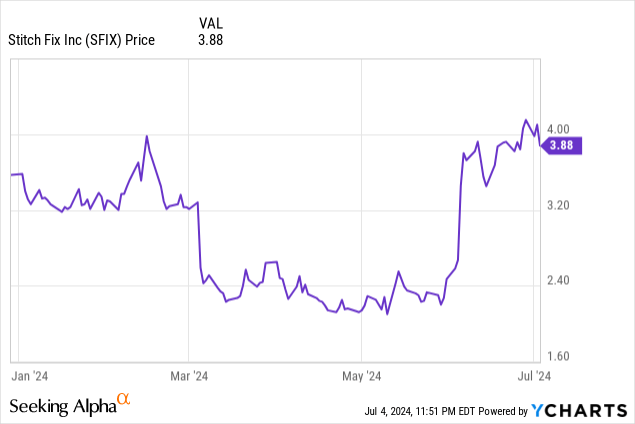

Wall Street loves a good rebound story, but the critical question is if turnarounds can be sustained. One of the stocks that surprised us over the past month is Stitch Fix (NASDAQ:SFIX), the e-commerce company that used to be known for sending its customers a box of five stylist-curated items called “Fixes,” from which customers selected their favorites and sent the rest back.

When the novelty of this approach receded, and especially amid weaker consumer spending post-pandemic, Stitch Fix started to tank. But an early-June fiscal Q3 (April quarter) earnings print started to reverse the story, and Stitch Fix has now rallied from its YTD lows and is up nearly 10% year to date.

But again, we have to ask critically: is the company capable of retaining this rally? In my view, the answer is no.

I last wrote a bearish note on Stitch Fix in April, when the stock was trading in the ~$2 range. And while I certainly didn’t foresee the post-Q3 earnings pop, I am standing by my sell rating on this stock as a plethora of short and long-term risks have emerged.

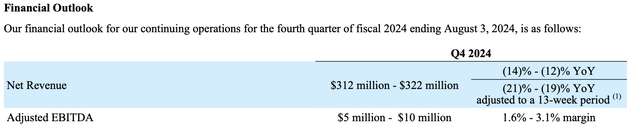

Stitch Fix primarily popped on the company’s outlook for Q4.

Stitch Fix Q4 outlook (Stitch Fix Q3 earnings materials)

For Q4, as shown above, the company has guided to revenue declining “only” -14% to -12% y/y, which is a sequential improvement from a -16% decline in Q3 and a -18% decline in the preceding Q2. The midpoint of the company’s guidance range of $317 million is $10 million, or ~3 points of growth, better than Wall Street’s $306.6 million initial expectations.

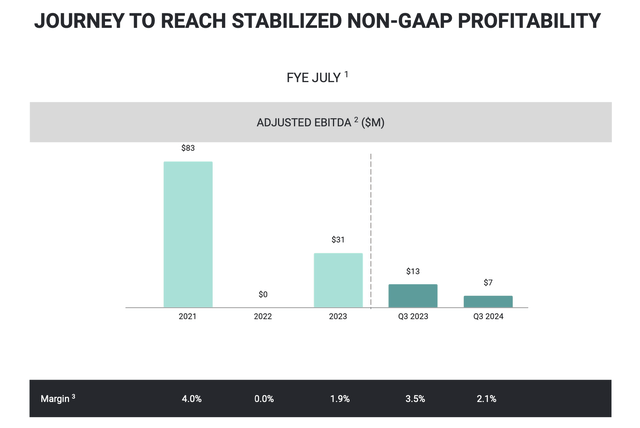

That being said: we have to recall how Stitch Fix is getting there. Earlier this year, the company noted that it would be throwing all of its resources behind improving customer retention, through a combination of both heavier marketing spend plus increasing customers’ touchpoints with its human stylists. All of these efforts are going to be costly, and as reflected in the guidance, the company is expecting only a 1.6-3.1% adjusted EBITDA margin: the midpoint of which is lower than 2.7% in the prior year Q4, and the peak 4.0% margin that Stitch Fix hit in 2021. The company is effectively eroding the gross margin benefits it’s gaining from selling a higher mix of private label items by spending more on sales outreach.

Here are several other core risks to be mindful of here:

- Stitch Fix’s unique elements have lost their novelty; is it just a fad now? The idea of getting a “Fix” of five items and keeping only what you like was the whole selling point behind Stitch Fix in the first place. But declining active customers seem to be suggesting that people don’t want this complexity in the shopping process. In fact, Stitch Fix introduced its direct-buy “Freestyle” program to mirror classic e-tailers: And in doing so, it lost its niche in the first place. Without much of a powerful brand to draw from, it’s unclear how Stitch Fix plans to remain relevant.

- Sharp competition from fast casual clothiers. Uniqlo, Zara, and a number of upstart direct-to-consumer brands have exploded on the retail scene. Amid “basic convenience” buyers, it’s unclear where Stitch Fix fits in.

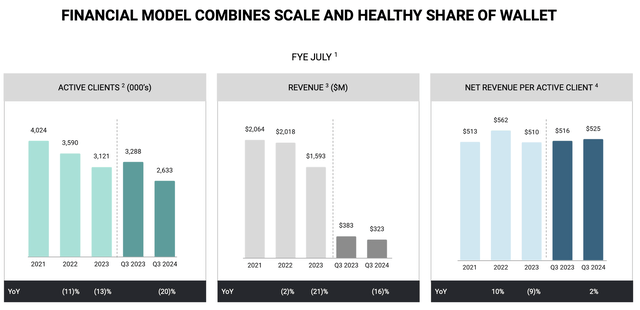

- Losing customers despite higher marketing spend. Despite Stitch Fix’s efforts to draw more customers in, it keeps bleeding active clients.

Steer clear here: Stitch Fix is very likely to unwind its recent rally.

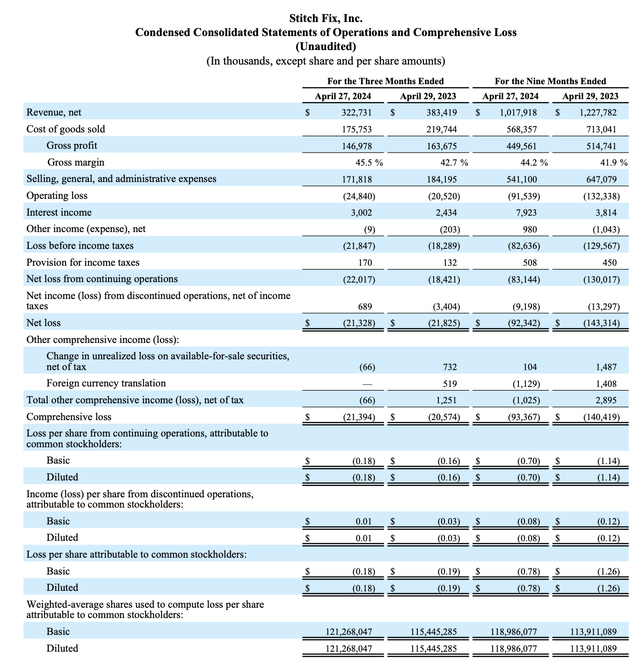

Q3 download

To me, despite the above-expectations guidance in Q4, the company’s actual results in Q3 did little to inspire continued confidence in this name. Take a look at the Q3 earnings summary below:

Stitch Fix Q3 results (Stitch Fix Q3 earnings materials)

Revenue declined -16% y/y to $322.7 million, which beat Wall Street’s expectations of $306.2 million (-20% y/y) by a four-point margin. Revenue growth did accelerate two points from a -18% y/y decline in Q2, but we also have to note that the company’s comps are getting easier as we are lapping very weak sales in 2023.

Meanwhile, Stitch Fix’s core problem of losing clients has continued to feature prominently. The Q3 ending client count was 2.63 million, down -20% y/y and representing a loss of 172k clients from Q2 alone.

Stitch Fix Q3 customer metrics (Stitch Fix Q3 earnings materials)

And we also point out that this is in spite of Stitch Fix spending 53% of its revenue on selling, general and administrative expenses (five points higher than 48% in the year-ago quarter) and 9% on advertising (two points higher than 7% in the year-ago quarter), which more than nullified three points of higher gross margins from a higher mix of private label sales.

There are small product tests that the company is running to try to improve results. One new initiative is “quick fixes,” which gives customers the optionality to add a second fix upon checkout. CEO Matt Baer noted that this effort has helped to boost average order values on the Q3 earnings call:

In Q3, we leveraged our analytics capabilities to improve the profitability of fixed transactions while strengthening client satisfaction. Following a robust analysis of client interactions, we found opportunities to reduce underperforming shipments. As an example, we currently offer quick fixes, which provide clients the option to schedule an additional fix immediately following checkout.

Utilizing our proprietary demand algorithms, we improve the performance of Quick Fix’s by only offering them to clients when we know the new fixes have a high likelihood of success. Within three weeks of this change, Quick Fix average order value improved by 25%.”

That said, new initiatives plus the company’s heightened expense on advertising has cut sharply into profitability. Adjusted EBITDA declined -50% y/y to $7 million as shown in the chart below, while adjusted EBITDA margins of 2.1% were 140bps weaker y/y:

Stitch Fix adjusted EBITDA (Stitch Fix Q3 earnings materials)

Key takeaways

With Stitch Fix’s customer base continuing to recede despite heavier efforts in advertising, I continue to be wary of Stitch Fix despite the stock’s recent rebound in confidence. Longer term, I find it very difficult to believe that the company can compete in a world of much larger and better-recognized fast fashion giants. Continue to steer clear here and invest elsewhere.

Read the full article here