Since I upgraded Netflix (NASDAQ:NFLX) to a ‘Buy’ rating in December 2023, the stock price has increased by more than 30%, outperforming the S&P 500 index return of 16%. I highlighted Netflix’s disciplined content spending and strong membership growth momentum in my previous coverages. Netflix released its Q2 FY24 result on July 18th after the bell, raising the full-year revenue and margin guidance due to strong membership growth. I appreciate the company’s progress in growing its ads business, with ads tier membership growing by 34% quarter on quarter. I am upgrading Netflix to a ‘Strong Buy’ rating with a fair value of $750 per share.

Solid Ads Membership & Paid Subscribers Growth

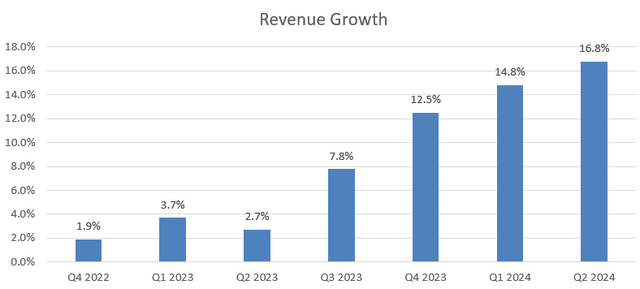

My biggest takeaway from the quarter is Netflix’s accelerated revenue growth, propelled by the growth of ads sponsored membership and paid subscriber growth. The management indicated that ads tier accounts for over 45% of all signups in the company’s ads markets.

Netflix Quarterly Earnings

I think Netflix’s accelerated revenue growth is driven by several factors:

- As mentioned in my previous article, Netflix launched their low-priced and ad-supported streaming services in several markets in order to expand their potential subscriber base. In Q2, their ad-supported membership grew by 34% quarter over quarter. During the earnings call, the management indicated that the company has been focusing on ads relevancy, targeting personalization and better measurement. The management expressed strong confidence in the growth of ad-supported streaming in the coming years.

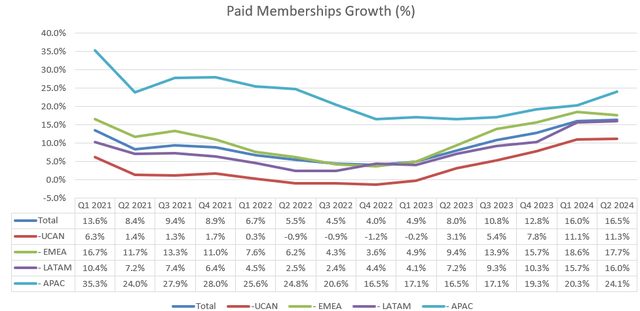

- Netflix’s paid membership grew by 16.5% year-over-year in Q2, with growth across all the major regions, as illustrated in the chart below.

Netflix Quarterly Earnings

The double-digit paid membership growth contributed significantly to the overall revenue growth, in my view.

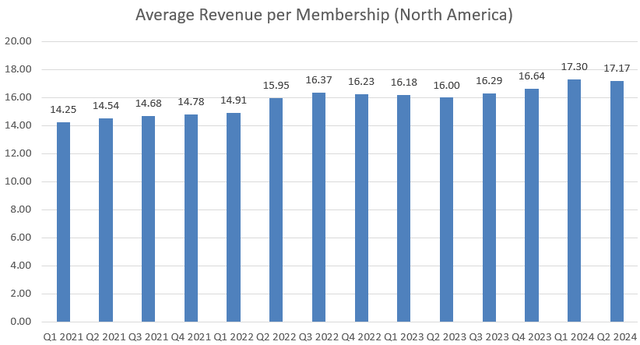

- Lastly, Netflix has been working on initiatives to crack down password sharing, offering features such as Transfer Profile and Extra Member to reduce password sharing among subscribers. As shown in the table below, the average monthly revenue per paying membership has grown in the US/Canada over the past few quarters, partially due to the password cracking.

Netflix Quarterly Earnings

FY24 Outlook

The company raised the full-year revenue guidance to 14% -15% ((versus previous guidance of 13% – 15%)), and its operating margin to 26% ((versus previous guidance of 25%)).

I am considering the following factors for revenue growth and margin expansion:

- In recent years, Netflix has allocated around $17 billion towards content spending annually, expect for FY23, which was disrupted by the strike. Assuming Netflix maintains content spending at around $17 billion while growing their revenue at double-digit, the company could generate tremendous operating leverage, as per my calculations.

- Netflix has been growing its advertising business, which carries much higher margin for Netflix. Netflix possesses tremendous data from their streaming services, which could be favored by advertisers, in my view. Digital TV Research forecasts that streaming services with ad-supported subscription plans will grow from $6 billion in 2023 to $20 billion by 2029. Consequently, I anticipate Netflix will continue to grow their ads supported streaming services and generate more ads revenue in the coming years.

- I anticipate Netflix’s paid membership to continue growing by 15%+ in the near future, thanks to share gains from the massive TV cable market, as well as Netflix’s password cracking initiatives.

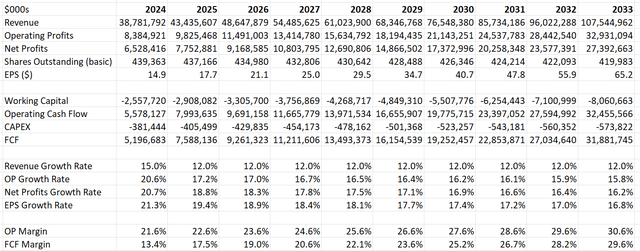

Overall, I forecast Netflix will deliver 15% revenue growth with a 100bps margin expansion, driven by gross profit leverage and declining amortization costs.

Valuation Update

For normalized growth, I forecast a 12% revenue growth, assuming 6% average monthly revenue per membership growth and 6% membership growth. The average monthly revenue per membership growth assumption aligns with their historical average over the past seven years.

On the margin side, I assumes content spending requires 5% year-over-year growth, and other operating expenses grow at the same rate as revenue growth. Due to operating leverage, I calculate their operating margin would expand to 30.6% by FY33.

Netflix DCF – Author’s Calculations

The WACC is calculated to be 11.3% with the following assumptions:

-risk free rate: 4.2% ((U.S. 10 year treasury yield))

-beta: 1.55. ((SA data))

-equity risk premium and cost of debt: 7%

-debt: $14 billion; equity $20 billion

-tax rate: 15%

Discounting all the free cash flow, the fair value of Netflix’s stock is calculated to be $750 per share.

Key Risks

In January 2024, Netflix announced a deal with TKO Group Holdings (TKO) to bring WWE’s flagship weekly program – RAW, to Netflix’s streaming from January 2025 in the U.S., Canada, UK, and Latam. Netflix plans to roll out RAW streaming in other countries over time. According to TKO’s disclosure, Netflix is agreed to pay more than $5 billion in total for a 10-year term. I have to say it is a quite expensive content acquisition for Netflix.

In addition, Disney (DIS) has also invested heavily in their ads supported streaming services, and the company has integrated ESPN to their streaming services and introduced various streaming bundles with Disney+. I view Disney as a respectable company, and Disney’s success in Disney+ could potentially pose some challenges for Netflix.

Conclusion

I am quite impressed with Netflix’s membership growth, driven by market penetration and ad-supported subscriptions. Netflix’s disciplined content spending is expected to help the company reduce the amortization costs and improve operating margin over time. I upgrade Netflix to a ‘Strong Buy’ rating, with a fair value of $750 per share.

Read the full article here