The GAP Inc (NYSE:GPS), is one of the most renowned denim brands in the world and a leading company in the fashion industry. It provides stylish, reasonably priced clothes that people adore.

After some years of stock stagnation, there are finally a lot of interesting policies that the company is undertaking that have prompted many investors to wonder whether now is the right time to invest in this dividend stalwart.

I will first analyze the stock’s performance, I will continue by analyzing the business and strategy, its financials, growth catalysts, and possible risks. I will finally conclude with a valuation and some takeaways from this article.

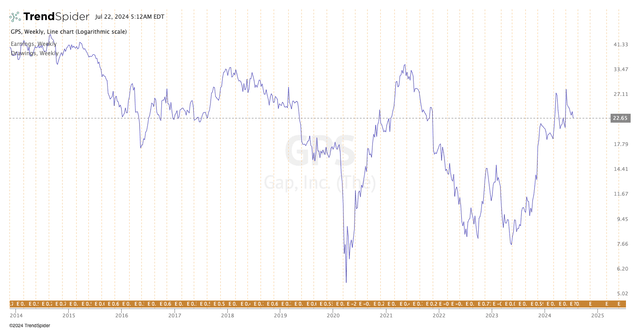

Stock’s Quotation

Stock Quotation (TrendSpider)

If we exclude the price collapse during the COVID-19 pandemic and the rapid recovery in 2021, the stock price has shown little movement over the past ten years. However, it is important to consider that the company pays dividends and that the stock price is highly influenced by its ability to distribute a steady source of income to shareholders.

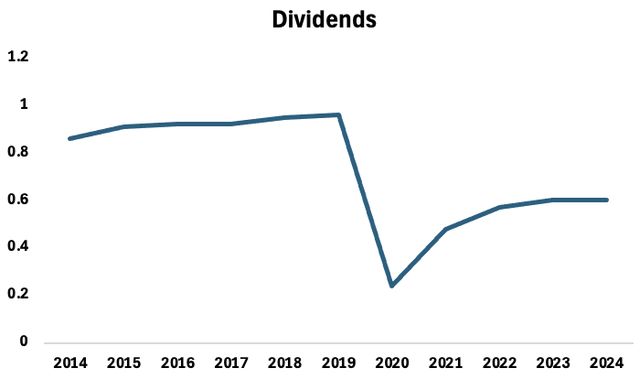

Dividends distributed (Author’s calculation)

Do you notice any similarities with the previous graph? The stock performance is highly correlated with the capability of the company to pay and increase dividends. I will discuss this more in detail later.

Company Overview

Company’s Business

The Gap is one of the most famous companies when it comes to denim clothing. What many people might not know is that The Gap Inc. is actually the parent company of many other famous fashion brands:

- Old Navy: a popular American clothing and accessories retail brand known for offering affordable, trendy, and casual apparel for the entire family.

- Gap: Is one of those companies that during the 70s-80s capitalized on the casual wear trend promoting denim as an essential part of the American casual lifestyle.

- Banana Republic: is a high-end clothing and accessories retailer known for offering sophisticated and polished fashion. It was acquired by the Gap in 1983.

- Athleta: is a women’s activewear brand known for offering high-quality athletic clothing designed for a variety of activities, including yoga, running, gym workouts, and outdoor adventures. It was acquired by the parent company in 2008 for approximately $150 million.

For many Americans, and indeed people worldwide, these brands have always been there. People have grown up seeing, shopping, and wearing their clothes. The power of branding acts as a formidable defense against competitors and new entrants, creating a substantial economic moat.

Company’s Strategy

All of the brands presented in the previous sub-paragraph have a long history. They were all born around the end of the 70s and the beginning of the 80s. The company is going through a turnaround to reinvigorate each of the brands. Specifically, they have identified unique opportunities for each brand to pursue in the coming years:

- Reassert Old Navy;

- Reignite Gap;

- Reestablish Banana Republic;

- Reset Athleta.

This turnaround, guided by the new CEO Richard Dickson, was precisely what the company needed. All of these brands primarily sell essential clothing, which requires modernization to stay relevant.

It is a little bit early to assess the results but for now, the company reports positive sales volumes in its last earning call.

Gap Inc. mainly focuses on retail sales through directly operated stores and franchised stores. It is also developing a strong online presence. In both channels, the company is focused on enhancing the customer’s experience. Similarly to what I discussed in my Moncler (OTCPK:MONRF) article, I perceive tremendous value from retail sales rather than wholesale in terms of profitability.

Industry Overview

The apparel industry is expected to grow at a 2.81% CAGR until 2028, and it should produce around $230.9 per person worldwide in 2024.

Even though the company has a strong market position, the industry is highly competitive and filled with big corporations ready to steal market shares. The denim sector in particular is intensively competitive, with the company facing competition from major brands, such as Levi’s (LEVI) and Kontoor Brands (KTB). To remain competitive the company Gap has to continuously invest in marketing and R&D.

Company’s Financials

Income Statement

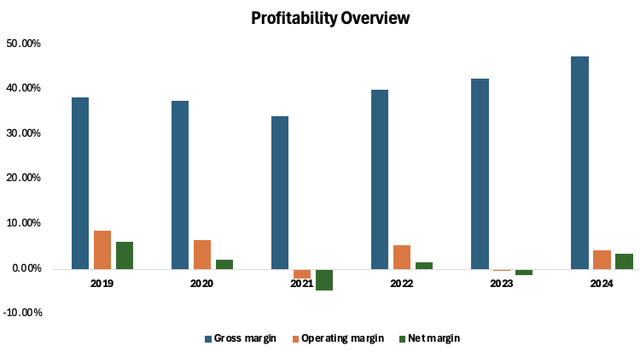

Throughout the last five years, the revenues decreased at a 1.7% CAGR while net income dropped at a worrying 10.9% CAGR. As a consequence net margin passed from 6.05% in 2019 to just 3.37% in 2024. Fortunately, the situation is better when analyzing the gross profit which improved at a 1.8% CAGR in the same period. This indicates that the company’s core operations remain stable and profitable, while the decline in net income is mainly due to increasing general and administrative costs. Fortunately, the new CEO is addressing the problem and the company is working hard to control these expenses.

I expect a significant improvement in profitability over the next couple of years primarily driven by a reduction in general and administrative expenses.

Profitability Overview (Author’s calculations)

Balance Sheet

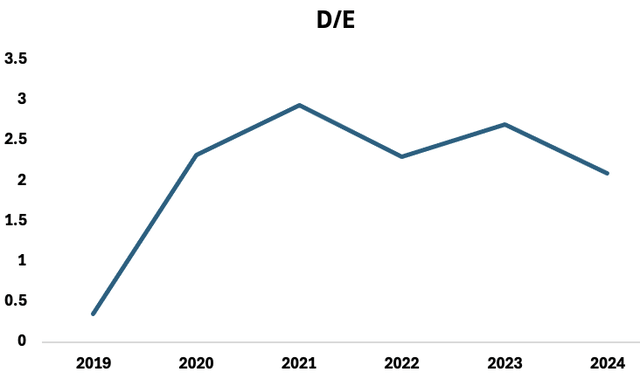

The company increased its debt in 2020 to navigate the difficulties caused by the pandemic. The total debt spiked from $1,249 million in 2019 to $7,677 million in 2020. Gap Inc. is now paying down the outstanding debt, and as a consequence also the interest figure is becoming lighter. According to the FY 2024, it would require around 10 years of net income to pay down the entire company’s debt. Fortunately, the majority of the debt is composed of Senior Notes due between 2029 and 2031, this gives the company enough flexibility to manage debt in the best way possible. Overall debt over equity ratio does not highlight a worrying situation being it is under the general threshold of 2.5.

Debt/equity ratio (Author’s calculations)

Cash Flow Statement

The main issue that the company had over the last years was a deterioration of its net working capital mainly driven by an increase in its cash conversion cycle which also ruined its free cash flow.

In other words, the company struggled to contain the three main indexes that compose the net working capital: accounts payable, accounts receivables, and inventory.

|

Under the new policy, the company has improved its inventory management and increased the payables resulting in an impressive $1.2 billion FCF for 2024. I expect the company to be able to tighten even more its suppliers’ terms and continue reducing its inventory in the next years, resulting in positive FCF figures that will be employed to pay down debt and increase dividends. Given the company’s exceptional performance in managing its cash conversion cycle, I believe the stock price does not fully reflect the company’s true value, especially considering its potential to generate substantial free cash flow.

Catalysts

When it comes to the growth catalysts of Gap, there are two distinct opportunities: one in the short term and one in the long term.

For what it concerns the short-term opportunity, according to TD-Cowen’s the back-to-school season presents a significant potential for the company. The new denim cycle, introduced by the reinvigorating policy I discussed previously, should boost the company’s top line in the next back-to-school season.

The long-term opportunity sounds quite different. A deeper look at the company’s revenue breakdown reveals that its presence abroad is very limited. This represents an incredible opportunity to expand its business in new regions. I feel like the clothes sold by the four brands include essentials that have broad appeal and could resonate with non-American customers. Expanding into international markets could unlock new revenue streams and drive long-term profit growth.

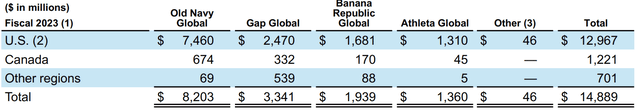

Revenues breakdown (Company’s 10-K)

Risks

A complete list of risks can be found in the company’s 10-k file.

Despite the competitive landscape, which I already discussed in the industry overview section, the main risk that the company has to face is related to changing consumer preferences and the brand’s reputation. It is obvious nowadays that fashion trends and customers’ preferences can change rapidly. The company has to adapt itself rapidly to meet any major shift to keep its relevance in the market. Similarly, it has to invest a lot to maintain a strong brand image. Negative publicity, quality issues, or associations with unethical labor practices can damage the brand and affect sales.

Valuation

It is always difficult to assess companies that are going through turnarounds because if everything goes in the right direction, they can reach stellar results, on the other hand, everything can deteriorate quickly if something goes wrong and some issues arise. Therefore, I will adopt a pretty pessimistic approach in my analysis.

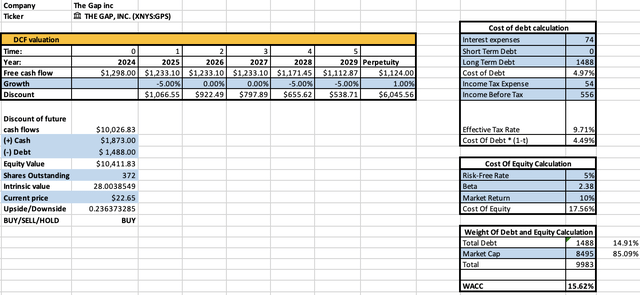

Company’s valuation (Author’s calculations)

First of all, I computed the weighted average cost of capital and I obtained 15.62% which is high mainly due to a high beta equal to 2.38. I forecasted a decrease in the free cash flow in FY 2025 of around 5%. I considered flat results for the following two years, and again a decrease of 5% for FY 2028 and 2029. I finally considered a perpetual growth rate of 1% and I obtained a discounted value of around $10 billion. Considering the cash and the financial debt outstanding I obtained a $10.4 billion equity value, around 20% higher than the current market capitalization of $8.5 billion.

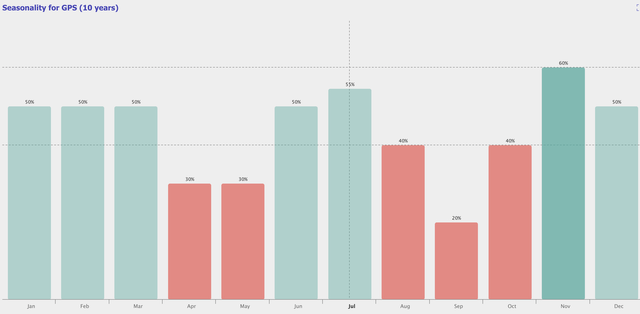

However, real prices and intrinsic values are two different things, especially in the short term, that is why, according to the stock 10-year seasonality, we should pay a lot of attention to the next three months which tend to deliver negative results for investors.

10 Years Seasonality (TrendSpider)

Conclusions

The company’s possibility to continue enhancing its conversion cycle, mixed with its future growth catalysts led me to assign a “buy” rating to the stock. I will follow closely the stock over the next months and I will start accumulating after any major drop.

Read the full article here