Consumer sentiment dropped to an 8-month low in July, according to the preliminary report for the Michigan Consumer Sentiment Index. The index fell 2.2 points (-3.2%) from June’s final reading to 66.0. The latest reading was below the forecast of 68.5.

The Michigan Consumer Sentiment Index is a monthly survey of consumer confidence levels in the U.S. with regard to the economy, personal finances, business conditions, and buying conditions, conducted by the University of Michigan. There are two reports released each month; a preliminary report released mid-month and a final report released at the end of the month.

Joanne Hsu, the director of surveys, made the following comments:

For the second straight month, consumer sentiment is essentially unchanged. July’s reading was a statistically insignificant 2 index points below last month, well within the margin of error. Although sentiment is more than 30% above the trough from June 2022, it remains stubbornly subdued. Nearly half of consumers still object to the impact of high prices, even as they expect inflation to continue moderating in the years ahead. With the upcoming election, consumers perceived substantial uncertainty in the trajectory of the economy, though there is little evidence that the first presidential debate altered their economic views. Year-ahead inflation expectations fell for the second consecutive month, reaching 2.9%. In comparison, these expectations ranged between 2.3 to 3.0% in the two years prior to the pandemic. Long-run inflation expectations came in at 2.9%, down from 3.0% last month and remaining remarkably stable over the last three years. These expectations remain somewhat elevated relative to the 2.2-2.6% range seen in the two years pre-pandemic.

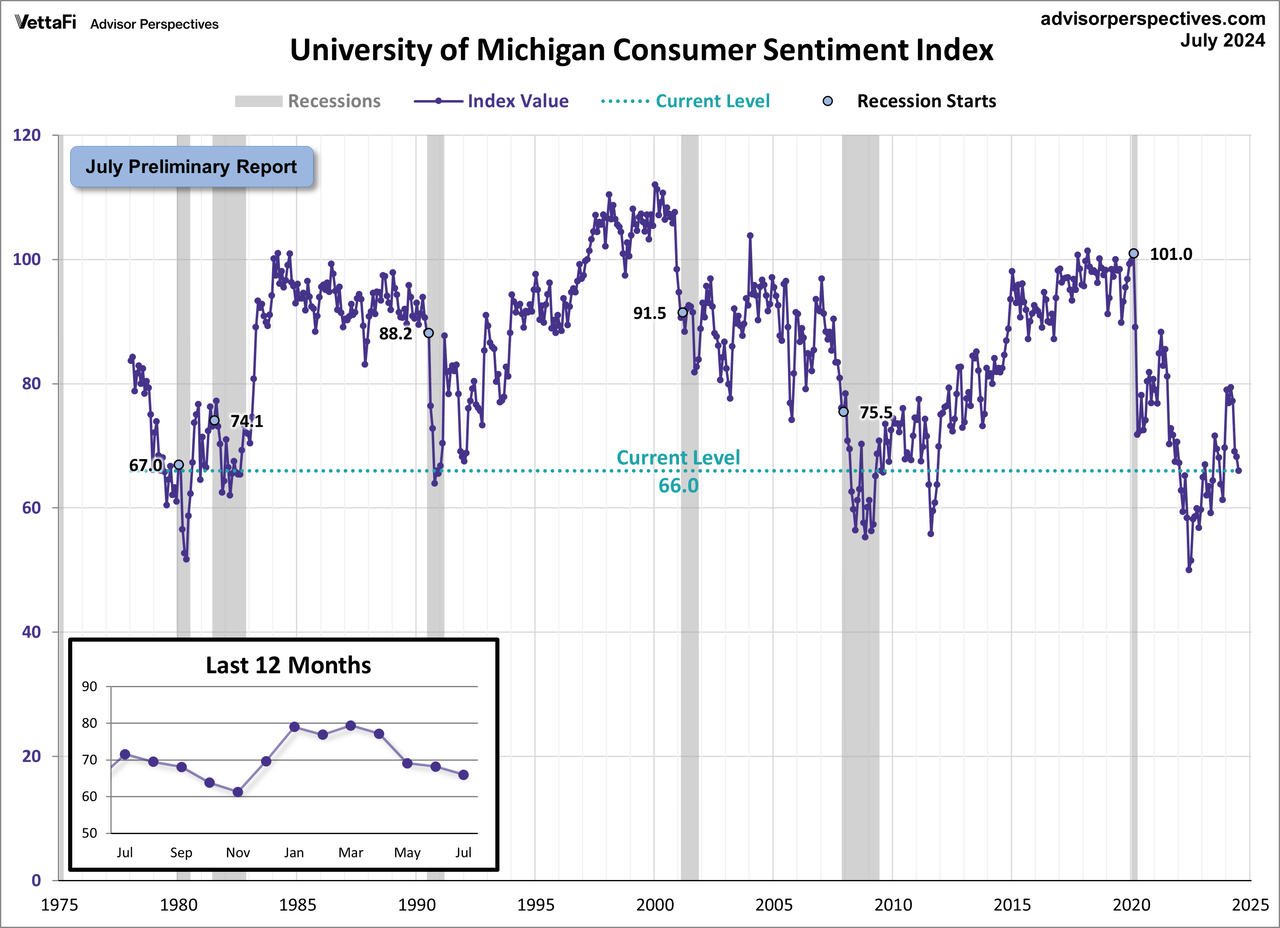

See the chart below for a long-term perspective on this widely watched indicator. We’ve highlighted the value of the index at the start of each recession and also included a callout to the most recent 12 months. The current level of 66.0 is below the index’s level at the start of 6 of the 6 recessions since the index’s inception.

To put today’s report into the larger historical context, since its beginning in 1978, consumer sentiment is 22.2% below its average reading (arithmetic mean) of 84.8 and 21.2% below its geometric mean of 83.7. The current index level is at the 10th percentile of the 559 monthly data points in this series.

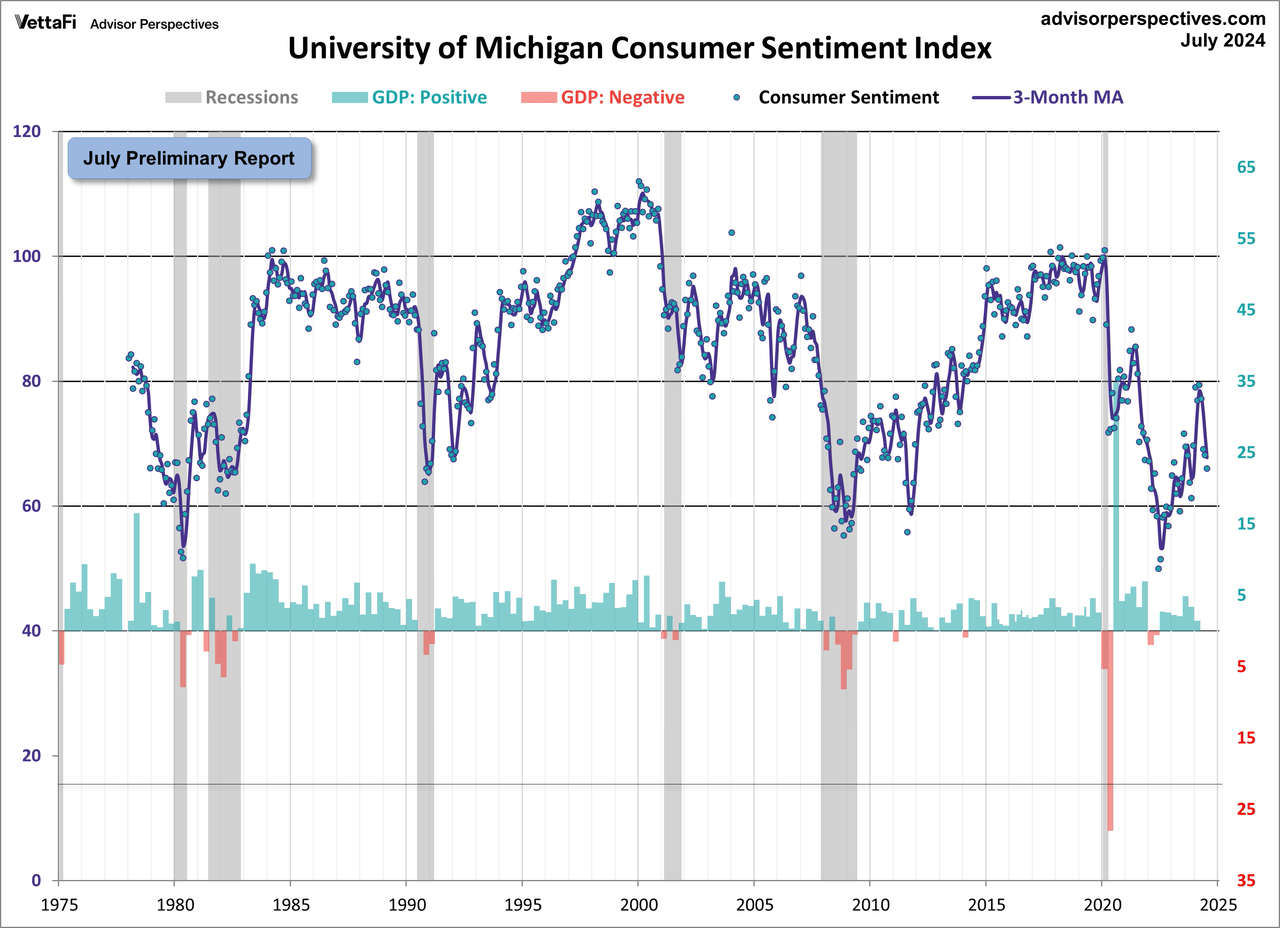

This indicator is somewhat volatile, with a 3.1-point absolute average monthly change. The latest data point saw a 2.2-point decrease from the previous month. For a visual sense of the volatility, here is a chart with the monthly data and a three-month moving average. The bottom half of the chart shows real GDP to help us evaluate the correlation between the Michigan Consumer Sentiment Index and the broader economy.

Other Sentiment Indicators

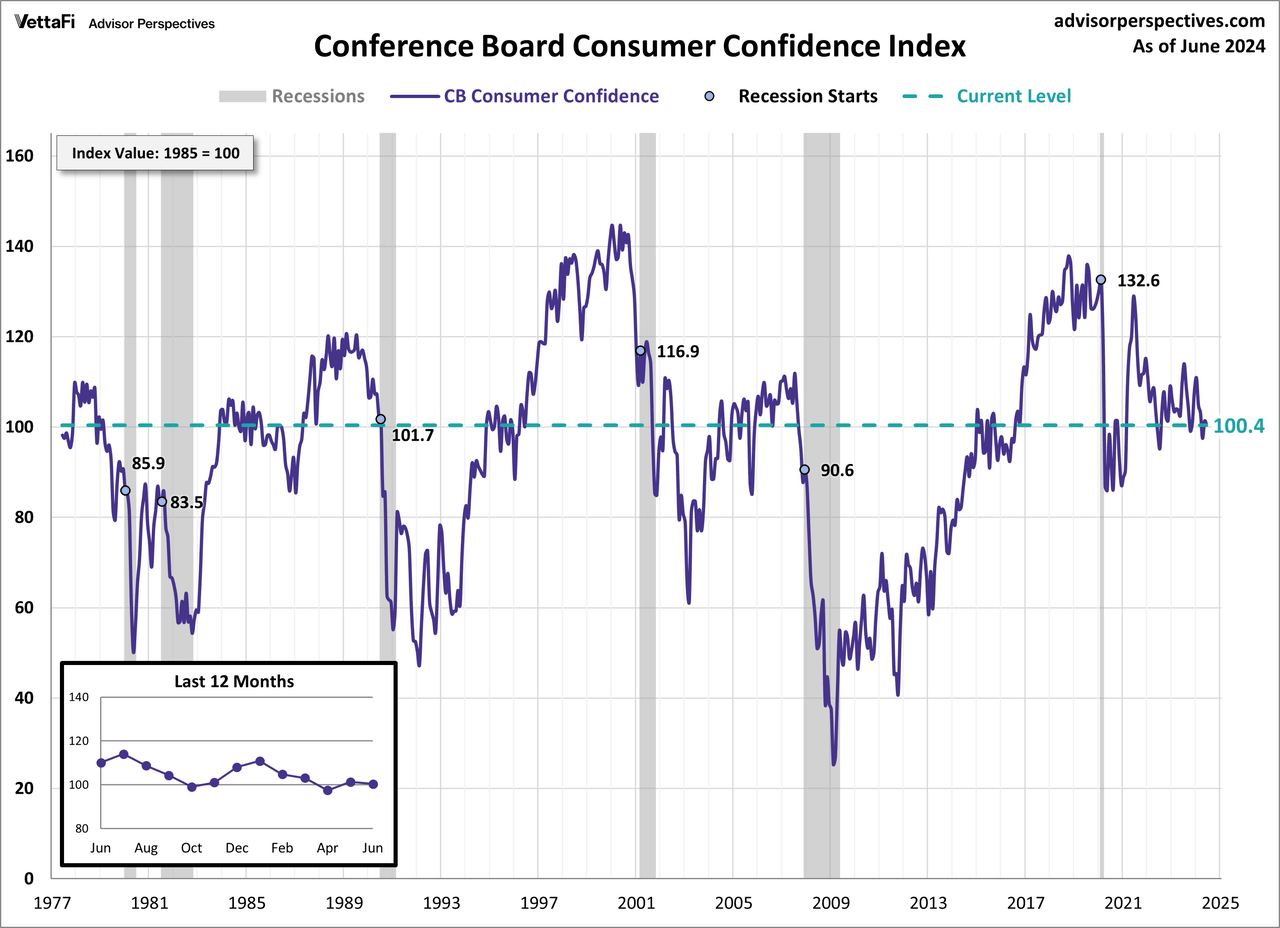

For an additional perspective on consumer attitudes, see the most recent Conference Board’s Consumer Confidence Index. Both indexes gauge consumer attitudes toward the current and future strength of the economy. However, the Consumer Confidence Index is more influenced by employment and labor market conditions, while the Michigan Sentiment Index is more focused on household finances and the impact of inflation.

The Conference Board index is the more volatile of the two, but the broad pattern and general trends have been remarkably similar to the Michigan index.

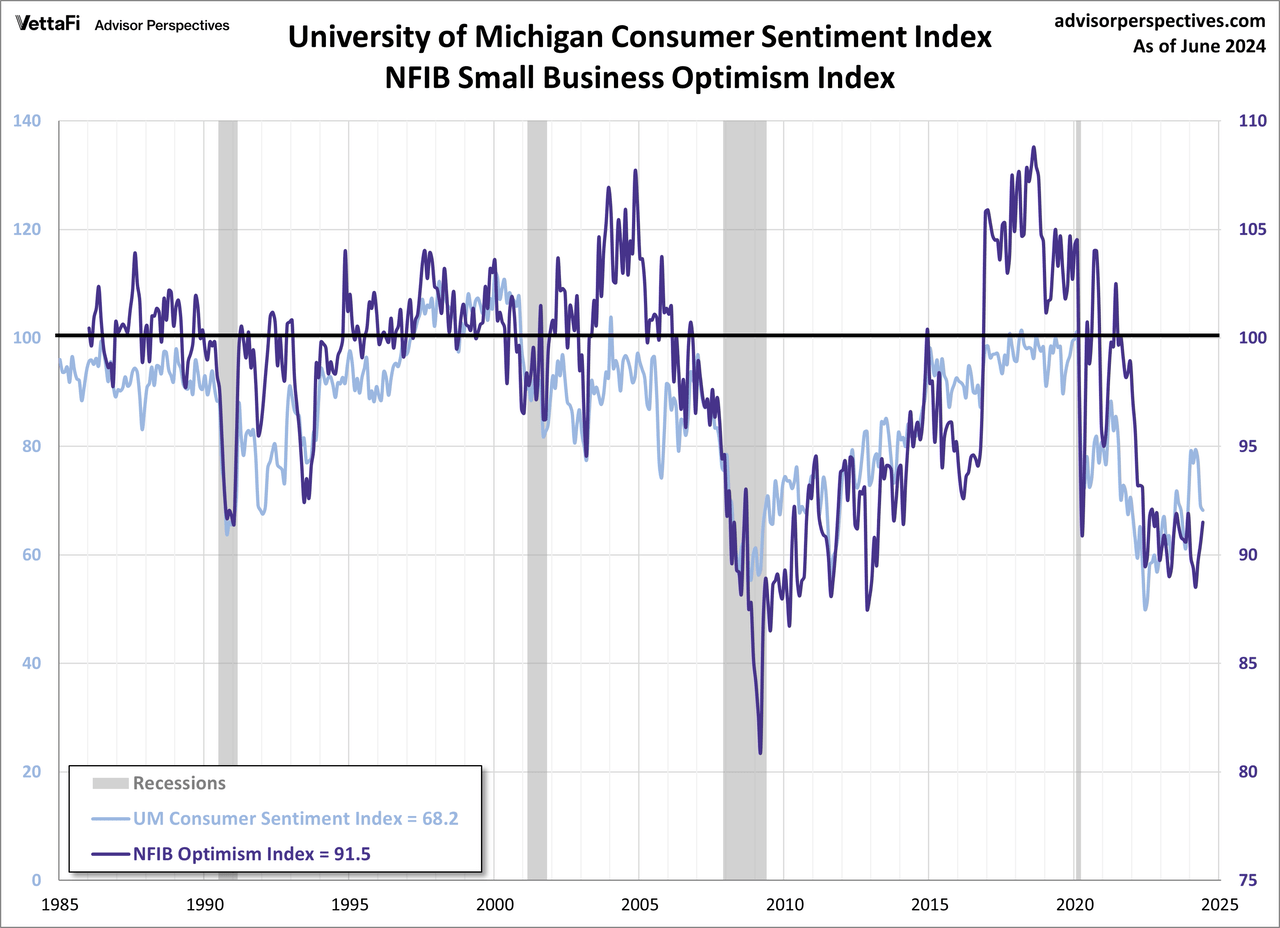

And finally, the prevailing mood of the Michigan survey is also similar to the mood of small business owners, as captured by the NFIB business optimism Index (monthly update here).

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here