Thesis

The iShares Frontier and Select EM ETF (NYSEARCA:FM) is an equities exchange traded fund. While most investors are familiar with emerging markets and the risk/reward implications, few understand the definition of frontier markets and the analytics behind them.

In this article we are going to have a closer look at FM, the fund’s composition and historic performance, as well as its analytics and forward in the current macro environment.

What are frontier markets exactly?

First let us go to finance nomenclature to establish the base here – the U.S. market is called a developed market due to its size, liquidity and volume. Most capital markets in Europe also fall in the developed market bucket. The next step down from developed markets is represented by emerging markets, which exhibit less depth, liquidity and volume when compared to developed markets. Furthermore political risk is a well known variable in the emerging market space. Further up the risk spectrum one can find frontier markets:

Frontier markets are less advanced capital markets in the developing world. A frontier market is a country that is more established than the least developed countries (LDCs) but still less established than the emerging markets because it is too small, carries too much inherent risk, or is too illiquid to be considered an emerging market. Frontier markets are also known as pre-emerging markets.

The best way to think about frontier markets (‘FMs’) is as the next step down from emerging markets. By their definition, FMs have low liquidity, carry higher risks than EM capital markets and can be very concentrated in a few names. Therefore FMs are inherently higher risk.

FM ETF composition

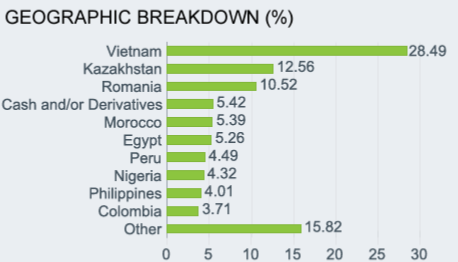

Let us look first at the geographic allocation for the FM fund:

Countries (Fund Website)

Vietnam is the largest exposure here with a 28% weighting, followed by Kazakhstan and Romania. Many readers might be more familiar with these countries from pop culture implications rather than capital markets research. Kazakhstan for example was popularized by the widely quoted movie Borat, where the lead character hails from said country.

When having a closer look at the Kazakhstan equity market one can extract the following analytics found in the Astana International Exchange presentation:

- $72 billion total market capitalization (just as a reminder, Apple’s total market capitalization is $3.4 trillion, so just one stock from the U.S. market represents multiples of the total capitalization of equities in Kazakhstan)

- In the first quarter of 2024, the total equity volume traded on the Kazakhstan market was $360 million

Investors can now understand the size of a frontier market and the relevant traded volumes. Moreover, what is not present in the above analytics is the inherent political risk. The ascension of a political party set to cut the country from investor capital can see capital controls put in, which would have an adverse impact of equity valuations.

The top three countries account for roughly half of the fund exposure in this name. From a sectoral standpoint Financials represent the highest allocation:

Sectors (Fund Website)

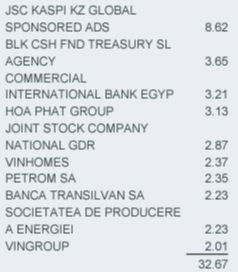

Financials are 34% of the name, followed by Materials and Real Estate. The top three sectors also account for roughly half of the fund. From a single name perspective we have the following list of names in this ETF:

Names (Fund Website)

There are a few bank names in there such as the International Bank of Egypt or the Romanian Banca Transilvan SA, as well as some energy names.

Historic performance versus EM

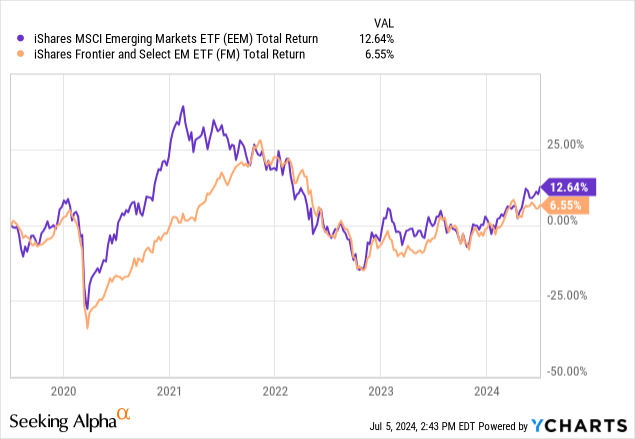

FM experienced a larger drawdown during the Covid crisis when compared to a proxy EM ETF, and a slower recovery:

We are comparing the fund with the iShares MSCI Emerging Markets ETF (EEM) in the above chart. EEM recovered faster after Covid due to its better liquidity and capital allocation, while FM lagged. Similarly FM has seen a larger drawdown in 2022/2023, mostly due to its currency risk as well.

An investor needs to understand that FM run currency risks versus the dollar. A strong USD results in a lower valuation for said jurisdiction, and the past two years have seen a very strong dollar performance.

A risk-on tool

When markets turn bearish, investors tend to sell all their high beta illiquid holdings first. FM falls in that category. Expect a significant drawdown during a bear market, with both capital and liquidity leaving said jurisdictions.

FM serves as a diversification risk-on tool, with no notable outstanding performances. If we look at a 10-year historic chart we see EEM outperforming. The fund is best used as a diversification instrument, or a means to obtain exposure to the top three countries, with a retail investor lacking country specific ETFs to tackle each jurisdiction.

Risk factors

There are numerous risk factors associated with this ETF. Due to its focus, the name buys equities in small, illiquid jurisdictions, thus a plethora of factors apply here.

As mentioned above, during risk-off events liquidity drains out, which leads to wider bid/ask spreads and the inability sometimes to exit large positions without moving the market. These markets are subject to ‘gap-down’ risks, where names can fall down in price significantly when several large investors liquidate positions. At the end of the day there are only a handful of large players allocating cash to these jurisdictions.

Political risk is another aspect to be keenly aware of. Suffice to point at a well-known EM jurisdiction, namely Turkey, which has seen its stock market widely gyrating based on Mr. Erdogan’s statements.

Capital controls and operational risk are others to consider. Small jurisdictions can prevent foreign capital from leaving, thus creating an effect where even after liquidating equity positions a fund cannot return its capital. Russia is an outside case, but many funds focused on local equities on the Moscow stock exchange saw their NAV obliterated after the start of the Russia/Ukraine conflict.

Conclusion

FM is an equities exchange traded fund. The vehicle focuses on frontier markets, which are capital markets from very small countries which do not fall in the EM bucket. Frontier markets are characterized by low overall capitalization, low volume and low liquidity. FM represents a risk-on tool, with severe drawdowns during risk-off periods and a historic total return which does not impress. The fund is to be bought only when the world equity markets are imploding and one can see liquidity driven gap-downs in price. With the market in a state of exuberance in the U.S. currently (in our opinion at least), FM is only a hold currently.

Read the full article here