I last covered the PIMCO Multisector Bond Active Exchange-Traded Fund (NYSEARCA:NYSEARCA:PYLD) in late 2023. The fund was brand new at the time, but I was bullish due to PIMCO’s strong track record and the fund’s above-average 5.5% dividend yield. PYLD has significantly outperformed its bond peers since, due to its above-average dividends, below average 4.6 duration, and strong active management. Volatility has been below average, too, although the fund has yet to experience an actual bear market. PYLD’s fundamentals remain strong, and so the fund remains a buy.

PYLD – Overview and Analysis

Strategy and Portfolio

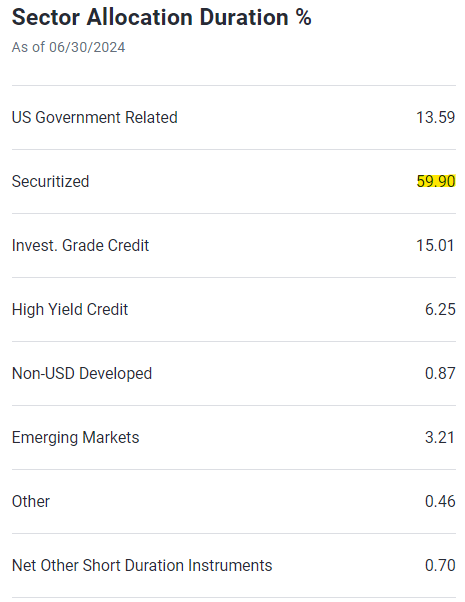

PYLD is an actively managed diversified bond ETF. It invests in most relevant bond sub-asset classes, but clearly focuses on mortgage-backed securities and collateralized mortgage obligations, or MBS and CMOs. It focuses on investment-grade securities, with smaller investments in high-yield. It currently invests in over 1,000 different bonds.

JPMorgan Guide to the Markets

Overall, PYLD is an incredibly well-diversified bond ETF, much more so than average, perhaps a bit less so than the largest, most diversified bond ETFs in the market. These include the Vanguard Total Bond Market Index Fund ETF (BND) and the iShares Core U.S. Aggregate Bond ETF (AGG).

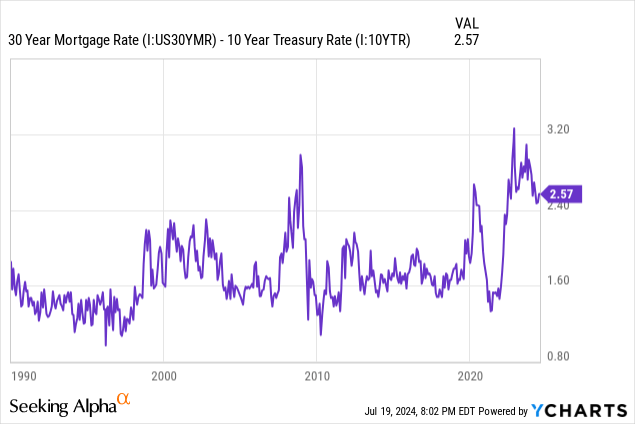

Right now, mortgage rates are much higher than average, with newly-issued MBS trading with attractive spreads relative to treasuries and other investment-grade bonds. Spreads are at their widest in decades.

Data by YCharts

Considering the above, focusing on MBS and CMOs, like PYLD does, seems like a good idea. I have further thoughts on these issues here.

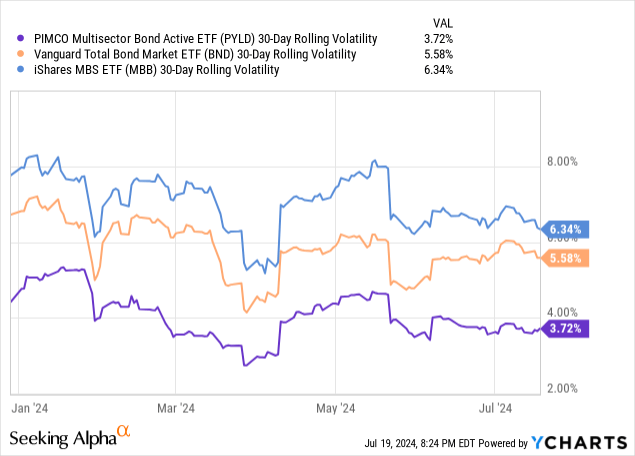

PIMCO bond ETFs sometimes use leverage, with PYLD sporting a 1.36x leverage ratio right now. Sometimes these leveraged positions are hedges or swaps that do not meaningfully increase portfolio risk, volatility, or drawdowns. From looking at the fund’s portfolio, it seems that its leverage is of the more traditional sort, but I’ve yet to see it reflected in the fund’s performance. PYLD’s performance does not seem meaningfully more volatile than average:

Data by YCharts

Realized volatility has, in fact, been lower:

Data by YCharts

In any case, PYLD’s leverage should boost the fund’s yield, returns, risks, and drawdowns moving forward. The effect has been muted so far, however.

Credit Quality

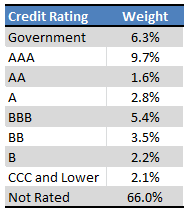

PYLD focuses on bonds without credit ratings, with these accounting for around 2/3rds of its holdings. Credit ratings are as follows:

PYLD – Table by Author

Notwithstanding the above, I believe that the overall credit quality of the fund to be good, although not outstanding.

Of the bonds with credit ratings, most are high-quality, investment-grade bonds, with an average / median credit rating of AAA. Of the bonds without ratings, most seem to be MBS and other securitized investments, which are generally investment-grade. Some of each are riskier high-yield bonds, but not most. Overall credit quality seems good, stronger than that of most high-yield bond ETFs, weaker than those targeting investment-grade securities, including most of the largest ones.

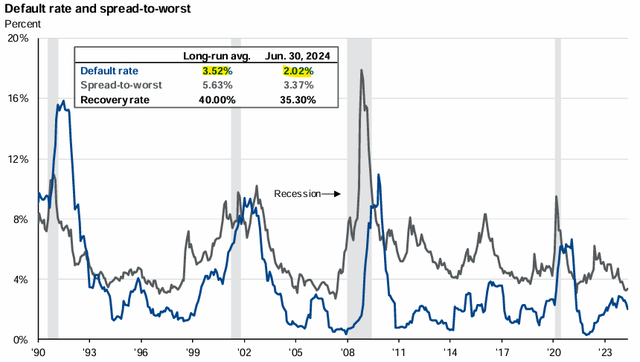

Right now, investment-grade bonds offer particularly compelling risk-adjusted returns and yields, as credit spreads are at their tightest levels in decades.

JPMorgan Guide to the Markets

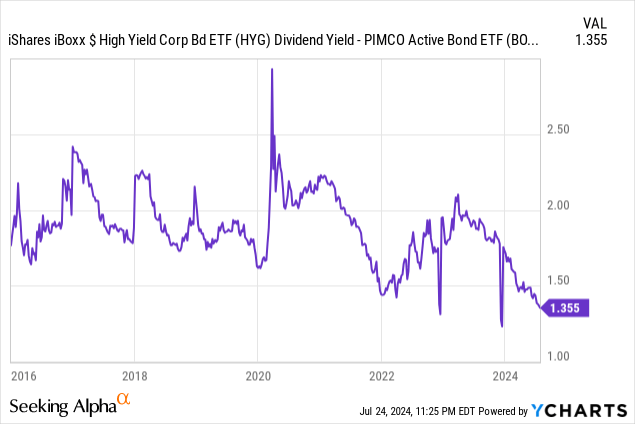

In most cases, I would compare PYLD’s dividend yield with that of benchmark high-yield bond ETFs to be absolutely certain that spreads have also narrowed for the fund itself. With its inception in mid-2023, the fund is too young for me to meaningfully analyze its spread to high-yield bonds. PIMCO has a somewhat similar, older bond ETF, the PIMCO Active Bond Exchange-Traded Fund ETF (BOND). Spreads for that fund have meaningfully decreased since mid-2023, and are at their lowest levels in decades. I’m sure the same would be true for PYLD.

In general terms, investment-grade bonds offer comparatively strong yields right now. One can clearly see that for the market as a whole and for BOND, the same is undoubtedly true for PYLD, although we lack the data for the latter.

Interest Rate Risk

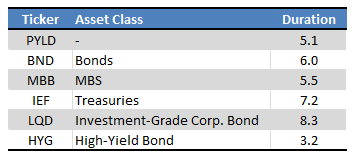

PYLD sports a duration of 5.1 years, somewhat below average, but not excessively so. Duration is consistent with a fund focusing on MBS with sizable high-yield investments.

PYLD – Table by Author

As PYLD’s duration is not significantly higher or lower than average, it provides no significant advantages or disadvantages relative to peers. With interest rates in flux, one has to analyze these issues, though, even when the final results have no obvious implications.

Dividend Yield

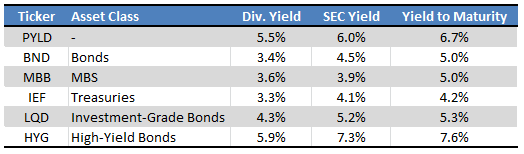

PYLD sports 5.5% TTM dividend yield, reasonably good on an absolute basis, and higher than that of most of its peers. As is the case for most bond ETFs, TTM dividend yields are lower than SEC yields and yield to maturity, as it generally takes a while for interest rate hikes to be reflected in ETF dividends: takes time for older, lower-yielding bonds to mature. Both of these metrics are higher than average, too.

Fund Filings – Table by Author

Overall, PYLD’s dividends are consistent with those of a leveraged MBS ETF with some high-yield bond investments. Doesn’t seem like the fund is focusing on bonds with comparatively high yields, although it is obviously impossible to know for certain as we lack detailed credit quality data for the fund’s portfolio.

PYLD’s dividend yield is reasonably good, but materially lower than that of high-yield bonds, senior loans, BDCs, and most CLOs. Some investors might prefer these investments over PYLD, although these are obviously riskier too. As mentioned previously, market conditions currently favor investment-grade bonds over riskier offerings, on risk-adjusted grounds at least.

Performance Track-Record

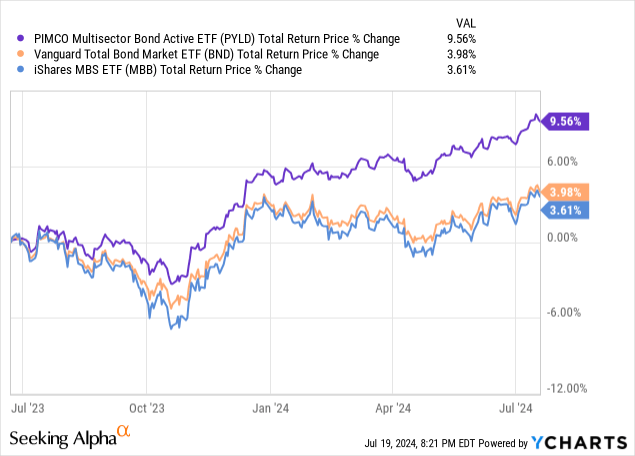

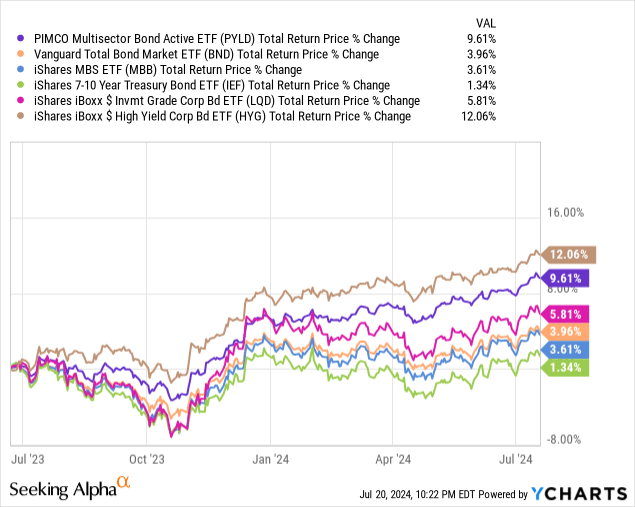

PIMCO bond ETFs tend to outperform, and PYLD is no exception. The fund has significantly outperformed relative to most bonds and bond sub-asset classes since inception in mid-2023.

Data by YCharts

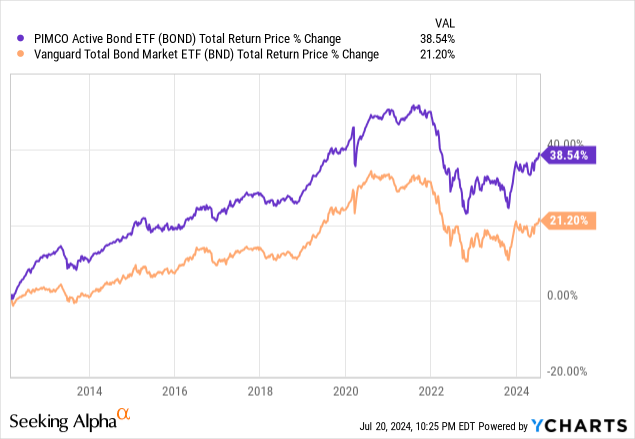

PYLD’s performance track record is, admittedly, quite short, and so not incredibly informative. PIMCO’s overall track record is, however, much longer, broader, and equally as strong. Most of PIMCO’s actively managed bond ETFs have outperformed their benchmarks, including their other diversified multi-sector bond ETFs:

Data by YCharts

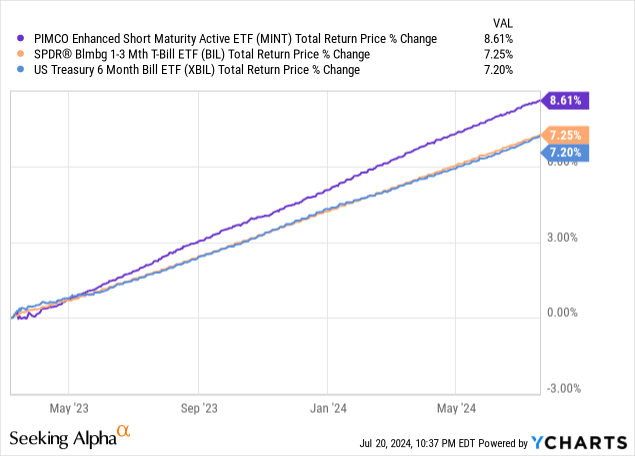

and their short-maturity bond ETF:

Data by YCharts

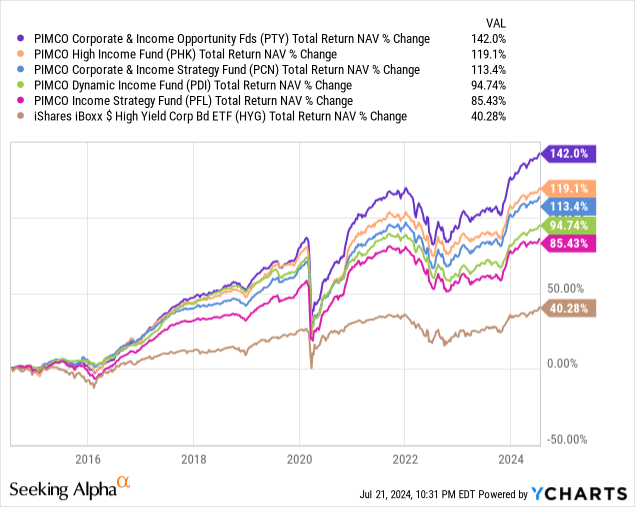

PIMCO’s bond CEFs tend to significantly outperform too, albeit with much higher risk.

Data by YCharts

PYLD’s performance track record is too short for it to be the sole basis of a buy rating, but PIMCO’s overall track record definitely is, in my opinion at least.

PYLD’s outperformance was due to several factors. Its high-yield exposure played a role, as did its leverage and below average duration. Strong active management almost certainly played a role too, and the data does seem to bear this out. By my calculations, and accounting for the fund’s leverage, high-yield bonds would have to account for +70% of the fund’s portfolio for zero alpha. This is inconsistent with the fund’s asset allocation / overweight MBS position. It isn’t impossible, most of the fund’s investments are not rated, but definitely implausible.

As mentioned previously, right now, MBS trades with very attractive spreads, especially newly-issued MBS. PYLD focuses on these, and I do believe this to be a good choice. Decisions such as this could easily be the source of past investment alpha, and result in further outperformance.

Conclusion

PYLD’s above-average 5.5% dividend yield and outperformance relative to peers make the fund a buy.

Read the full article here