By Dmitry Khaykin & Deepon Nag

Green Hydrogen Eyes Heavy Industry Market Overview

U.S. equities continued to be a tale of two cities, as enthusiasm for artificial intelligence and new weight loss drugs drove an increasing concentration of “winners” while slowing economic indicators weighed on the broader market. Against this backdrop, the Russell 1000 Value Index trailed its growth counterpart in the quarter, returning -2.17% to the Russell 1000 Growth Index’s 8.34% return. Value stocks took a defensive turn in the quarter, with utilities and consumer staples leading as the market rotated out of more cyclical sectors toward companies with more stable earnings, and as some utilities began to get credit for their role in powering the data centers on which AI relies. More economically sensitive and commodity-linked sectors, such as materials and energy, trailed due to rising disinflation and cracks in industrial and consumer activity, which also weighed on consumer discretionary stocks.

Against this backdrop the Strategy modestly underperformed the benchmark, despite strong showings from health care and communication services holdings. In health care, McKesson (MCK), a drug distributor, raised its EPS guidance to reflect mid-double-digits growth for the coming fiscal year. The company is benefiting from a stable competitive environment, as well as large share gains such as its recent partnership with UnitedHealth’s (UNH) OptumCare business. McKesson is also a beneficiary of the growth of GLP-1 medications for diabetes and obesity, with revenues from GLP-1s making up a sizable portion of recent growth in its U.S. pharmaceutical segment (albeit at relatively low profitability). We continue to see the company as a durable compounder, with limited sensitivity to the broader macro economy, and which we believe warrants a higher valuation.

In communication services, Alphabet (GOOG,GOOGL) remains an online advertising leader, with AI tailwinds starting to ramp up while Google Search is trending above expectations. AI overviews are not yet moving the needle, but query volume and conversion rates are picking up.

Main contributors also included Air Products and Chemicals (APD), which signed a 15-year agreement to supply TotalEnergies’ (TTE) European refineries with 70,000 tons of green hydrogen a year starting in 2030. The hydrogen will avoid around 700,000 tons of CO₂ each year and help TotalEnergies reduce its net greenhouse gas emissions (Scope 1 and 2) by 40% by 2030 compared to 2015. The deal represents an important step as APD begins to execute on a large backlog of major hydrogen projects that can provide commercial scale green hydrogen to decarbonize heavy industry. It also accounts for one-third of the initial capacity of APD’s Neom project, so other transactions, with TotalEnergies or other parties, appear likely. If future deals have similar economics, they will continue to support double-digit returns for the Neom project.

“PC and server markets remain depressed, but we believe that aging infrastructure and the ongoing growth of IT workloads will lead to a cyclical recovery.”

Utilities rose largely on merchant power companies serving the data centers powering AI; the rest of the sector, along with real estate, suffered as rate cut expectations were pushed out. One exception was our holding Sempra (SRE) – a well-managed and diversified utility holding company. Sempra possesses large franchises in Texas and California, as well as a large LNG business. Sempra is a leading player in each of its markets and all its segments enjoy robust growth outlooks, which should drive high-single-digit growth for the company overall. Sempra, along with other California utilities, recently filed a California Public Utilities Commission application for hydrogen blending demonstration projects to help reduce methane emissions and achieve the state’s net-zero goal in 2045.

The massive ramp up in spending on AI spending has crowded out spending in other technology verticals such as software and traditional enterprise infrastructure. This has also driven a market where “AI winners” have enjoyed strong multiple expansion, while perceived “AI losers” have been severely punished. One example of a perceived AI loser was the Strategy’s top detractor for the quarter, Intel (INTC), whose shares declined as it put out financial targets for 2027 that were below Wall Street expectations, and also noted that demand for its core PC and server chips remained depressed. We take a contrarian view of Intel and do not think it will be an AI loser, but rather see underappreciated opportunity as AI PCs ramp over the next few quarters in enterprises, where Intel has a stronghold. We also believe that the company’s technology roadmap remains intact, which we believe will lead to a stabilization in market share in its core PC and server markets. Both markets remain depressed, but we believe that aging infrastructure and the ongoing growth of IT workloads will lead to a cyclical recovery in both markets, which should benefit shares.

Also among detractors, CVS Health (CVS) is coping with a prolonged uptick in the utilization of medical services by its Medicare Advantage clients, which has coincided with government pressure on payer reimbursements. In this environment, CVS severely mispriced its Medicare Advantage book in an attempt to gain share, which has led to large losses in its insurance business. While we believe it will take some time to recover profitability in the segment, the short cycle nature of managed care insurance along with the company’s focus on “margins over members” gives us confidence that it will be able to grow earnings over the next few years. With the stock trading at a very low multiple, we believe the market is capitalizing these losses in perpetuity, which we view as overly pessimistic and which should set the stock up for strong returns over the medium term.

Our industrials holdings weighed on relative performance as we are more exposed to transports such as “less than truckload” provider XPO (XPO) and parcel delivery company United Parcel Service (UPS), which are struggling with weak volumes during the post-COVID freight recession. With industry volumes down to pre-COVID levels and strong pricing power in the LTL space in particular, we believe that the next upcycle will prove to be very strong for earnings. As a result, we added to XPO in the quarter while reducing our position in UPS on concerns that industry capacity remains excessive. Meanwhile, we have less exposure to electrical equipment stocks, which have been rewarded by views that they will benefit from the buildout of AI data centers.

Portfolio Positioning

Portfolio adjustments were modest during the quarter as we maintain our thesis on most of our holdings despite near-term sentiment. We continued to build out our position in Nestle (OTCPK:NSRGY), which we initiated late in the first quarter. Nestle is a large global manufacturer of foods and beverages with a high-quality portfolio of brands across many categories. It is especially strong in pet care, coffee and nutritional beverages, which are all advantaged categories enjoying superior growth. Recently, Nestle stumbled with an enterprise resource planning (‘ERP’) transition in its health science division, resulting in missed orders and a period of out of stocks in some of its U.S. vitamins, minerals and supplements. This drove negative revisions in guidance, and (along with overall sector sentiment) caused the stock to sell off to levels not seen since 2019. Our research shows that the disruptions from the ERP transition are temporary, and Nestle’s brand portfolio should offer consistent mid-single-digit revenue growth, which should merit a re-rating back to a premium multiple versus the lower-growth food and beverage group. Following the selloff, the stock is trading at an attractive valuation.

The only outright sell was Charter Communications (CHTR), which we had reduced to a marginal position, and which we sold amid ongoing competitive threats to its broadband business from fixed wireless and fiber.

Outlook

We are aware of potential volatility from several quarters – the U.S. presidential election, interest rate uncertainty, economic slowing – but look at the portfolio with a bottom-up perspective focused on the strength of the franchises we own and their competitive positioning, which we believe will provide strong stable returns through any macroeconomic environment. We also believe that the divergence in valuations between perceived AI winners and losers has created a number of attractive opportunities where high-quality companies are being underappreciated.

Portfolio Highlights

The ClearBridge Large Cap Value ESG Strategy underperformed its Russell 1000 Value Index benchmark during the second quarter. On an absolute basis, the Strategy saw positive contributions only from the utilities sector of the 11 sectors in which it was invested. The IT, industrials and health care sectors were the main detractors.

On a relative basis, overall stock selection detracted from performance while sector allocation was positive. In particular, stock selection in the IT, industrials and consumer staples sectors detracted from relative returns. Conversely, stock selection in the health care and communication services sectors, a utilities overweight and a consumer discretionary underweight were beneficial.

On an individual stock basis, the largest contributors were Alphabet, Sempra, McKesson, Air Products and Chemicals and Motorola Solutions (MSI). Positions in Intel, CVS Health, Sherwin-Williams (SHW), Travelers (TRV) and Martin Marietta Materials (MLM) were the main detractors.

ESG Highlights: Dispatches from the Circular Economy

The Ellen MacArthur Foundation lists three basic principles of the circular economy: eliminating waste and pollution, circulating products and materials, and regenerating nature. These principles align with some key parts of ClearBridge’s fundamental ESG framework, notably factors such as resource efficiency, recycling, product life cycle management, renewable generation and land usage, which we engage on as part of ongoing company research. By reducing energy use, stress on the environment and pollution, the circular economy is also linked to mitigating climate change and conserving biodiversity.

Many ClearBridge holdings thus contribute to the circular economy as they either execute on best practices or make improvements in these areas. We have often highlighted Trex (TREX) as exemplary of the circular economy. Trex is the market share leader of wood-alternative composite decking. Trex’s low-maintenance and high-quality decking products are composed of 95% recycled wood fibers and plastic, making use of waste that would otherwise end up in landfills. Trex has continued to innovate and advance plastic recycling processes. Recently, as the demand for “clean streams” of plastic waste has increased in different parts of the economy, Trex has upgraded technology to be able to accept “dirtier” streams of plastic waste into the manufacturing process. This allowed Trex to begin using additional quantities of waste plastic that would otherwise never be recycled, without compromising product quality standards. Trex products are more durable and have a longer life than traditional wood decking, therefore reducing overall raw material usage and end-product manufacturing. Finally, the quality and durability of the product saves consumers money through less frequent replacements and lower maintenance and upkeep costs.

Molecular Recycling Takes a Step Forward

While companies like Trex are making clear gains on plastic recycling, a circular economy that solves for plastics use remains a challenge. Regulatory bodies are stepping up requirements, such as the EU’s new rules to reduce, reuse and recycle packaging, provisionally agreed upon in March 2024. Under the new rules, plastic packaging must also include minimum recycled content. Helping companies meet these new rules will be ClearBridge holding Eastman Chemical (EMN), which makes a range of advanced materials, chemicals and fibers for everyday purposes, among them plastics for food packaging.

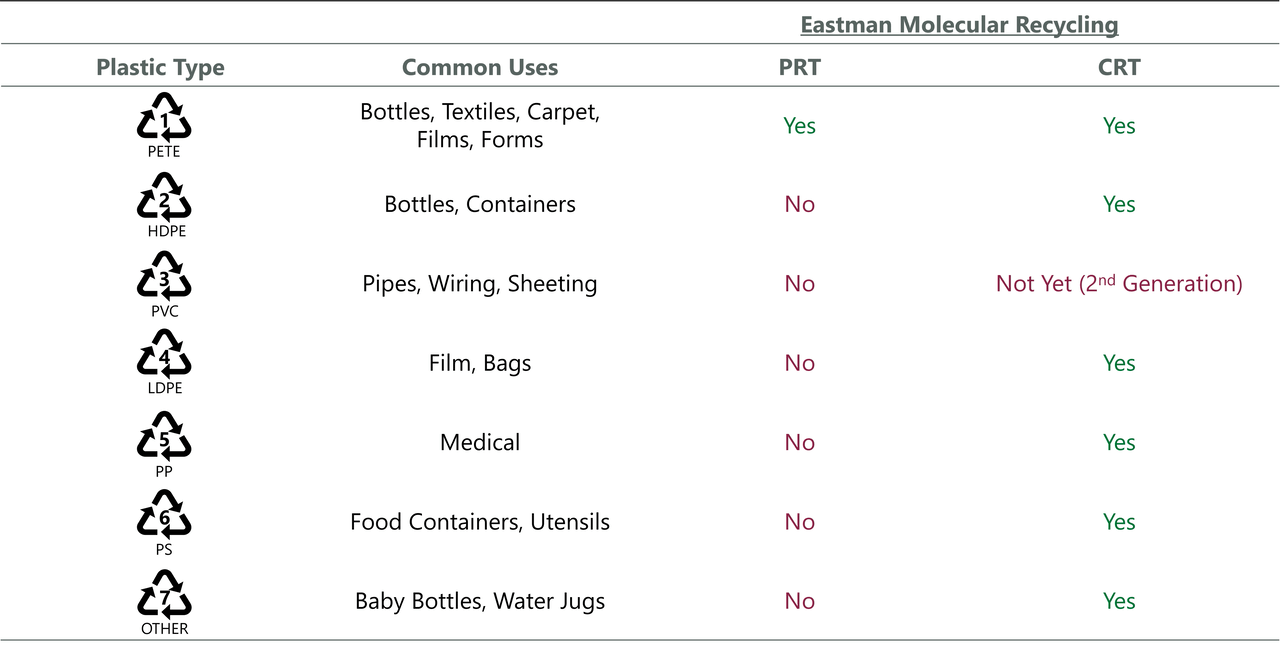

In a recent engagement with Eastman Chemical we discussed two different chemical recycling technologies it has developed: polyester renewal technology (‘PRT’) and carbon renewal technology (‘CRT’). PRT recycles polyester-based materials such as soda bottles, carpet fibers and even clothing, breaking down their basic molecules until they are indistinguishable from materials made from virgin or nonrecycled content. CRT operates in a similar way but can take a broader range of plastic types and replaces the use of coal as a feedstock to make fibers. Combining these two technologies gives Eastman a competitive advantage in molecular recycling, as it can take most types of waste plastics (Exhibit 1). Ironically, securing feedstock (i.e., waste plastic) has been a bottleneck to scaling molecular recycling as competitor technologies not using Eastman’s dual technologies often require the waste plastic to be separated purely according to grade, which waste and recycling companies do not readily offer. Eastman’s dual technology approach allows it to accept most plastic grades, making it less reliant on waste companies’ sorting.

Eastman’s first recycling plant is now operational in Tennessee, which will supply its internal Advanced Materials lines while also proving out the technology. The company is already working toward a second plant in Texas that will have Pepsi (PEP) as its anchor customer. In the second plant, not only will Eastman help Pepsi meet its recycled content goals, but it is also expected to receive long-term, take-or-pay volume commitments, for doing so. This should greatly improve earnings visibility, and in turn, potentially valuation.

Exhibit 1: Eastman Chemical’s Molecular Recycling Methods

Source: Eastman Chemical.

Sustainable Food Needs Sustainable Plastic

As the case of Eastman Chemical suggests, plastic is central to sustainable food. Accordingly, companies in the food industry can advance the circular economy through practices such as recycling, reducing or improving the sustainability of packaging and reducing landfill waste. Canadian grocer Loblaw (OTCPK:LBLCF) can make an impact with all three of these practices.

In a recent engagement with Loblaw, we discussed its goal of making 100% of its control brand and in-store plastic packaging recyclable or reusable by 2025. This would put it in compliance with the Golden Design Rules (‘GDR’), a set of rules established by the Consumer Goods Forum, made up of leading international retail and consumer goods companies, to benchmark packaging design, emphasizing the reduction of materials and the removal of problematic elements.

Noteworthy steps along the way have involved changes to Loblaw’s protein packaging, which used to come in polystyrene foam trays; the vast majority now are packaged in clear recycled PET trays, which are accepted in all the municipalities in which the store operates and allow for greater detectability in the recycling stream. The shift to PET trays for mushrooms led to 39.9 million trays entering the recycling stream in 2023. Removing the plastic window from 10 kg potato bags allowed 23 million bags to be more easily recycled in 2023. In addition, extending expiry dates for its PC Money Account and PC Mastercard physical cards should prevent more than 10,000 kgs of plastic waste in the next 12 years.

Loblaw’s advances in these areas also speak to its power to use its size to change the industry, as it communicated its GDR standards to hundreds of control brands and national brand vendors, effectively dictating a new national industry standard for plastic packaging. While navigating recycling standards and practices that vary from municipality to municipality, to improve recycling rates overall Loblaw supports extending producer responsibility, a system that give brand owners responsibility of both the cost and performance of recycling systems, incentivizing them to increase the recyclability of their packaging while empowering them with control over the recycling systems themselves.

Food waste is an avoidable crisis that has both environmental and societal costs, and linking food as an organic resource in a circular economy can reduce land use and better support growing populations. Loblaw has set a goal to send zero food to landfill by 2030, a goal supportive of Sustainable Development Goal 12: Responsible Consumption and Production, in particular target 12.3, to halve global food waste by 2030. The company is currently ramping up data collection on food waste but achieved over 78,000 metric tons of diverted food waste in 2023, with most going to composting, animal feed and redistribution of food surplus to food charities.

Supplying the Auto Aftermarket

LKQ is also focused on recycling heavy materials. LKQ is the largest wholesale distributor of alternative parts for the auto aftermarket in North America and Europe. It provides “like kind and quality” (‘LKQ’) auto parts as lower-cost alternatives to those provided by auto OEMs. It is the largest wholesale distributor of collision parts (used to repair vehicle exteriors) in the U.S. and Canada and the largest distributor of mechanical parts (used to repair internal components) in Europe. LKQ also runs its own salvage and recycling operations. As the world’s largest recycler of cars at end-of-life, recovering 90%+ of the materials from scrap cars for reuse or recycling, LKQ supports resource efficiency and responsible consumption as an investable theme.

In a recent engagement with LKQ we had an extensive discussion about how it has become increasingly efficient over time at inventorying and selling more parts from its salvage vehicles, which reduces the amount of parts going for scrap and increases LKQ’s margins, as it earns higher revenues from same fixed cost of goods.

Circular Economies Span All Sectors

One powerful aspect of the circular economy is how, although with differing dynamics and levels of challenges, every sector may contribute. ClearBridge will continue to share key company advances and engagements on the topic as our holdings innovate to operate more efficiently and enable a more resilient economic system, with fewer emissions and less waste.

Dmitry Khaykin, Managing Director, Portfolio Manager

Deepon Nag, Portfolio Manager

|

Past performance is no guarantee of future results. Copyright © 2024 ClearBridge Investments. All opinions and data included in this commentary are as of the publication date and are subject to change. The opinions and views expressed herein are of the author and may differ from other portfolio managers or the firm as a whole, and are not intended to be a forecast of future events, a guarantee of future results or investment advice. This information should not be used as the sole basis to make any investment decision. The statistics have been obtained from sources believed to be reliable, but the accuracy and completeness of this information cannot be guaranteed. Neither ClearBridge Investments, LLC nor its information providers are responsible for any damages or losses arising from any use of this information. Performance source: Internal. Benchmark source: Russell Investments. Frank Russell Company (“Russell”) is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company. Neither Russell nor its licensors accept any liability for any errors or omissions in the Russell Indexes and/or Russell ratings or underlying data and no party may rely on any Russell Indexes and/or Russell ratings and/or underlying data contained in this communication. No further distribution of Russell Data is permitted without Russell’s express written consent. Russell does not promote, sponsor or endorse the content of this communication. |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here