If you believe that Artificial Intelligence (“AI”) is more than just a fad, Super Micro Computer (SMCI) may be a solid investment choice for your portfolio. Cloud companies and enterprises have displayed a heavy demand over the last year and a half for accelerated compute platforms necessary for training and running advanced generative AI algorithms. Once OpenAI introduced ChatGPT to the world in November 2022, Super Micro Computer, also called Supermicro, became a go-to provider for companies that needed hardware to develop AI-based services.

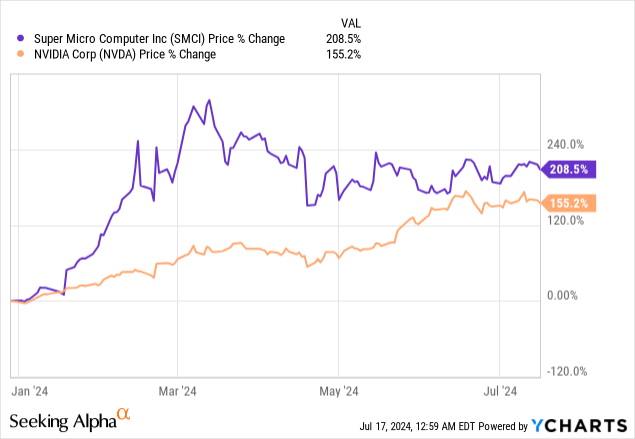

I first recommended Supermicro on November 15, 2023. The stock has been up 197.32% since I wrote my first article, compared to the S&P 500’s (SPX) rise of 25.79%. The second time I recommended the stock on April 05, 2024, didn’t fare nearly as well. The stock is down 9.40% versus the S&P 500 rising 9.85%. The company may be digesting its rapid gains since the beginning of the year. It’s one of the few stocks outperforming NVIDIA (NVDA) in 2024.

Although the company’s stock price has stalled recently, demand for AI infrastructure remains high. Grand View Research forecasts that the global AI infrastructure market will grow from $35.42 billion in 2023 at a compound annual growth rate (“CAGR”) of 30.4% to $227 billion in 2030. Another research company, Clear ML, in partnership with the AI Research Alliance, wrote a report that forecasted the AI infrastructure market rising at a CAGR of 29.8% from $23.5 billion in 2021 to $309.4 billion by 2031. So, while Supermicro’s stock price has stalled recently, I believe there is still potential upside. Therefore, this article will reiterate a buy recommendation for Supermicro.

This article will summarize Supermicro’s business, briefly discuss the company’s third-quarter earnings report, review the competitive environment, examine a few risks and the valuation, and discuss why the stock remains a buy.

Overview

I decided to write this overview of Supermicro because understanding data center architecture and why this company has become a leading player in this market can be challenging for people with non-technical backgrounds. Hopefully, this overview can help investors understand the company better.

The company defines its business in its 2023 10-K:

We are a Silicon Valley-based provider of accelerated compute platforms that are application-optimized high performance and high-efficiency server and storage systems for a variety of markets, including enterprise data centers, cloud computing, artificial intelligence (“AI”), 5G and edge computing. Our Total IT Solutions include complete servers, storage systems, modular blade servers, blades, workstations, full rack scale solutions, networking devices, server sub-systems, server management and security software.

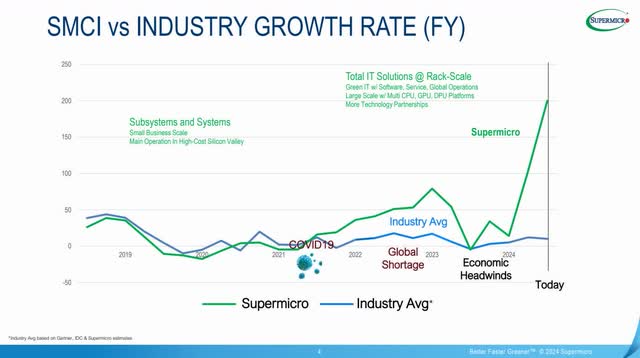

The following image from the company’s third-quarter fiscal year (“FY”) 2024 earnings deck compares Supermicro’s growth rate to the industry growth rate.

Supermicro Third Quarter FY 2024 Earnings Deck

The green type labeled subsystems and systems references the era when the company sold traditional server products, which some viewed as commodity products. Subsystems are components like the central processing unit (“CPU”), memory chips, hard disks, motherboards, and more. Systems are bundled components of compute, network cards, and storage into one independent, standalone chassis, such as a workstation, tower server, and blade server. Supermicro sold these subsystems and systems to small businesses, data centers, and cloud providers running standard workloads. Supermicro mainly competed in selling these systems based on price before 2021, which may be why it grew in line with industry averages.

Around 2022, the company emphasized what it called Total IT Solutions at Rack-scale. This term refers to a new data center architecture that separates traditionally bundled server components of compute, network cards, GPU (Graphics Processing Unit) acceleration, and storage into independent, standalone modules. For instance, one Rack-scale module may contain only network cards. Another may contain only central processing units. A Rack is a metal frame that can hold multiple modules connected by high-speed fiber, PCIe, or InfiniBand interconnects. One or more racks share cooling and power inside a larger enclosure called a cabinet.

Supermicro Third Quarter FY 2024 Earnings Deck

Supermicro has invested significant sums in research & development (R&D) for using a modular approach across its whole product line, including its traditional servers. Although the company didn’t invent Rack-scale, it was an early adopter and one of the prime promoters of using a modular approach in Rack-scale over the last several years. A modularized construction has multiple advantages, including future-proofing the system. Customers have the capability to upgrade, remove, and replace modules without negatively impacting operations. In my last article on the company, I discussed how one of its biggest differentiating competitive advantages is that its building-block modules help Supermicro deliver a system more rapidly than its competitors. Replicating that approach will be challenging and require substantial investment from competitors like Dell Technologies (DELL) and Hewlett Packard Enterprise (HPE) to catch up. The company’s Chief Executive Officer (“CEO”) Charles Liang said:

We continue to gain market share, especially our rack-scale plug-and-play solution that reduce customers’ lead time and also reduce customers’ time to online. With our rack-scale plug-and-play, customer able to put the system — deploy the system online in next day or next few days instead of the next few weeks. So, time to online saving is a big advantage to customer.

Supermicro describes its Rack-Scale solutions in a PDF on its website (emphasis added):

Supermicro RSD [Rack Scale Design], a rack-scale total solution, empowers cloud service providers, telecoms, and Fortune 500 companies to build their own agile, efficient, software-defined data centers. Built on industry standard Redfish APIs and open-source Rack Scale Design software framework from Intel, Supermicro RSD runs on Supermicro server/storage/switch hardware offerings and maximizes utilization through disaggregating compute, network and storage resources distributed within a rack or across multiple racks.

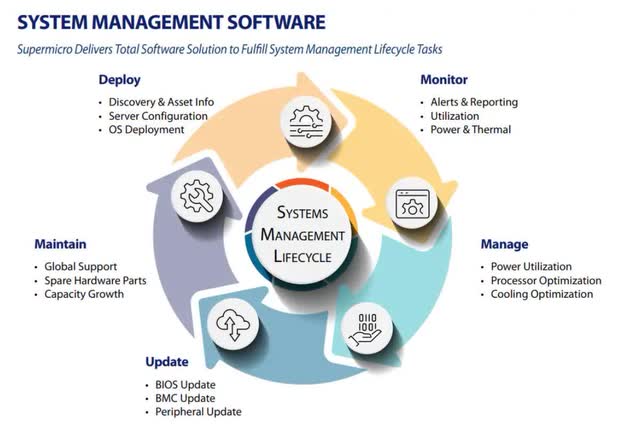

Typically, data center operators use software to operate the underlying hardware as virtual servers. Some may be unaware that Supermicro is more than just a hardware company; it has a growing software opportunity to manage its hardware.

Supermicro Website

The company sells its system management software in several bundles. Its most advanced software suite, Enterprise, offers (emphasis added) “Extended data center management for enhanced security, proactive service, software-defined infrastructure, and more.” Rack-scale hardware infrastructure is an enabler of software-defined data centers (SDDCs). The following article defines SDDCs:

Traditionally data centers use physical infrastructure like physical servers, switches, and storage resources. Their scalability is located individually to each hardware element on site.( servers, switches, firewalls, storage systems, etc). Software-Defined Data Center [SDDC] uses “virtualization” to abstract all these hardware resources on-site providing highly scalable, efficient, and portable virtual compute, networking, networking, and security.

SDDCs facilitate innovations such as cloud computing, high-performance computing, 5G, the Internet of Things, edge computing, and AI for cloud service providers (“CSPs”), hyperscale data centers, and large enterprises. Once Supermicro became heavily involved in evolving Rack-scale and SDDC technology, it began benefiting from the growth of multiple secular technology trends, including generative AI. Today, the rapid adoption of generative AI drives much of the company’s revenue growth.

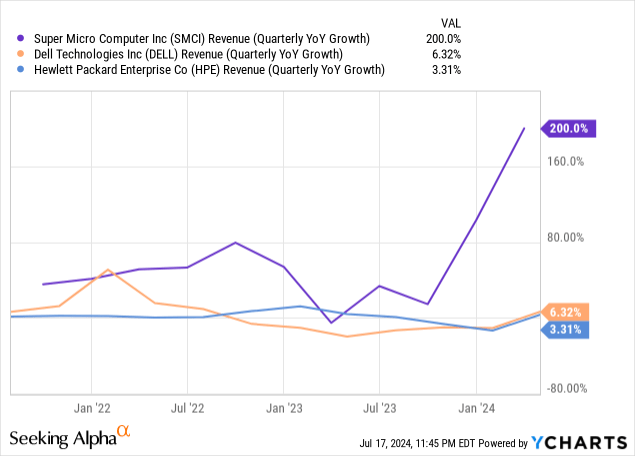

Supermicro fundamentals

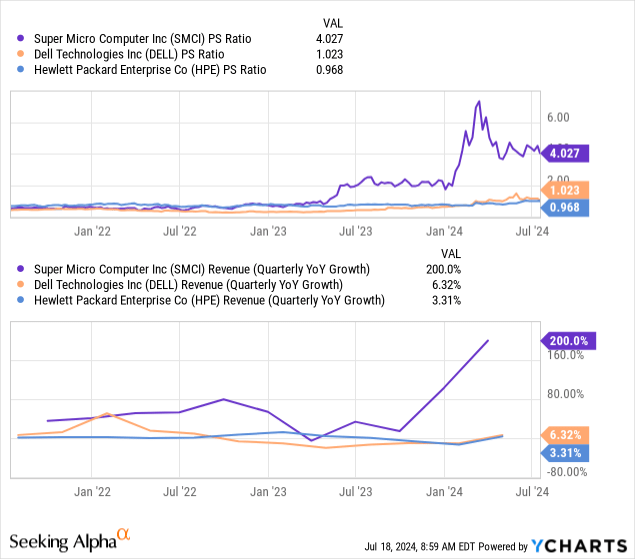

Supermicro generated $3.85 billion in its third quarter FY 2024, 200% year-over-year, substantially faster than its legacy competitors. Chief Financial Officer (“CFO”) David Weigand said, “AI GPU platforms … represented more than 50% of revenues with AI GPU customers in both the enterprise and cloud service provider markets.” An improving supply chain and the company’s design wins should drive 314% year-over-year growth to the mid-point of the fourth quarter FY 2024 guidance of $5.3 billion.

Management is optimistic about the company’s near-term growth. It raised guidance for the full-year FY 2024 revenue from $14.3 billion to $14.7 billion to $14.7 billion to $15.1 billion. The company’s FY 2024 concluded at the end of the June quarter. Zacks Investment Research forecasts the company to report its fourth quarter and full-year FY 2024 earnings on August 13, 2024.

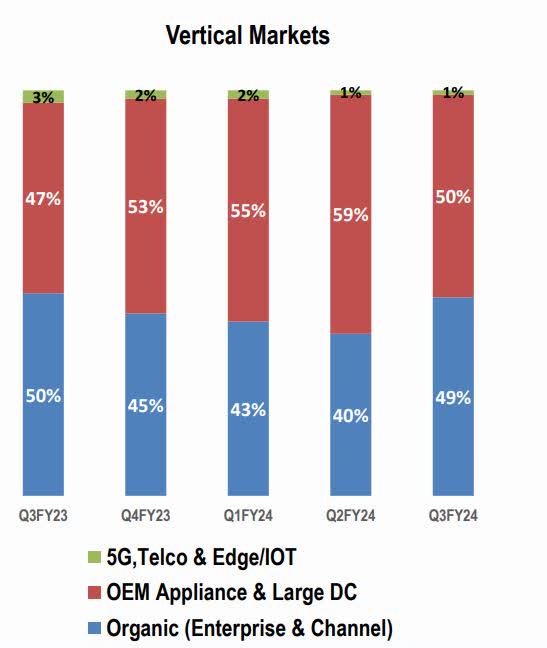

The following bar charts show the company’s vertical markets performance. Supermicro grew Enterprise and Channel 190% over the previous year’s comparable quarter and 26% sequentially to $1.88 billion. The company must show strength in Enterprise to remain competitive since that’s an area of strength for traditional server manufacturers Dell and HPE.

Supermicro Third Quarter FY 2024 Earnings Deck

During the Bank of America (BAC) Securities 2024 Global Technology Conference, Bank of America analyst Ruplu Bhattacharya asked the Supermicro CFO about the company’s strategy for gaining share in the Enterprise Market against Dell and HPE. CFO Weigand gave the following answer:

First of all, … enterprise represents 50% of our business. … So, we’re already entrenched into the enterprise and we had a lot of different use cases. And so we — what we need to do is that we need to continue to do what we’ve been doing for the last 31 years, which is bringing the very best AI solutions to market. And by the way, at GTC [GPU Technology Conference], [NVIDIA CEO] Jensen Huang was in our booth and this is on YouTube, and he said if you want the very best AI solutions buy Supermicro, and as far as I know, the very best means only one.

I am bringing this topic up because since Dell recently won business with specialized cloud provider CoreWeave, EV manufacturer Tesla (TSLA), and Elon Musk-backed AI researcher x.ai, there was a perception that Dell was taking share from Supermicro. At the same Bank of America conference, when Ruplu Bhattachary asked whether Supermicro was losing market share to Dell, Supermicro CFO Weigand said (emphasis added):

If you look at our sales performance for the nine months ended March 31 — fiscal year ’24 versus fiscal year ’23, our revenues are $9.6 billion, which is up about 95% over the prior year. Now I think that kind of establishes the case that we’re obviously gaining share at a rate that’s pretty much faster than the industry. …And so, the only thing that has restrained us to date is [chip] supply. And so, if somebody else is able to take a share, it’s probably because [customers] have to go to their second or third choice because we don’t — because we only have — we can only get so much supply. So, supply has definitely restrained our growth and there’s no question that we would be further ahead in the numbers because that’s why what’s caused our backlog to grow, we’d be further ahead if we had more supply.

There is little concrete evidence that any company is grabbing market share from Supermicro. It still appears that Supermicro is still the one grabbing market share from the overall server market.

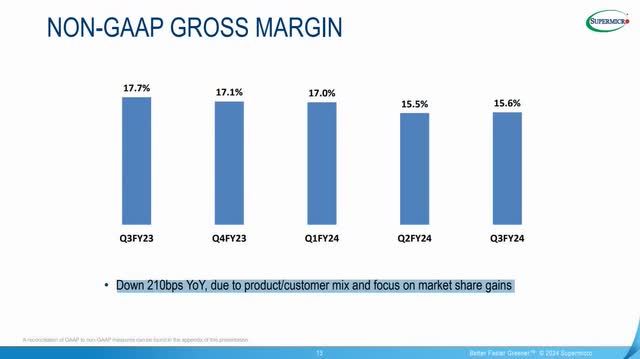

Let’s discuss profitability. The company claims that it’s hard to hit gross margin guidance with precision and instead guides for a range of 14% to 17%. So, although non-GAAP (Generally Accepted Accounting Principles) declined since the third quarter of FY 2023, its third quarter of FY 2024 number is still within the target range.

Supermicro Third Quarter FY 2024 Earnings Deck

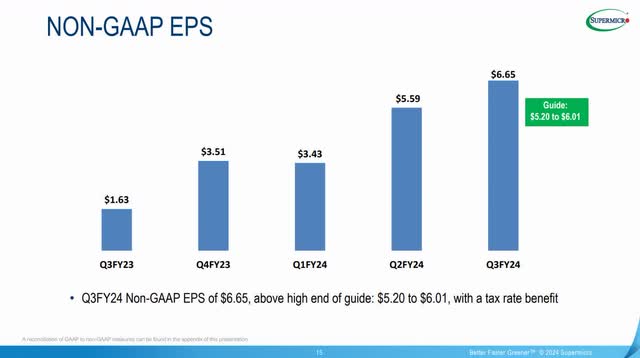

The following chart shows that the company’s third quarter FY 2024 non-GAAP earnings-per-share (“EPS”) increased 308% year-over-year to $6.65, exceeding guidance.

Supermicro Third Quarter FY 2024 Earnings Deck

Management forecasted a fourth quarter FY 2024 non-GAAP diluted EPS of $7.62 to $8.42. If the company hits the mid-point of guidance, non-GAAP diluted EPS will rise 128% when it reports. Management gave FY 2024 guidance for non-GAAP diluted EPS of $23.29 to $24.09. At the mid-point of guidance, FY 2024 non-GAAP diluted EPS would rise 100% to $23.69.

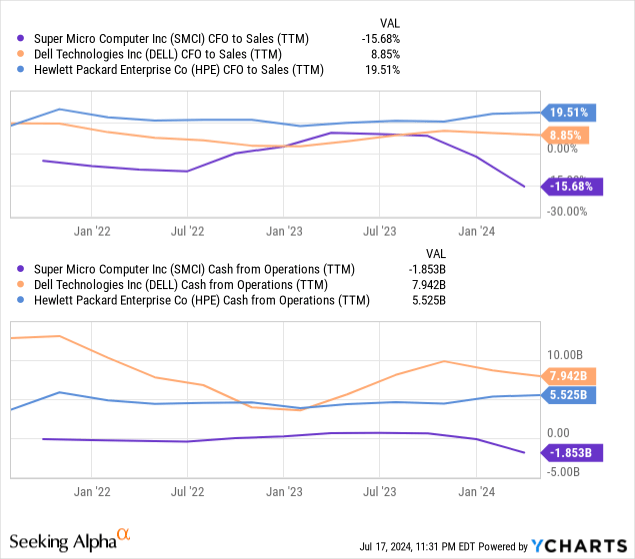

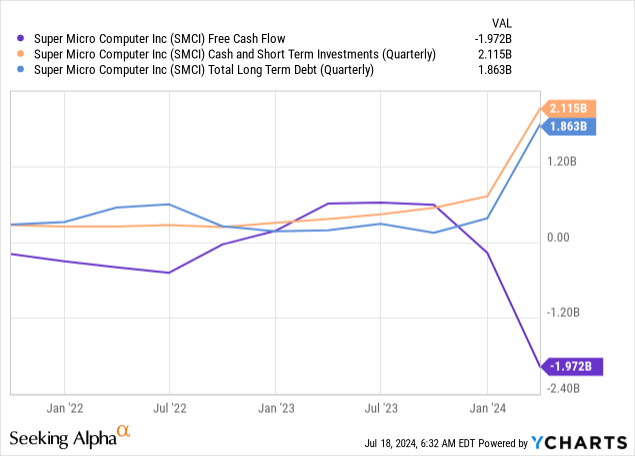

The following chart compares Supermicro’s cash flow from operations (“CFO”) to sales and CFO to its main competitors. Its end-of-March quarter earnings release shows a significant drop-off in CFO-to-sales into negative territory and a CFO trailing 12-month (“TTM”) loss of $1.85 billion. The reason for the loss is that the company’s rapid sales growth necessitates it spend cash in advance of future sales to build inventory. Yet there is a lag before it can collect cash from future sales. The timing mismatch between outgoing and incoming money creates a CFO loss.

CEO Liang said the following about increased inventory on the company’s earning call:

Two reasons we had to increase inventory. One is because Q4, I mean, June quarter, we will have a strong revenue growth. Second reason, because we’re preparing for high volume liquid cooling. Again, we have more than 1,000 of 100 kilowatt liquid cooling rack we had to ship to customer in Q4. And liquid cooling, as you know, is pretty new. So, we had to prepare enough inventory, so that we can deliver liquid cooling rack-scale product to customer on time or with minimum lead time.

Still, management believes inventory levels will eventually improve as the company begins benefitting from economies of scale. Of course, with a negative CFO, the company produced a trailing 12-month negative free cash flow (“FCF”) during the quarter. However, analysts estimate that Supermicro will achieve a full-year positive FCF of $954.1 million in FY 2025. Supermicro ended its March quarter with $2.12 billion in cash and short-term investments and $1.86 billion in long-term debt.

Its debt-to-equity ratio is 0.37, meaning the company relies on equity more than debt to finance its operations. Supermicro has a debt-to-EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) ratio of 1.6. Generally, a number below three is a sign that a company has the ability to pay off its long-term debt. Last, it has an interest coverage of 60.62, which means it has plenty of EBIT (Earnings Before Interest and taxes) to cover the interest expense. Supermicro has a low risk of defaulting on its debt.

The competitive environment

Supermicro got ahead of its competitors in developing advanced server technologies, and management believes it has several competitive advantages. Yet, some may question how long those advantages may last. For instance, Dell and HPE may have sold Rack-Scale solutions longer than Supermicro. While Supermicro got ahead of both companies by offering customers more customization options, both companies have recently become better at customizing servers for customers. Dell and HPE also have enough financial resources to potentially replicate modular technology over the long-term. There is a risk that customization and speed to market may cease to be significant differentiating factors for Supermicro over time. There are also other large companies, such as International Business Machines Corp. (IBM) and Lenovo Group (OTCPK:LNVGY)(OTCPK:LNVGF), that may also have enough financial resources to pour into R&D and potentially catch up.

Similarly, Supermicro heavily promotes liquid cooling as a differentiating competitive advantage. However, while researching Dell and HPE, I discovered that both companies have had liquid cooling technology for quite a while and are currently rolling it out to their customers. Liquid cooling and Supermicro’s focus on “Green Computing” could also cease to be an advantage for the company over time.

Other risks

Supermicro spends considerably more on R&D as a percentage of revenue than many of its competitors, which can be risky if its R&D investments fail to pay off in increased sales.

The company has a relatively small backlog compared to quarterly net sales. Although AI computers have recently had a massive demand spurt, the server manufacturing industry is historically cyclical. If demand for AI computers suddenly declines, sales and revenue could fall sharply. Additionally, the company may be stuck with a massive load of excess inventory. Investors likely would react negatively to such a situation.

Valuation

Supermicro’s price-to-sales P/S ratio is 4.0, well above Dell, HPE, and the computer hardware industry’s average of 2.32. The company’s 200% revenue growth rate is likely why the market has valued it well above its peers.

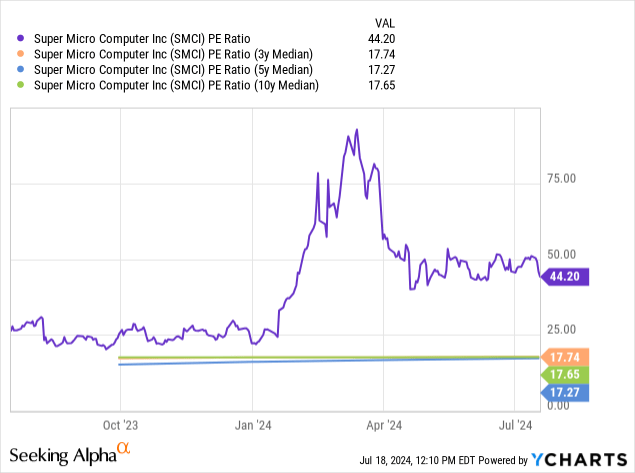

The chart below shows that Supermicro’s price-to-earnings (P/E) ratio of 44.20 is well above its median P/E of the last three, five, and ten years, suggesting overvaluation.

The following table from Seeking Alpha shows the company’s consensus non-GAAP EPS and forward P/E ratio. Generally, the market considers a stock fairly valued when its forward P/E matches its EPS growth rate. Since Supermicro’s FY 2025 EPS estimated growth rate exceeds its forward P/E, the market may undervalue the stock. If the stock’s forward P/E traded at its FY 2025 EPS estimate, the stock price should be $1,399.48 by the end of June 2025, up 75% from its July 18, 2024, closing stock price of $801.61.

Seeking Alpha

So, despite the massive stock rise this year, the market may still undervalue the stock based on analysts’ expected earnings growth over the next year.

Supermicro is still a buy

With the ongoing demand for AI computers still voracious, it’s hard to conclude that demand for Supermicro’s servers will drop off over the next year. Additionally, it may take competitors several years to catch up to Supermicro’s time-to-market and other advantages its modular construction provides. Barring a severe economic meltdown, investors will likely remain tantalized by the company’s massive revenue and EPS growth. Although conservative investors may want to proceed with caution and possibly avoid investing in this company, the stock may be ideal for aggressive growth investors looking for ways to invest in the proliferation of AI. I reiterate my buy recommendation of Supermicro.

Read the full article here