“There is nothing permanent except change” and the shareholders of Berkshire Hathaway (NYSE:BRK.B, NYSE:BRK.A, NEOE:BRK:CA) were reminded of this timeless wisdom after the passing of the company’s vice chairman, Charlie Munger. Now, as we ponder the future of Berkshire after the eventual departure of chairman Warren Buffett, questions arise about the direction the company will take under new leadership.

Warren Buffett and Charlie Munger have transformed Berkshire into the vast and successful enterprise it is today. The company would not be where it is without the extraordinary leadership of this dynamic duo. This raised the crucial question: what the future holds for Berkshire when both of these influential leaders are no longer at the helm?

Berkshire is already a sizeable and mature enterprise, and for better or worse, the new leaders will have less leeway to chart their own path. Having said that, Berkshire is structured to redeploy the free cash flows of mature businesses into attractive growth areas within the group and acquisitions. The new CEO will need to manage substantial sums of money coming into the corporate accounts and decide how to redeploy it most effectively.

Greg Abel will be the main decision-maker driving Berkshire’s future growth

Capital allocation is the single most important task of Berkshire’s CEO. The stock will only be able to continue outperforming the market if the new leaders are successful at this job. We have to point out that Berkshire pays no dividend, and the value of the stock is driven entirely by the pace of book value appreciation. The rate of return on capital redeployed is therefore the main driver of Berkshire’s growth.

In our previous article, Berkshire After Buffett, What To Expect?, we suggested that the new generation of leaders might not command the same level of trust as Buffett, potentially increasing stock price volatility after his departure.

It has now been confirmed that Mr. Abel will be solely responsible for all capital allocation at Berkshire. Just as we have spent a great deal of time scrutinising the biographies and track records of Warren Buffett and Charlie Munger, now it is time to get to know Greg Abel a lot better.

In this article, we analyse the track record of Greg Abel, the future CEO and principal capital allocator of Berkshire Hathaway, as our trust in Mr. Abel might soon be tested by the market.

Berkshire Hathaway Energy, managed by Greg Abel, has been the fastest organically growing division of Berkshire

Mr. Abel joined Berkshire 25 years ago when Mr. Buffett acquired MidAmerican Energy. Starting as second in command, Abel rose to CEO of the utilities company by 2008. This position of responsibility is a good starting point for analysing Mr. Abel’s track record at Berkshire. In January 2018, Greg Abel was promoted to Vice Chairman of Berkshire Hathaway’s non-insurance operations, overseeing BNSF along with all manufacturing and services businesses.

Under Abel’s leadership, MidAmerican transformed into a major player in renewable energy. The company invested heavily in wind and solar power generation, as well as transmission lines to transport electricity from sunny and windy areas to population centres. Additionally, the company has expanded in natural gas infrastructure in response to rising production and gradual coal power phase-out. US energy infrastructure upgrade requires very substantial amounts of capital, especially as growing renewable generation puts additional strain on the grid.

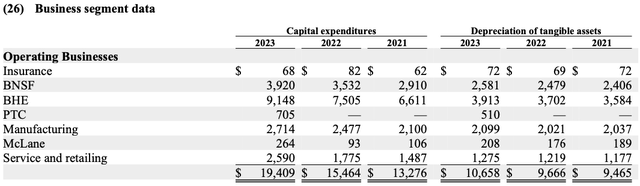

The Utilities and Energy division, led by Abel, has become the fastest organically growing division of Berkshire, with earnings tripling since he took over. Greg Abel seems to have the trust of Mr. Buffett, as his division is allocated the largest share of organic capital investment within the group. BHE’s investments significantly exceed the depreciation of the division, accounting for half of Berkshire Hathaway’s overall capital spending.

Capital expenditures (Berkshire Hathaway Annual Report)

Greg Abel has also significantly contributed to Berkshire Hathaway Energy’s growth through substantial acquisitions. His division was rebranded “Berkshire Hathaway Energy” and beyond MidAmerican now includes several regulated power utilities, gas, and power transmission operators as well as independent power producers.

Over his tenure as CEO of the Utilities and Energy division, Abel has made acquisitions worth over $16 billion. The most notable deals include the $5.6 billion NV Energy acquisition and the $4 billion Dominion midstream assets acquisition, both having enterprise values of about $10 billion each when including debt. It is therefore safe to say that Mr. Abel has experience in making large acquisitions.

|

Largest Acquisitions |

Equity Value ($ billion) |

|

NV Energy (2013) |

5.6 |

|

AltaLink (2014) |

2.7 |

|

Dominion gas midstream (2020) |

4 |

|

Cove Point LNG (2023) |

3.3 |

|

Combined |

15.6 |

Value of BHE acquisitions

Greg Abel’s track record of organic investment and acquisitions at BHE is indicative of the potential future success of the entire Berkshire Hathaway under his leadership. It is also quite reassuring to see that his track record was attained by operating large sums.

Combining capital expenditures and acquisitions, the Railroad, Utilities, and Energy division of Berkshire has experienced a steady increase in book value, growing at an average rate of 5% per year since the acquisition of BNSF in 2010. This growth has been primarily driven by BHE, which has tripled earnings under Abel, achieving an annual growth rate of approximately 11.5%.

|

Railroad, Utilities and Energy |

2009 |

2010 |

2011 |

2015 |

2016 |

2022 |

2023 |

Cagr, % (2010-2022) |

|

BHE earnings |

1,157 |

1,238 |

1,204 |

2,370 |

2,542 |

4,775 |

2,962 |

11.5% |

|

BNSF earnings |

0 |

2,459 |

2,972 |

4,284 |

3,569 |

5,946 |

5,087 |

5.8% |

|

Overall |

1157 |

3,697 |

4,176 |

6,654 |

6,111 |

10,721 |

8,049 |

9.3% |

|

Assets |

44,771 |

113,605 |

117,377 |

165,012 |

169,816 |

222,463 |

258,772 |

|

|

Liabilities |

25,474 |

43,993 |

45,596 |

72,766 |

73,640 |

100,190 |

114,858 |

|

|

Equity |

19,297 |

69,612 |

71,781 |

92,246 |

96,176 |

122,273 |

143,914 |

4.8% |

|

RoE, % |

6.0% |

5.3% |

5.8% |

7.2% |

6.4% |

8.8% |

5.6% |

Berkshire Hathaway Annual Reports

The return on equity of the Railroads, Utilities, and Energy division has been increasing

Despite rapid growth, the returns from Berkshire Hathaway’s capital-intensive Railroad, Utilities, and Energy division were unimpressive. While growing in the Utilities and Energy industry can be straightforward with abundant capital, the real challenge lies in achieving profitable growth.

During FY2022, when no wildfire expenses were incurred, the Railroad, Utilities, and Energy division achieved an 8.8% return on equity. Considering that over the past 10 years, Berkshire has been compounding at a rate of return of 12%, the returns generated by Mr. Abel seem underwhelming.

However, a closer look reveals that returns have been improving under Greg Abel’s leadership. From 2009 to 2022, the return on equity in the Railroads and Energy division rose from about 6% to 8.8%. This is a very important and encouraging indication of the capital allocation and operational acumen of Greg Abel.

Consistent earnings growth outpacing book value appreciation suggests that the marginal returns on new investments were significantly higher than historic averages. Mr. Abel might have taken over a business that generates a 6% return on equity, but he has been investing at much higher returns.

Greg Abel has been deploying capital at ~13% return, exceeding even Warren Buffett’s stock portfolio returns

Berkshire tends to trade at a stable price to book value multiples and therefore the faster the book value grows, the more rapidly the stock price appreciates. As the business does not pay dividends, the main driver of the book value growth is the rate of return on retained earnings. The higher the reinvestment rates of return, the more rapid stock price appreciation.

It is crucial to assess the rates of return that the upcoming chairman, Greg Abel, can generate to determine if Berkshire will continue outperforming the market. Over the past decade, the S&P 500 has delivered an average annualized return of about 13%. Berkshire needs a similar rate of return on its investments to outperform the market.

The Railroads and Energy division of Berkshire recorded an 8.8% rate of return on equity back in 2022, the last year without extraordinary wildfire expenses. This could seem troubling, as this number falls considerably below the performance of the S&P 500. We have to keep in mind that this metric is backwards-looking, and what we do care about are the current and future expected rates of return.

The fact that earnings of the division are growing considerably faster than the book value indicates that the current rates of return on new investments are considerably higher than the historic rates of return. From 2010 to 2022, the Railroads and Energy division added $53 billion of equity while increasing earnings by $7 billion. We can thus deduct that Greg Abel has been able to achieve an average return on new equity investments of ~13%. Considering that a vast amount of capital was deployed, whilst in a low interest rate environment, this rate of return is quite impressive.

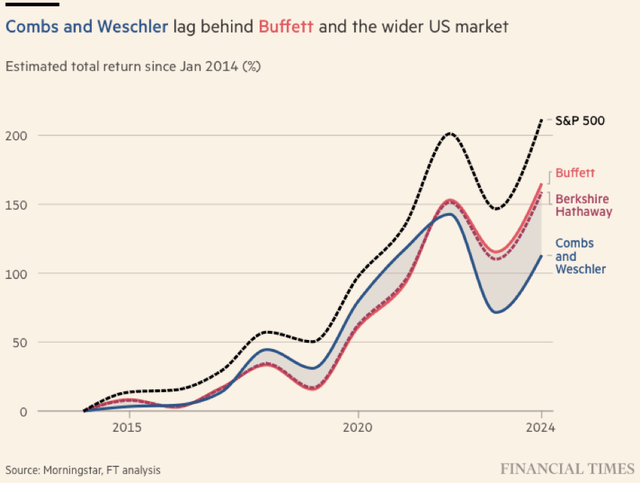

As estimated by Morningstar and Financial Times, Mr. Abel has outperformed other Berkshire managers. From 2014 until 2022, Ted Weschler and Todd Combs grew their stock portfolios by 150%, or 10.6% compounded annually. Warren Buffett’s stock picks have also performed in line with his lieutenants. During the same period though, Greg Abel has added $39 billion of equity and increased BHE earnings by $5 billion, achieving a ~13% marginal rate of return, thus outperforming even Warren Buffett.

Financial Times

Berkshire Hathaway will continue benefitting from insurance float growth

Some might frown upon the 13%, but these returns are actually in line with what Buffett has been able to accomplish with large sums of money in his prime. In the early years and with smaller sums of money at his disposal, Buffett has been able to generate 20%+ returns but as Berkshire matured and the sums involved became larger, returns have been reduced considerably.

The investment approach of Mr. Buffett has never relied upon hitting it out of the park on every investment. The core of Berkshire’s enduring success over the decades has been low-risk investing financed with low-cost funds. Insurance float growth has been the main source of low-cost funds and has helped Buffett to outperform the markets.

Frazzini, Kabiller, and Pedersen in their excellent research paper titled Buffett’s Alpha have ventured to break down the track record of Warren Buffett and discover the sources of his outperformance. Quite surprisingly, they have discovered that the average rates of return on public market investments generated by Buffett have been in the low-to-mid teens for the most part. In line with Greg Abel is generating now.

However, acquisitions have been partly funded with the free insurance float, helping to elevate the rates of return on equity deployed. Because of this financing advantage, Berkshire has been able to grow its book value at ~20%, despite Buffett only achieving mid-teen returns in the markets.

The insurance business of Berkshire Hathaway continues growing and delivering additional float, and therefore, Greg Abel will also benefit from this financing advantage once he is in charge. If Mr. Abel continues being able to generate 13% returns on large amounts of capital deployed in the Utilities and Energy space, Berkshire Hathaway’s book value growth will likely exceed this rate due to financing advantages.

We do have to point out that the Insurance division is also reaching maturity; therefore, the financing advantages are not as big as they once were. Having said that, it will still be a considerable tailwind for the group as the insurance division has amassed huge amounts of capital and therefore can invest almost all float to equity.

Over the past 3 years, Berkshire’s insurance float has increased by $10 billion per year on average. This float growth would have been enough to finance the whole capital investment programme of the Railroads, Utilities, and Energy division of Berkshire Hathaway. Instead of investing the float in treasuries yielding 4-5%, Berkshire can transfer the capital to the low-risk Utilities and Energy division and generate ~13% return on equity instead.

Berkshire Hathaway Annual Report

The value of the float has not been as obvious in the ultra-low interest rate environment as Berkshire has been sitting on huge sums of idle cash. Chances are that rates will not go back to the low levels seen over the past decade and that asset prices will decline, making the low-cost float a lot more valuable. Ajit Jain, the president of the insurance division, will most certainly help Greg Abel to grow Berkshire faster.

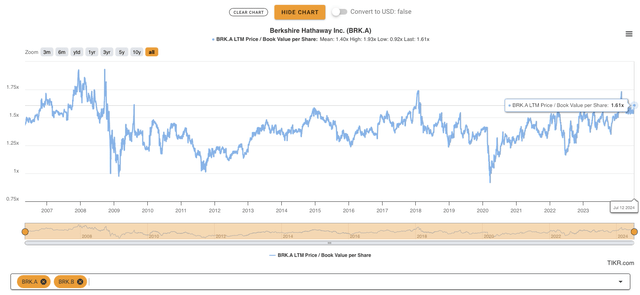

Berkshire is not cheap, but growth prospects are good

Berkshire Hathaway is currently trading slightly above long-term average valuation multiples. In our previous article, we looked into the value of separate parts of Berkshire and concluded that even at these higher valuation multiples, Berkshire is trading at close to fair value.

Berkshire Price To Book (TIKR Terminal)

Berkshire is not undervalued, just as could be expected from a large-cap and high-quality company. Investors holding or buying the stock at these price levels are betting on continuing value growth of Berkshire at competitive rates.

It is therefore reassuring to see that the upcoming Chairman of Berkshire has been able to find attractive investment opportunities for large amounts of capital at attractive rates of return. The return on equity of the Railroads and Energy division is likely to continue increasing as profitable investment opportunities are being found. It is also important to note that the low-risk infrastructure division is an attractive investment alternative for insurance float. The Railroads and Energy division can grow faster when it is paired with a growing insurance operation.

Greg Abel has been redeploying equity at ~13% in the Utilities and Energy space through organic investment and acquisitions. However, if the group has more capital at its disposal than just retained earnings, the profit growth rates could exceed 13%. The insurance division can provide that extra capital.

Even if Utilities and Energy gradually become an ever more significant part of Berkshire, the growth of the group will not decelerate.

As Greg Abel takes over, the earnings growth of the group should continue at a rapid pace, driving BRK’s share price upwards. Mr. Abel has been performing well and will most likely continue doing so.

We are therefore bullish on BRK.

Key Risk

The job of running and growing a vast conglomerate is not easy. Greg Abel will no doubt face difficult situations and struggle from time to time. At the moment, issues at PacifiCorp and BNSF stand out.

The way how Mr. Abel handles these situations will determine the level of trust the market has in him. Poor outcomes could make Berkshire stock a lot more volatile and potentially re-rate to a lower book value multiple. We intend to follow these developments and provide continuing coverage here on Seeking Alpha.

Read the full article here