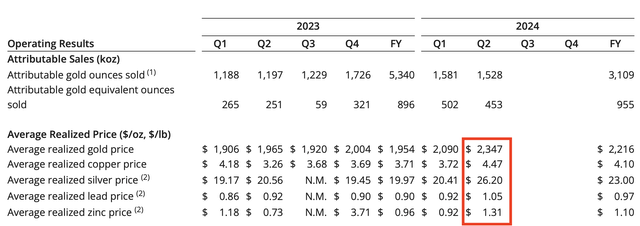

The company’s realized gold price last quarter was $2,090 per ounce. I would estimate that figure increased by ~$250 per ounce this quarter.

Newmont disclosed last evening that the average realized gold price increased by $257 per ounce to $2,347. I also want to highlight the surge in realized prices of silver and base metals.

Newmont

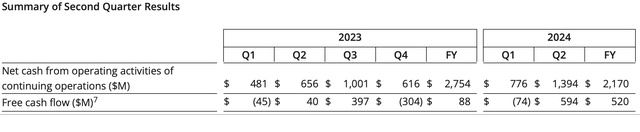

As for operating. cash flow, as I stated last month, using the same attributable gold ounces sold as in Q1 and the likely realized gold price, it would equate to ~$400 million of additional pre-tax operating cash flow or a 50% increase compared to the OCF reported in Q1. That also wasn’t accounting for the surge in other metal prices. Q1 was also impacted by negative changes in working capital, which included a one-off $291 million stamp duty payment for the Newcrest merger. In combination with the much higher realized gold price, my expectation was that operating cash flow after changes in working capital would likely more than double QoQ.

As for free cash flow, quote:

Assuming similar CapEx this quarter, Newmont should generate robust free cash flow, potentially north of $500 million.

Actual results are below, as operating cash flow increased 80% quarter-over-quarter (or $618 million), from $776 million to $1.39 billion. While I thought there was a good chance OCF would more than double, that was assuming similar ounces sold in Q2 compared to Q1 (NEM sold ~50,000 fewer ounces last quarter), and the quarterly results also included $263 million of unfavorable changes in working capital, primarily due to a build in stockpiles of $185 million. Free cash flow increased to $594 million, which was in line with my “potentially north of $500 million” forecast.

Newmont

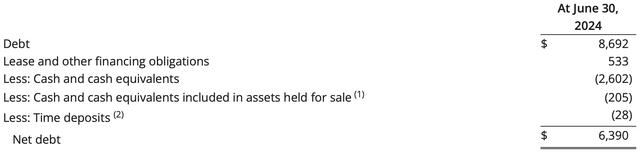

The free cash flow resulted in a $400 million reduction in net debt at the end of Q2 – or $6.39 billion compared to $6.79 billion at the end of Q1 2024.

Newmont

Dividends And Buybacks

Newmont also paid $289 million in dividends in Q2 and repurchased $104 million of shares in the quarter. This month, it’s repurchased $146 million of its stock or $250 million since last quarter.

NEM was crushed earlier this year after the company announced it was reducing the dividend, but investors didn’t understand the “whys.”

NEM paid a base dividend of $1.00 per share in 2023, with a variable component based on incremental free cash flow at higher gold prices. Investors were counting on a $1.60 per share dividend last year.

NEM continues to pay the $1.00 per share base dividend in 2024, but the variable component was removed starting in Q4 2023.

The details, though, are important.

There is a much higher share count now as a result of the Newcrest acquisition. In total, Newmont paid $1.4 billion in dividends last year, including the variable component. This year, it expects to pay $1.2 billion, so only slightly less, and that’s without a gold-linked bonus.

Also, NEM took on Newcrest’s net debt, which further increased by ~$1 billion as Newcrest paid its shareholders a special cash dividend before the close of the merger. Newmont wanted to use more free cash flow to reduce its debt burden.

Finally, Newmont announced a $1 billion share repurchase program in addition to the dividend as part of a more balanced return on capital framework. The company’s reasoning behind the decision was that a substantial number of shares were issued for Newcrest, and it would prefer to use some excess free cash flow to reduce the share count, which it’s doing. Considering how undervalued the stock has been, how could one be opposed to this decision?

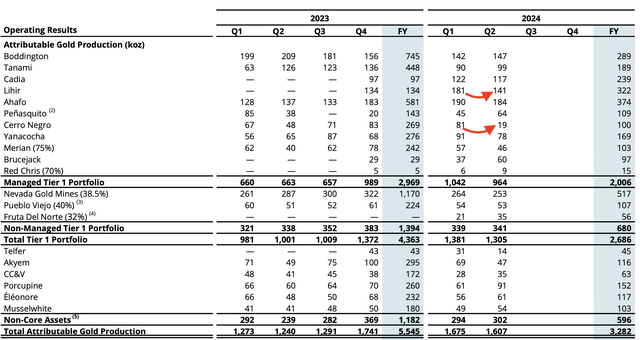

Lower Production And Higher AISC

Attributable gold production declined 4% QoQ to 1.607 million ounces as Newmont suspended operations at Cerro Negro on April 9, 2024, following the fatalities at the mine, and Lihir was negatively impacted due to heavy rainfall. Cerro Negro resumed operations on May 24, but the mine was unable to make up any of the shortfall, and production totaled just ~19,000 ounces in the quarter, down from 81,000 ounces in Q1. Production at Lihir dropped by ~40,000 ounces. The lower overall production, combined with the increase in sustaining capital in Q2 compared to the prior quarter, resulted in an AISC of $1,562 per ounce last quarter, or 9% higher than in Q1. This could partially explain the weakness in NEM today, which is unwarranted given the cash flow results and what’s expected in the second half of the year.

Newmont

Why Buy The Dip?

1) Even More Robust Cash Flow Ahead

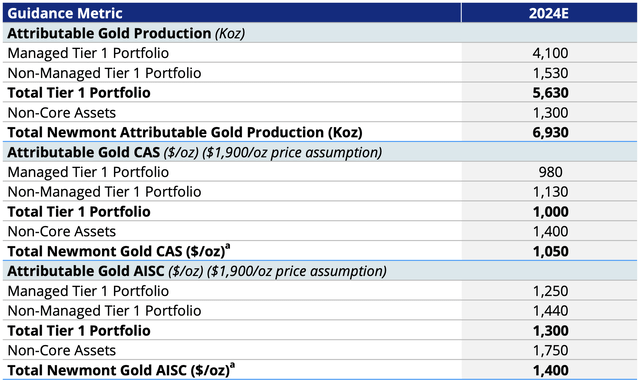

Newmont produced 3.28 million ounces of gold at an AISC of $1,500 per ounce in the first half of the year. 2024 guidance is expected to be second-half weighted due to increased grades at Peñasquito, Ahafo, and Tanami, higher gold output at Lihir and Boddington, and improvements at its non-managed assets (Nevada Gold Mines JV and Pueblo Viejo).

2024 guidance calls for full-year gold production of 6.93 million ounces at an AISC of $1,400 per ounce. Newmont reiterated guidance for the year, which means production in H2 should increase by more than 10% while AISC should drop to $1,300 or less. Even if there is a shortfall in production and higher-than-expected AISC in the second half, output should increase and costs decline compared to H1 2024, translating into even more free cash flow per quarter than the already robust Q2 results.

Newmont

High free cash flow is sustainable over the long term, as Newmont’s 5-year outlook shows further gains in production and increasing margins. I will reiterate that I’m pricing in flat AISC as I believe inflationary pressures will offset the expected decline. Even in that scenario, Newmont offers exceptional leverage to gold, exceptional margins, and exceptional long-term value. It’s a portfolio that should deliver impressive free cash flow through the rest of this decade and well into the 2030s.

Newmont Newmont

2) NEM Is Still Considerably Undervalued

Per my previous article on the company, with no movement in the price of gold, NEM would need to increase 30% to get in line with its peers and its fair value. While the shares have risen by 11% since then, they still trade at a healthy discount, and gold has also slightly increased since then.

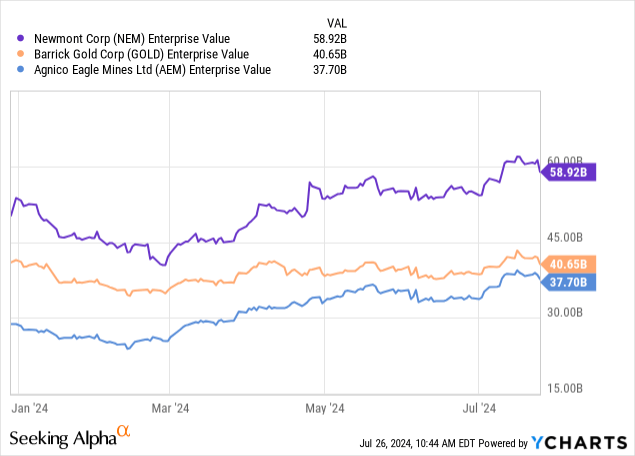

Newmont is ~2.3x the size of Agnico Eagle (AEM) in terms of production (~8 million GEOs for NEM vs. 3.5 million for AEM). AEM has lower jurisdictional risks and slightly better cash costs and AISC margins, but the quality of Newmont’s portfolio is superior, and Newmont also has numerous mega-growth projects (something that AEM lacks). AEM trades at an enterprise value of $38 billion. Even if we assume 10-15% higher operating cash flow on a per-ounce basis for AEM, given its better margins, NEM should trade at ~2x the enterprise value of AEM, or an EV of $76 billion. Yet NEM is only valued at ~$60 billion and would need to increase 30% to get in line with AEM. The discount to AEM is the same as it was in my previous article despite the increase in NEM, as Agnico has also risen in value. This valuation comparison also gives zero value to the six non-core assets that Newmont plans to divest. On a P/CF basis, NEM represents superior value to AEM. In terms of Barrick Gold (GOLD), the valuation gap is less, but NEM is underpriced by comparison and offers better risk/reward.

While there is plenty of upside in NEM at the current gold price, there is also a realistic scenario in play where gold breaks out to new all-time highs between now and the end of the year and accelerates, which will result in an even more dramatic re-rating in NEM.

3) Asset Monetization

Newmont is looking to sell six non-core assets – CC&V, Éléonore, Musselwhite, Porcupine, Akyem, and Telfer – which produce ~1.3 million ounces of gold per year.

These are all higher-cost mines, but they still should command $1.5 – $2.0 billion of value, and we are in a prime selling market with the price of gold breaking out to record highs over the last few months.

Asset sales will act as bullish catalysts and further drive the re-rating.

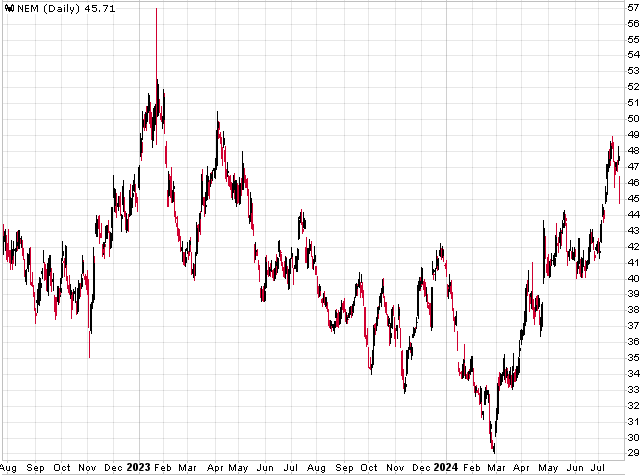

A Healthy Pullback

NEM was overbought in the short term as of last week, and the drop from the recent peak is healthy consolidation. The shares could still drift lower before they reverse, but I still expect NEM to hit new highs for the year within the next few months. The fundamentals support continued price appreciation, and Q2 results show the bullish thesis is playing out as forecast.

StockCharts.com

Risks To The Thesis

A few of the many pluses about Newmont that help me sleep well at night owning the stock are the company has an incredibly diversified asset base, with the majority of production coming from favorable jurisdictions in the Americas and Australia, and it has such strong margins that it will generate robust cash flow even at lower gold prices.

However, that doesn’t mean NEM is a risk-free investment.

Not including a major downdraft in the gold price, the main risks I see are:

1) Peñasquito is a large open-pit mine in Mexico. The country isn’t permitting any new open-pit projects, and a new President is taking office in a few months that has discussed an open-pit ban. It’s unclear whether any policy change will include currently producing mines or only projects in development.

Peñasquito only accounted for 3-4% of Newmont’s gold production in the first half of this year, but the operation makes up over half of the company’s additional co-product GEO production and 13% of Newmont’s total GEOs.

There was also a lengthy (4-month) mine strike at Peñasquito last year that seriously impacted production.

2) Will the Newcrest assets that Newmont acquired actually live up to the expectations and the conclusions drawn from the due diligence conducted? While not an extreme risk, until NEM has operated these mines for at least another 6-12 months, there is the potential that some might underperform, especially on the cost side.

The two risks highlighted above are already priced into the stock. Even if Peñasquito was offline, the fair value of Newmont would be higher than the stock is trading at today as Peñasquito doesn’t account for 20-30% of Newmont’s NAV.

Read the full article here