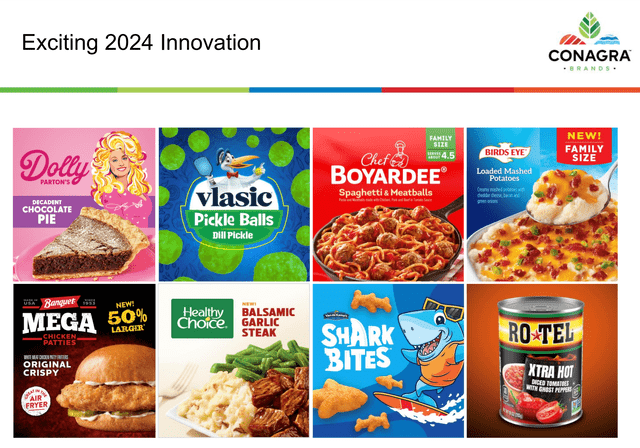

Conagra Brands (NYSE:CAG) is a manufacturer of food products and it owns many well-known brands which include household names like: Duncan Hines, Gardein, Swiss Miss, Healthy Choice, Log Cabin, Slim Jim, Hebrew National, Wesson, Hunt’s, Orville Redenbacher’s, Chef Boyardee, Libby’s, Jiffy Pop, Mrs. Butterworth’s, and more. It also offers private label foods which are sold by major grocery stores. My last article on Conagra was way back in 2014, and I suggested it was worth buying after a sharp pullback over an earnings miss. Back then it yielded about 3.5%, and today (thanks to increases in the dividend) it yields around 5%.

Conagra shares have recently declined about 10% from recent highs, making this a potentially ideal buying opportunity. The other big reason I think there’s a potential buying opportunity is because the economy is slowing down, and we could be headed for a recession, which will make investors want to seek out stocks that could be defensive and recession-resistant. With this in mind let’s take a closer look at the investment opportunity in Conagra for 2024:

Source: Conagra Brands

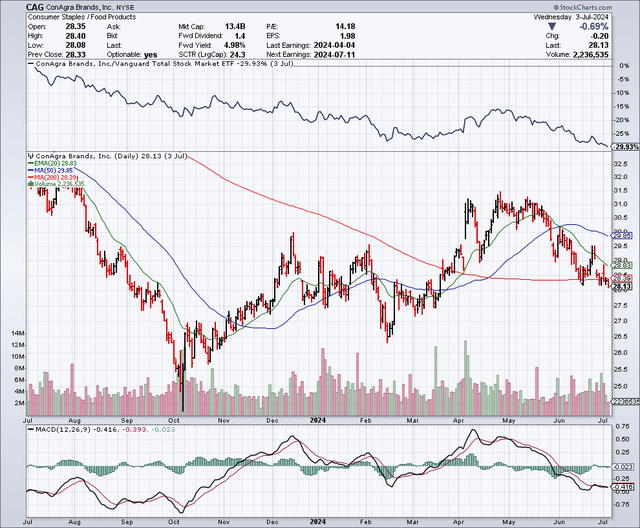

The Chart

As the chart below shows, Conagra shares were recently trading for around $31.50, but have since pulled back down to about $28. This stock is now trading below the 50-day moving average which is $29.85 and right around the 200-day moving average which is $28.39.

StockCharts.com

Earnings Estimates And The Balance Sheet

As shown below, the consensus earnings estimate provided by Seeking Alpha, show low to mid single digit growth rates for 2025 and 2026. This is not uncommon with major food stocks and with consumer staples. These estimates suggest a price to earnings ratio of just about 10 times, and this is extremely low when compared to the average for the S&P 500 Index (SPY), which is currently more than 20 times earnings.

Earnings Estimates

|

FY |

EPS |

YoY |

PE |

Sales |

YoY |

|---|---|---|---|---|---|

| 2024 |

2.63 |

-5.12% |

10.70 |

$12.08B |

-1.63% |

| 2025 |

2.69 |

+2.51% |

10.44 |

$12.18B |

+0.89% |

| 2026 |

2.83 |

+4.87% |

9.96 |

$12.41B |

+1.88% |

The balance sheet is not as strong as I would like to see, with about $8.68 billion in debt and $78.5 million in cash. However, since the food industry typically provides strong and consistent cash flows, this an offsetting factor for me in terms of risk and in viewing relative balance sheet strength.

Let’s Review Q4 Results And 2025 Guidance

On July 11, 2024, Conagra released 4th quarter results which reflected a net loss of $567.3 million or $1.18 per share. However, excluding certain items, the company earned a profit of $0.61 per share which was a beat of $0.04 over the consensus estimates. These results were impacted by declines in sales of 2.1% in grocery and snacks, a decline of 3.8% in refrigerated and frozen revenues and a 3.9% decline in foodservice sales. On the positive side, international sales increased by 6.4% but this segment is not as big in terms of revenues when compared to the other segments. As for guidance, the company is expecting adjusted earnings of $2.60 and $2.65 per share for 2025. While these results are generally in line with expectations, and not overly exciting, I do like seeing the progress this company is making on paying down debt. The Q4 earnings call transcript details the progress on strengthening the balance sheet and it states:

“In Q4, we repaid a $1 billion senior note that matured in May 2024 through a combination of cash on hand, commercial paper borrowings and the issuance of a $300 million one year unsecured term loan. For the fiscal year, our ending net debt was $8.4 billion, a reduction of $777 million, or 8.5% from fiscal ‘23.”

Upside Catalysts I See For Conagra

Conagra has been focusing successfully on reducing expenses and paying down debt. This could lead to lower interest expenses and multiple expansion for the stock if significant debt reduction continues over the next few years.

Interest rates are expected to decline over the next couple of years and this could be a big positive for Conagra, allowing more of its cash flow to go towards debt repayment instead of high interest expenses.

Conagra has a history of spinning off assets and some of these spinoffs have been very successful. For example, in 2016, Lamb Weston (LW) was spun-off from Conagra and it has been able to command a higher price to earnings multiple when compared to Conagra. With so many well-known food brands, Conagra has many options to divest certain brands by selling them to other companies, or to do additional spinoffs which could create shareholder value.

Conagra only generated about $267 million during the quarter from international sources. I believe it could have significant potential to expand internationally and this segment was a bright spot for the quarter in terms of revenue growth.

I see potential for multiple expansion, because when compared to other very slow growing food companies, the price to earnings ratio for Conagra is very low. Other food companies like Nestle (OTCPK:NSRGY) and Unilever (UL) have very slow growth, and yet Nestle trades for about 19 times earnings as does Unilever.

The Dividend

Conagra pays a quarterly dividend of $0.35 per share, which totals $1.40 per share on an annual basis. This provides a yield of about 5%, which is in line with what money market funds currently yield. The dividend has been raised for each of the past four years and the payout ratio is just around 50%, which leaves plenty of room for increases in the future. The dividend also appears secure with the payout ratio at this level.

Recession Risks Appear To Be Rising

I believe there are more and more signs of a potential recession looming. Recent jobs growth data shows a slowdown and this could accelerate in the coming months. The Federal Reserve just released their minutes on July 3, which indicate it’s not ready to cut rates until it has greater confidence that inflation is moving down to the 2% level. This higher for longer policy shows me a pattern from the Federal Reserve whereby they do not act until it is too late, because by the time the data confirms everything, we could already be in a recession. I believe the Fed made the same type of policy errors when it was calling inflation “transitory” and it waited too long to act in that instance as well.

Many consumers appear to be under significant pressure now with recent data showing rising delinquencies with auto loans as well as record levels of credit card debt. Many consumers are also delinquent in paying their credit cards. In another sign confirming potential problems with the economy, the Consumer Sentiment Index dropped to 65.6 in June, which was down from 69.1 in May. This represents the third monthly decline in a row. A few more months of this downward type data coupled with the Fed holding rates higher for longer could be the perfect recipe for a recession.

Interest Rates Could Decline Significantly And Push Up High Yield Dividend Stocks Like Conagra

Whether rates are lowered by the Fed preemptively in order to create a soft landing, or whether the Fed misses the mark and is forced to lower rates because the economy has dipped into a recession, I see interest rates declining in the coming years. Even the Federal Reserve is expecting sharply lower interest rates sooner or later. The Federal Reserve just updated its “Summary of Economic Projections”, and it is forecasting that the Fed Funds rate could drop from about 5% currently, to just around 3% in 2026. This means the yields on money market funds are also likely to decline to around 3%, and this could put investors back on the hunt for high yielding stocks like Conagra.

Challenges Facing Conagra And Potential Downside Risks

The food business is very competitive and some peers are spending more money on marketing. Conagra has about one third of its revenues coming from the frozen food category. While many Americans will always want the convenience that frozen foods offer, whether it be frozen vegetables or frozen prepared meals, there is a trend towards fresh foods.

Conagra is a slow growth company and it might choose to make acquisitions in order to boost revenues and growth rates. Acquisitions can go great or end up destroying shareholder value. The announcement of a buyout often causes a drop in the stock of the acquiring company (especially if the market does not like the deal), so this is a potential downside risk to consider.

A recession could cause a stock market correction, which could put pressure on just about every stock, even food stocks like Conagra. The difference however is that Conagra could be relatively strong in a big market pullback and even rebound or show strength as investors seek value stocks that provide a high yield and have recession-resistant business models.

In Summary

I view Conagra as a pretty boring investment, somewhat like a bond that can provide me with a 5% yield which is competitive with what money market funds currently pay. However, I do see the potential for capital gains in this stock as well, which could be fueled by lower interest rates in the future. I also see some potential for price to earnings multiple expansion since this stock is trading for less than half of the market averages. I won’t make Conagra a big position in my portfolio, but it makes sense to me now after a pullback, and it could be poised to offer solid total returns over the next couple of years as interest rates decline and as investors potentially appreciate the defensive nature of the food industry in what could be a coming recession.

No guarantees or representations are made. Hawkinvest is not a registered investment advisor and does not provide specific investment advice. The information is for informational purposes only. You should always consult a financial advisor.

Read the full article here