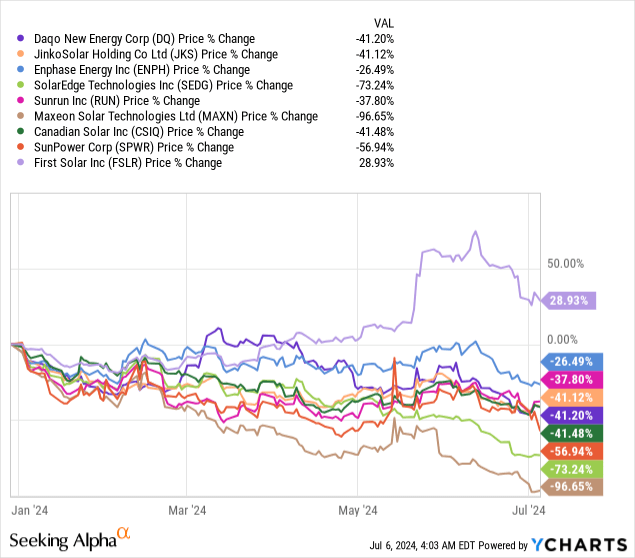

The solar industry has been obliterated in the past months, and fairly so because of incompetent management. One of the largest losers was none other than SolarEdge (SEDG), who thought it would be a good idea to throw cash towards buybacks in a very competitive and depressing environment. SolarEdge has neither pricing power nor product differentiation compared to competitors and that is highly visible in their operational performance. Months after doing buybacks, SolarEdge realized the mistake due to insufficient cash and priced a $300M convertible debt offering.

Further, SunPower (SPWR) dropped by more than 20% last Friday on the news that their auditor, EY, has resigned due to allegations of misconduct by management and unwillingness to be associated with the financial statements prepared by management. These examples do not give much confidence to investors that the solar industry is a safe place to invest money.

In the solar industry, it is all about scale of efficiencies, oligopoly and product differentiation. If a solar stock does not have 2 or more of these characteristics then you can expect it to be highly risky. Daqo New Energy (NYSE:DQ) does have scale of efficiencies, is one of the top 3 polysilicon producers in the world and has a product mix with more than 70% of n-type polysilicon (the highest quality solar-grade silicon).

Increasing efficiencies in the eye of the bottom

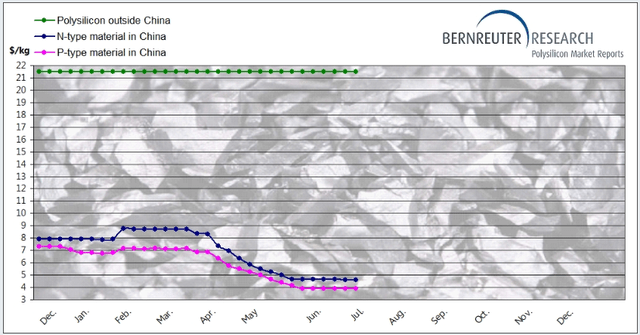

In the beginning of June it seems that polysilicon prices have finally found a bottom below the production cost of all tier 2 and tier 3 polysilicon makers. Even tier 1 polysilicon makers like Tongwei, GCL and Daqo New Energy will probably show losses on their income statements in the coming quarters.

Bernreuter Research

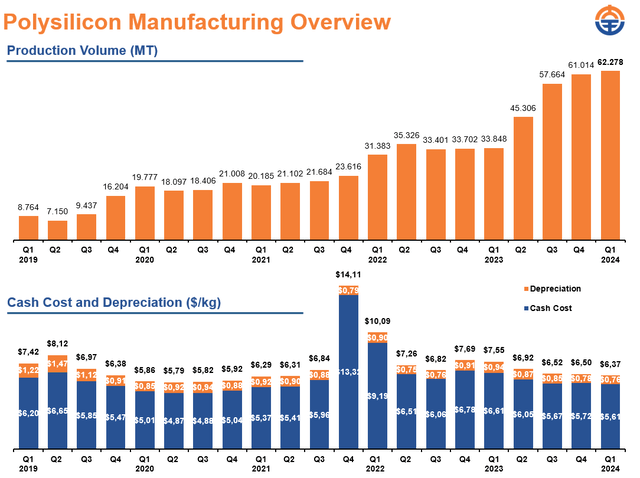

Historically, we know that in the wake of low polysilicon prices, the cash cost of Daqo New Energy also improves to offset the losses. In the Covid-19 crisis, polysilicon prices hit a low of $6.75/kg. Daqo New Energy’s production cost improved drastically as well with cash cost at $4.87/kg in Q2 2020. In 2024, a similar declining trend can be seen.

Last quarter, Daqo was still able to be profitable with an EBITDA margin of 18%. Profitability in Q2 will all depend on the time of transactions and the average price of polysilicon sales the company was able to do. Since cash cost should decrease further because of declining silicon powder prices and more operational efficiencies in the new factories, Daqo might surprisingly squeeze out another profitable quarter. In the third quarter of 2024, investors should expect a loss as in June and July n-type polysilicon prices sunk below $5/kg and p-type polysilicon below $4/kg.

Investor Presentation 24Q1

Best positioned in the industry

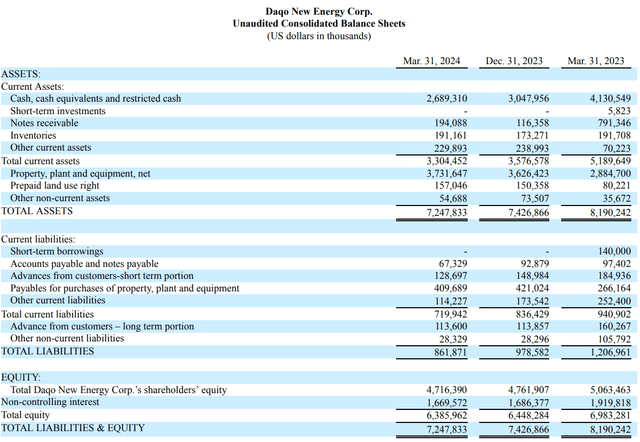

Daqo New Energy remains the most healthy company in the whole industry. The company has a fortress of a balance sheet with $2.9 billion in cash and notes receivables. In addition, the balance sheet is free of long term debt and has only $720 million in current liabilities, which consists partly out of advances from customers.

The CEO of Daqo New Energy, Xiang Xu, mentioned in the first quarter of 2024 the following:

At this level, we believe the entire solar value chain, including polysilicon, is likely to be loss-making in general and that a large number of polysilicon producers are currently unprofitable. The solar industry has gone through multiple cycles in the past and, based on our previous experience, we believe that the current low prices and market downturn will eventually result in a healthier market, as poor profitability and losses, as well as cash burn, will lead to many market players exiting the business with some possible bankruptcies. This will bring the inevitable capacity rationalization and solve the overcapacity issue we are currently experiencing. And as demand growth resumes after excess inventories are depleted in the short-run and on the backdrop of positive policies pushing renewable installations in the long-run, the solar PV industry will return to normal profitability and achieve better margins. We believe that at the end of the quarter, we had one of the industry’s lowest levels of finished goods inventory, with approximately two weeks of production.”

The most important part is where the CEO mentioned that they have one of the lowest levels of finished goods. Normally in these times of overcapacity the market gets oversaturated and inventory levels start to spike up. Nevertheless, Daqo is managing the inventory levels very well, while still running on full capacity.

Investor Relations – 24Q1

Surprisingly, when we compare the balance sheets of the tier 1 polysilicon producers next to each other then there is a clear winner. Daqo New Energy balance sheet is healthier both in terms of the current ratio and debt to equity ratio. Tongwei is a vertical integrated player and its balance sheet does not only consist out of the polysilicon business. However, it does show that Daqo New Energy will be able to suffer losses the longest in the industry and is in a good position to take market share and remain great relationships with clients.

In addition, Daqo is looking to expand their business out of China. This could bring benefits of higher average selling prices because the demand for non-Chinese made polysilicon is higher due to U.S. restrictions. Of course, out of China it is likely that the cash cost to make polysilicon will be higher.

Valuation

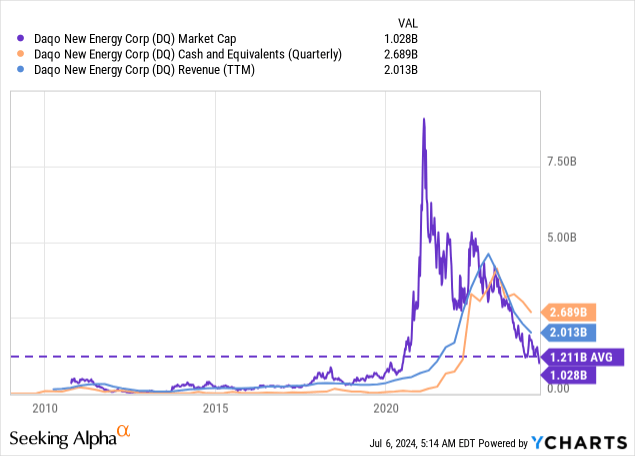

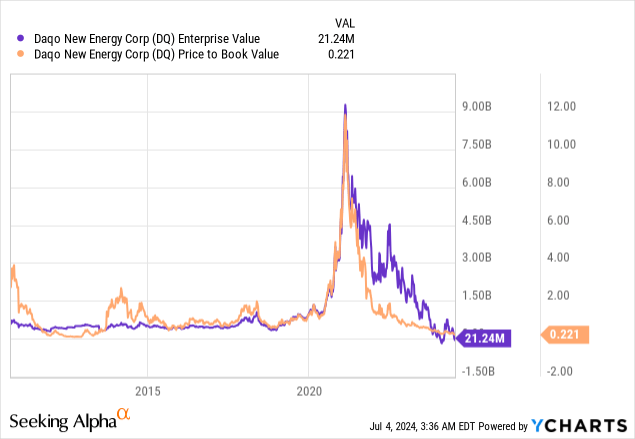

The gap between Daqo New Energy’s market cap and cash position keeps widening, while polysilicon prices make the whole polysilicon market unprofitable. Daqo’s balance sheet is an enormous advantage compared to competitors. The company has no debt interest to pay, can survive multiple unprofitable quarters and managed to upgrade their production capacity before the next upward cycle.

Daqo’s enterprise value is now nearing zero as the market cap keeps declining and the cash position remains relatively stable. The book value of $4.7 billion owned by Daqo New Energy shareholders is below the market cap of $1 billion. Therefore, the price to book value is nearing all time lows at 0.22x.

Investors need to keep in mind the cyclical behavior of the polysilicon industry. The standard valuation measure tool, price-to-earnings, will increasingly be less reliable to value the company. The company is expected to suffer losses in the coming quarters, which will result in the increase of the PE ratio. Nonetheless, in cyclical cycles most companies will be the most attractive to invest in when they show high price-to-earnings multiples, as it could signal the bottom of a cycle. The bottom of a cycle exist out of losses for the whole industry and is followed by a slow recovery is average selling prices.

Tier 2 and 3 manufacturers will have to leave to market or will be accumulated by the tier 1 manufacturers. As a result, the overall polysilicon capacity will decrease and overcapacity should subside.

Regardless of that, it is important to note that tier 1 manufacturers are still expanding polysilicon capacity and this could neutralize the decrease in the overall capacity due to the exit of tier 2 and 3 manufacturers.

Risks

Investors need to keep in mind that Daqo New Energy has been identified by the SEC under the Holding Foreign Companies Accountable Act. This means the company can be delisted, if they do not show the right auditing under the rules of the United States.

However, the SEC announced the following, saying that there are currently no issuers at risk of delisting:

As noted above, on December 15, 2022, the PCAOB vacated its previous determinations that it is unable to inspect and investigate completely PCAOB-registered public accounting firms headquartered in mainland China and Hong Kong. Accordingly, until such time as the PCAOB issues any new determination, there are no issuers at risk of having their securities subject to a trading prohibition under the HFCAA.

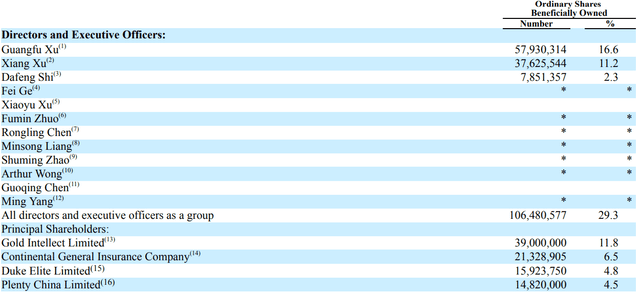

The high concentration of ownership by management could be another risk to consider. In case management lost confidence in the business they might sell shares, which could further pressure the stock price.

In the face of falling stock prices, Daqo New Energy announced that Xu Guangfu, the actual controller and chairman of the board, voluntarily promised not to reduce his direct holdings of the company in any way within 6 months from July 23, 2024. This action shares the confidence management has in the rebound in the business.

Investor Relations – Annual report 2023

Takeaway

Despite a further weakening market environment for polysilicon manufacturers, Daqo New Energy is still standing strong. The big question is how much longer the downcycle will last. The longer the low polysilicon prices persist, the more companies will have to leave the industry. Daqo will have the chance to take market share and wait till the downcycle is over.

The second half of the year is poised to be the tipping point for the solar industry. Only when wafer inventories get depleted can we expect a rise in polysilicon prices. On the other hand, I do expect Daqo New Energy to announce a new buyback program before the end of the year. Management does understand how undervalued to company currently is and will take advantage of the low prices. The only reason for them not to start a new buyback program is if we see further declines in polysilicon prices, which seems unlikely at this point.

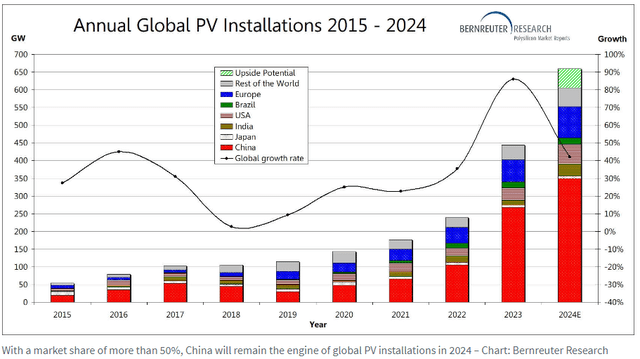

The overall trend of solar energy is positive and remains a tailwind for the stock. Solar is arguably one of the most competitive and cheapest forms of power generation. In 2024, Bernreuter Research even expects a new record in solar installations between 600 and 660 GWdc due to the low solar module prices. If demand picks back up, then the overcapacity of polysilicon of wafer manufacturers could be depleted relatively soon, and new orders for polysilicon should arrive.

Bernreuter Research

I remain my “Strong Buy” rating for Daqo New Energy. In case you want to know more about Daqo New Energy, you can always check out my profile and read my previous articles. Thank you for reading.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here